|

|

|

|

|

| |

|

| |

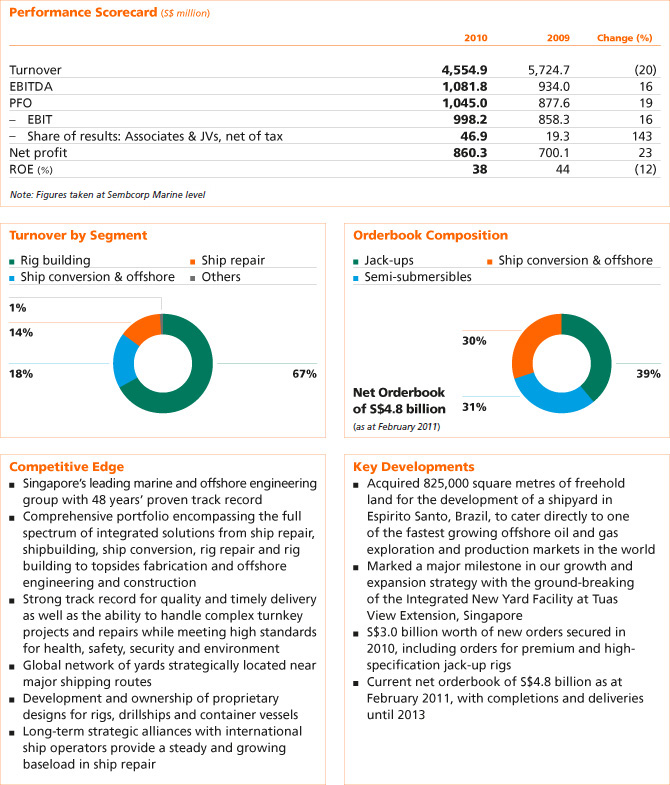

Sembcorp’s Marine business delivered strong results

in 2010 underpinned by its rig building, offshore and

conversion and ship repair businesses. Turnover was

S$4.6 billion compared to S$5.7 billion in 2009, while

the business’ net profit attributable to shareholders of

the company (net profit) grew 23% to a record high

of S$860.3 million from S$700.1 million in the previous

year. The business’ profit from operations (PFO) also

increased 19% to S$1.0 billion from S$877.6 million in

2009. A one-off credit of S$52.6 million arising from

the settlement of the disputed foreign exchange

transactions with Société Générale was included in the

PFO for 2010. This improved performance was mainly

attributable to the execution of projects ahead of

schedule and the achievement of better margins for

the business’ rig building, offshore and conversion

projects through higher productivity, as well as the

resumption of margin recognition for a rig building

project upon securing a buyer.

The business’ operating profit of S$998.2 million

was 16% higher as compared to 2009. The business’

operating margin also improved in 2010 with its

gross profit margin increasing from 17% to 25% in

the corresponding period, mainly attributable to

operational efficiencies and project execution ahead

of schedule. Its return on equity for the year stood

at a strong 38%.

The Marine business’ current net orderbook stands

at a strong S$4.8 billion as at February 2011, with

completions and deliveries until 2013. This includes

S$3.0 billion in contracts secured in 2010 and

S$361 million worth of orders secured since the start

of 2011, excluding ship repair contracts.

During the year, ship repair turnover stood at

S$646.1 million compared to S$706 million in 2009

and accounted for 14% of total revenue. A total of

282 vessels docked at our yards in 2010 and the

average value per vessel was S$2.3 million. Long-term

strategic alliance customers continued to provide

a steady and growing baseload. Together with our

regular repeat customers, they contributed 85% of

total ship repair revenue in 2010. High value repairs

to oil tankers, container vessels, liquefied natural

gas (LNG) and liquefied petroleum gas (LPG) tankers,

passenger ships and drillships as well as floating production storage and offloading (FPSO) upgrading

dominated the segment.

During the year, we secured a long-term contract

from Carnival Corporation & plc, to provide ship repair,

refurbishment and upgrading services for its passenger

ships operating in the Far East. This followed two earlier

repair, upgrading and refurbishment projects secured

with Carnival Australia and Carnival Cruise Line (United

Kingdom), both part of Carnival Corporation & plc.

As a world leader for LNG repairs, the business

was awarded several repair contracts for LNG carriers.

These include repairs for five membrane LNG carriers

for China LNG Shipping (International) Company,

repair works for three LNG carriers for K Line Ship

Management and an LNG carrier longevity contract

from North West Shelf LNG Venture which is a

Favoured Customer Contract partner. The business

also secured a cargo ship life extension contract from

Bluescope Steel and the renewal of a long-term

contract with Eitzen Group for the scheduled repair

and upgrading of its ships.

Other upgrading and repair orders secured during

the year included a ship repair contract from a regular

Taiwanese customer, a contract for lengthening and

dry-docking repairs from Interislander, and upgrading

and repair jobs for both Star Cruises (Malaysia) and PT

Pelayaran Nasional Indonesia.

Three other upgrading and repair projects worth

S$92 million were secured in 2011, including an

upgrade of a dynamically positioned heavy-lift and

pipelay vessel, an LNG carrier longevity project, and

an upgrade of a drillship.

Turnover from ship conversion and offshore

activities in 2010 was lower than the previous year at

S$820.4 million, compared with S$1.3 billion in 2009.

The sector constituted 18% of the total turnover of

the Marine business. Projects completed during the

year included two FPSO conversions for Tanker Pacific

Offshore Terminals and MODEC, a floating, drilling

production, storage and offloading vessel conversion

for Petroserv as well as an offshore platform for

Maersk Olie og Gas.

During the year, the Marine business secured a

S$130 million contract to carry out the pre-conversion

of a very large crude carrier (VLCC) into a FPSO, to

be renamed P62, for Petrobras Netherlands and a S$550 million contract from ConocoPhillips Skandinavia

to build the Ekofisk accommodation topside to be

installed in the North Sea.

In 2010, the business was also awarded two

offshore conversion contracts worth S$75 million,

comprising the conversion of the tanker BW Genie into a floating production unit (FPU) for BW Offshore

and the upgrading of FPSO Glas Dowr for Bluewater

Energy Services, as well as a S$351 million contract to

convert an Aframax tanker into a FPSO vessel, to be

renamed FPSO Petrojarl Cidade de Itajai, for Teekay

Petrojarl Production.

Further adding to its offshore orderbook, the

business secured a S$123 million contract in January

2011 for the engineering, procurement, construction

and commissioning of a dynamically positioned blue-water

research vessel, to be named RV Investigator,

for Teekay Shipping (Australia).

The rig building segment contributed S$3.1 billion

or 67% of our Marine business’ total turnover, compared

to S$3.6 billion in 2009. During the year, we completed

and delivered six proprietary Pacific Class 375 design

jack-up rigs on or ahead of schedule: the Setty for

the Egyptian Drilling Company, Tam Dao 02 for

Vietsovpetro, West Leda for Seadrill, Sneferu for

Egyptian Drilling, El Qaher I for Egyptian Offshore

Drilling Company and Kan Tan 6 for SINOPEC as well as

a heavy-lift jack-up barge, ARB-3, for Aramco Overseas.

In addition, we completed and delivered two newbuild

Friede & Goldman semi-submersibles, the PetroRig III for Grupo R and West Orion for Seadrill, as well as the

Noble Jim Day, a semi-submersible converted from a

bare-deck hull, for Noble Drilling.

The business also sold a CJ-70 harsh-environment

jack-up rig to a subsidiary of Seadrill.

New rig orders clinched during the year included

the building of two turnkey Pacific Class 400 jack-ups

valued at up to US$364 million from Atwood Oceanics

Pacific, with options for three additional jack-up units;

the construction of two turnkey Friede & Goldman

JU2000E jack-ups worth US$384 million for Seadrill,

with options for four additional jack-up rigs; as well

as the building of two turnkey premium Friede &

Goldman JU3000N jack-up rigs valued at up to

US$400 million for a subsidiary of Noble Corporation,

with options for another four jack-up units and a US$195 million turnkey jack-up rig for Transocean

based on the Pacific Class 400 design.

In January 2011, Atwood Oceanics Pacific exercised

the first of its three jack-up options granted in 2010

with delivery at the end of June 2013.

In February, the business positioned itself for future

sustainable growth by announcing its acquisition of

land for the development of a new shipyard in Brazil

to cater directly to one of the fastest growing offshore

oil and gas exploration and production markets in

the world. The business acquired 825,000 square

metres of freehold land with 1.6 kilometres of

coastline in the state of Espirito Santo, the second

largest oil-producing state in Brazil, for this project.

Located in the municipality of Aracruz, the site is

strategically located close to the offshore Espirito

Santo Basin, which is one of the recently discovered

giant pre-salt oil basins of Brazil, making it an ideal

location from which to support the country’s oil and

gas activities.

On completion, the shipyard will be equipped

with state-of-the-art facilities for constructing

drillships, building semi-submersible rigs, undertaking

FPSO integration, fabricating topside modules and

constructing platform supply vessels, in addition to

the traditional activities of drilling rig repairs, ship

repairs and modification works.

In Singapore, the business marked a major

milestone in its growth and expansion strategy with

the ground-breaking of its Integrated New Yard

Facility at Tuas View Extension in June. As Singapore’s

first purpose-built, custom-designed integrated yard

facility, the 206 hectare landmark development will

further reinforce our Marine business’ competitive

edge through enhanced work-efficient processes as

well as state-of-the-art facilities and equipment.

With its new technologies and optimised layout,

the New Yard Facility will enable the business to

benefit from resource optimisation and economies

of scale through greater operational synergy,

production efficiency and critical mass. This will enable

it to provide customers enhanced services, faster

turnaround time and more cost-competitive solutions.

Designed as a centralised and integrated ’one-stop

solutions’ hub for ship repair and conversion,

shipbuilding, rig building and offshore engineering and construction, the New Yard Facility will be well-equipped

to serve a wide range of vessels, including

VLCCs, new generations of mega containerships,

LNG carriers and passenger ships, while meeting new

regulatory and environmental standards.

The facility will be built in three phases over a

period of six years. When fully completed it will

increase the business’ total dock capacity by 62% from

1.9 million deadweight tonnes to 3.1 million deadweight

tonnes. Under the first phase of its development,

73.3 hectares will be developed for ship repair and

ship conversion operations. This first phase featuring

four drydocks with a total capacity of 1.6 million

deadweight tonnes is scheduled for completion in

2013, with partial operations targeted to commence in

the second half of 2012.

Although global recovery has improved in the past

months, recent events in the Middle East and North

Africa may create uncertainties in the world economy

which may have an impact on businesses.

Fundamentals for the oil and gas industry remain

intact with oil prices expected to be sustained above

US$80 per barrel. Exploration and production (E&P)

spending budgets continue to show positive development

with oil companies reporting their intention to increase

E&P spending further in 2011.

Given the ageing rig fleets and the increasing

focus in the jack-up market on newer, safer and

more efficient rigs, demand for premium and high-specification

rigs is expected to remain strong. Since the

fourth quarter of 2010, Sembcorp Marine has already

secured eight firm orders for jack-up rigs amounting to

S$2.0 billion with options for another ten units.

While drilling activities in the Gulf of Mexico have

slowed pending finalisation in deepwater drilling

regulations, deepwater drilling activities for the rest

of the world are nonetheless expected to increase.

This optimism is reflected in the number of offshore

newbuild orders secured since the last quarter of 2010,

in particular for drillships by drilling contractors. With

its proven track record in deepwater rigs, our Marine

business will be well-positioned to meet the industry’s

most stringent operating requirements, capture new

orders and grow its market share. Overall enquiries

for this segment have improved, though competition

remains keen.

Meanwhile, the ship repair market continues to

improve with continued demand for bigger docks.

The Marine business has secured several long-term

contracts from its customers, particularly in the niche

segments of the repair, upgrading and life extension

of LNG carriers as well as passenger and cruise vessels.

These long-term customers will continue to provide

a stable baseload for the business’ ship repair sector

going forward. |

| |

|

|

|

|