The board and management of Sembcorp recognise

that well-defined corporate governance processes

are essential in enhancing corporate accountability

and long-term sustainability, and are committed to

high standards of corporate governance to preserve

and maximise shareholder value. This report sets out

the company’s corporate governance processes and

activities for the financial year with reference to the

principles set out in the Singapore Code of Corporate

Governance 2012 (the Code). The board is pleased

to report that the company has complied in all

material aspects with the principles and guidelines

set out in the Code, and any deviations are

explained in this report.

The company continually reviews and refines its

processes in light of best practice, consistent with

the needs and circumstances of the Group, and we

are encouraged that our efforts towards excellent

governance have been recognised. At the 2014

Singapore Corporate Awards, Sembcorp Industries

won gold awards for Best Managed Board and

Best Annual Report for companies with S$1 billion

and above in market capitalisation. Our Group

President & CEO Tang Kin Fei was also named

Best Chief Executive Officer in the same category.

In addition, the company was ranked in the top

three on Singapore’s Governance and Transparency

Index, an independent ranking exercise by the

National University of Singapore’s Centre for

Governance, Institutions and Organisations, CPA

Australia and The Business Times that assesses

644 Singapore-listed companies in terms of

governance, ethics, transparency and rigour in

financial reporting. Furthermore, the Securities

Investors Association (Singapore) named Sembcorp

the runner-up for the Singapore Corporate

Governance Award at the 15

th Investors’ Choice

Awards. The award was given under the category

of companies with market capitalisation of

S$1 billion and above.

BOARD MATTERS

Board’s Conduct of Affairs (Principle 1)

Effective board to lead and effect controls

Sembcorp is led by an effective board comprising

mainly independent non-executive directors. The

board is headed by Ang Kong Hua. He is joined on

the board by Mr Tang, Goh Geok Ling, Evert

Henkes, Bobby Chin Yoke Choong, Margaret Lui,

Tan Sri Mohd Hassan Marican, Tham Kui Seng,

Dr Teh Kok Peng, as well as Ajaib Haridass and

Neil McGregor who joined the board on May 1, 2014.

Role of the board

The board is collectively responsible for the long-term

success of the company. Each director exercises

his independent judgement to act in good faith and

in the best interest of the company for the creation

of long-term value for shareholders. The principal

duties of the board are to:

|

•

|

Provide leadership and guidance to

management on the Group’s overall strategy,

taking into consideration sustainability issues

and the need to ensure necessary financial and

human resources are in place

|

|

|

|

|

•

|

Ensure the adequacy of the Group’s risk

management and internal controls framework

and standards, including ethical standards, and

that its obligations to shareholders and other

key stakeholders are met

|

|

|

|

|

• |

Review management performance and oversee

the Group’s overall performance objectives, key

operational initiatives, financial plans and annual

budget, major investments, divestments and

funding proposals, quarterly and full-year

financial performance reviews, risk management

and corporate governance practices

|

|

|

|

|

•

|

Provide guidance on sustainability issues, such as

environmental and social factors, as part of the

Group’s overall business strategy

|

To assist the board in the efficient discharge

of its responsibilities and provide independent

oversight of management, the board has established

the following board committees with written terms

of reference:

• Executive Committee

• Audit Committee

• Risk Committee

• Executive Resource & Compensation Committee

• Nominating Committee

• Technology Advisory Panel

Special purpose committees are also established

as dictated by business imperatives.

Composition of the board committees is structured

to ensure an equitable distribution of responsibilities

among board members, maximise the effectiveness

of the board and foster active participation and

contribution. Diversity of experience and appropriate

skills are considered along with the need to maintain

appropriate checks and balances between the

different committees. Hence, membership of the

Executive Committee, with its greater involvement

in key businesses and executive decisions, and

membership of the Audit and Risk Committees, with

their respective oversight roles, are mutually exclusive.

The Group has adopted internal controls and

guidelines that set out financial authorisation and

approval limits for borrowings, including off-balance

sheet commitments, investments, acquisitions,

disposals, capital and operating expenditures,

requisitions and expenses. Significant investments

and transactions exceeding threshold limits are

approved by the board while transactions below

the threshold limits are approved by the Executive

Committee and management to facilitate

operational efficiency, in accordance with

applicable financial authority limits.

Executive Committee

The Executive Committee (ExCo) is chaired by

Mr Ang and its members include Mr Goh,

Mr Tang

and Mrs Lui.

Within the limits of authority delegated by the

board, the ExCo reviews and approves business

opportunities, strategic investments, divestments,

and major capital and operating expenditure.

The ExCo also evaluates and recommends larger

investments, capital and operating expenditure,

as well as divestments to the board for approval.

Technology Advisory Panel

The Technology Advisory Panel (TAP) comprises

board members Mr Ang, Mr Tang and Dr Teh, as

well as co-opted members Dr Josephine Kwa Lay

Keng, Dr Ng How Yong and Prof Lui Pao Chuen.

Their profiles may be found

here.

The TAP provides guidance to the Group on its

vision and strategy in leveraging technology to

enhance Sembcorp’s leadership in the energy and

water industries. The panel advises on technologies

for research and development as well as investment,

oversees the application of significant emerging and

potentially disruptive technologies in the energy and

water sectors, and ensures the appropriate

management of specialised research and

development projects and systems for intellectual

property creation and protection. In addition, the

panel advises Sembcorp’s board and management

on technological trends and opportunities in line

with the company’s growth strategies.

The other committees’ respective composition,

roles and responsibilities are further explained in this

report. Minutes of board committee meetings are

circulated to the board to keep directors updated on

each committee’s activities.

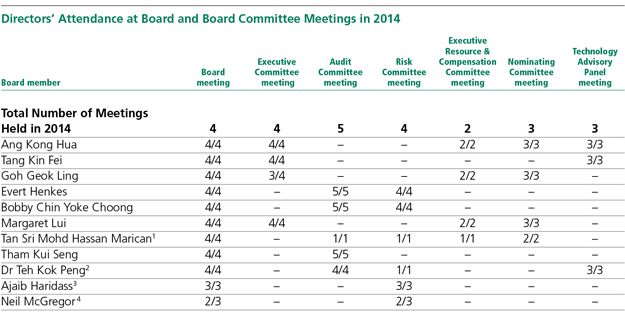

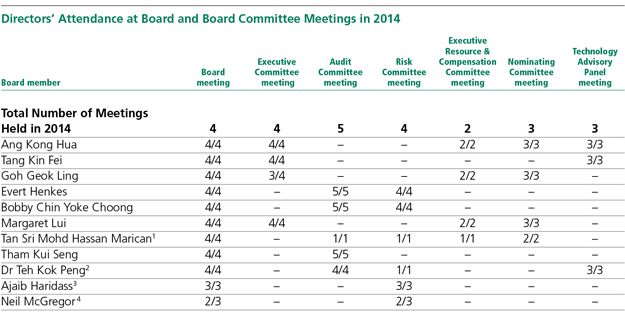

Meetings and attendance

The board meets on a quarterly basis to review and

approve the release of the company’s quarterly

results, as well as to deliberate on key activities and

business strategies, including significant acquisitions

and disposals. At these board meetings, the Group

President & CEO updates the board on the

development and prospects of the Group’s

businesses and each board committee also reports

an update of its activities. An additional board

meeting is held at the end of each financial year to

review the Group’s strategy going forward and to

consider and approve the Group’s budget for the

following year, and ad-hoc board meetings may also

be convened as necessary to consider other specific

matters. Time is also set aside at these scheduled

meetings for the board to discuss management’s

performance; members of management are not

present at or privy to such discussions.

Board and board committee meetings, as well

as annual general meetings (AGMs) of the company

are scheduled in consultation with the directors in

advance of each year. Telephonic attendance and

conference via audio-visual communication channels

are allowed under the company’s Articles of

Association to enable the participation of directors

who are unable to be present, and decisions of the

board and board committees may be obtained at

meetings or via circular resolution. Should a director

be unable to attend a board or board committee

meeting, he / she will still be sent the papers tabled

for discussion and have the opportunity to

separately convey any views to the chairman for

consideration or further discussion with other

directors. If necessary, a separate session may be

organised for management to brief that director

and obtain his / her comments and / or approval.

The directors’ attendance at board and

committee meetings held during the financial year

2014 is set out below.

Board orientation and training

All new directors receive formal letters of

appointment explaining the Group’s governance

policies and practices, as well as their duties and

obligations as directors. New directors also receive

an information pack which contains the Group’s

organisation structure, the contact details of

members of senior management, the company’s

Memorandum and Articles of Association,

respective committees’ terms of reference, the

Group’s policy relating to disclosure of interests in

securities and prohibition on dealings in Sembcorp

securities, as well as guidelines on directors’ fees.

The company conducts orientation programmes

for new directors with comprehensive briefings on

board policies and processes, as well as presentations

by senior management on Sembcorp’s overall

strategic plans and direction, financial performance

and activities in its various geographical markets.

As part of training and professional development

for the board, the company ensures that directors

are briefed from time to time on changes to

regulations, guidelines and accounting standards,

as well as other relevant trends or issues. These are

done either during board meetings or at specially

convened sessions, including training sessions and

seminars conducted by external professionals.

Briefings and updates provided for directors in 2014

|

•

|

Briefings on developments in accounting and

governance standards presented by our external

auditors at Audit Committee meetings

|

|

|

|

|

•

|

Updates on the Group’s business and strategic

developments presented by the Group President

& CEO to the board

|

|

|

|

|

•

|

Insights on China and India markets presented

by external advisors to the board

|

|

|

|

|

•

|

Review of the Group’s country risk framework

with benchmarking against global best

practices presented by an external advisor to the

Risk Committee

|

|

|

|

|

•

|

Quarterly overviews on the risk and controls

environment of the Group and updates relating

to other risk management and governance

initiatives, such as the governance assurance

framework, presented by the Group Risk and

Governance departments to the Risk Committee

|

|

|

|

|

•

|

Public forum discussions on boards and

technology by eminent US and Asian practitioners

|

|

|

|

Besides such briefings, articles and reports

relevant to the Group’s businesses are also circulated

to the directors for information. Furthermore, facility

visits to the Group’s operating sites are also arranged

to enhance directors’ understanding of the Group’s

businesses as well as meetings with key customers

and government officials. In October 2014, a facility

visit was conducted in conjunction with the official

opening of the Sembcorp Cogen @ Banyan and the

Sembcorp Technology & Innovation Centre on

Jurong Island in Singapore.

Board Composition and Guidance (Principle 2)

Strong and independent board exercising objective judgement

Board composition

The current board comprises eleven directors, eight

of whom are independent directors. Excluding the

Group President & CEO, all the directors are non-executive.

The board members include business

leaders and professionals with strong experience

relevant to the Group’s businesses, from engineering,

petrochemicals, oil and gas and real estate industries

to accountancy, finance and legal sectors. Best efforts

have been made to ensure that in addition to

contributing their valuable expertise and insight to

board deliberations, each director also brings to the

board an independent and objective perspective to

enable balanced and well-considered decisions to be

made. The board is of the view that given that the

majority of directors are non-executive and

independent of management in terms of character

and judgement, objectivity on issues deliberated is

assured. Profiles of the directors may be found

here.

Review of directors' independence

The independence of each non-executive director

is assessed annually, with each director required to

complete a Director’s Independence Checklist drawn

up based on the guidelines provided in the Code.

The checklist also requires each director to assess

whether he considers himself independent despite

involvement in any of the relationships identified in

the Code. Thereafter, the Nominating Committee

reviews the completed checklists, assesses the

independence of the directors and presents its

recommendations to the board. Particular scrutiny is

applied when assessing the continued independence

of directors who have served more than nine years.

Taking into account the views of the Nominating

Committee, the board determined in 2014 that with

the exception of Mr Tang, Mrs Lui and Mr McGregor,

all of Sembcorp Industries’ directors are independent.

Mr Tang is Group President & CEO and an executive

director, while Mrs Lui is Chief Executive Officer of

Azalea Asset Management, a related company of

Temasek Holdings (Temasek) which holds more than

10% interest in the Group. Mr McGregor was

regarded as an independent director at the time of his

appointment to the board and prior to his employment

as Senior Managing Director of Temasek’s Enterprise

Development Group on June 1, 2014. Thereafter he

was deemed

non-independent given his direct

association with Temasek as defined in the Code.

Tan Sri Mohd Hassan Marican sits on the board

of Sembcorp Marine, a listed subsidiary from which

the company has received payment in excess of

S$200,000 in aggregate for consultancy services

and provision of utilities services, as did Mr Goh

prior to April 22, 2014. The board has assessed this

matter and is of the view that the payment received

from Sembcorp Marine is insignificant in the context

of the Group’s earnings. The board believes that

Tan Sri Mohd Hassan Marican and Mr Goh’s

directorships in Sembcorp Marine have not and

will not interfere, or be reasonably perceived to

interfere, with their abilities to exercise independent

judgement and act in the best interest of

Sembcorp Industries.

Mr Goh and Mr Henkes have served on our

board since their appointments in 2000 and 2004

respectively. The board has established that despite

serving as directors for more than nine years,

Mr Goh and Mr Henkes continue to demonstrate

the essential characteristics of independence

expected by the board and furthermore, their

length of service and in-depth knowledge of the

Group’s businesses are viewed by the board as

especially valuable.

The board has determined that Mr Chin,

who was appointed a director to the board of

Temasek on June 10, 2014, and Tan Sri Mohd

Hassan Marican and Mr Tham, who respectively

hold the positions of Senior International Advisor

and Corporate Advisor at Temasek International

Advisors, a subsidiary of Temasek, are independent.

The board believes that the three directors have

consistently exercised strong independent

judgement in their deliberations and that they act

in the best interest of the company as they are not

accustomed or under an obligation, whether formal

or informal, to act in accordance with the directions,

instructions or wishes of Temasek.

Chairman and Chief Executive Officer (Principle 3)

Clear division of responsibilities between the board

and management

The Chairman and the Group President & CEO

are not related to each other. Their roles are kept

separate to ensure a clear division of responsibilities,

increased accountability and a greater capacity of

the board for independent decision-making.

The Chairman, who is non-executive, chairs the

board, ExCo, Executive Resource & Compensation

Committee, Nominating Committee and the TAP.

He leads and ensures effective and comprehensive

board discussion on matters brought to the board,

including strategic issues as well as business planning.

The Chairman promotes an open environment for

deliberation and ensures that board and board

committee meetings are conducted in a manner

that allows non-executive directors to participate

in meaningful and active discussion. He also

monitors follow-up to the board’s decisions

to ensure that such decisions are translated

into executive action and provides advice to

management. In addition, the Chairman provides

leadership and guidance to management,

particularly with regard to its global growth

strategy and project investments. He also helps

to oversee the Group’s talent management, and

works with the Group President & CEO to ensure

that robust succession plans are in place for key

management positions.

The Group President & CEO makes strategic

proposals to the board, develops the Group’s

businesses in accordance with strategies, policies,

budgets and business plans as approved by the

board and provides close oversight, guidance

and leadership to senior management.

Board Membership (Principle 4)

Formal and transparent process for the appointment and re-appointment of directors

Nominating Committee

The Nominating Committee (NC) comprises

non-executive directors, namely Mr Ang, Mr Goh,

Mrs Lui and Tan Sri Mohd Hassan Marican. Three

out of four directors in the NC (including the

Chairman)

are independent.

The NC is responsible to review Sembcorp’s

board to ensure strong, independent and sound

leadership for the continued success of the

company and its businesses.

The key responsibilities of the NC are to:

|

•

|

Ensure that the board has the right balance

of skills, attributes, knowledge and experience

in business, finance and related industries,

as well as management skills critical to the

company’s businesses

|

|

|

|

|

•

|

Review the composition and size of the board

and its committees and recommend new

appointments, re-appointments and

re-elections to the board and board

committees as appropriate

|

|

|

|

|

•

|

Review the directors’ independence and

succession plans for the board

|

|

|

|

|

•

|

Develop a process to evaluate board and

board committee performance

|

|

|

|

|

•

|

Review training and professional development

programmes for the board

|

|

|

|

Succession planning, appointment and

re-appointment of directors

The NC seeks to refresh board membership

progressively and in an orderly manner. All

appointments to the board are made on merit and

measured against objective criteria. Candidates

must be able to discharge their responsibilities as

directors while upholding the highest standards of

governance practised by the Group. The board also

recognises the contributions of directors who have,

over time, developed deep insight into the Group’s

businesses and exercises its discretion to retain the

services of such directors where appropriate to

avoid an abrupt loss of experienced directors with

a valuable understanding of the Group.

With reference to the Group’s strategies and

business plans, the NC reviews the skills mix of board

members to ensure that the board has the required

diversity including gender, as well as the competencies

to support our growth. When the need for a new

director is identified, the NC consults with management

and identifies a list of candidates sourced through an

extensive network of contacts, based on the skill sets,

experience, knowledge and attributes required

to position the board to lead the growth of the

company. Thereafter, the NC will interview the

candidates and make its recommendation to

the board for approval. In accordance with the

company’s Articles of Association, the new director

will hold office until the next AGM and, if eligible,

can stand for re-appointment.

The company subscribes to the principle that all

directors, including the Group President & CEO,

should retire and submit themselves for re-election

at regular intervals, subject to their continued

satisfactory performance. The company’s Articles of

Association require a third of its directors to retire and

subject themselves for re-election by shareholders at

every AGM (one-third rotation rule).

In addition, all newly-appointed directors submit

themselves for retirement and re-election at the

AGM immediately following their appointment.

Thereafter, these directors are subject to the

one-third rotation rule. Directors who are above

the age of 70 are also statutorily required to seek

re-appointment at each AGM.

Pursuant to the one-third rotation rule, Mr Chin

and Dr Teh will retire and submit themselves for

re-election at the forthcoming AGM. Mr Haridass

and Mr McGregor, who were newly appointed to

the board on May 1, 2014, will also submit

themselves for retirement and re-election by

shareholders at the forthcoming AGM.

In addition, Mr Ang, Mr Goh and Mr Henkes,

who are above the age of 70, will submit their

retirement at the coming AGM in accordance with

the statutory requirement. The board has been

informed that Mr Ang will offer himself for

re-appointment, while Mr Goh and Mr Henkes have

decided not to

seek re-appointment.

The board does not encourage the appointment

of alternate directors. No alternate director has

been or is currently being appointed to the board.

Review of directors’ time commitments

While reviewing the re-appointment and

re-election of directors, the NC also considers the

directors’ other board directorship representations

and principal commitments to ensure they have

sufficient time to discharge their responsibilities

adequately. Taking into consideration the total

time commitment required of our directors for

involvement in Sembcorp’s board and board

committees and for their other appointments

outside our company, the board has determined

that the maximum number of listed company

board representations held by any Sembcorp

Industries director should not exceed six.

For 2014, the board is satisfied that all directors

have given sufficient time and attention to the

affairs of the company and have discharged

their duties adequately.

Board Performance (Principle 5)

Active participation and valuable contributions

are key to overall effectiveness of the board

Board evaluation process and

performance criteria

The board believes that board performance is

ultimately reflected in the long-term performance

of the Group. Each year, in consultation with

the NC, the board assesses its performance to

identify key areas for improvement and requisite

follow-up actions.

To provide feedback to aid in this assessment,

each director is required to complete a questionnaire

on the effectiveness of the board, board committees

and directors’ contribution and performance.

The evaluation considers factors such as the size

and composition of the board and board

committees, board processes and accountability,

board and board committees’ development and

effectiveness, information management, decision-making

processes, risk and crisis management,

succession planning, communication with senior

management and stakeholder management.

The evaluation and feedback are then consolidated

and presented to the board for discussion on areas

of strengths and weaknesses, to improve the

effectiveness of the board and its committees.

In 2014, the NC reviewed and improved the

questionnaire to further enhance assessment of

board and board committee effectiveness.

Access to Information (Principle 6)

Directors have complete, adequate and timely

information and resources

Complete, adequate and timely information

The company recognises that directors should be

provided with complete, adequate and timely

information on an ongoing basis. This is to enable

them to make informed decisions, discharge their

duties and keep abreast of the Group’s operational

and financial performance, key issues, challenges

and opportunities. Sembcorp’s management

furnishes management and operation reports as

well as financial statements to the board on a

regular basis. Financial highlights of the Group’s

performance and key developments are presented

on a quarterly basis at board meetings and the

Group President & CEO, Group Chief Financial

Officer and members of senior management attend

board and board committee meetings to provide

insight into matters under discussion and address

any queries which the directors may have.

In line with Sembcorp’s strong commitment

towards environmental responsibility, directors are

provided with electronic tablets to enable them to

access board and board committee papers prior to

and during meetings. As a general rule, board and

board committee papers are disseminated to

directors at least three working days prior to

meetings to provide sufficient time to review and

consider matters at hand, and so that discussions

at the meetings can be focused on the directors’

questions arising from these matters. The board

has ready and independent access to the Group

President & CEO, senior management, the

Company Secretary and internal and external

auditors at all times, should it need to request

for additional information.

Company Secretary

The Company Secretary assists the Chairman to

ensure good information flow within the board and

its committees and between the board and senior

management. In addition, the Company Secretary

attends to corporate secretarial matters, such as

arranging orientations for new directors and

assisting with their professional development as

required. In consultation with the Chairman and the

Group President & CEO, the Company Secretary

assists the board with scheduling of board and

board committee meetings and the preparation of

meeting agendas, and also administers, attends and

minutes board proceedings. The Company Secretary

assists the board on the Group’s compliance with

the Memorandum and Articles of Association and

applicable regulations, including requirements of

the Companies Act, Securities & Futures Act and the

SGX-ST. Moreover, the Company Secretary liaises on

behalf of the company with the SGX-ST, the

Accounting and Corporate Regulatory Authority

and when necessary, shareholders.

Independent professional advice

In the furtherance of its duties, the board exercises

its discretion to seek independent professional advice

at the company’s expense, if deemed necessary.

REMUNERATION MATTERS

Procedures for Developing Remuneration

Policies (Principle 7)

Remuneration of directors adequate and not excessive

With the assistance of the Executive Resource &

Compensation Committee, the board ensures that

a formal policy and transparent procedure for

determining remuneration of executives and

directors are in place.

Executive Resource & Compensation Committee

The Executive Resource & Compensation Committee

(ERCC) is chaired by Mr Ang, an independent non-executive

director, and he is joined on the committee

by Mr Goh, Mrs Lui and Tan Sri Mohd Hassan Marican.

The ERCC is responsible for developing, reviewing

and recommending to the board the framework of

remuneration for the board and key management

personnel as defined in the Code. To this end, it:

|

•

|

Assists the board to ensure that competitive

remuneration policies and practices are

in place and aligned with the prevailing

economic environment

|

|

|

|

|

•

|

Reviews and recommends to the board for

endorsement each director and member of key

management’s specific remuneration package

|

|

|

|

|

•

|

Establishes guidelines on share-based incentives

and other long-term incentive plans and

approves the grant of such incentives to key

management personnel. These incentives serve

to motivate executives to maximise operating

and financial performance and shareholder

value, and are aimed at aligning the interests

of key management personnel with those

of shareholders

|

|

|

|

|

•

|

Reviews succession planning for key

management personnel and the leadership

pipeline for

the organisation

|

In its deliberations, the ERCC takes into

consideration industry practices and compensation

norms. The Group President & CEO does not attend

discussions relating to his own compensation,

terms and conditions of service, or the review of

his performance. In addition, no ERCC member or

any director is involved in deliberations in respect

of any remuneration, compensation, share-based

incentives or any form of benefits to be granted

to himself / herself.

The ERCC has access to expert professional

advice on human resource matters whenever there

is a need for such external consultation. In 2014,

Mercer (Singapore) was engaged as external

consultants to provide such advice. In engaging

external consultants, the company takes care to

ensure that the relationship, if any, between the

company and these external consultants will not

affect the independence and objectivity of the

external consultants. In 2014, the ERCC undertook

a review of the independence and objectivity of

Mercer (Singapore) and has confirmed that it has

no relationships with the company which would

affect its independence.

In reviewing succession planning and the

Group’s leadership pipeline, the ERCC reviews

the development of senior staff and assesses their

strengths and development needs based on the

Group’s leadership competencies framework, with

the aim of building talent and maintaining strong

and sound leadership for the Group. On an annual

basis, the ERCC conducts a succession planning

review of the Group President & CEO, officers

reporting directly to him, as well as other selected

key positions in the company. Potential internal and

external candidates for succession are reviewed for

different time horizons according to immediate,

medium-term and long-term needs. In addition, the

ERCC also reviews the company’s obligation arising

in the event of termination of the Group President &

CEO and key management personnel’s contracts

of service, to ensure that such contracts contain

fair and reasonable termination clauses.

Level and Mix of Remuneration (Principle 8)

Competitive reward system to ensure highest

performance and retention of directors and

key management personnel

Sembcorp believes that its remuneration and reward

system is aligned with the long-term interest and

risk policies of the company and that a competitive

remuneration and reward system based on

individual performance is important to attract,

retain and incentivise the best talent.

The Group President & CEO, as an executive

director, does not receive director’s fees from

Sembcorp. As a lead member of management,

his compensation consists of his salary, allowances,

bonuses and share-based incentives conditional

upon meeting certain performance targets. Details

on the share-based incentives and performance

targets are available in the

Directors’ Report and

Note 36 in the Notes to the Financial Statements.

Non-executive directors' fees

In 2014, the ERCC reviewed and updated the

directors’ fee framework to include a new all-in

chairman’s fee. This reflects the greater commitment

required of the Chairman in spending time outside

regular board and board committee meetings to

guide and provide oversight to the company and its

management where this is needed, such as in the

Group’s expansion into new markets. With the

introduction of the all-in chairman’s fee, the

Chairman will not receive further fees or allowances

as a director on our board or for involvement in any

of the board’s committees, such as membership fees.

The framework below adopted by the company

is based on a scale of fees divided into basic retainer

fees, attendance fees and allowances for travel and

service on board committees:

The directors’ fees payable to non-executive

directors are paid in cash and in share awards under

the Sembcorp Industries Restricted Share Plan

2010. The ERCC has determined that up to 30%

of the aggregate directors’ fees approved by

shareholders for a particular financial year may be

paid out in the form of restricted share awards.

Directors’ cash fees and share awards will only be

paid and granted upon approval by shareholders

at the AGM of the company. Directors and their

associates also abstain from voting on any

resolution(s) relating to their remuneration.

Share awards granted under the Sembcorp

Industries Restricted Share Plan 2010 to directors as

part of directors’ fees will consist of the grant of

fully paid shares outright with no performance and

vesting conditions attached, but with a selling

moratorium. This however does not apply to Mr

Tang, as he does not receive directors’ fees given

that he is Group President & CEO of the company.

Non-executive directors are required to hold shares

in the company (including shares obtained by other

means) worth at least the value of their annual basic

retainer fee (currently S$75,000); any excess may be

disposed of as desired. A non-executive director

may only dispose of all of his shares one year after

leaving the board. Subject to shareholders’ approval

at the forthcoming AGM, the cash component of

the directors’ fees for FY2015 is intended to be

paid half-yearly in arrears.

The actual number of shares to be awarded to

each non-executive director will be determined by

reference to the volume-weighted average price of

a share on the SGX-ST over the 14 trading days

from (and including) the day on which the shares

are first quoted ex-dividend after the AGM (or, if the

resolution to approve the final dividend is not

approved, over the 14 trading days immediately

following the date of the AGM). The number of

shares to be awarded will be rounded down to the

nearest hundred and any residual balance will be

settled in cash. The share component of the

directors’ fees for FY2015 is intended to be

paid after the AGM in 2016 has been held.

The company does not have a retirement

remuneration plan for non-executive directors.

Remuneration for key management personnel

Sembcorp’s remuneration and reward system for

key management personnel is designed to ensure a

competitive level of compensation to attract, retain

and motivate employees to deliver high-level

performance in accordance with the company’s

established risk policies. The remuneration of

our key management personnel comprises three

primary components:

|

•

|

Fixed remuneration

Fixed remuneration includes an annual basic

salary, and where applicable, fixed allowances,

an annual wage supplement and other

emoluments. Base salaries of key management

personnel are determined based on the scope,

criticality and complexity of each role, equity

against peers with similar responsibilities,

experience and competencies, individual

performance and market competitiveness.

|

|

|

|

|

•

|

Annual variable bonuses

The annual variable bonus is intended to

recognise the performance and contributions of

the individual, while driving the achievement of

key business results for the company. The annual

variable bonus includes two components. The

first is linked to the achievement of pre-agreed

financial and non-financial performance targets,

while the second is linked to the creation of

economic value added (EVA).

The EVA-linked bonus component is held in

a “bonus bank”. Typically, one-third of the

balance in the bonus bank is paid out in cash

each year, while the balance two-thirds is carried

forward to the following year. Such carried-forward

balances of the bonus bank may either

be reduced or increased in future, based on the

yearly EVA performance of the Group and its

subsidiaries. There are provisions in the EVA

incentive plan to allow for forfeiture of the

outstanding balances in the bonus bank in

exceptional circumstances of misstatement

of financial results or misconduct resulting in

financial loss to the company.

|

|

|

|

|

•

|

Share-based incentives

The company’s performance share plan and

restricted share plan were approved and

adopted by the shareholders at an Extraordinary

General Meeting of the company held on April

22, 2010. Through our share-based incentives,

we motivate key management personnel to

continue to strive for the Group’s long-term

shareholder value. In addition, our share-based

incentive plans aim to align the interests of

participants with the interests of shareholders,

so as to improve performance and achieve

sustainable growth for the company.

|

|

|

|

Pay for performance

As in prior years, a pay-for-performance study was

conducted in 2014 by our external consultants,

Mercer (Singapore), to review the alignment

between the Group’s executive pay programme,

shareholder returns and business results. The Group

benchmarked itself with established global energy

and utilities firms and comparably-sized local listed

companies with which the Group competes for

talent and capital.

The study benchmarked different elements of

senior executive pay, namely fixed remuneration,

total cash remuneration and total compensation

including long-term incentives, against that of peer

companies. It found senior executive pay to be

positioned competitively vis-à-vis the Group’s

relative size and performance. Executive

compensation for the year had a robust correlation

to the Group’s profit from operations and EVA. In

the longer term, there was also a strong relationship

between executives’ total compensation (which

includes share awards for the Group President &

CEO and senior executives) and the Group’s

three-year earnings per share growth, wealth added

and total shareholder return. Overall, the study

showed a strong correlation between the Group’s

executive pay and its business results and

shareholder returns, indicating strong pay-for-performance

alignment.

Disclosure on Remuneration (Principle 9)

The computation of non-executive directors’ fees

totalled S$2,165,833 in 2014 (2013: S$1,583,728).

This comprised S$1,516,083 in cash and S$649,750

to be paid in the form of restricted share awards

under the Sembcorp Industries Restricted Share

Plan 2010. More information on directors and key

management personnel’s remuneration may be

found under the related item in the

Supplementary

Information section of the Financial Statements.

In 2014, the company had no employees who

were immediate family members of a director or

the Group President & CEO.

ACCOUNTABILITY AND AUDIT

Accountability (Principle 10)

The board is accountable to shareholders

Sembcorp is committed to open and honest

communication with shareholders at all times. The

company presents a balanced and clear assessment

of the Group’s performance, position and prospects

to shareholders through the timely release of its

quarterly and annual financial reports. The company

believes that prompt compliance with statutory

reporting requirements is imperative to maintaining

shareholders’ confidence and trust in the company.

In line with stock exchange requirements, negative

assurance statements were issued by the board to

accompany the company’s quarterly financial results

announcements, confirming that to the best of its

knowledge, nothing had come to its attention

which would render the company’s quarterly results

false or misleading.

Risk Management and Internal Controls (Principle 11)

The board has overall responsibility for the

governance of the Group’s risk management

and internal controls. The company’s board and

management are fully committed to maintaining

sound risk management and internal control

systems to safeguard shareholders’ interests and

the Group’s assets.

The board determines the company’s levels

of risk tolerance and risk policies, and oversees

management in the design, implementation and

monitoring of risk management and internal

control systems.

Risk Committee

The Risk Committee (RC) assists the board in

overseeing risk management for the Group. The

RC is chaired by Mr Henkes and its other members

include Mr Chin, as well as Mr Haridass and

Mr McGregor who joined the RC on May 1, 2014.

Dr Teh and Tan Sri Mohd Hassan Marican, who

served as RC members for the first four months of

the year, relinquished their seats on the RC on May 1,

2014;

Dr Teh then joined the Audit Committee

whilst Tan Sri Mohd Hassan Marican joined the

ERCC and NC.

The RC’s principal functions are to:

|

•

|

Review and endorse the risk management plans

of the Group

|

|

|

|

|

•

|

Review and approve group-wide risk policies,

guidelines and limits

|

|

|

|

|

•

|

Review the adequacy and effectiveness of the

risk management systems, processes and

procedures of the Group

|

|

|

|

|

•

|

Review risk-related reports submitted to it by

management. These include updates on the

Group’s risk portfolio, reports on major risk

exposure and any other risk-related issues as

well as actions taken to monitor and manage

such exposure / issues

|

|

|

|

|

•

|

Review infrastructure and resources in place to

support the management of risk, including for

instance human resources, information technology

systems, reporting structure and procedures

|

Adequate and effective system of internal controls

The Group has implemented a comprehensive

enterprise risk management (ERM) framework

where key risks identified are deliberated by

management with the support of the risk

management function, and reported regularly to

the RC. Supporting the ERM framework is a system

of internal controls, comprising a code of business

conduct, group-wide governance and internal

control policies, procedures and guidelines dictating

the segregation of duties, approval authorities and

limits, and checks and balances embedded in

business processes. The Group has also considered

the various financial risks, details of which are found

here. For more

information on the company’s ERM framework,

please refer to the

Risk Management and Internal Controls chapter.

Our ERM framework is complemented by a

governance assurance framework and a risk-based

control self-assessment programme. During the year,

the Group’s risk profile was reviewed and updated.

The effectiveness of our internal controls was also

assessed and enhanced through a combination of

management control self-assessments, certifications

and internal audits, as well as actions taken in

follow up to these exercises.

For the financial year under review, the board

has been assured by the Group President & CEO

and Group Chief Financial Officer that financial

records have been properly maintained, that the

financial statements give a true and fair view of

the company’s operations and finances and that

the risk management and internal control systems

of the Group are adequate and effective.

Based on the internal controls established and

maintained by the Group, work performed by

external and internal auditors and reviews

performed by senior management, the board, with

the concurrence of the Audit Committee, is of the

opinion that the company’s internal controls were

adequate and effective as at December 31, 2014 to

address the financial, operational, compliance and

information technology risks of the Group. Internal

controls, because of their inherent limitations, can

provide reasonable but not absolute assurance

regarding the achievement of their intended control

objectives. In this regard, the board will ensure that

should any significant internal control failings or

weaknesses arise, necessary remedial actions will

be swiftly taken.

Audit Committee (Principle 12)

The Audit Committee (AC) comprises directors who

are both independent and non-executive. The AC is

chaired by Mr Chin and its members are Mr Henkes,

Mr Tham and Dr Teh, who joined the AC on May 1,

2014. Tan Sri Mohd Hassan Marican served as a

member of the AC for the first four months of the

year, before relinquishing his seat on the committee

on May 1, 2014.

Authority and duties of the AC

The AC assists the board in fulfilling its fiduciary

responsibilities relating to the internal controls,

financial accounting and reporting practices of

the Group. Its main responsibilities are to:

|

•

|

Review the company’s policies and control

procedures and accounting practices with external

auditors, internal auditors and management

|

|

|

|

|

•

|

Review and act in the interest of the

shareholders in respect of interested

person transactions, as well as any matters or

issues that affect the financial performance

of the Group

|

|

|

|

|

•

|

Review the quarterly, half-year and full-year

results announcements, accompanying press

releases and presentation slides, as well as

the financial statements of the Group and the

adequacy and accuracy of information disclosed

prior to submission to the board for approval

|

The AC has explicit authority to investigate any

matter within its terms of reference. It has full access

to and co-operation from management and full

discretion to invite any director or executive officer to

attend its meetings, as well as reasonable resources

to enable it to discharge its function properly.

Where relevant, the AC is guided by the

recommended best practice for audit committees

as set out in the revised Guidebook for Audit

Committees issued by Singapore’s Audit Committee

Guidance Committee in August 2014.

External auditors

Each year, the AC reviews the independence of

the company’s external auditors and makes

recommendations to the board on the

re-appointment of the company’s external auditors.

The AC reviews and approves the external audit

plan to ensure the adequacy of the audit scope. It

also reviews the external auditors’ management letter

and monitors the timely implementation of required

corrective or improvement measures. The AC meets

external and internal auditors at least once a year

without the presence of management. It has reviewed

the nature and extent of non-audit services provided

by the external auditors to the Group for the year,

excluding services provided to Sembcorp Marine,

a listed subsidiary that has its own audit committee.

The AC is satisfied that the independence of the

external auditors has not been impaired by their

provision of non-audit services. Accordingly, the AC

has recommended the re-appointment of the external

auditors at the forthcoming AGM. Details of non-audit

fees payable to the external auditors are found

in

Note 33(a) in the Notes to the

Financial Statements.

Whistle-blowing policy

The AC oversees the whistle-blowing policy

implemented by the Group to strengthen corporate

governance and ethical business practices across all

business units. Employees are provided with

accessible channels to report suspected fraud,

corruption, dishonest practices or other

misdemeanours to the Group’s internal auditors and

are protected from reprisal to the extent possible.

This aims to encourage the reporting of such

matters in good faith. For more information on our

whistle-blowing policy, please refer to the

Risk

Management and Internal Controls chapter.

Internal Audit (Principle 13)

Independent internal audit function

The Group Internal Audit department (GIA) is an

independent function of the Group. The AC

approves the hiring, termination, evaluation and

compensation of the Head of GIA, who reports

directly to the AC on audit matters and to the

Group President & CEO on administrative matters.

Adequacy of the internal audit function

The AC reviews the effectiveness of the internal

audit function on an annual basis, including the

adequacy of audit resources. GIA adopts a risk-based

methodology in drawing up its annual

internal audit plan, which is reviewed and

approved by the AC.

GIA also assists the board and management

in the discharge of their corporate governance

responsibilities, as well as in improving and

promoting effective and efficient business processes

within the Group. Internal audits aim to ensure that

the Group maintains a sound system of internal

controls and that our operations comply with the

internal control framework. Internal audit reports

issued are reviewed by the AC.

Professional standards and competency

GIA employs qualified staff and provides training

and development opportunities for them so that

their technical knowledge remains current and

relevant. GIA is guided by and has met standards

for the professional practice of internal audit

promulgated by the Institute of Internal Auditors

(IIA). An external assessment of GIA affirmed that

its internal audit activity conforms on the whole

to the standards set by IIA.

SHAREHOLDER RIGHTS AND RESPONSIBILITIES

Shareholder Rights (Principle 14)

Sembcorp treats all shareholders fairly and equitably.

The company recognises, protects and facilitates the

exercise of shareholders’ rights and continually

reviews and updates such governance arrangements.

The company is committed to ensuring that all

shareholders have easy access to clear, reliable and

meaningful information in order to make informed

investment decisions. The company regularly

communicates major developments in its business

operations via SGXNET, press releases, circulars to

shareholders and other appropriate channels. The

company also encourages shareholder participation

and voting at general meetings of shareholders.

Communication with Shareholders (Principle 15)

Regular, effective and fair communication with shareholders

Sembcorp advocates high standards of corporate

transparency and disclosure. This commitment is

embodied in the company’s investor relations policy

which adheres to fair disclosure principles and

emphasises active dialogue and engagement with

shareholders, investors and analysts.

Disclosure of information on timely basis

Sembcorp makes every effort to ensure that

shareholders and capital market players have easy

access to clear, meaningful and timely information

on the company in order to make informed

investment decisions. To do this, various channels

including announcements, press releases,

shareholder circulars and annual reports are utilised.

All price-sensitive and material information is

disseminated via SGXNET on a non-selective basis

and in a timely and consistent manner. The

company’s announcements are also uploaded

on the corporate website,

www.sembcorp.com,

after dissemination on SGXNET.

The date of the release of quarterly results

is disclosed at least two weeks prior to the date

of announcement via SGXNET. On the day of

announcement, the financial statements as well as

the accompanying press release and presentation

slides are released via SGXNET and on the company

website. Thereafter, a briefing or teleconference

by management is jointly held for the media

and analysts. For first-half and full-year results

announcements, results briefings are concurrently

broadcast live via webcast. Investor relations officers

are available by email or telephone to answer

questions from shareholders, analysts and the media

as long as the information requested does not

conflict with the SGX-ST’s rules of fair disclosure.

The company also maintains a dedicated

investor relations section on its corporate website

to cater to the specific information needs of

shareholders, investors, analysts and the financial

community. Designed to provide a convenient

repository for investors’ information needs, the site

includes filings on the company’s results

announcements since the company’s listing in

1998, an archive of the company’s results briefing

webcasts, downloadable five-year financial data,

a calendar of upcoming events, as well as pertinent

stock information such as dividend history, share

price charts and analyst coverage. Investor relations

contact information is also displayed on the website

for direct

shareholder enquiries.

Establishing and maintaining regular

dialogue with shareholders

Sembcorp employs multiple communication

platforms to engage with its shareholders. In

addition to its results briefings, the company also

maintains regular dialogue with its shareholders

through investor-targeted events such as AGMs,

roadshows, conferences, site visits, group briefings

as well as one-to-one meetings. These platforms

offer opportunities for senior management and

directors to interact first-hand with shareholders,

understand their views, gather feedback as well

as

address concerns.

To keep senior management and the board

abreast of market perception and concerns, the

investor relations team provides regular updates

on analyst consensus estimates and views. On an

annual basis, a more comprehensive update is

presented, which includes updates and analysis

of the shareholder register, highlights of key

shareholder engagements for the year as well

as

market feedback.

For further details on Sembcorp’s communications

with its shareholders, please refer to the

Investor Relations chapter.

Dividend policy

Sembcorp is committed to achieving sustainable

income and growth to enhance total shareholder

return. The Group’s policy aims to balance cash

return to shareholders and investment for

sustaining growth, while aiming for an efficient

capital structure. The company strives to provide

consistent and sustainable ordinary dividend

payments to its shareholders on an annual basis.

Conduct of Shareholder Meetings (Principle 16)

Greater shareholder participation at general meetings

All shareholders are invited to participate in the

company’s general meetings.

The company disseminates information on

general meetings through notices in its annual

reports or circulars. These notices are also released

via SGXNET, published in local newspapers as well

as posted on the company website ahead of the

meetings to give ample time for shareholders to

review the documents. In line with the company’s

commitment towards environmental responsibility,

the company’s annual reports and circulars are sent

to shareholders in the form of a CD-ROM. The

annual reports and circulars may also be viewed on

the company website. However, we are mindful that

some shareholders may prefer to receive a printed

copy and this will be provided upon request.

The company’s Articles of Association allow all

shareholders the right to appoint up to two proxies

to attend general meetings and vote on their behalf.

The company also allows Central Provident Fund

investors to attend general meetings as observers.

Voting in absentia by mail, facsimile or email is

currently not permitted as such voting methods

would need to be cautiously evaluated for feasibility

to ensure that there is no compromise to the

integrity of the information and the authenticity

of the shareholders’ identity.

The Group President & CEO delivers a short

presentation at each AGM to shareholders to

update them on the performance of Sembcorp’s

businesses. Every matter requiring approval at

a general meeting is proposed as a separate

resolution. Shareholders present are given an

opportunity to clarify or direct questions on issues

pertaining to the proposed resolutions before the

resolutions are voted on. The board and management

are in attendance to address these queries or

concerns and obtain feedback from shareholders.

External auditors and legal advisors are also present

to assist the board

as necessary.

The company conducts electronic poll voting

at shareholder meetings for greater transparency

in the voting process. The total number of votes cast

for or against each resolution is tallied and displayed

live on-screen to shareholders immediately after the

vote has been cast and is also announced after the

meetings via SGXNET.

Minutes of shareholder meetings are available

upon request by shareholders.

Dealings in securities

The company has adopted a Code of Compliance

on Dealing in Securities, which prohibits dealings

in the company’s securities by its directors and

senior management within two weeks prior to

the announcement of the company’s financial

statements for each of the first three quarters

of its financial year and within one month prior

to the announcement of the company’s full-year

financial statements. Directors and employees

are also expected to observe insider trading laws

at all times, even when dealing in the company’s

securities outside the prohibited trading period,

and are reminded not to deal in the company’s

securities on short-term considerations.

Interested person transactions

Shareholders have adopted an interested person

transaction (IPT) mandate in respect of interested

person transactions of the company. The IPT mandate

defines the levels and procedures to obtain approval

for such transactions. Information regarding the IPT

mandate is available on the staff intranet. All business

units are required to be familiar with the IPT mandate

and report any interested person transactions to the

company, to be reviewed by the AC. The Group

maintains a register of the company’s interested

person transactions in accordance with the reporting

requirements stipulated by Chapter 9 of the SGX-ST

Listing Manual. Information on interested person

transactions for 2014 may be found in the related

item under the

Supplementary Information section

of the Financial Statements.

Governance Disclosure Guide

In line with Sembcorp’s commitment towards high standards of corporate governance and disclosure,

the company has completed the Disclosure Guide developed by the Singapore Exchange in 2015. The

company’s responses to the Disclosure Guide can be found

here.

SEMBCORP INDUSTRIES ANNUAL REPORT 2014 Governance & Sustainability > Corporate Governance Statement

SEMBCORP INDUSTRIES ANNUAL REPORT 2014 Governance & Sustainability > Corporate Governance Statement