In the context of constantly evolving requirements

of disclosure, transparency and corporate governance,

we aim to provide investors with an accurate,

coherent and balanced account of the Group’s

performance. Sembcorp has a dedicated investor

relations team and communicates with the investing

public through multiple platforms and channels.

These include group briefings to analysts, investors

and the media; one-on-one meetings with

shareholders and potential investors; investor

roadshows as well as the

investor relations section

of our corporate website. In addition, company

visits and facility tours are also organised to help

investors gain insights into the Group’s operations.

PROACTIVE COMMUNICATION WITH THE FINANCIAL COMMUNITY

During the year, senior management and the

investor relations team continued to actively engage

with the financial community. We held over 150

one-on-one and group meetings with shareholders,

analysts and potential investors. These included

non-deal roadshows to international financial

centres. In the Asia Pacific, we covered Singapore,

Malaysia and Australia; in Europe, England, Scotland

and Switzerland; and in North America, Canada

and the US. We also participated in six investor

conferences: the Credit Suisse 17

th Annual Asian

Investment Conference in Hong Kong, and in

Singapore, the Maybank Invest ASEAN Conference

the dbAccess Asia Conference, the Citibank ASEAN

Investor Conference, the Macquarie ASEAN

Conference and the Morgan Stanley 13

th Annual

Asia Pacific Summit. We also continued to organise

site visits to our facilities on Jurong Island, Singapore

to provide analysts and investors a first-hand look at

our operations and allow them to gain a better

understanding of Sembcorp’s capabilities and

operational track record.

COMMITMENT TO GOOD CORPORATE GOVERNANCE

As a strong endorsement of Sembcorp’s excellence

in corporate governance management and

disclosure, Sembcorp won top awards in three out

of five categories at the 2014 Singapore Corporate

Awards. These included gold awards for Best

Managed Board and Best Annual Report for

companies with S$1 billion and above in market

capitalisation, as well as the gold award for Best

Chief Executive Officer, which was awarded to

Sembcorp Industries’ Group President & CEO Tang

Kin Fei. The Singapore Corporate Awards celebrate

the best in corporate governance among listed

companies, as well as individuals who, through

their corporate practices, have helped to raise

Singapore's standard of governance and disclosure.

The awards are organised by the Institute of

Singapore Chartered Accountants, the Singapore

Institute of Directors and The Business Times, and

supported by the Accounting and Corporate

Regulatory Authority and the Singapore Exchange.

In 2014, Sembcorp also improved its ranking

on the Governance and Transparency Index (GTI)

and became the third-highest ranked company on

the GTI. A well-respected ranking exercise by the

National University of Singapore Business School’s

Centre for Governance, Institutions and

Organisations in collaboration with CPA Australia

and The Business Times, the GTI assesses the

transparency of 644 Singapore-listed companies’

financial disclosures as well as their governance,

ethics and rigour in financial reporting.

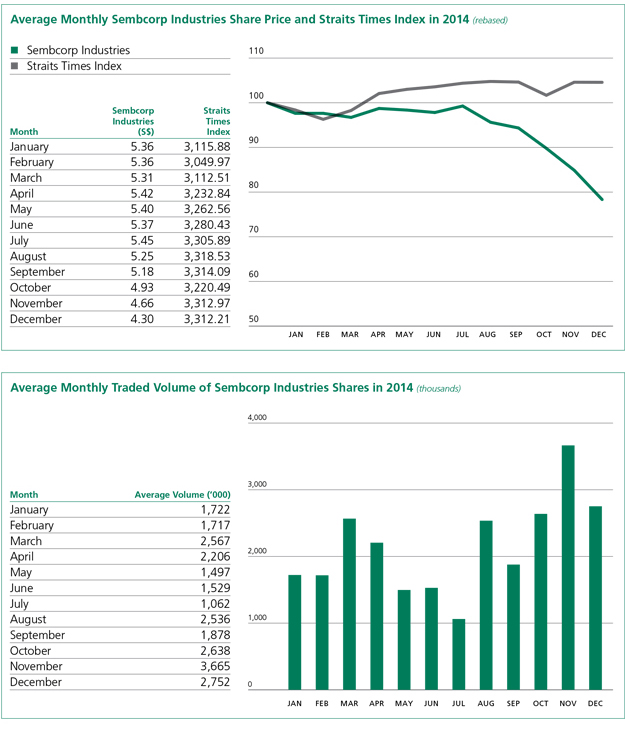

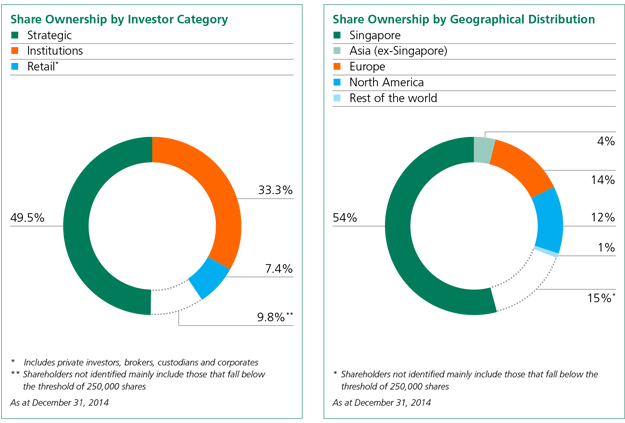

TOTAL SHAREHOLDER RETURN

Sembcorp Industries’ last traded share price in

2014 was S$4.45, and the company ended the

year with a market capitalisation of S$8.0 billion.

The company’s share price averaged S$5.16 during

the year, registering a high of S$5.55 in April

and a low of S$4.10 in December. Daily turnover

averaged 2.1 million shares. In May 2014, we paid

out a final tax exempt one-tier dividend of 17 cents

per ordinary share for the financial year 2013,

comprising a final ordinary dividend of 15 cents

per ordinary share and a final bonus dividend of

2 cents per ordinary share.

Falling oil prices, exacerbated by the decision

of the Organization of the Petroleum Exporting

Countries (OPEC) to maintain oil production levels,

sparked a sell-off in oil and gas-related stocks

globally. The negative sentiment on the sector has

had an impact on the performance of Sembcorp

Industries shares, and for 2014, total shareholder

return stood at negative 16%. In relative terms,

this performance compared favourably against the

FTSE ST Oil & Gas Sector Index’s negative 23%;

but against the broader market, this was below

the Straits Times Index’s positive 10% return

and the MSCI Asia Pacific ex-Japan Industrials

Index’s flat performance.

Based on feedback from shareholders and in line

with Sembcorp’s commitment to deliver shareholder

value, we paid an interim dividend for the first

time to shareholders, increasing the frequency of

dividend payments to twice a year. For the financial

year 2014, an interim tax exempt one-tier dividend

of 5 cents per ordinary share was declared

and paid to shareholders in September 2014.

In addition, a final tax exempt one-tier dividend

of 11 cents per ordinary share has been proposed,

subject to approval by shareholders at the next

annual general meeting. Together with the interim

dividend, this brings our total dividend for FY2014

to 16 cents per ordinary share.

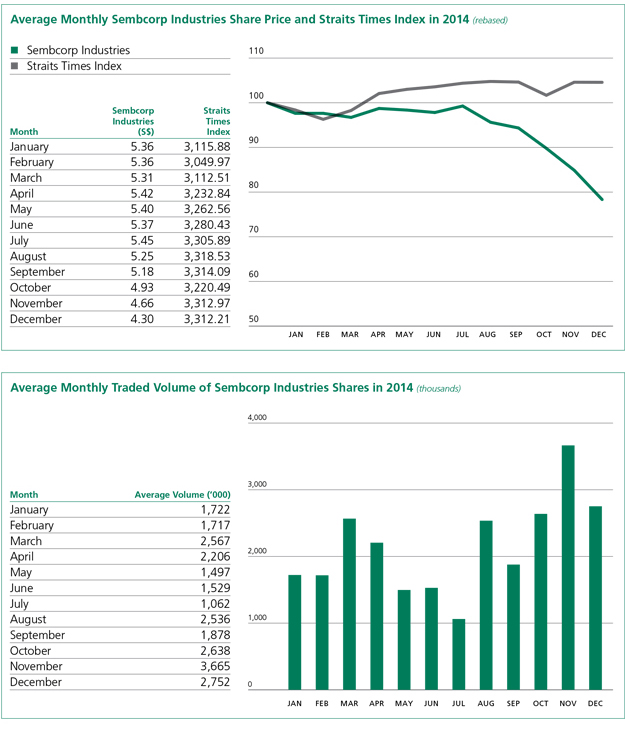

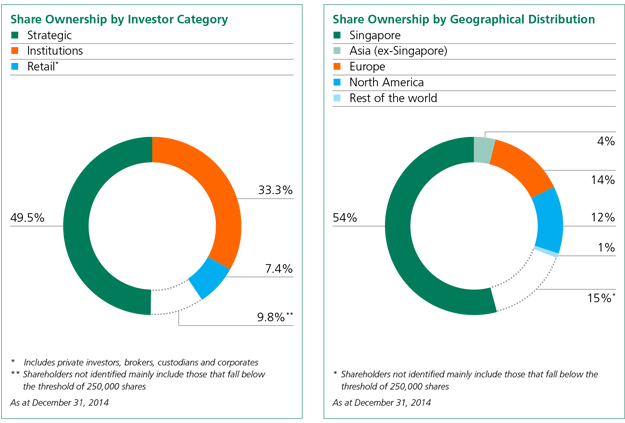

SHAREHOLDER INFORMATION

In 2014, institutional shareholders as a group

continued to dominate Sembcorp’s shareholder

base. Other than our major shareholder Temasek

Holdings which held 49.5% of our shares at the

end of 2014, institutional shareholders accounted

for 33.3% of our issued share capital or 66% of

free float, while retail shareholders

1 and unidentified

shareholders

2 held 17.2% of issued share capital or

34% of free float. In terms of geographical spread,

excluding the stake held by Temasek Holdings,

our largest geographical shareholding base was

Europe with 14% of issued share capital, followed

by shareholders from North America and Asia

which accounted for 12% and 9% of our

company’s issued share capital respectively.

SEMBCORP INDUSTRIES ANNUAL REPORT 2014 Governance & Sustainability > Investor Relations

SEMBCORP INDUSTRIES ANNUAL REPORT 2014 Governance & Sustainability > Investor Relations