- EMERGING

STRONGER - OPERATING & FINANCIAL REVIEW

- ENVIRONMENTAL, SOCIAL AND GOVERNANCE REVIEW

- FINANCIAL STATEMENTS

- Directors’ Statement

- Independent Auditors’ Report

- Balance Sheets

- Consolidated Income Statement

- Consolidated Statement of

Comprehensive Income - Consolidated Statement of

Changes in Equity - Consolidated Statement of

Cash Flows - Notes to the Financial Statements

- Supplementary Information

- EVA Statement

- Shareholders' Information

- Governance Disclosure Guide

- Corporate Information

- Notice of Annual General Meeting

- Proxy Form

- Letter to Shareholders

- Financial Calendar

UTILITIES REVIEW

Competitive Edge

| • | A leading developer, owner and operator of energy and water assets with strong operational, management and technical capabilities |

| • | Operations in 14 countries with a strong presence in growth markets and an established presence in Asia |

| • | Global leader in the provision of energy, water and on-site logistics to multiple industrial site customers |

| • | A balanced global portfolio of high efficiency thermal and renewable assets, with capabilities in gas, coal, wind, solar, biomass and energy-from-waste |

| • | Solid track record in providing total water and wastewater treatment solutions for industries and water-stressed regions |

OPERATING AND FINANCIAL REVIEW

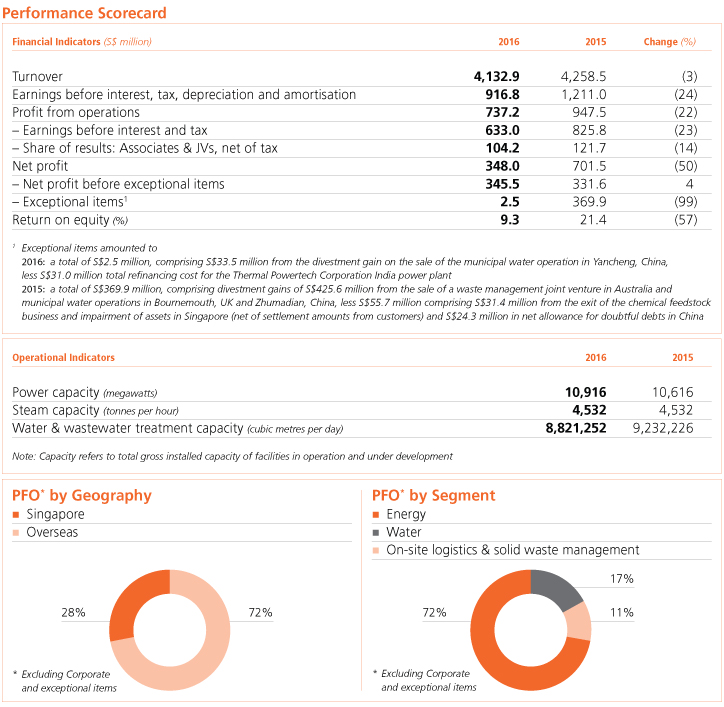

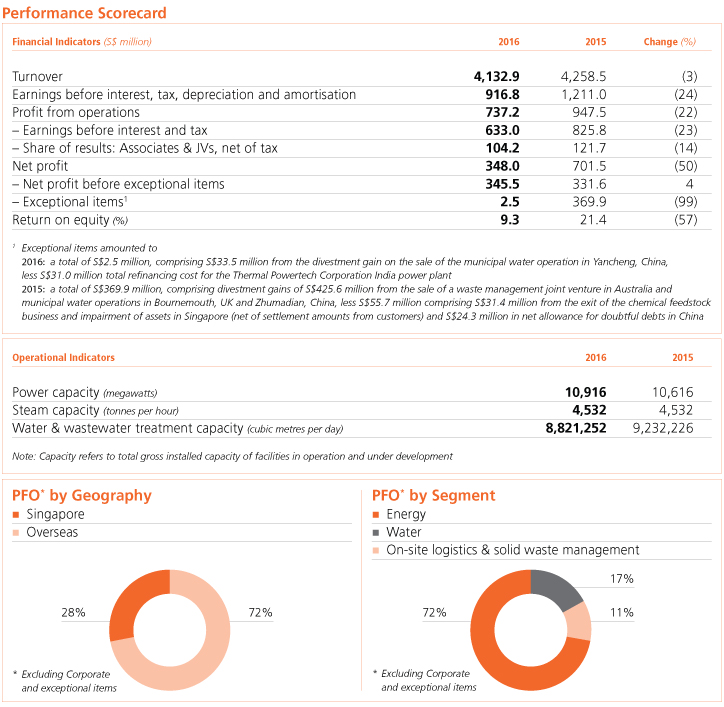

Overseas operations now contribute 72% of profit from operations

The Utilities business continued to provide a strong income base for Sembcorp in 2016. Operations in China turned in record profits for the year, while Singapore operations continued to be a key profit contributor despite intense competition in the power market.

Turnover was S$4.1 billion compared to S$4.3 billion in 2015. Profit from operations (PFO) was S$737.2 million compared to S$947.5 million, while net profit was S$348.0 million compared to S$701.5 million. In 2015, the business divested an Australian waste management joint venture and municipal water operations in the UK and Zhumadian, China and recorded exceptional items totalling S$376.3 million. In 2016, the business recorded S$13.5 million in exceptional items, which includes a gain from the divestment of the Yancheng municipal water operations in China. Excluding exceptional items which mainly comprised gains from these divestments, PFO grew 27% to S$723.7 million, while net profit rose 4% to S$345.5 million from S$331.6 million in 2015.

Overseas operations contributed almost three-quarters of the Utilities business’ PFO before exceptional items in 2016 or S$513.1 million, a growth of 30% over last year. Meanwhile, Singapore operations contributed 28% of the Utilities business’ PFO, with S$198.3 million.

On a net profit basis, overseas operations generated 63% or S$222.8 million of the business’ net profit, while Singapore operations turned in the remaining 37% or S$132.1 million.

Our Singapore operations achieved a steady performance in 2016 with a PFO of S$198.3 million, driven by a solid performance by its centralised utilities and solid waste management units. This was roughly comparable to the business’ 2015 PFO of S$203.9 million.

On a net profit basis, the Singapore business turned in S$132.1 million, compared to S$146.8 million in 2015. Our power business in the country continues to face intense competition. However our diversified utilities operations, supplying power, steam, natural gas, total water and wastewater treatment solutions, on-site logistics as well as solid waste management, has provided resilience.

In 2016, PFO from China operations increased to S$140.1 million from S$110.7 million in 2015. On a net profit basis, the business turned in a record profit of S$124.8 million, representing a growth of 31% over 2015. Both the energy and water segments posted improvements in earnings. In addition, earnings from the country included a final dividend from the Yangcheng coal-fired power plant, for which the cooperative joint venture agreement expired in October 2016.

Meanwhile in December 2016, we completed the divestment of our 49% stake in municipal water unit Yancheng China Water Co to the local government’s municipal utilities investment company. Arising from this, a divestment gain of S$34.7 million (S$33.5 million at net profit level) was recognised as an exceptional item.

PFO from India operations was S$239.5 million in 2016 compared to S$127.3 million in 2015, however in net profit terms the business posted a net loss of S$16.1 million.

Sembcorp Green Infra, our India renewable energy arm, performed better in 2016 over the previous year. The unit’s profits benefited from improved wind speeds in the second half of 2016 after the passing of El Niño, as well as an additional 139 megawatts of wind power coming into operation.

On the thermal power side, our first 1,320-megawatt coal-fired power plant, Thermal Powertech Corporation India (TPCIL) generated 9,091 million units and operated at an average plant load factor of 78%. Our focus during the year was stabilising the operations of the plant, and resolving teething issues typical of large-scale coal-fired power plants in their initial stage of operations. At the operating level, TPCIL generated a healthy PFO of S$162.1 million, and posted a net profit of S$2.5 million after deducting financing costs and taxes. Notwithstanding this, TPCIL made good progress on the commercial front. The plant contracted 86% of its net capacity, or 1,070 megawatts, under long-term power purchase agreements, securing a steady source of recurring income. 500 megawatts have been contracted to Andhra Pradesh and Telangana for 25 years, while another 570 megawatts are contracted to Telangana for eight years. With these long-term power purchase agreements in place, we took the opportunity to refinance the project finance loan for the asset. Total refinancing cost of S$31.0 million (at net profit level) was incurred and recognised as an exceptional item. The reduction in interest expense will more than offset this cost of refinancing over the long term. Meanwhile, our second coal-fired power plant Sembcorp Gayatri Power commenced operation of the first of two 660-megawatt generating units in November and reported a net loss for the year.

PFO from the Rest of Asia, where operations comprise gas-fired power plants in Vietnam and Myanmar as well as municipal water operations in Indonesia and the Philippines, declined 68% to S$16.7 million. This was primarily due to the absence of contribution from our former waste management joint venture in Australia, which was grouped under this region prior to our divesting it in November 2015. While our build-operate-transfer Sembcorp Myingyan power project in Myanmar is still under construction, S$231.3 million in service concession from the project was recognised in 2016 in accordance with the INT FRS 112 accounting guideline.

PFO from Middle East & Africa operations increased 21% to S$64.0 million due to a better operating performance by our UAE operations. Meanwhile, PFO from the UK & the Americas was S$52.8 million, comparable to PFO from the region in 2015.

Positioning the business for long-term growth

Expanding our recurring income base, deepening our presence in key markets and actively growing our renewables business

During the year, we continued efforts to position the Utilities business for the future. Firstly, we expanded our recurring income base through focused execution of our pipeline of projects. Secondly, we continued to make progress in building strong operations in key markets to sow the seeds for future growth. Thirdly, we maintained concerted efforts to broaden and deepen our renewable energy capabilities and develop this emerging business as a new engine of growth for the Group.

Maintaining momentum in China and India

In China, our Chongqing Songzao mine-mouth coal-fired power project commenced operation of its first 660-megawatt expansion unit in November 2016, followed by a second 660-megawatt expansion unit in January 2017, ahead of schedule. Together with the project’s existing 300-megawatt facility, this brings the asset’s total capacity to 1,620 megawatts. On the water front, we completed new industrial wastewater treatment plants in Jingmen, Hubei province and Qidong, Jiangsu province. Also in Jiangsu, we successfully completed upgrading works for a wastewater treatment plant in a chemical industrial park in Lianyungang. Following our successful reconfiguration, the plant is now able to treat industrial wastewater to meet more stringent discharge regulations imposed by the authorities. We have also built in a pre-ozonation system to treat wastewater that is not easily biodegradable, further enhancing the plant’s performance and ensuring its ability to operate consistently and reliably. With increasing emphasis on environmental sustainability, we see a growing demand for sustainable industrial wastewater treatment solutions. This pilot project will allow us to showcase our abilities in upgrading brownfield facilities, and present a new business model that we can replicate elsewhere in China and beyond.

In India, we marked a key milestone in the official opening of the Sembcorp Gayatri Power Complex in Andhra Pradesh in February 2016. The US$3 billion (approximately S$4 billion) power complex is the largest foreign direct investment-driven thermal power project on a single site in India to date and houses two supercritical coal-fired power plants of 1,320 megawatts each. The first of these plants, TPCIL, commenced full commercial operations in September 2015 and achieved its first full year of operations in 2016. Meanwhile, the second plant, the Sembcorp Gayatri Power project, commenced full commercial operations in February 2017. Its first 660-megawatt unit was completed in November 2016 and its second 660-megawatt unit in February 2017.

Making progress in Myanmar and Bangladesh

In addition, we also made progress in other rapidly developing economies. In Myanmar, we secured a power purchase agreement for our gas-fired combined cycle Sembcorp Myingyan power project, which has a contracted capacity of 225 megawatts. A build-operate-transfer agreement with the government was secured in January 2017. Construction for the project is progressing well and the project is on track to begin operation in 2018. Once operational, the Sembcorp Myingyan power project will be one of Myanmar’s largest and most efficient gas-fired power plants, and will play a key role in meeting the country’s growing demand for electricity.

Meanwhile in Bangladesh, we signed a long-term power purchase agreement for our upcoming Sirajganj Unit 4 dual-fuel combined cycle power project. Project financing was secured from the International Finance Corporation of the World Bank Group, Clifford Capital and CDC Group, the UK government’s development finance institution. The World Bank Group’s Multilateral Investment Guarantee Agency was also engaged to provide political risk cover. Construction for the plant, which has a contracted capacity of 414 megawatts, has commenced. At present, Bangladesh’s power demand exceeds supply and per capita consumption of power remains among the lowest in the world. The government of Bangladesh is working towards providing power for all its citizens by 2021 and plans to add nearly 16 gigawatts of capacity over the next five years. Given this background, the country presents significant opportunities for Sembcorp.

Actively growing our renewable energy business

We remain committed in our focus to grow the renewable share of our energy portfolio. In 2016, we made good progress towards this objective.

In India, which is Sembcorp’s largest market in terms of our renewable energy presence, we have reached 971 megawatts in renewable power capacity in operation and under construction. During the year, an additional 139 megawatts of wind power capacity came into operation, bringing total operating capacity to 788 megawatts. We completed a 60-megawatt project in Madhya Pradesh, a 26-megawatt project in Tamil Nadu and part of an 80-megawatt project in Karnataka. At the same time, we continue to keep an active lookout for new viable renewable projects to add to our pipeline. Demonstrating our confidence in the strong potential of the business, we increased our equity interest in India renewables arm Sembcorp Green Infra by another 4%, to 68.7%.

In China, the 150-megawatt Laoshibeihe wind farm in Huanghua, Hebei is now 97% complete. When fully completed in 2017, it will take our renewable energy operating portfolio in the country to 446 megawatts. Additionally, two new wind power projects in Huanghua, the 99-megawatt Huanghua Phase 3 and the 200-megawatt Huangnanpaigan projects, are planned for development and expected to come onstream in 2018. Our renewable power capacity in the country now totals 745 megawatts in operation and under development.

Besides expanding capacity with new projects, we have also deepened the capabilities of our renewables business. To enhance our competitiveness, we implemented key initiatives during the year to increase revenue and reduce cost. The first initiative was a performance optimisation programme driven by improvements in technology, engineering and operations. In addition, instead of outsourcing operations and maintenance, our renewables business started to implement self-performed operations and maintenance to manage its facilities.

OUTLOOK

The World Bank expects growth in the global economy to improve in 2017, and forecasts a growth of 2.7% compared to 2.3% in 2016.

In Singapore, the Ministry of Trade and Industry forecasts the economy to expand by 1% to 3% in 2017. Meanwhile, the Economic Development Board expects fixed asset investment commitments to be between S$8.0 billion and S$10.0 billion for the year, comparable to the S$9.4 billion achieved in 2016. We expect the operating environment in Singapore’s power sector to remain challenging, with continued intense competition. However, the performance of our centralised utilities, gas and solid waste management businesses in the country is expected to remain steady.

Meanwhile, China’s growth is projected to moderate from 6.7% in 2016 to 6.4% between 2017 and 2019, according to World Bank forecasts. The rebalancing of the economy, from investment to consumption, and from industry to services, is expected to continue at a more measured pace. In 2016, our China Utilities business delivered record profits. Its performance in 2017 is expected to remain steady although lower than in 2016, given the expiry of the Yangcheng cooperative joint venture agreement in 2016. In the medium to long term, we believe that China’s strong emphasis on environmental protection presents opportunities for our business. For instance, the country has demonstrated its commitment to sustainability through more stringent targets to reduce water pollution, improve water quality and protect water resources in its 13th Five-year Plan, as well as through targets to increase the renewable share of its energy mix.

In India, we have a combined power capacity of over 3,600 megawatts, with two thermal power plants as well as renewable energy assets. The second thermal power plant, Sembcorp Gayatri Power, commenced full commercial operations in February 2017 but has yet to secure long-term power purchase agreements. As spot and short-term power tariffs remain weak, its performance is expected to be adversely affected.

Operating performance in the other regions is expected to be stable.

The Utilities business will remain focused on operational excellence as well as the execution of its pipeline of projects to deliver long-term growth.

In Singapore, the Ministry of Trade and Industry forecasts the economy to expand by 1% to 3% in 2017. Meanwhile, the Economic Development Board expects fixed asset investment commitments to be between S$8.0 billion and S$10.0 billion for the year, comparable to the S$9.4 billion achieved in 2016. We expect the operating environment in Singapore’s power sector to remain challenging, with continued intense competition. However, the performance of our centralised utilities, gas and solid waste management businesses in the country is expected to remain steady.

Meanwhile, China’s growth is projected to moderate from 6.7% in 2016 to 6.4% between 2017 and 2019, according to World Bank forecasts. The rebalancing of the economy, from investment to consumption, and from industry to services, is expected to continue at a more measured pace. In 2016, our China Utilities business delivered record profits. Its performance in 2017 is expected to remain steady although lower than in 2016, given the expiry of the Yangcheng cooperative joint venture agreement in 2016. In the medium to long term, we believe that China’s strong emphasis on environmental protection presents opportunities for our business. For instance, the country has demonstrated its commitment to sustainability through more stringent targets to reduce water pollution, improve water quality and protect water resources in its 13th Five-year Plan, as well as through targets to increase the renewable share of its energy mix.

In India, we have a combined power capacity of over 3,600 megawatts, with two thermal power plants as well as renewable energy assets. The second thermal power plant, Sembcorp Gayatri Power, commenced full commercial operations in February 2017 but has yet to secure long-term power purchase agreements. As spot and short-term power tariffs remain weak, its performance is expected to be adversely affected.

Operating performance in the other regions is expected to be stable.

The Utilities business will remain focused on operational excellence as well as the execution of its pipeline of projects to deliver long-term growth.