- EMERGING

STRONGER - OPERATING & FINANCIAL REVIEW

- ENVIRONMENTAL, SOCIAL AND GOVERNANCE REVIEW

- FINANCIAL STATEMENTS

- Directors’ Statement

- Independent Auditors’ Report

- Balance Sheets

- Consolidated Income Statement

- Consolidated Statement of

Comprehensive Income - Consolidated Statement of

Changes in Equity - Consolidated Statement of

Cash Flows - Notes to the Financial Statements

- Supplementary Information

- EVA Statement

- Shareholders' Information

- Governance Disclosure Guide

- Corporate Information

- Notice of Annual General Meeting

- Proxy Form

- Letter to Shareholders

- Financial Calendar

URBAN DEVELOPMENT REVIEW

Competitive Edge

| • | Over 20 years’ track record in undertaking master planning, land preparation and infrastructure development to transform raw land into urban developments |

| • | Significant land bank of integrated urban developments comprising industrial parks as well as business, commercial and residential space in Vietnam, China and Indonesia |

| • | A valued partner to governments, with the ability to deliver the economic engine to support industrialisation and urbanisation by attracting local and international investments |

OPERATING AND FINANCIAL REVIEW

Strong Vietnam performance but higher costs

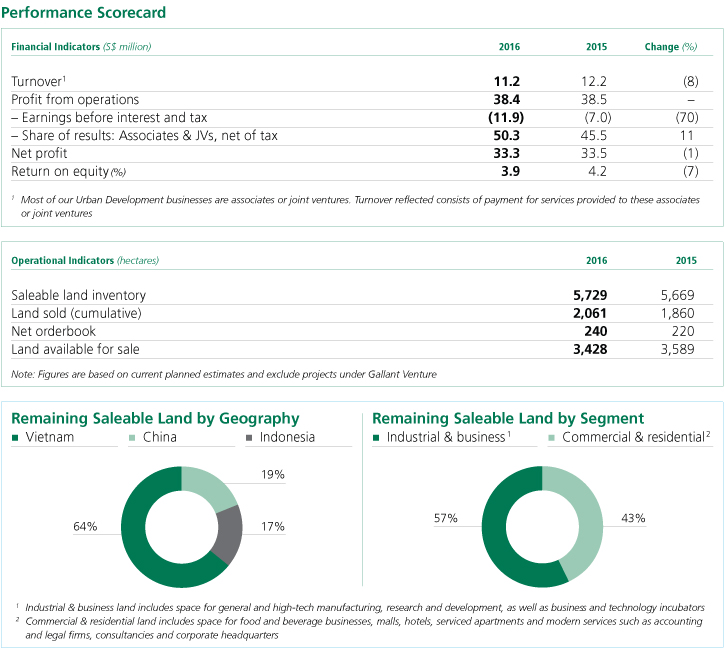

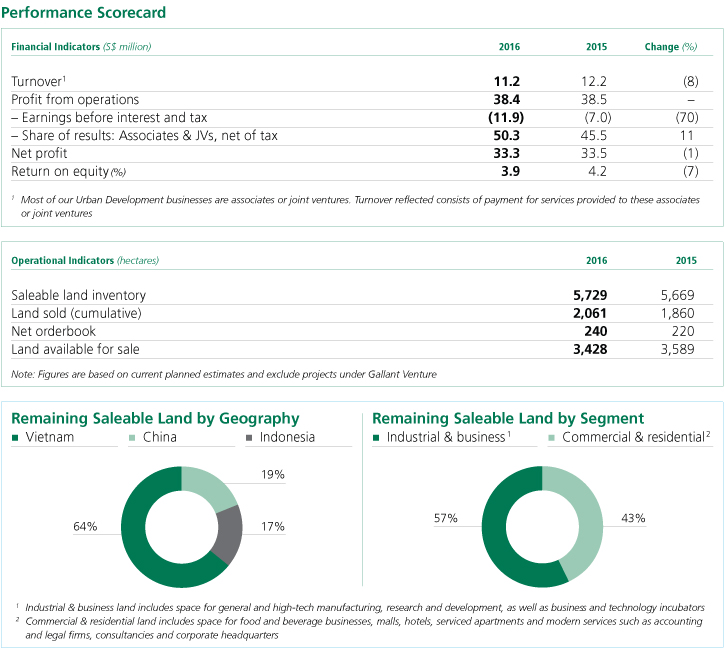

The Urban Development business turned in steady profits in 2016. Profit from operations (PFO) stood at S$38.4 million compared to S$38.5 million in 2015, while net profit was S$33.3 million compared to S$33.5 million the previous year. While Vietnam operations turned in a better performance, the business incurred higher corporate costs and pre-operating costs from new projects.

In 2016, the business sold a total of 201 hectares of land. Land sales in Vietnam increased 9% to 163 hectares from 149 hectares in the previous year, driven by robust demand for industrial land at the Vietnam Singapore Industrial Park (VSIP) projects. Land sold in China totalled 30 hectares compared to 60 hectares in 2015, due to delayed land sales in Nanjing.

Land commitments received from customers remained healthy at 221 hectares, bringing the business’ net orderbook to 240 hectares as at the end of 2016. This included a sizeable 42.6-hectare site on the Sino-Singapore Nanjing Eco Hi-tech Island, for which an auction closed in December. Profit from the sale of this site will be recognised in 2017.

Vietnam

Our Vietnam business continued to perform well in 2016.

Positive investor sentiment towards the country’s manufacturing sector continued to drive take-up for industrial and business land, which accounted for 98% of land sold. Commercial and residential land accounted for the remaining 2% of land sales.

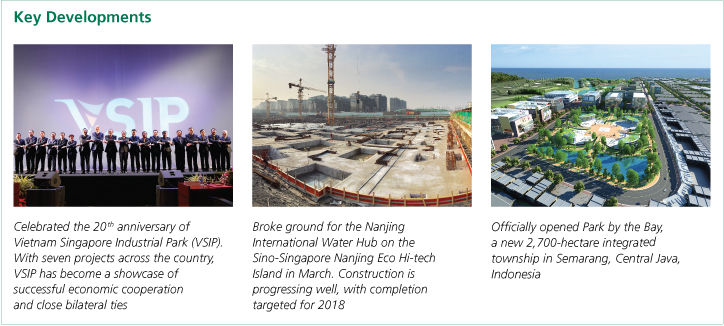

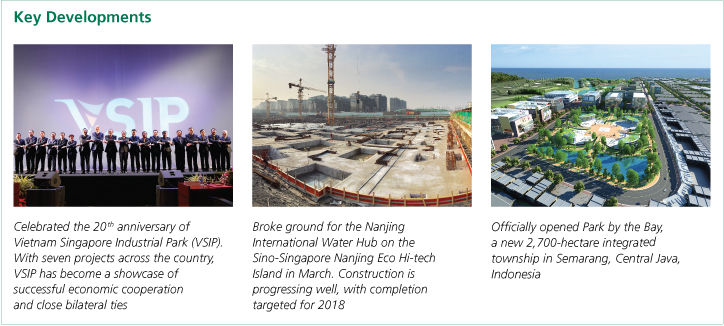

In September, VSIP celebrated its 20th anniversary with an event graced by the Deputy Prime Ministers of Singapore and Vietnam. This gesture signifies the success of VSIP as a showcase of successful economic cooperation and close bilateral ties. Since its founding in 1996, VSIP has evolved into a leading developer in Vietnam with seven projects across the southern, central and northern economic corridors of the country spanning 6,660 hectares in gross project size. It has drawn US$9.4 billion in total investment capital from 670 companies, and created more than 183,000 jobs. With demand for land at its projects remaining strong, VSIP signed memoranda of understanding with the People’s Committees of Binh Duong and Bac Ninh provinces to explore the feasibility of new expansions in these provinces. These could potentially add 1,500 hectares to VSIP’s current land bank.

During the year, we launched the first phase of our residential project, The Habitat Binh Duong. Located in Thuan An District at our first VSIP, the condominium will cater to the needs of tenants of VSIP as well as professionals working in the province. The initial launch of 139 units was well received, and a further 128 units were released for sale at the end of October. As at end December, 184 units or 69% of the project have been taken up. Construction of the project is on track for handover of units to buyers in 2017, upon which profits from the sale of these units will be recognised.

China

During the year, our 1,000-hectare Singapore-Sichuan Hi-tech Innovation Park project attracted RMB 4.7 billion in investment from companies in the interactive digital media sector, adding to the RMB 9.5 billion of investments attracted in 2015 from biomedical science companies. This has firmly established it as a home for high-technology companies in Chengdu.

We have completed development of the 18-hectare west zone of the Xinchuan Heartbeat Central Park, a public park featuring scenic man-made lakes. The park is the first of three major landscaped areas anchoring the live-and-play areas of Singapore-Sichuan Hi-tech Innovation Park. Already, its partial completion has enhanced the value of land in the vicinity and improved take-up.

In recognition of the Singapore-Sichuan Hi-tech Innovation Park’s success in attracting investors, as well as its progressive concept, green building design standards and ecological initiatives, Sichuan’s Provincial Department of Housing and Urban-Rural Development has selected it as a provincial-level eco-city showcase project. It is the only development in Chengdu to receive this honour.

Meanwhile, at the Sino-Singapore Nanjing Eco Hi-tech Island project, performance was affected by the timing of land sales. In December, we sold a 42.6-hectare commercial and residential plot on the eco-island for which the profit will be recognised in 2017. In addition, our jointly developed and 21.5%-owned Island Residences condominium, located within the eco-island’s upcoming New One North mixed development, was launched in August. The launch was well received and the project’s 182 units of 34,243 square metres gross floor area were sold out. Profits from these sales will be recognised in 2018, when construction is completed and the apartments are handed over to buyers.

In March, we broke ground for our Nanjing International Water Hub project on the Sino-Singapore Nanjing Eco Hi-tech Island. Targeted for completion in 2018, the water hub will feature fully equipped research and development (R&D) facilities, as well as office and conference space. It aims to bring together leading investors and operators of water facilities, technology and R&D providers, government agencies, academia as well as research institutes, to create a vibrant industry ecosystem. So far, four water technology companies have signed letters of intent to set up at the water hub, joining respected state-level water research institutes that are backed by local universities in Nanjing.

Over in Wuxi, our Wuxi-Singapore Industrial Park continued to generate healthy revenue from electricity and rental income. Average occupancy rates for its ready-built and built-to-specifications factories remained at healthy levels of above 85%. In light of the continued demand for industrial space in the industrial park, we are developing an additional 30,000 square metres of standard factory space, targeted for completion in 2017.

Indonesia

In November, we celebrated the official opening of Park by the Bay, our 2,700-hectare integrated township project in Semarang, Central Java. The occasion was graced by the President of Indonesia and the Prime Minister of Singapore. The project is set to form the economic engine to draw investment and create jobs for the region.

The first integrated township of its kind in Central Java, Park by the Bay is a coastal development located along the Jakarta-Semarang-Surabaya Economic Corridor, which includes industrial, commercial as well as residential space to be developed over several phases. Its master plan features themed industrial clusters such as Fashion City, Food City, Furniture Hub and Building Materials Zone. Each will target companies involved in various stages of the industry value chain, from the processing of raw materials, to design, manufacture and marketing of finished products. In addition, the project will have commercial space for trade shows and retail activities.

Land and infrastructure development have commenced for the project’s 860-hectare first phase. So far, the project has received an encouraging level of interest. In total, 27 companies have indicated interest to set up operations in the township, bringing in more than US$330 million in investments and creating 4,000 jobs to support their initial operations.

OUTLOOK

In 2016, Vietnam’s gross domestic product (GDP) grew by 6.2%, with manufacturing and merchandise trade as the country’s main economic drivers. Foreign direct investments increased 9% to US$15.8 billion. Favourable labour costs and tax incentives available in Vietnam, as well as the country’s proximity to Asian markets, continue to make the country attractive to international manufacturers. Reflecting the buoyant investment climate, VSIP has a healthy orderbook for 2017.

In 2016, China’s GDP grew 6.7%. While this was below the country’s target, it nonetheless represented one of the highest rates of growth among major economies. As China focuses on restructuring its economy and developing value-added industries, we have positioned our projects to attract investments from high-technology and innovation-driven sectors. Given improved infrastructure at our Chengdu and Nanjing projects, auction prices for land have increased. This is set to lift contributions from our China projects. However, the timing of land sales at our China businesses will continue to be dependent on auction schedules set by the government. For 2017, we can look forward to improved contributions from our Nanjing project, when the profit from the sale of a 42.6-hectare commercial and residential site will be recognised following the close of a tender for it in December 2016.

Meanwhile, Indonesia recorded GDP growth of 5.0% for the full year with its manufacturing purchasing managers’ index contracting below 50 by the end of December. Notwithstanding this, our Park by the Bay project has drawn a respectable orderbook for 2017, following the official opening of the project in 2016. The project may also benefit from major infrastructure improvements by the government going forward.

The Urban Development business has a healthy orderbook totalling 240 hectares of land, comprising 152 hectares of industrial and business land and 88 hectares of commercial and residential land. The business remains well positioned as one of the most established players in the region, with a strong track record in land development. Its wholly-owned subsidiary, Sembcorp Properties, launched a residential project in Vietnam in 2016 and commenced the design and development of two projects in China. These initiatives are expected to yield good contributions to the Urban Development business over the next two years.

The Urban Development business is expected to deliver a better performance in 2017, underpinned by land sales in Vietnam, China and Indonesia.

In 2016, China’s GDP grew 6.7%. While this was below the country’s target, it nonetheless represented one of the highest rates of growth among major economies. As China focuses on restructuring its economy and developing value-added industries, we have positioned our projects to attract investments from high-technology and innovation-driven sectors. Given improved infrastructure at our Chengdu and Nanjing projects, auction prices for land have increased. This is set to lift contributions from our China projects. However, the timing of land sales at our China businesses will continue to be dependent on auction schedules set by the government. For 2017, we can look forward to improved contributions from our Nanjing project, when the profit from the sale of a 42.6-hectare commercial and residential site will be recognised following the close of a tender for it in December 2016.

Meanwhile, Indonesia recorded GDP growth of 5.0% for the full year with its manufacturing purchasing managers’ index contracting below 50 by the end of December. Notwithstanding this, our Park by the Bay project has drawn a respectable orderbook for 2017, following the official opening of the project in 2016. The project may also benefit from major infrastructure improvements by the government going forward.

The Urban Development business has a healthy orderbook totalling 240 hectares of land, comprising 152 hectares of industrial and business land and 88 hectares of commercial and residential land. The business remains well positioned as one of the most established players in the region, with a strong track record in land development. Its wholly-owned subsidiary, Sembcorp Properties, launched a residential project in Vietnam in 2016 and commenced the design and development of two projects in China. These initiatives are expected to yield good contributions to the Urban Development business over the next two years.

The Urban Development business is expected to deliver a better performance in 2017, underpinned by land sales in Vietnam, China and Indonesia.