Competitive Edge

|

•

|

A leading developer, owner and operator

of energy and water assets with strong

operational, management and technical

capabilities

|

|

•

|

Operations in 14 countries with an established

presence in Asia and a strong growing presence

in emerging markets

|

|

•

|

Strong track record in generating and supplying

power, steam and natural gas, and providing

total water and wastewater treatment solutions

for industries and water-stressed regions

|

|

•

|

Global leader in the provision of energy,

water and on-site logistics to multiple industrial

site customers

|

OPERATIONS AND FINANCIAL REVIEW

Underlying operations deliver growth in earnings

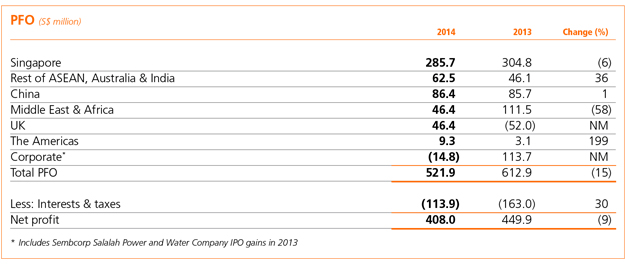

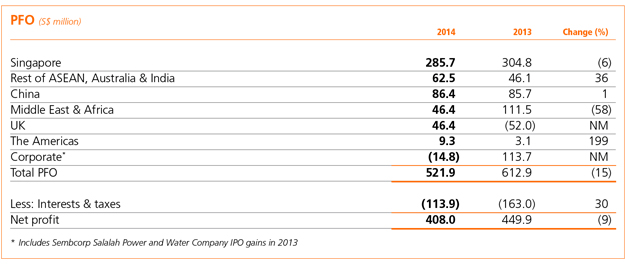

Underpinned by contribution from its overseas

operations, the Utilities business delivered profit

growth from its underlying operations despite

intense competition in Singapore’s power market.

The business’ turnover was S$4.9 billion in 2014

compared to S$5.1 billion in 2013, while net profit

was S$408.0 million, compared to S$449.9 million

last year. Excluding significant items in 2013

1, net

profit grew by 7% in 2014.

Profit from operations (PFO) stood at

S$521.9 million, a 15% decline from last year’s

S$612.9 million. Excluding 2013’s significant

items, PFO decreased by 6% in 2014.

Singapore operations accounted for 53% of total

PFO, while overseas operations accounted for 47%.

In 2014, PFO from operations in

Singapore decreased 6% to S$285.7 million, reflecting intense

competition in the local power market. The Uniform

Singapore Energy Price continued to slide, averaging

S$137 per megawatt for the year compared to

S$173 per megawatt in 2013. New income streams

from the Banyan facilities, short-term merchant

income and improved contractual rates in the solid

waste management business helped to mitigate

the decline in PFO.

The business’ PFO from the

Rest of ASEAN,

Australia & India grew 36% to S$62.5 million. In

Vietnam, we raised our effective stake in Phu My 3

power plant to 66.7% and commenced recognition

of our additional 33.3% stake in September. Arising

from this transaction, a S$10.3 million one-off net

gain was recognised. Meanwhile, our solid waste

management associate in Australia, the other major

contributor within this region, delivered a comparable

performance to last year’s.

PFO contribution from our business in

China

stood at S$86.4 million in 2014, comparable to

S$85.7 million in 2013. Our Yangcheng coal-fired

power plant and Shanghai Cao Jing cogeneration

plant delivered a better performance in 2014, but this

was offset by weaker performance by our wind power

assets and water operations. In the fourth quarter, an

increase in the natural gas tariff was implemented by

the government, affecting the performance of the

gas-fired Shanghai Cao Jing plant for the quarter.

Our

Middle East and Africa operations

registered a PFO of S$46.4 million in 2014

compared to S$111.5 million in 2013, due to the

deconsolidation of Sembcorp Salalah Power and

Water Company after its initial public offering in

September 2013. Meanwhile, operations in the

UK

recorded a PFO of S$46.4 million, backed by an

improved performance on Teesside. As part of our

strategy to restructure our business on Teesside and

develop the Wilton International site into a green

hub, we divested our asset protection business and

de-commissioned two ageing coal-fired boilers on the

site. During the year, we also successfully extended

contracts with two on-site customers. Meanwhile, our

businesses in

the Americas spanning Chile, Panama

and the Caribbean registered a combined PFO of

S$9.3 million, compared to S$3.1 million in 2013,

on the back of an improved operating performance.

BUILDING A STRONG DEVELOPMENT

PIPELINE TO DRIVE LONG-TERM GROWTH

Growing Our Portfolio

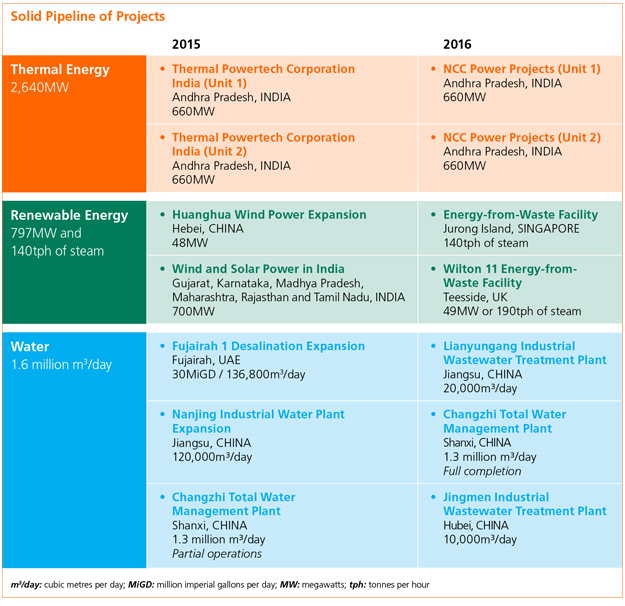

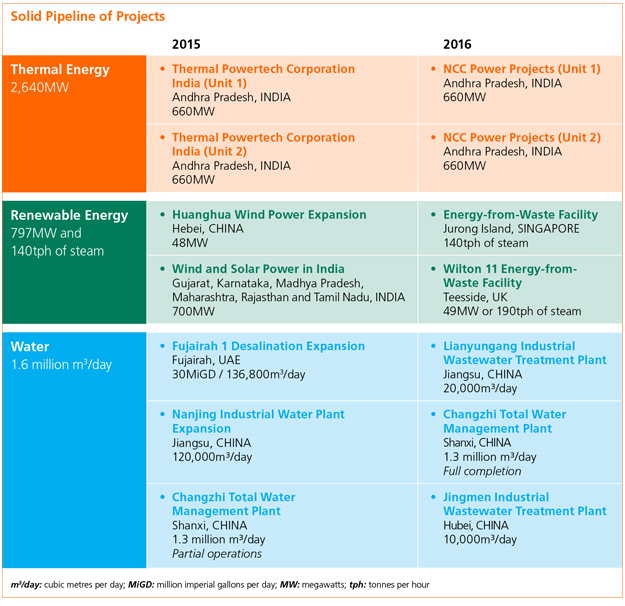

Adding over 3,400 megawatts of power and

1.6 million cubic metres per day of water and

wastewater treatment capacity to our

operating portfolio in 2015 and 2016

In 2014, we remained focused on sowing the seeds

for future growth. In 2015 and 2016, we will add

over 3,400 megawatts of power and 1.6 million

cubic metres per day of water and wastewater

treatment capacity to our operating portfolio,

bringing our gross power and water capacity to

almost 7,900 megawatts and over 9.5 million

cubic metres per day.

ASEAN and the Middle East

ASEAN and the Middle East

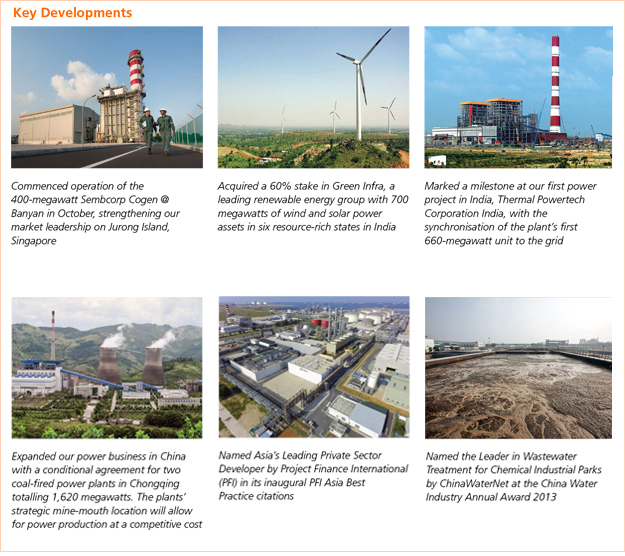

Besides securing new projects to build up our

project pipeline, we have also maintained a strong

focus on the execution of projects under

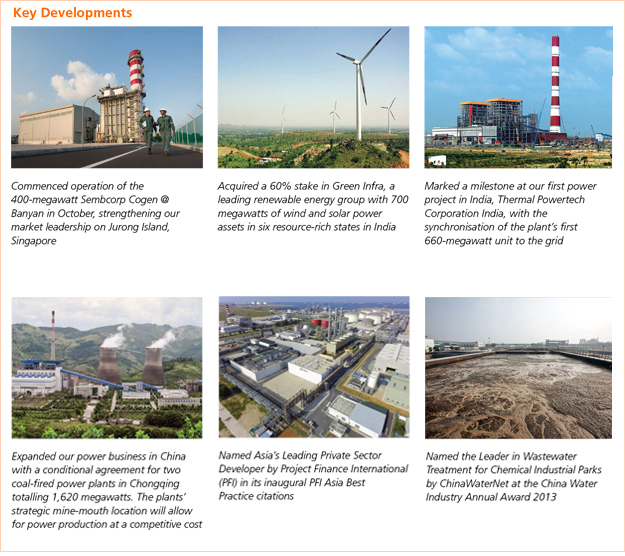

development. During the year, we added 400

megawatts of gross power and 200 tonnes per

hour of steam to our total operating capacity with

the completion and operation of Sembcorp Cogen

@ Banyan, our second cogeneration plant in

Singapore’s Jurong Island petrochemical hub.

This investment reinforces our position as the

preferred supplier of energy, water and on-site

logistics to companies on Jurong Island. Meanwhile

in the UAE, our 30 million imperial gallons per day

expansion to the desalination capacity of the

Fujairah 1 Independent Water and Power Plant is

progressing well and is expected to come onstream

in the third quarter of 2015.

China

In 2014, we continued efforts to extend the reach

of our industrial water and wastewater treatment

business in China, particularly in the industrial and

petrochemical sectors. We made good progress in

the construction for an upcoming 120,000 cubic

metres per day expansion to our Nanjing industrial

water facilities, as well as an upcoming total water

management plant to serve a major coal-to-chemicals

customer in Changzhi. As at end 2014,

these plants were respectively 70% and 37%

complete, with the Nanjing expansion on track for

completion in the first half of 2015, and partial

operations for the Changzhi project expected in

2015. In addition, in response to customer feedback

that a higher demand was expected, we increased

the planned cooling water capacity of the Changzhi

plant by a further 144,000 cubic metres per day. This

brings the project’s total water capacity to 1.3 million

cubic metres per day. The project has been selected

by the governments of China and Singapore as a

joint showcase for integrated water management.

In June, we signed a joint venture agreement

to acquire and upgrade an existing wastewater

treatment facility at the Lianyungang Lingang

Chemical Industrial Park. We will equip the facility

to effectively treat high concentration wastewater

and increase its capacity to 20,000 cubic metres

per day. This project is significant as it kicks off a

new collaboration with the Jiangsu Environment

Protection Department, which has chosen

Sembcorp as their partner to improve industrial

wastewater management at Jiangsu’s industrial

parks. If successful, this could provide a model

that can be replicated at industrial parks across

Jiangsu and other provinces.

On the energy front, we inked a conditional

joint venture agreement for a mine-mouth coal-fired

power project in Chongqing. Sembcorp will

hold 49% in the joint venture, which will own an

existing 300-megawatt coal-fired power plant and

develop an adjacent 1,320-megawatt coal-fired

power plant targeted for completion in 2017. The

entire project will cost approximately RMB6 billion

(approximately S$1.2 billion). The plants’ strategic

mine-mouth location offers significant savings in

logistics costs and will enable the production of

power at a lower cost.

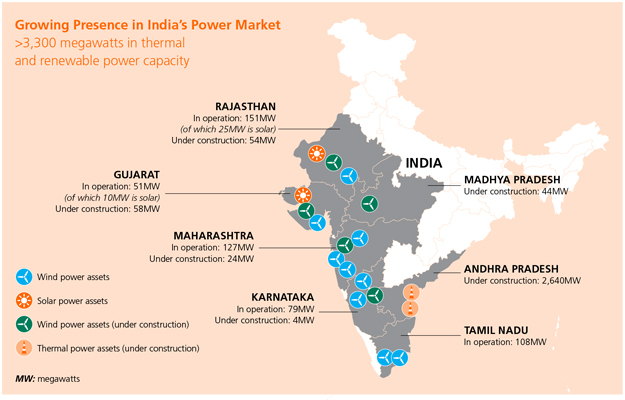

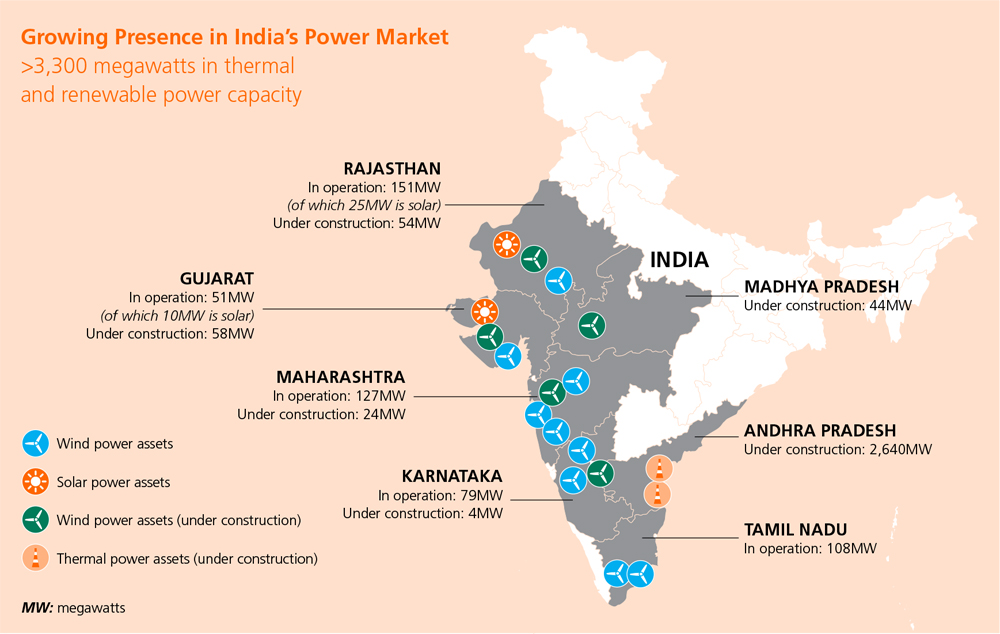

India

Construction of our two supercritical coal-fired

projects in Nellore, Andhra Pradesh is progressing

well, and the plants are on track to be completed in

2015 and 2016 respectively.

The first of these 1,320-megawatt power

plants will commence commercial operation of its

initial 660-megawatt unit in the first quarter of

2015. The plant’s second 660-megawatt unit is

expected to undergo commissioning soon and

begin commercial operation in the third quarter of

the year. During the year, we increased our stake

in this US$1.5 billion project from 49% to 65%,

giving us majority control. To maintain flexibility,

the plant’s load will be sold through a mixture

of long-term, medium-term and short-term

contracts. To date, we have secured power

purchase agreements for the sale of 900

megawatts of power, including a long-term

agreement to supply 500 megawatts to the

states of Andhra Pradesh and Telangana.

We embarked on our second coal-fired power

project in the country early in the year, with the

acquisition of a 49% stake in a 1,320-megawatt

facility being built on an adjacent site. This

acquisition doubled our thermal power capacity in

India to 2,640 megawatts. The proximity of both

plants will enable us to benefit from operational

synergies, such as shared coal importation and

logistics infrastructure and a common management

team. The total investment for our 49% stake

amounts to Rs 923.4 crores (approximately

S$190.7 million), and we intend to increase our

share to 65% upon receipt of relevant approvals.

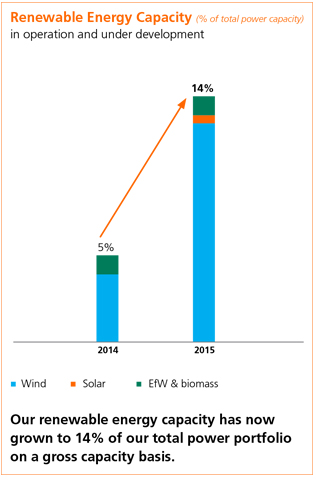

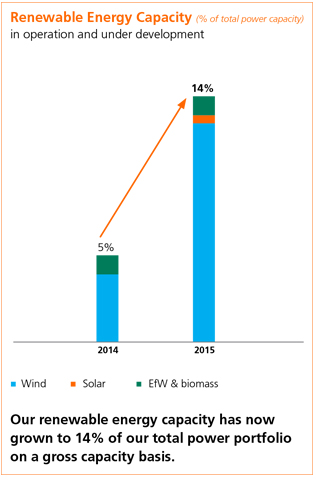

A Balanced Portfolio for Sustainability

Growing our renewable energy business and

capabilities globally

Expanding our renewable energy capabilities and

capacity as part of having a balanced portfolio

of

high-efficiency thermal and renewable energy

assets is a key element in our strategy for building

a sustainable power portfolio. To this end, we have

made meaningful progress. From 5% of our total

power capacity in 2014, renewable energy now

comprises 14% of our total power portfolio on

a gross capacity basis.

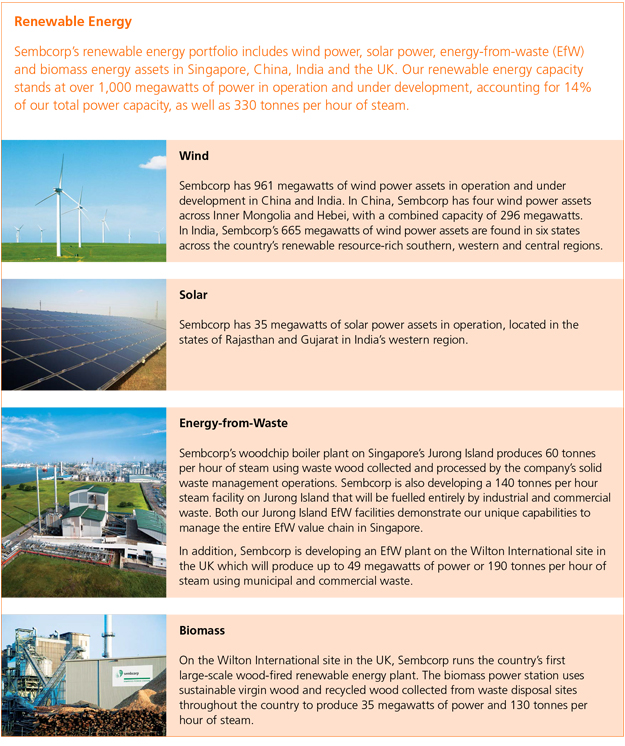

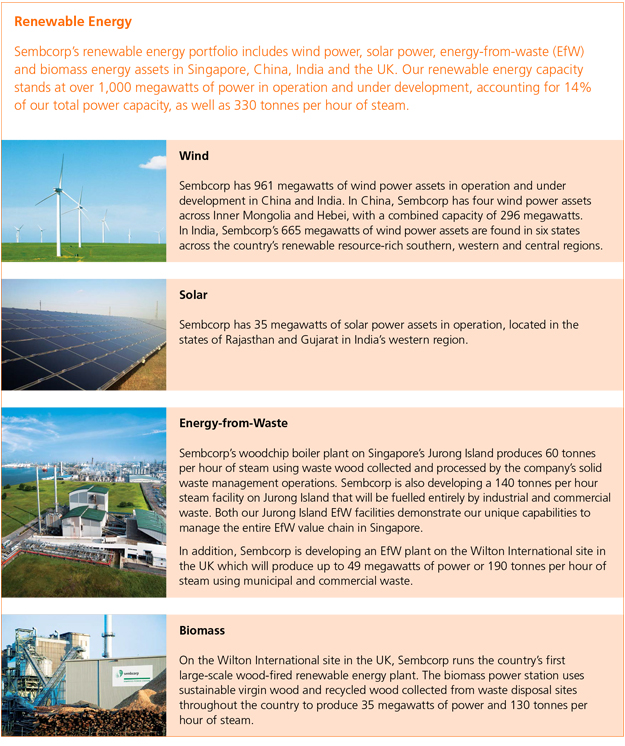

In China, our 48-megawatt wind power

capacity expansion in Huanghua, Hebei province,

was completed in February 2015. Meanwhile,

construction of our energy-from-waste (EfW)

facilities in Singapore and the UK is 38% and

48% complete respectively. Our upcoming 140

tonnes of steam per hour EfW facility on Singapore’s

Jurong Island will be our largest in the country,

and both it and our 49-megawatt EfW facility on

Wilton International in the UK are targeted for

completion in 2016.

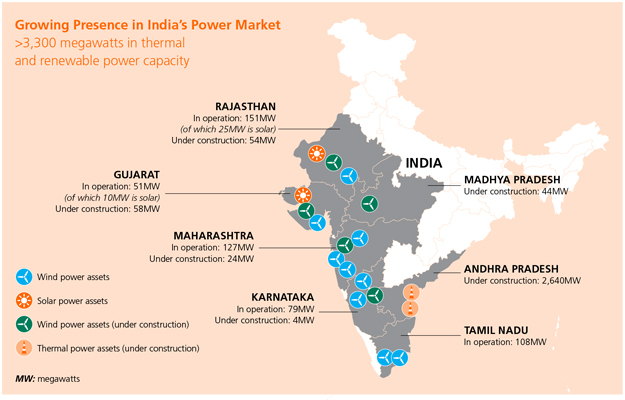

In February 2015, we marked our entry into

India’s fast-growing renewable energy market with

the acquisition of a 60% stake in Green Infra, a

leading renewable energy group with wind and

solar power assets in six states across the southern,

western and central regions of the country. The

addition of Green Infra will add approximately 700

megawatts of operating assets to Sembcorp’s

renewable energy portfolio in 2015. The acquisition

almost triples Sembcorp’s total renewable energy

capacity to over 1,000 megawatts globally.

With gas-fired and coal-fired thermal power

plants, as well as a global renewable portfolio

that encompasses wind, solar, energy-from-waste

and biomass assets, Sembcorp is now

well-positioned for growth in both the thermal

and renewable energy sectors.

Optimising the Management of Our Assets

Enhancing competitiveness with technology and innovation

In October, we officially opened the new

Sembcorp Technology & Innovation Centre on

Jurong Island in Singapore. Comprising laboratories

and applied research and development facilities,

it is a centre for the development and integration

of innovative processes and the commercialisation

of emerging technologies.

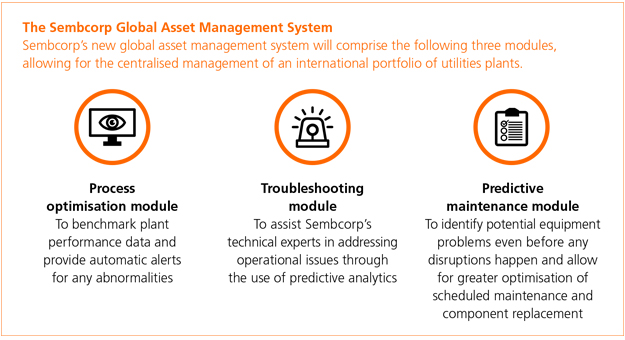

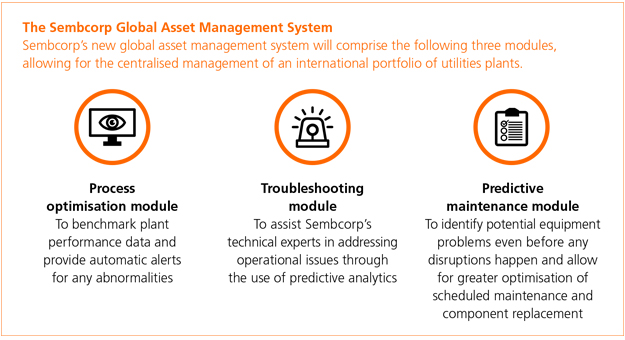

It also houses an advanced global asset

management system to centrally manage our

international utilities operations from Singapore.

Currently in development, the Sembcorp Global

Asset Management System will allow us to better

harness our collective global expertise, drive

operational excellence and optimise asset

performance for enhanced reliability, availability

and cost effectiveness.

OUTLOOK

In 2015, the world’s economy is expected to face

strong and complex cross-currents, leading to a

mixed economic outlook. According to the World

Bank’s Global Economic Prospects, while the global

economy is expected to grow by a moderate 3%

in 2015 against a lower-than-expected 2.6% in

2014, low oil prices are expected to contribute

to diverging prospects for oil-exporting and

oil-importing countries.

In Singapore, the Ministry of Trade and

Industry forecasts the economy to grow between

2% and 4% in 2015, compared to 2.9% in 2014.

Meanwhile, the Economic Development Board has

lowered its fixed asset investments forecast for 2015

to a range of between S$9 billion to S$11 billion,

from S$10 billion to S$12 billion in 2014. The lower

forecast reflects factors such as a sharper focus on

attracting projects that are in line with Singapore’s

stage of economic development, as well as greater

uncertainty in the outlook for the global economy.

The Utilities business environment in Singapore is

expected to be challenging in 2015, with continued

intense competition in the power market as well as

low oil prices.

According to the World Bank, China’s economy

is expected to grow at a moderate 7.1% in 2015,

down from its estimated 7.4% growth in 2014. The

government is expected to continue with its pursuit

of structural reforms to make the economy more

market driven and maintain its strong promotion

of greater environmental protection.

Meanwhile, the World Bank forecasts that India’s

economy will grow by an estimated 6.4% in 2015,

up from an estimated 5.6% in 2014. This signals

regained economic momentum and continued

recovery from two years of modest growth between

2012 and 2013, to growth levels that are more in

line with the country’s high long-term potential.

The new government continues to push ahead

with measures to reform the power sector, including

efforts to resolve coal issues and encourage greater

growth in renewable energy. The first of our

1,320-megawatt power plants in India will

commence operation in phases in 2015, followed by

our second 1,320-megawatt power plant in 2016.

Together with our recent acquisition of Green Infra,

this will bring our gross power capacity in India to

over 3,300 megawatts, comprising both thermal

and renewable energy assets.

Despite the mixed global economic outlook,

essential energy and water solutions will continue

to remain relevant, particularly in emerging growth

markets. Sembcorp has built up a successful track

record in developing large-scale greenfield projects

and is well-positioned to secure opportunities. Our

Utilities business remains focused on operational

excellence and efficiency, as well as the execution

of our significant pipeline of projects and the

pursuit of new growth opportunities to deliver

long-term growth.

SEMBCORP INDUSTRIES ANNUAL REPORT 2014 Operating & Financial Review > Utilities Review

SEMBCORP INDUSTRIES ANNUAL REPORT 2014 Operating & Financial Review > Utilities Review Competitive Edge

Competitive Edge

1 Significant items in 2013 amounted to S$68.6 million, comprising the gain from the IPO of Sembcorp Salalah Power and Water

1 Significant items in 2013 amounted to S$68.6 million, comprising the gain from the IPO of Sembcorp Salalah Power and Water