Our Shanghai Caojing Cogeneration power plant (pictured)

has an installed capacity of 660 megawatts of power and

728 tonnes per hour of steam. |

|

Financial Management

The Group’s continuous efforts to improve our cashflow generation resulted in significant improvement in cashflow from operations

to

S$828 million.

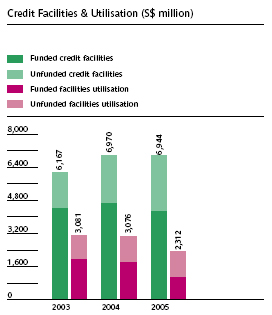

Facilities

The Group consolidates and diversifies its sources of funding by building on its existing and developing new bilateral banking relationships. The Group also accesses the capital markets as and when appropriate. As at end

of 2005, the Group’s undrawn credit facilities amounted

to S$4.6 billion, consisting of 60% bilateral banking facilities and the remaining 40% accessible from

the capital markets.

Cashflow

The Group’s continued efforts towards the improvement of our cashflow generation resulted in significant improvement in cashflow from operations to S$828 million (2004: S$494 million). Strong core operational performance, down payments from customers together with improved management of debt collection and credit terms as well

as divestment proceeds contributed to the improvement in cashflow generation. Accordingly, the gross borrowings of the Group reduced from S$1.9 billion to S$1.1 billion by end 2005. Taking into account cash and cash equivalents, the Group remained in a net cash position of S$125 million (2004: S$195 million) after paying down S$845 million

of short-term debt during the year.

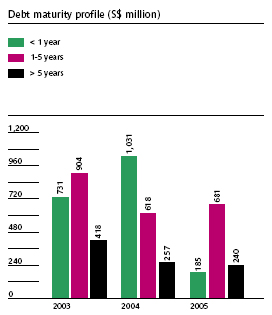

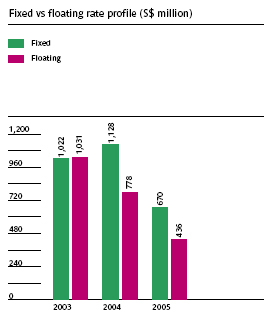

Borrowings

Our focus remains on the maintenance of an efficient

and optimal mix of committed and uncommitted facilities, fixed and floating rate borrowings, prudent financial

ratios and the reduction of the cost of funding. As

at December 31, 2005, gross borrowings amounted

to S$1.1 billion. Of this, committed funding comprised

90% (2004: 67%) of the Group’s gross borrowings and 61% (2004: 59%) of the overall debt portfolio was not exposed to interest rate fluctuations. The Group continually seeks to limit its interest rate exposure by adopting a prudent debt structure, whilst balancing this with funding cost considerations. The weighted average cost of funding

was lower at 3.4% in 2005 (2004: 3.7%). Interest cover ratio remained healthy at 12.4 times (2004:14.9 times).

The current maturity profile of the Group favours the longer dated maturities, which reduces the impact of refinancing risks. As at end 2005, the Group’s debt maturing within one year was reduced to 10% (2004: 54%).

Treasury management

The Group’s financing and treasury activities continues to be mainly centralised within SembCorp Financial Services (SFS), the funding vehicle of the Group. SFS on-lends funds borrowed by it to companies within the Group. SFS also actively manages the cash within the Group by taking

in surplus funds from those with excess cash and lending to those with funding requirements. Such proactive cash management continues to be an efficient and cost-effective way of financing the Group’s requirements.

Risk management

As part of the Group’s Enterprise Risk Management framework, our subsidiaries adopted the Group Treasury Policies and Financial Authority Limits. The Group Treasury Policies set out the parameters for management of Group liquidity, counterparty risk, foreign exchange and derivative transactions and financing. The Group utilises various financial instruments to manage exposures to foreign exchange, interest rate and commodity price risks arising from operational, financing and investment activities. Such transactions hedge the Group against fluctuations

in the market prices of the underlying instruments.

The Financial Authority Limits seek to limit and mitigate operational risks by setting out the threshold of approvals required for the entry into contractual obligations and investments.

|

|