We consider timely, transparent and honest communication with our shareholders

and the financial community as integral

to instilling confidence in our company.

At SembCorp Industries, we believe that proactive, timely and quality communication with investors and financial analysts is integral to helping the Company achieve a fair valuation of its shares. Our investor relations team is committed to providing meaningful information that would enable all capital market players to make informed investment decisions.

Communicating growth and sustainability of earnings

In 2005, over 150 one-on-one and group meetings were held with shareholders, analysts and potential investors. These were ideal opportunities to convey our investment proposition – growth upside from favourable fundamentals in the oil and gas and petrochemical sectors and sustainability of earnings due to our strong market positions, long-term partnerships with customers and unique integrated utilities business model.

During the year, non-deal marketing roadshows were conducted in Milan, Edinburgh, London, Hong Kong

and Tokyo to reinforce SembCorp Industries’ investment proposition and update shareholders and investors on key developments in our Company. We also participated in

the JP Morgan 10th Annual Asia Pacific Equity Conference in New York in September.

The focal point of our investor relations activities

in 2005 centred on improving the financial market’s appreciation of our Utilities business and its sustainability. By communicating intensively and openly, our aim was to enable the financial community to evaluate and assess our business and strategy appropriately. Educational sessions or “teach-ins” on our Utilities business were organised for sell-side analysts, as well as for institutional investors, arranged jointly with their brokers. These sessions provided insights on trends and developments in the industry and established a dialogue for investors and analysts with senior management from our operations. We organised a tour showcasing our integrated utilities facilities on Jurong Island for sell-side analysts in October 2005. We further arranged for Singapore-based sector analysts to visit

our operations at Wilton International, Teesside, UK.

That site tour included an in-depth introduction to renewable energy and its future potential by senior management from our UK operations. We believe that

site tours such as these as well as interaction with our front-line colleagues are valuable in gaining a better understanding of our business and operating environment.

Delivering a Total Shareholder Return

SembCorp Industries shares performed well in 2005.

Our shares began the year at S$1.65 and closed at S$2.74

on the last trading day of the year. This represents a share price return of 56% adjusted for the capital reduction and a total return of 66% including dividends. SembCorp Industries was the fourth best performing member of the Straits Times Index in 2005, outperforming the benchmark by 43%.

Interest in the stock remained robust. Daily turnover increased to an average of 4.6 million shares in the

last 12 months, compared to 4.0 million shares in 2004.

For the year, our shares averaged S$2.43, hitting a low of S$1.62 on January 4 and a high of S$3.12 on October 10.

On June 10, we completed our capital reduction by paying our shareholders a total of S$214.8 million. The rationale for the exercise was to return surplus capital to investors and to improve our Return On Equity and Earnings Per Share. The exercise reduced our issued share capital

by 6% or 110.0 million shares to 1,733.0 million.

The reduction was done proportionately, such that

all shareholders maintained their proportionate stake

in SembCorp Industries.

We believe that favourable industry fundamentals,

an improved understanding of our Utilities business

and enhanced efforts to reach a wider range of investors have all contributed to the positive performance of our share price in 2005.

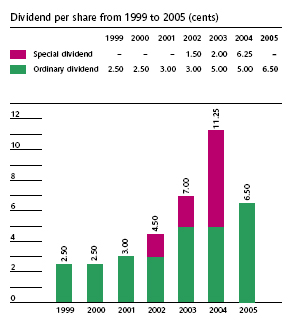

Proposed dividend for 2005

The Board of Directors has proposed a gross ordinary dividend of 6.5 cents per share less tax for 2005, subject to shareholders’ approval at the Annual General Meeting on April 27, 2006. This will result in a payout of S$90.8 million¹ or 33% and a dividend yield of 2.4% based on

the closing share price on December 30, 2005.

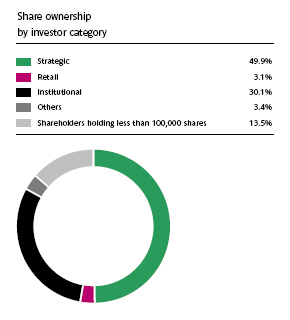

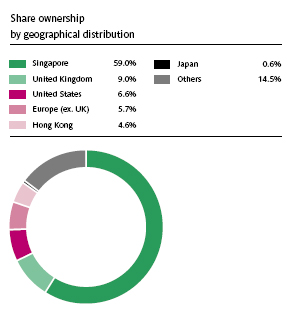

Gaining more interest from institutional investors

2005 saw strong interest from institutional shareholders who continued to increase their shareholdings and dominate our free float. Institutional shareholders held 30% of issued share capital or 60% of our free float, compared to 53% the year before. Foreign investors accounted for the increase, particularly from US and Hong Kong institutions. US institutions increased their shareholdings from 10% to 12% of free float while institutions from Hong Kong increased their share from 5% to 7%. We believe that our roadshows have helped

us to attain more visibility among investors.

Maintaining open channels of communication

Results announcements

Combined press and analysts conferences were held

for the release of our half year and full year results.

These were webcast live and archived for six months on our website www.sembcorp.com.sg. Conference calls were organised for the first quarter and third quarter results. All accompanying presentation materials, financial statements and press releases can be found on our website.

SGX-MAS Research Incentive Scheme

We continued to support and participate in the SGX-MAS Research Incentive Scheme, organised by the Singapore Exchange and the Monetary Authority of Singapore. The scheme allows the investing public to access free independent research reports on SembCorp Industries written by Philip Securities and Net Research.

Annual General Meeting

The Seventh Annual General Meeting was held on April 26, 2005 at the Theatrette, 60 Admiralty Road West. The meeting was well attended by shareholders, with over 150 investors in attendance. The event afforded the opportunity for shareholders to clarify matters about the Company and communicate directly with the Board of Directors and senior management. The Annual General Meeting was followed by an Extraordinary General Meeting, specially convened to seek approval for the capital reduction exercise – which was subsequently approved by shareholders.

| Calendar of quarterly results announcement* |

| |

| First Quarter |

May 8, 2006 |

Monday |

| |

| First Half |

August 7, 2006 |

Monday |

| |

| Third Quarter |

November 6, 2006 |

Monday |

| |

| Full Year 2006 |

February 2007 |

|

| |

Note:

1 Based on shareholding as at December 31, 2005.

* Dates subject to change