Competitive Edge

|

•

|

Over 20 years’ track record in undertaking master planning, land preparation and

infrastructure development to transform raw land into urban developments

|

|

•

|

Significant land bank of integrated urban developments comprising industrial parks

as well as business, commercial and residential space in Vietnam, China and Indonesia

|

|

•

|

A valued partner to governments, with the ability to deliver the economic engine to

support industrialisation and urbanisation by attracting local and international investments

|

OPERATIONS & FINANCIAL REVIEW

Creditable performance amid a challenging year

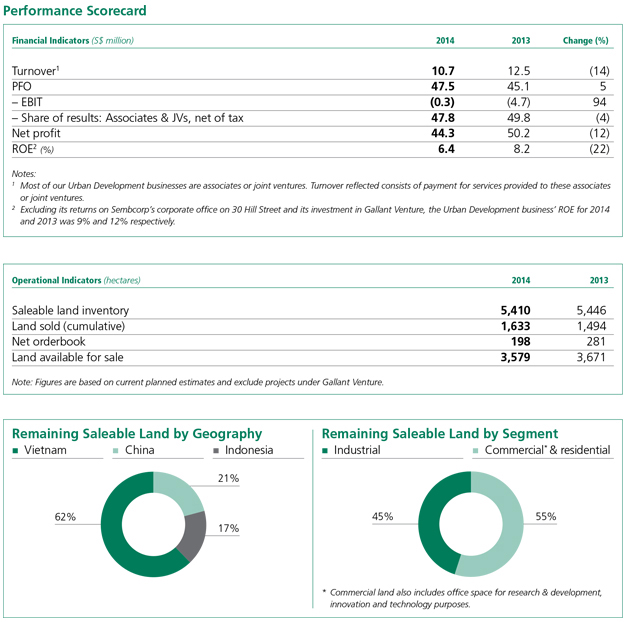

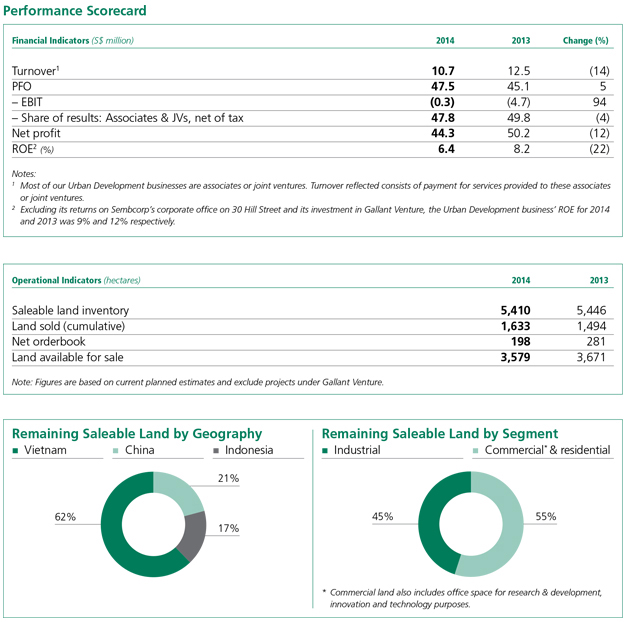

Against the backdrop of difficult market conditions,

our Urban Development business recorded a net

profit of S$44.3 million compared to S$50.2 million

the previous year. Profit from operations (PFO)

stood at S$47.5 million compared to S$45.1 million

in 2013.

2014 saw a slower property market in China

and dampened investor sentiment in Vietnam

following an unrest in the country. With investor

confidence returning in the fourth quarter, the

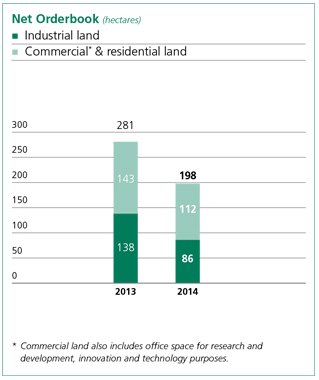

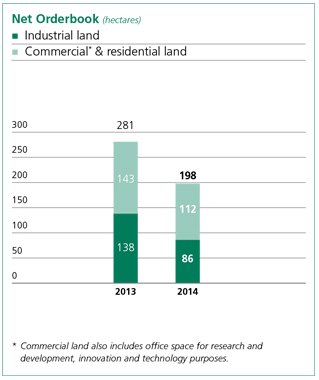

business ended the year with a total of 140 hectares

of land sales in Vietnam and China. It also received

commitments from customers for a further

56 hectares of land, bringing its net orderbook

to a total of 198 hectares as at end 2014. Industrial

land accounted for 78% of the land sold in 2014,

while commercial and residential land accounted

for the remaining 22%.

Vietnam

Vietnam

2014 was a challenging year for our Vietnam

operations. In May, unprecedented riots broke out

across several provinces in the country. Binh Duong

province, where our Vietnam Singapore Industrial

Park (VSIP) I and II are located, was amongst the

worst hit. In the aftermath of the unrest, we saw

cancellations and delays for land orders across all

VSIP projects, with dampened sentiment continuing

through the second and third quarters of the year.

Notwithstanding this, our Vietnam business

delivered a creditable performance for the year.

With investor confidence recovering late in the

fourth quarter, we ended 2014 with higher land

sales than in 2013. In terms of product mix,

industrial land continued to form the bulk of land

sold in the VSIPs, accounting for 94%, while the

remaining 6% of land sold comprised higher-margin

land for commercial and residential purposes.

During the year, we incorporated Sembcorp

Infra Services to provide on-site warehousing and

logistics operations to customers within the VSIP.

This new subsidiary will offer tenants multiple

pick-up and delivery points across the VSIP

projects. It will also offer 15,000 square metres of

warehouse space in VSIP Hai Phong by end 2015.

Response so far has been encouraging, with a

number of customers already making reservations

to take up warehouse space. This new unit widens

our suite of value-added solutions for tenants of

the VSIPs, and is expected to contribute recurring

income to

the business.

China

China

In 2014, China’s economy posted its weakest

growth in 24 years. This translated to a sluggish

market for land sales. Furthermore, the country

saw a slowdown in industrial growth, with the

Purchasing Managers’ Index decreasing to

50.1 in December 2014 compared to 51.0

in December 2013.

In particular, the performance of our Wuxi-Singapore Industrial Park (WSIP) project, which relies

on factory rental and electricity distribution as its

main sources of income, was affected by poor

sentiment in both the property and manufacturing

sectors. Despite this, the development saw the entry

of a new long-term tenant during the year. It

handed over an 11,000-square metre factory built

to specifications for Muehlbauer, which began an

eight-year lease in June. Take-up for commercial and

residential projects launched by WSIP was marginally

higher compared to 2013. These projects included

WSIP’s business and technology park, which saw 65%

of its initial phase taken up; the International Garden

City residential project, where 171 or 97% of the

apartment units have been sold; as well as Hongshan

Mansion, a new residential development which has

also sold 21 units or 19% of its initial phase.

Meanwhile, our Sino-Singapore Nanjing Eco

Hi-tech Island (SNEI) project saw a slowdown in

new land sales for much of the year. However, this

was mitigated by several announcements from the

local and central governments from the third

quarter of the year. In September, Nanjing’s

municipal government announced the abolition

of restrictions that limit the number of homes

that residents can own, while in October, the

central government eased monetary policy by

lowering its benchmark lending rates. The impact

of these announcements was immediately seen

in an improved take-up of residential units in

Jiangxinzhou, where SNEI is located, as well as

in good response to a public auction of land in

the SNEI in December, with land sales to be

booked next year.

In 2014, our Singapore-Sichuan Hi-tech

Innovation Park made maiden profits from a land

sale. The 1,000-hectare innovation park, located in

the central business district of Chengdu’s Tianfu

New City and within a newly established national-level

economic zone, broke ground in 2012.

Indonesia

Indonesia

In Indonesia, our new Kendal Industrial Park (KIP)

project in Central Java has already begun to draw

interest from both local and foreign manufacturers.

Two companies have signed expressions of

interest to buy land, even before the formal

launch of the project.

Located along the Jakarta-Semarang-Surabaya

Economic Corridor in Central Java, KIP is positioned

to benefit from the spillover of manufacturing

activity from greater Jakarta. During the year,

the detailed engineering design for the entire

860-hectare project was completed. The first of

KIP’s eight ready-built factories was also constructed,

with the remaining seven to be built on demand.

Land and infrastructure development for the project

continues to progress in preparation for handover

of prepared land to customers in 2015.

Following the dilution of Sembcorp’s stake in

Gallant Venture (GV) to 11.96% and the

reclassification of GV as an available-for-sale

financial asset, our subsidiary Sembcorp Parks

Management has ceased to provide marketing

services to Batamindo Industrial Park and

Bintan Industrial Estate.

OUTLOOK

The Urban Development business has an orderbook

of 198 hectares of land, which will be converted

into sales in the next two years. This comprises 86

hectares of industrial land and 112 hectares of

commercial and residential land. In addition, we

continue to receive enquiries for land within our

projects in Vietnam, China and Indonesia.

While the World Bank has projected global

growth to rise moderately to 3% in 2015, risk

factors for our business include residual uncertainty

as to the outcome of government measures to

promote sustained recovery in the Vietnam and

China property markets. Other risk factors include

economic uncertainty in the eurozone, which may

affect our customers’ export markets, and the weak

yen drawing Japanese investment and manufacturing

activities back to their home base.

Going forward, the outlook for our key markets

is expected to improve. In 2014, Vietnam recorded

gross domestic product growth of just under 6%,

marking its highest growth in three years. Investor

confidence appears to have recovered since the last

quarter of 2014 and in November, Vietnam’s

parliament approved new regulations for the real

estate sector permitting foreign ownership of

property. This is expected to boost interest in

residential real estate. Furthermore, the country is

looking forward to the conclusion of the Trans-Pacific Partnership, which is expected to benefit

Vietnam and its industries, such as the garment

and footwear manufacturing sectors.

While China’s growth has moderated, the

impact on its real estate sector is expected to be

mitigated by new measures introduced by the

authorities, including a rate cut by the People’s

Bank of China in November. Furthermore in the

third quarter of 2014, the government lifted

restrictions in Chengdu, Wuxi and Nanjing on

the number of homes that residents can own.

This is expected to provide a boost to the property

market over the next year.

Meanwhile in Indonesia, pre-launch interest

in KIP has been very encouraging. With the

development’s strategic location in Central Java,

it is well-positioned to capture the spillover of

manufacturing activities from Jakarta. The

project has secured commitments for land,

and continues to receive enquiries from Jakarta-based

manufacturers.

In 2015, the business is expected to deliver

a steady operating performance. As we continue

to focus on the successful execution of our new

projects, we believe we are ready to respond

quickly to a growth momentum in orderbook

and deliver land to our customers.

SEMBCORP INDUSTRIES ANNUAL REPORT 2014 Operating & Financial Review > Urban Development Review

SEMBCORP INDUSTRIES ANNUAL REPORT 2014 Operating & Financial Review > Urban Development Review Competitive Edge

Competitive Edge