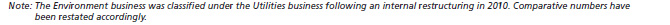

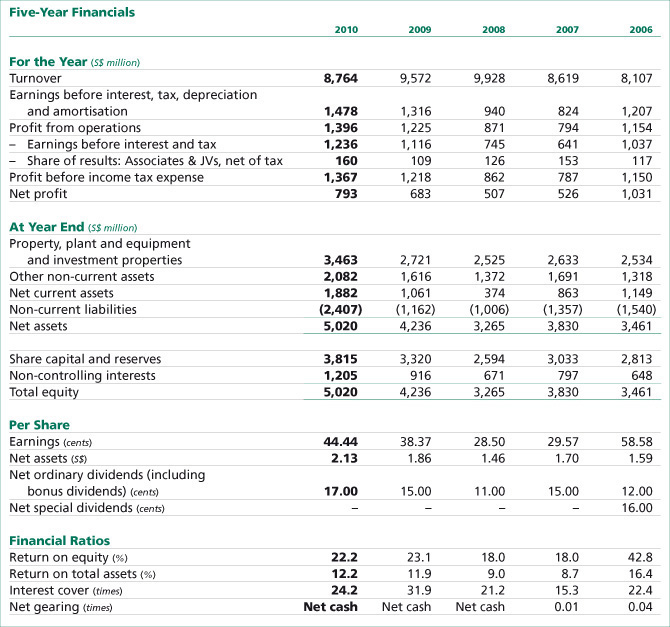

Sembcorp’s net profit for the year

grew 16% from S$682.7 million

to S$792.9 million, while turnover

was S$8.8 billion compared to

S$9.6 billion in 2009.

The Utilities and Marine

businesses continued to be the

Group’s main profit contributors,

accounting for 95% of its net

profit. The Utilities business’

net profit improved by 2%. All

regions registered growth except

for operations in Teesside, UK.

Singapore operations performed

well, mainly driven by high

electricity prices and higher

contributions from our natural

gas importation business. Outside

Singapore, operations in China and

Middle East & Africa also registered

strong growth, increasing 226% and

80% respectively. The performance

of operations in Teesside, UK was

affected by lower volumes as a

result of the previously announced

closure of some of its customers’

facilities, low market spreads for

power as well as the write-down of

certain ageing assets. The Marine

business’ contribution to net profit

grew 22% from S$430.2 million to

S$524.9 million. This increase was

mainly attributable to the execution

of projects ahead of schedule and

the achievement of better margins

for the business’ rig building,

offshore and conversion projects

through higher productivity, as

well as the resumption of margin

recognition for a rig building

project upon securing a buyer.

During the year, the Group

recorded an exceptional gain of

S$32.1 million comprising the Group’s

share of the Marine business’ full and final amicable settlement of disputed

foreign exchange transactions.

Sembcorp’s net profit for the year

grew 35% from S$507.1 million

to S$682.7 million, while turnover

stood at S$9.6 billion.

The Marine business’ contribution

to net profit grew 63% from

S$263.7 million to S$430.2 million,

attributable to a combination of

operational efficiency and execution

of projects ahead of schedule

resulting in better margins and the

resumption of margin recognition

for some of the business’ projects.

The Utilities business’ net profit

grew by 12% from S$202.4 million

to S$226.7 million, with operations

in Singapore, China, Vietnam and

the UAE showing growth.

Sembcorp’s turnover increased by

15% from S$8.6 billion to S$9.9 billion.

Net profit for the year stood at

S$507.1 million. Excluding the one-off

write-back of S$48.0 million of tax

provisions recorded in 2007, Sembcorp

achieved a net profit growth of 6%.

The Marine business’ contribution

to net profit rose 75% to S$263.7

million, mainly due to higher

revenue and operating margins

from its rig building and ship repair

businesses. The Utilities business’

net profit stood at S$202.4 million

with main contributions from

Singapore and UK operations.

During the year, the Group

recorded an exceptional loss of

S$26.9 million comprising of the

Group’s share of the Marine

business’ foreign exchange losses

from the unauthorised transactions.

Sembcorp achieved a 6% growth

in turnover to S$8.6 billion. Net profit

in 2007 stood at S$526.2 million.

Strong business fundamentals

continued to drive Sembcorp’s

growth, backed by positive

operating performance from the

Utilities business’ Singapore and UK

operations and the Marine unit’s rig

building and ship repair businesses.

The Group recorded a net

exceptional loss of S$31.0 million

during the year, which comprised

the Group’s share of losses

recognised by the Marine business’

unauthorised foreign exchange

transactions, partially offset by gains

on the sale of certain investments.

Sembcorp achieved a net profit of

S$1.0 billion, a growth of 240% over

2005. Turnover from continuing

operations increased by 30% to S$7.5

billion. Excluding the exceptional

gains of S$650.2 million, net profit

for the year stood at S$380.8 million,

driven mainly by strong performance

from the Utilities business’ UK

operations and higher operating

margins from the Marine unit’s rig

building and ship repair businesses.

The Group recorded exceptional

gains of S$650.2 million in 2006. These

comprised the net gain on the sale of

subsidiaries and other financial assets,

tax benefits relating to compensation

and related costs incurred in the

Solitaire arbitration and the write-back

of an impairment for property,

plant and equipment. These were

partially offset by an additional charge

arising from the final settlement of

the Solitaire arbitration as well as a

loss from the sale of a subsidiary. |

| |

|

|

|

| |

|

| |

|

| |