- EMERGING

STRONGER - OPERATING & FINANCIAL REVIEW

- ENVIRONMENTAL, SOCIAL AND GOVERNANCE REVIEW

- FINANCIAL STATEMENTS

- Directors’ Statement

- Independent Auditors’ Report

- Balance Sheets

- Consolidated Income Statement

- Consolidated Statement of

Comprehensive Income - Consolidated Statement of

Changes in Equity - Consolidated Statement of

Cash Flows - Notes to the Financial Statements

- Supplementary Information

- EVA Statement

- Shareholders' Information

- Governance Disclosure Guide

- Corporate Information

- Notice of Annual General Meeting

- Proxy Form

- Letter to Shareholders

- Financial Calendar

MARINE REVIEW

Competitive Edge

| • | A global leader in integrated offshore and marine solutions with more than 50 years’ proven track record |

| • | Able to offer diversified, innovative solutions across the offshore and marine value chain, both within and beyond the oil and gas sector |

| • | Established capabilities in rigs & floaters, repairs & upgrades, offshore platforms and specialised shipbuilding |

| • | Global network with yard facilities strategically located in Singapore, Indonesia, India, the UK and Brazil |

OPERATING AND FINANCIAL REVIEW

Disciplined execution amidst a challenging macro environment

Despite a challenging macro environment and uncertainty in the oil and gas sector, the Marine business returned to profitability in 2016.

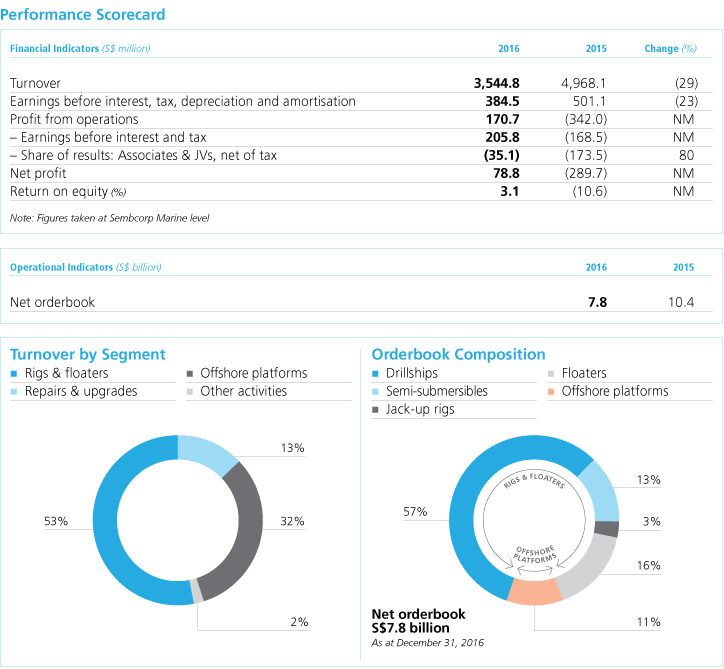

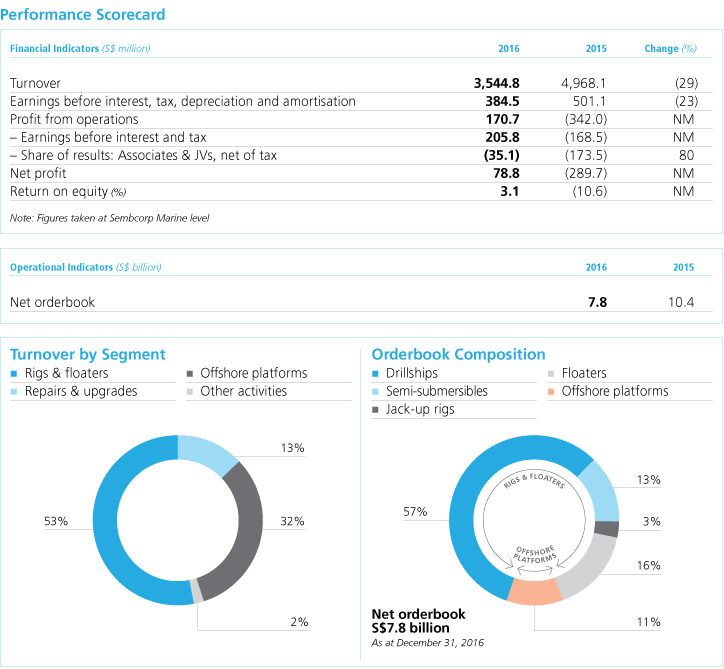

Turnover was S$3.5 billion, compared to S$5.0 billion in 2015. Profit from operations was S$170.7 million, compared to negative S$342.0 million in 2015. Net profit was S$78.8 million compared to a net loss of S$289.7 million in 2015.

In 2015, Sembcorp Marine had made impairment and provisions totalling S$609 million for its rig contracts, comprising S$329 million for the Sete Brasil contracts and SS$280 million for the deferment and possible cancellation of rigs. The business regularly reviews the adequacy of the provisions, and in its latest review determined that the provisions remain adequate under the present circumstances.

Focused execution of orderbook

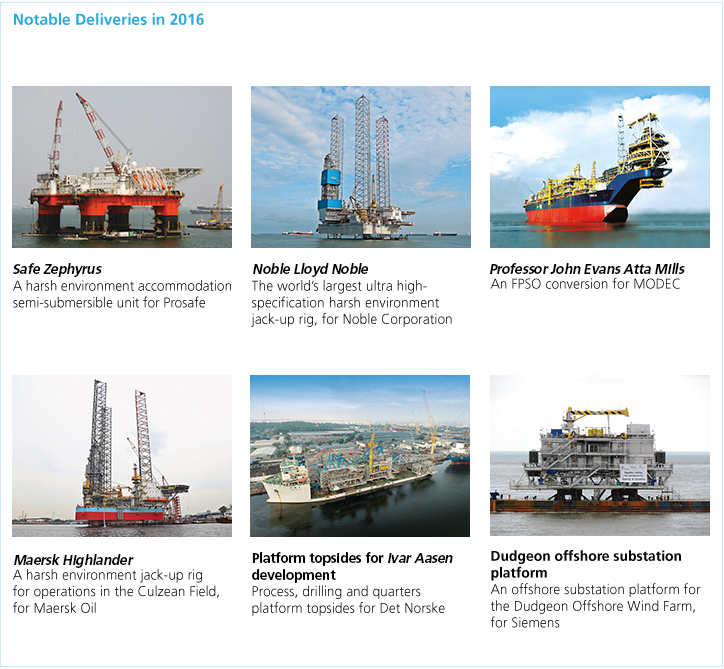

Despite uncertainty in the industry, Sembcorp Marine stayed focused and disciplined in the execution of its orderbook. Key projects were completed and handed over to customers in 2016, generating significant operating cash flows and a stronger balance sheet.

The Marine business continued to actively pursue opportunities in spite of challenging market conditions. A total of S$320 million in new contracts was secured during the year. At the end of 2016, net orderbook stood at S$7.8 billion. Excluding the Sete Brasil contracts, net orderbook stood at S$4.7 billion. The majority of projects in the current net orderbook are based on progressive payment terms.

Sembcorp Marine has continued to make good progress on the execution of its current orderbook. Leveraging the capabilities of the state-of-the-art Tuas Boulevard Yard and other facilities in Singapore, the business has been able to secure and deliver mega construction projects which were previously undertaken by competitors outside of Singapore. Examples of such projects currently under construction include: a semi-submersible crane vessel for Heerema, a newbuild floating storage and offloading (FSO) vessel for MODEC, and harsh environment topside modules for Maersk Oil targeted for deployment in the Culzean field. In addition, work is also progressing on the floating production storage and offloading vessels (FPSOs) Pioneiro de Libra, Kaombo Norte, Kaombo Sul and Gina Krog.

Over in Brazil, the Estaleiro Jurong Aracruz yard made good progress on the construction and integration of topside modules for Petrobras’ P-68 and P-71 FPSOs. A number of repair and upgrading jobs on vessels were also completed at the yard during the year.

Monitoring developments on deferred projects, actively engaging with customers

Sembcorp Marine continues to monitor developments relating to deferred rigs and drillship projects, while taking the appropriate actions to protect its interests in these contracts.

While Sembcorp Marine has agreed with some customers to defer the delivery of their jack-up rigs, these rigs have already been technically accepted by the same customers. The business is evaluating different courses of action for these rigs, including sales to third parties. In 2016, a customer, Perisai, announced its insolvency and plans to undergo financial restructuring. Our Marine business has taken steps to protect its interests in the two rigs that have been completed and technically accepted by Perisai. Meanwhile, the standstill agreement with North Atlantic Drilling for the West Rigel semi-submersible rig has been further extended to July 6, 2017, whilst North Atlantic Drilling and Sembcorp Marine continue to market the unit for charter or sale.

In 2016, the business’ customer, Sete Brasil, filed for judicial restructuring and submitted its restructuring plans. In connection with this, Sembcorp Marine commenced arbitration proceedings against various subsidiaries of Sete Brasil to preserve its interests under the Sete Brasil contracts. Discussions between Sete Brasil and its creditors, shareholders and other stakeholders are ongoing to find equitable solutions. Without prejudice to its ongoing arbitration proceedings, Sembcorp Marine continues to engage with Sete Brasil, in order to monitor the situation and any implications for its business.

Managing costs tightly

During these tough times, the Marine business continues to focus on liquidity, costs and balance sheet management. This includes active management of manpower requirements in line with changing needs.

Sembcorp Marine’s overall strategy is to ensure long-term workforce sustainability. To this end, it has sought to maintain and enhance capabilities required for the safe, efficient and effective execution of its projects, while positioning itself for the market’s eventual recovery.

With the increase in activities to serve the non-drilling segment, the business has been actively reallocating excess manpower from drilling to non-drilling projects, whilst being mindful not to compromise safety or the quality of execution. It has optimised the number of sub-contractors in its yards in line with the volume of work and allowed for natural attrition of its employees. In addition, it has taken measures to reduce operating costs through salary freezes and adjustments to variable remuneration components for management since 2015. At the same time, the business has sought to strengthen its capabilities in support of future growth in new segments, through selective recruitment, skills training and upgrades. In particular, this has been to strengthen its expertise in near-shore gas infrastructure solutions.

In January 2017, Phase II of the Tuas Boulevard Yard was completed, offering further opportunities to optimise yard capacities and realise operational efficiencies. The business intends to maximise utilisation of the Tuas Boulevard Yard, while reviewing the schedule for the return of other Singapore yards at or before their lease expiry dates. To date, the Marine business has returned the Pulau Samulun Yard to the Singapore government, and in 2017, the Shipyard Road Yard and Tuas Road Yard are scheduled to be returned. To date, most of the business’ capital expenditure for new yard infrastructure has been expended. Going forward, capital expenditure for yards that is required for execution of secured contracts, or which will realise cost savings, will proceed. Meanwhile, non-essential capital expenditure will be deferred. The business will also explore potential for cost savings by further optimising the rate of development of its Tuas Boulevard Yard.

Diversifying solutions, targeting new customers and positioning the business for the future

To position itself for the future, the Marine business made several selective strategic acquisitions in 2016 to enhance its proprietary design and engineering capabilities. These investments support its push to diversify its offering and expand beyond drilling solutions to non-drilling solutions. They will also strengthen the business’ ability to offer innovative solutions across the offshore and marine value chain, both within and outside the oil and gas sector.

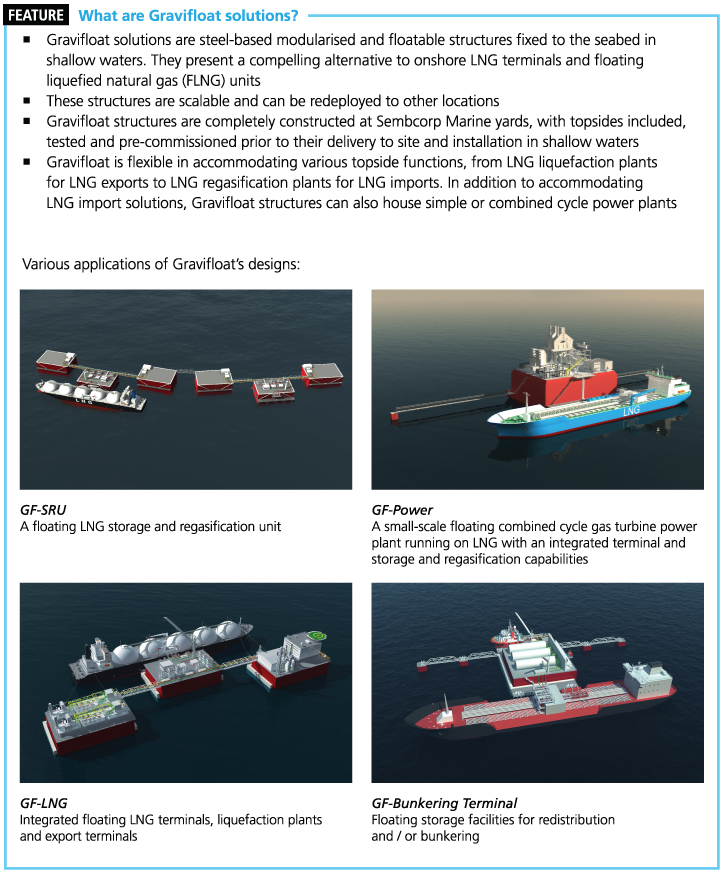

One area where we have identified potential opportunities is in offering innovative solutions to players in the gas value chain. This is given greater interest in the use of gas, a cleaner fuel, in power generation, bunkering and other operations. In March, our Marine business acquired an additional 44% equity stake in Gravifloat, increasing its ownership to 56%. Gravifloat designs and holds patents for a suite of cost-effective, redeployable, modularised near-shore solutions. These include import and export terminal infrastructure for treatment, storage, liquefaction, regasification and offloading of liquefied natural gas (LNG) and liquefied petroleum gas (LPG). Already, these solutions are attracting market interest. In 2016, the business entered into a memorandum of understanding with ENGIE to collaborate on the use of Gravifloat technology in integrated solutions for near-shore receiving, storage and regasification of LNG as well as power generation. As a Group, we are also exploring opportunities for potential collaboration between the Marine and Utilities businesses. In addition, in June the Marine business acquired a 50% stake in process design and engineering group Aragon. Aragon’s customised solutions for the FPSO market enhance the business’ capabilities to serve the production segment of the oil and gas sector.

In August, the Marine business also acquired 100% of LMG Marin, a Norway-based naval architecture company with expertise in naval design, engineering and technology development. The company originated several key designs adopted by Sembcorp Marine over the years, including the next-generation Espadon drillship design, a newbuild FSO vessel design and Gravifloat’s modular platform solutions. In the same month, the Marine business also acquired the remaining 15% of PPL Shipyard, obtaining sole ownership of the yard which has helped propel it to be a global player in the rig market over the years. Having full control of the yard’s operations will allow Sembcorp Marine to manage its resources optimally and better align the yard with its overall strategic direction.

OUTLOOK

While prospects for the oil and gas industry have taken a more positive turn following the November 2016 agreement by the Organization of the Petroleum Exporting Countries (OPEC) and major non-OPEC countries to cut production, Sembcorp Marine believes that a more robust recovery may take longer. Despite the challenging outlook and intense competition, the business believes that growth prospects for the offshore and marine industry remain positive in the medium to long term.

With increasing enquiries for non-drilling solutions, an earlier recovery in demand for fixed platforms, FPSO and FSO conversions and newbuilds in the next few years is foreseeable. Rising global demand for gas also augers well for broad-based LNG solutions and capabilities. Sembcorp Marine believes that these are the key segments that will offer opportunities in 2017.

The Marine business’ strategy and focus remain anchored on strengthening and optimising its talent pool, pursuing operational excellence in executing its projects, investing in new capabilities, products and technological innovation to help grow its orderbook and prudently managing its financial resources to preserve financial flexibility and ensure the overall sustainability of its business.

With increasing enquiries for non-drilling solutions, an earlier recovery in demand for fixed platforms, FPSO and FSO conversions and newbuilds in the next few years is foreseeable. Rising global demand for gas also augers well for broad-based LNG solutions and capabilities. Sembcorp Marine believes that these are the key segments that will offer opportunities in 2017.

The Marine business’ strategy and focus remain anchored on strengthening and optimising its talent pool, pursuing operational excellence in executing its projects, investing in new capabilities, products and technological innovation to help grow its orderbook and prudently managing its financial resources to preserve financial flexibility and ensure the overall sustainability of its business.