- EMERGING

STRONGER - OPERATING & FINANCIAL REVIEW

- ENVIRONMENTAL, SOCIAL AND GOVERNANCE REVIEW

- FINANCIAL STATEMENTS

- Directors’ Statement

- Independent Auditors’ Report

- Balance Sheets

- Consolidated Income Statement

- Consolidated Statement of

Comprehensive Income - Consolidated Statement of

Changes in Equity - Consolidated Statement of

Cash Flows - Notes to the Financial Statements

- Supplementary Information

- EVA Statement

- Shareholders' Information

- Governance Disclosure Guide

- Corporate Information

- Notice of Annual General Meeting

- Proxy Form

- Letter to Shareholders

- Financial Calendar

INVESTOR RELATIONS

At Sembcorp, we are committed to ensuring that all capital market players have easy access to clear, reliable and meaningful information on our company in order to make informed investment decisions.

In the context of constantly evolving disclosure, transparency and corporate governance requirements, we aim to provide investors with an accurate, coherent and balanced account of the Group’s performance and prospects. Sembcorp has a dedicated investor relations team and communicates with the investing public through multiple platforms and channels. These include group briefings to analysts, investors and the media; one-on-one meetings with shareholders and potential investors; investor roadshows as well as the investor relations section of our company website. In addition, we also organise company visits and facility tours to help investors gain insights into the Group’s operations.

Proactive Communication with the Financial Community

During the year, senior management and the investor relations team actively engaged the financial community. We held nearly 130 one-on-one and group meetings with shareholders, analysts and potential investors. These included meetings during non-deal roadshows in Singapore, London, Amsterdam, New York, Los Angeles, San Francisco and Toronto. We participated in investor conferences including the Credit Suisse 19th Annual Asian Investment Conference in Hong Kong, as well as the HSBC ASEAN & India Conference 2016 and the Morgan Stanley 15th Annual Asia Pacific Summit in Singapore. We also continued to organise site visits to our facilities. In 2016, we organised a plant tour for analysts to the Sembcorp Gayatri Power Complex in India. The visit provided analysts a first-hand look at our operations in India.

Commitment to Good Corporate Governance

Sembcorp continues to rank among the top companies in Singapore for good corporate governance and transparency. We were the sixth-highest ranked company in Singapore in the 2016 edition of the Singapore Governance & Transparency Index. Singapore’s leading index assessing corporate governance practices of listed companies, the Singapore Governance & Transparency Index is a collaboration between CPA Australia, National University of Singapore Business School’s Centre for Governance, Institutions and Organisations and the Singapore Institute of Directors. It compares the transparency of 631 Singapore-listed companies based on their annual financial announcements.

In addition, we were recognised as the Most Transparent Company in the Industrials category at the SIAS Investors’ Choice Awards 2016. This award honours and recognises public listed companies that have demonstrated exemplary corporate governance and transparency throughout the year.

Total Shareholder Return

Sembcorp Industries’ last traded share price in 2016 was S$2.85 and the company ended the year with a market capitalisation of S$5.1 billion. The company’s share price averaged S$2.75 during the year, registering a low of S$2.19 in January and a high of S$3.23 in March. Daily turnover averaged 5.8 million shares.

Sembcorp Industries’ total shareholder return for 2016 stood at negative 3%. This was lower than the Straits Times Index’s positive 4% and the MSCI Asia Pacific ex-Japan Industrials Index’s negative 2%. However, this was more favourable than the FTSE ST Oil & Gas Index’s negative 9%. During the year, the weak sentiment towards the oil and gas industry continued to weigh on our 60.9%-owned listed Marine subsidiary.

Sembcorp remains committed to delivering shareholder value amidst difficult operating conditions. For the financial year 2016, an interim dividend of 4 cents per ordinary share was declared and paid to shareholders in August 2016. In addition, a final dividend of 4 cents per ordinary share has been proposed, subject to approval by shareholders at the coming annual general meeting to be held in April 2017. Together with the interim dividend, this would bring our total dividend for 2016 to 8 cents per ordinary share.

Shareholder Information

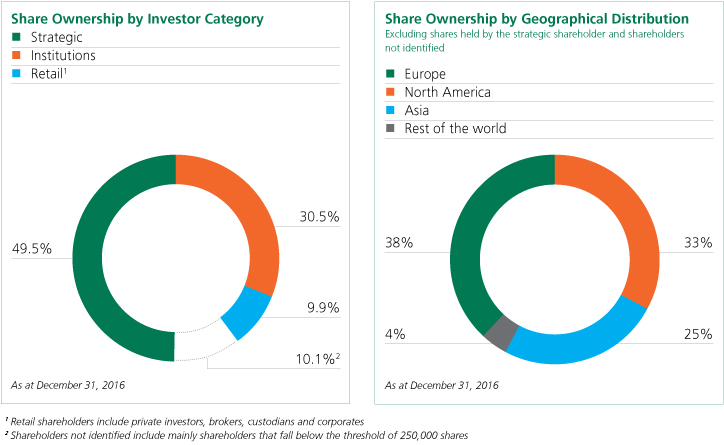

In 2016, institutional shareholders as a group continued to dominate Sembcorp’s shareholder base. Other than our major shareholder Temasek Holdings, which held 49.5% of our shares at the end of 2016, institutional shareholders accounted for 31% of our issued share capital or 60% of free float, while retail shareholders1 and shareholders not identified2 held 20% of issued share capital or 40% of free float. In terms of geographical spread, excluding the stake held by Temasek Holdings and shareholders not identified, our largest geographical shareholding base was Europe with 38%, followed by shareholders from North America and Asia, which accounted for 33% and 25% of the shares respectively.