|

|

|

|

|

| |

|

| |

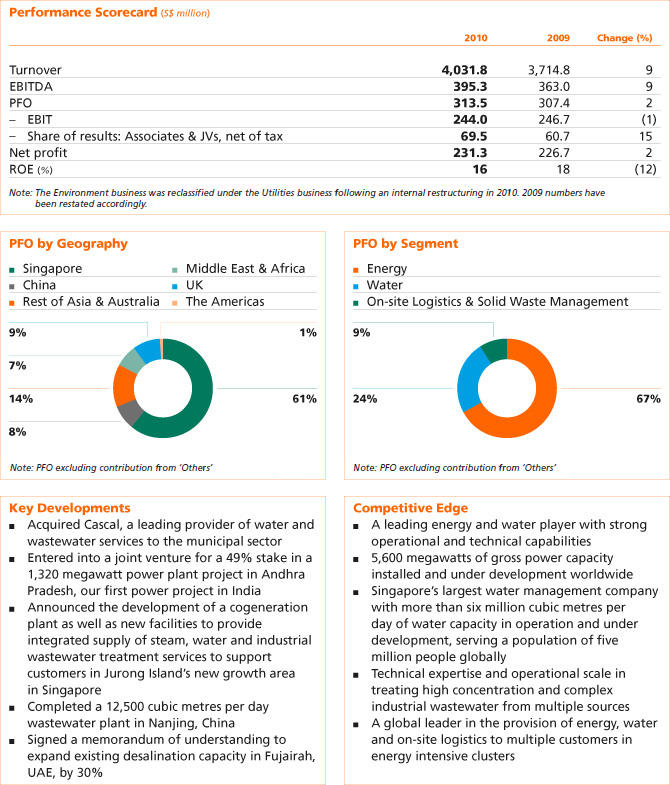

The Utilities business delivered a healthy

operational performance in 2010. Turnover from

the business was S$4.0 billion compared to S$3.7 billion

while net profit attributable to shareholders (net

profit) was S$231.3 million, up 2% compared to

S$226.7 million in the previous year. Profit from

operations (PFO) increased 2% from S$307.4 million to

S$313.5 million with all regions except the UK showing

growth. Singapore operations performed well,

contributing 61% of the business’ PFO and growing

11% over the previous year. Outside Singapore,

operations in China and Middle East & Africa also

registered strong growth in PFO, increasing 229% and

96% respectively. The business’ performance in the UK

was affected by lower operational volume as a result

of the previously announced closure of some of its

customers’ facilities, low market spreads for power as

well as the write-down of certain ageing assets at its

Teesside operations. Our energy business contributed

67% of the Utilities unit’s PFO while our water business

accounted for 24% of Utilities PFO, with on-site

logistics and solid waste management accounting

for the remainder. Total contracts secured from

the industrial sector during the year amounted to

S$3.9 billion, up from S$624 million in 2009. This

comprised S$3.0 billion worth of contracts secured

in Singapore, S$358 million from the UK and

S$494 million of new contracts secured in China.

2010 saw significant progress in our efforts to

grow our energy and water businesses. During the

year, we grew our asset portfolio and extended our

global reach through organic growth and strategic

investments. We increased our gross power capacity

installed and under development by more than 40%

to 5,600 megawatts and grew our water capacity in

operation and under development by around 50%

to six million cubic metres per day.

In July, we acquired Cascal, a leading provider of

water and wastewater services to the municipal sector,

through a voluntary tender offer. At US$6.75 per share,

the total consideration for our 97.66% shareholding

amounted to US$203 million. Following Cascal’s

successful delisting from the New York Stock Exchange

and deregistration with the Securities and Exchange

Commission in the latter half of 2010, squeeze-out

proceedings under the Dutch Civil Code for Sembcorp

to achieve full ownership of the company are currently ongoing. With this acquisition, Sembcorp is now a

global water service provider with enhanced capabilities

to serve the total water and wastewater needs of

both industrial and municipal customers. Cascal was

consolidated as a subsidiary under our Utilities business

with effect from July 2010, and its operations are now

fully integrated into the Sembcorp Group.

During the year, we integrated our solid waste

management business (formerly known as the

Environment unit) with the Utilities business for

greater management efficiency and to better leverage

synergies in the waste-to-energy sector.

Sembcorp’s Singapore operations posted a healthy

PFO for 2010. Our Singapore operations’ 11% growth

in PFO to S$197.2 million was mainly driven by higher

contributions from our natural gas importation business

and electricity sales from our cogeneration plant.

In addition to our existing operations on Jurong

Island performing well, in 2010, we announced steps

to position ourselves to grow with the new wave

of investments coming into the petrochemical and

chemical hub. During the year, we secured contracts to

supply utilities services to Jurong Aromatics Corporation

(JAC) and LANXESS, our first anchor customers located

in Jurong Island’s new growth area covering the

Tembusu, Angsana and Banyan districts. To support the

energy and water requirements of these customers as

well as other companies in the new growth area, we are

developing a new 400 megawatt gas-fired combined

cycle gas turbine cogeneration plant as well as new

facilities to provide the integrated supply of steam,

water and industrial wastewater treatment services.

Representing a total investment of approximately

S$840 million, our new industrial wastewater treatment

plant is expected to begin operations in 2012, while

the cogeneration plant and remaining multi-utilities

facilities are expected to be completed by the second

half of 2013. Having secured an additional generation

licence of 900 megawatts, we will be developing the

new cogeneration plant in phases. With an eventual

intended capacity of 800 megawatts of power, the

facility is set to double our existing power capacity in

Singapore. As a provider of third-party open access

service corridor networks across the island, we also

extended our infrastructure coverage to the new

growth area on the island during the year.

Outside of Jurong Island, 2010 also marked the

full completion and official opening of our Sembcorp

NEWater Plant in Changi. With a capacity of 50 million

imperial gallons (or 228,000 cubic metres) per day,

the plant is Singapore’s fifth and biggest NEWater

plant and one of the world’s largest water reuse

facilities. During the year, it was awarded the 2010

Global Water Awards’ Water Reuse Project of the

Year by Global Water Intelligence as well as the 2010

WateReuse International Award organised by the

US-based WateReuse Association, in recognition of its

contribution to the global water reclamation industry.

Operations in China delivered strong growth in

2010, with PFO contribution from the country

increasing 229% over 2009 to S$27.0 million. This

growth was primarily driven by higher customer

demand, improved tariffs and capacity ramp-ups. In

Shanghai, our cogeneration plant continued to

perform well, although the plant saw an increase in

the natural gas price from July 2010. In Zhangjiagang,

we completed a 7,200 cubic metres per day wastewater

pre-treatment plant, while in Nanjing, we completed

a 12,500 cubic metres per day wastewater treatment

facility. Signifying the successful implementation of our

high concentration industrial wastewater treatment

model in China, this Nanjing facility is our second plant

in China able to treat high concentration industrial

wastewater directly from source, eliminating the

need for our customers to invest in and run their own

wastewater pre-treatment facilities. Our Zhangjiagang

facilities, which pioneered this concept in China, won

Honour Awards in both the East Asian and Global

International Water Association Project Innovation

Awards in 2010, in recognition of their effective and

sustainable approach to water management.

During the year, we also commenced construction

of a 15,000 cubic metres per day industrial wastewater

treatment plant in Guangxi province. Expected to

commence commercial operations in the second

half of 2011, the facility marks our first industrial

wastewater treatment facility in southern China. It

will serve the Qinzhou Port Economic & Technological

Development Zone, which hosts a newly opened 10

million tonnes per annum PetroChina oil refinery and

has been earmarked by the central government for

development into a significant petrochemical hub.

As a result of the Cascal acquisition, 2010 also saw

nearly half a year’s contribution from municipal water

operations in Fuzhou, Qitaihe, Xinmin,Yancheng,

Yanjiao and Zhumadian, held through the China Water

Company (CWC). In October, Sembcorp consolidated

its stake in CWC by purchasing all remaining shares

in it which were not already owned through Cascal.

Amounting to 13% of CWC, these shares were purchased

from Waterloo Industrial, which is under the Kadoorie

Group, for a consideration of US$12.8 million, paid for

with 3,630,192 Sembcorp shares.

With the acquisition of Cascal, we added six

municipal water operations in the country to our

business. Together with our new beachhead in

Qinzhou, we now have energy and water operations

in 12 locations across nine provinces in China and are

strategically located in key industrial sites and cities

in the country.

PFO from Asia and Australia, excluding Singapore

and China, improved by 13% in 2010 to S$44.8 million.

In Vietnam, our 33%-owned Phu My 3 power plant

delivered another year of consistent performance

underpinned by its long-term power purchase

agreement. In Australia, our solid waste management

associate SembSITA Australia, which markets its

services under the SITA Environmental Solutions

brand, continued to perform well, backed by sound

operations and a strong Australian dollar. In December

2010, SembSITA Australia was named the successful

bidder to acquire WSN Environmental Solutions

(WSN), the waste management firm of the federal

government of New South Wales. WSN’s portfolio

of assets, which includes advanced resource recovery

facilities, engineered landfills, transfer stations and

material recovery facilities, is expected to strengthen

SembSITA Australia’s long term positioning in the

state of New South Wales as well as nationally. The

A$235 million acquisition was completed in February 2011.

The region’s performance in 2010 also included

almost six months’ contribution from water operations

previously under Cascal in Indonesia and the Philippines.

In Indonesia, these consist of a 49%-owned associate

with a 25-year concession in Batam Island for the

supply and distribution of municipal water, as well as a

39%-owned associate with a 20-year concession in the

district of Talang Kelapa in Palembang City. Meanwhile in the Philippines, our 29%-owned associate has a

30-year concession for municipal water supply and

wastewater treatment services for Subic Bay Freeport

Zone, an economic trade zone north of Manila, as

well as for the adjacent city of Olongapo.

In May, we entered into a joint venture with Gayatri

Energy Ventures for a 49% stake in a 1,320 megawatt

coal-fired power plant to be located in Krishnapatnam,

Andhra Pradesh. The joint venture became effective

as of February 2011 and commercial operations of

the new facility are expected to commence in 2014.

The project is our first investment in the fast-growing

Indian energy market. The S$1.9 billion power plant

will utilise supercritical technology, a more efficient

and environmentally-friendly technology compared to

conventional coal-fired power generation. It will be

well-positioned to meet the growing power demand in

the southern, western and northern regions of India,

which is expected to increase at a compounded annual

growth rate of 9% over the next 10 years. 75% of the

project cost will be funded through project financing

and the remaining 25% through shareholders’ equity.

PFO from Middle East & Africa grew 96% from

S$11.1 million to S$21.7 million.

In the UAE, our Fujairah 1 Independent Water and

Power Plant continued to deliver strong operating

performance. In June 2010, we signed a memorandum

of understanding with our partner, the Abu Dhabi

Water and Electricity Authority (ADWEA), for the

development of a new seawater reverse osmosis plant

on the existing site which will be capable of producing

around 30 million imperial gallons (or 136,800 cubic

metres) per day of desalinated water. Targeted for

completion end 2013, the expansion will increase our

desalination capacity on the site by 30% to 130 million

imperial gallons (or 591,800 cubic metres) per day. The

increased output is expected to be sold to the Abu

Dhabi Water and Electricity Company (ADWEC) under

a long-term water purchase agreement.

Meanwhile in Oman, we commenced construction

of the US$1 billion power and desalination plant

in Salalah. The facility’s 65 megawatts first phase is

expected to complete in the second half of 2011. 60%

owned by Sembcorp, the Salalah Independent Water and Power Plant is set to be the largest and most

efficient power and water plant in the Governorate

of Dhofar and will play a major role in meeting the

region’s growing power and water needs. The project

is expected to begin full commercial operations in the

first half of 2012.

With our acquisition of Cascal, contribution from

the region also included contribution from South

Africa, our first beachhead in the African continent.

Our South African operations provide the cities of

Ballito and Mbombela, formerly known as Nelspruit,

with municipal water supply and wastewater

treatment services. Our company in Mbombela,

Sembcorp Silulumanzi, was awarded the prestigious

Blue Drop certification for the second consecutive year

by the Department of Water Affairs and Forestry for

the Nelspruit water treatment plant.

PFO from the UK declined from S$78.1 million to

S$30.8 million due to weak performance from our

Teesside operations.

As we had guided the market, as at the end of

January 2010, three customers on the Wilton

International site in Teesside who had earlier

announced closures ceased operations on the site.

The associated production areas are being demolished

and cleared, freeing up significant heavy industrial

development land. The regional development agency,

One North East, has invested almost £7 million to

acquire and develop the former Invista land on the site,

through which it can support future inward investment.

2010 saw the arrival of Lotte Chemicals UK (Lotte),

which took over and successfully restarted the purified

terephthalic acid (PTA) and polyethylene terephthalate

(PET) production plants that closed down when

previous owner Artenius entered administration

in 2009. Sembcorp concluded new utilities supply

agreements with Lotte in May 2010.

In 2010, our Teesside operations also faced a

challenging operating environment which saw power

spreads at their lowest since 2003-2004, as well as

reliability and efficiency issues including with some

of the ageing assets on the site. During the year, we

saw failures of some ageing but critical plant items.

Although repaired, these assets were written down

through accelerated depreciation and an after-tax

charge of S$14.3 million was taken in the fourth quarter of the year. With cost management remaining

a priority, we also ceased a defined benefit pension

scheme for employees on the site during the year.

Converting the scheme to a future accrual scheme

resulted in a one-off gain of approximately S$8 million.

Despite these challenges, the business continued

to make progress on a number of value-adding

initiatives. During the year, we completed modification

works to our biomass power plant to convert it into a

combined heat-and-power plant so as to enhance our

green income from renewable obligation certificates.

To secure more off-site income, a 52 megawatt steam

condensing turbine project is currently under

construction and is expected to be completed by

mid-2011. When completed, this will provide the

flexibility of generating power for export to the pool

or distributing process steam on-site.

With the acquisition of Cascal, our UK assets now

also include municipal water operations in Bournemouth.

Located in southern England, Sembcorp Bournemouth

Water provides municipal water to Dorset, West Hampshire

and part of Wiltshire under a 25-year rolling contract.

It was rated the top performing water company for

service delivery in England and Wales for the second

year running by water industry regulator Ofwat.

The acquisition of Cascal has given us our first

Utilities footprint in the American continent with

the addition of municipal water operations in Chile,

Panama and the Caribbean to the business. In Chile,

we operate to the north of the capital city of Santiago,

as well as in Antofagasta, a city near the Atacama

Desert from which we also supply treated effluent

to Xstrata’s copper mine in La Negra. In Panama, we

supply bulk treated water under a 30-year contract

with Panama’s national water agency, while operations

in the Caribbean islands of Antigua, Bonaire and

Curaçao provide desalinated water to our customers.

Overall, the global economy is expected to

improve, but growth is expected to remain uneven.

The International Monetary Fund is forecasting

an overall growth of 4.4% in 2011. Growth in the

advanced economies is expected to remain subdued at

2.5%, while developing economies in Asia, including

China, India, Indonesia, Philippines and Vietnam, are expected to grow at a faster pace of 8.3%. However,

recent events in the Middle East and North Africa

could create uncertainties and threaten global

economic recovery. Although our utilities projects in

Oman and the UAE are not affected by the current

unrest, nonetheless, we continue to closely monitor

the situation in the region.

Singapore’s Economic Development Board reported

that total fixed asset investment commitments

increased from S$11.8 billion in 2009 to S$12.9 billion

in 2010. Investment commitments from the chemical

sector accounted for the second largest proportion of

total fixed asset investment commitments in 2010 and

amounted to S$1.7 billion.

Further investments by downstream chemical

players are expected going forward with the addition

of two new world-class chemical crackers by Shell

and ExxonMobil on Jurong Island. The Shell Eastern

Petrochemicals Complex opened in May 2010, while

ExxonMobil’s integrated chemical and refining site

is expected to start up in 2011. Chemical companies

which have announced plans to invest in new facilities

or expansions to existing operations on Jurong Island

in 2009 and 2010 include Asahi Kasei Chemicals,

Chang Chun Group and Dairen Chemical Corporation,

Evonik Degussa, JAC, LANXESS, Stolthaven Terminals,

Sumitomo Chemical and Zeon Chemicals. In addition,

Shell has announced that it is studying the feasibility

of using Singapore as a base for the production of

world-scale high-purity ethylene oxide (HPEO), which

is used as a feedstock for detergent and soaps. If this

development materialises, it is expected to spur a

new HPEO corridor on Jurong Island to cater to soap

and detergent makers. There is also the possibility of

a fourth oil refinery with an expected value of

between US$6 million to US$8 million and a capacity of

300,000 to 500,000 barrels per day, which is reportedly

being studied by a consortium involving Singapore,

Chinese and European investors.

To cater to the expected increase in demand

stemming from these additional investments, our new

multi-utilities facilities located in the vicinity of the

Tembusu, Banyan and Angsana districts where most

of the new investors will be located, will commence

operations in 2012 and 2013. Our new 9,600 cubic

metres per day integrated wastewater treatment facility is expected to begin operations in 2012, while

our new 400 megawatt cogeneration plant, as well

as the remaining multi-utilities facilities to serve the

area are expected to be completed in the second half

of 2013. In addition, our importation of an additional

90 billion British thermal units per day of natural gas

from the West Natuna Sea, Indonesia remains on track

for delivery in the second half of 2011. This will boost

our current natural gas supply capacity by 26% to

431 billion British thermal units per day.

In China, to serve increasing customer demand,

several new facilities are expected to begin

operations in 2011. A 24,000 cubic metres per day

water reclamation plant in the Zhangjiagang Free

Trade Port Zone, which will supply industrial water

and demineralised water from recycled effluent to

customers, is targeted to come onstream in mid-2011. A 20,000 cubic metres per day expansion to

our industrial water facilities in the Nanjing Chemical

Industrial Park and our 15,000 cubic metres per day

industrial wastewater treatment plant in Qinzhou Port

Economic & Technological Development Zone are also

expected to start commercial operations in 2011.

In Australia, SembSITA Australia will focus on

integrating WSN and strengthening its positioning in the

alternative waste treatment sector. In Vietnam, our Phu

My 3 power plant is expected to deliver satisfactory

operational results. However, tariffs are expected to

decline from 2010 onwards as stipulated in the power

purchase agreement.

Our Fujairah 1 Independent Water and Power

Plant in the UAE is expected to continue performing

well, supported by its long-term purchase agreement

with ADWEA. Following the memorandum of

understanding for the development of a new

seawater reverse osmosis plant on the site, a long-term

water purchase agreement with ADWEC for

this additional output is expected to be signed in

2011. Meanwhile in Oman, construction of our

combined power and desalination facility in Salalah

continues, progressing towards the facility’s planned

commencement of its 65 megawatt first phase in the second half of 2011 and its expected full commercial

operations in the first half of 2012.

The UK economy is expected to remain weak, with

GDP growth for 2011 forecasted at 2.1% by the

Office of Budget Responsibility.

Low power spreads in the UK are expected to

continue to impact the performance of our Teesside

operations in 2011. However, in the long term, we

expect power spreads to improve given the impending

power capacity gap from the retirement of old assets

in 2015 and the need to encourage new power

investments in the country. In 2011, our 52 megawatt

steam condensing turbine is expected to come

onstream and this will provide flexibility between

steam and power production for our operations.

In addition, the business continues its efforts to

re-position the site by targeting new opportunities

outside the traditional chemical industries.

Our regulated municipal water business in

Bournemouth, UK is expected to continue performing

well in 2011. The business completed its tariff review

with the UK water services regulator Ofwat, and

tariffs have now been set for the five-year period

commencing April 2010. Underpinned by this and its

25-year rolling contract for the provision of water

to its municipal customers, it is expected to continue

to deliver a steady performance going forward.

Meanwhile operations in the Americas are expected

to experience continued organic growth, underpinned

by long-term concession agreements. |

| |

|

|

|

|