|

|

|

|

|

| |

|

| |

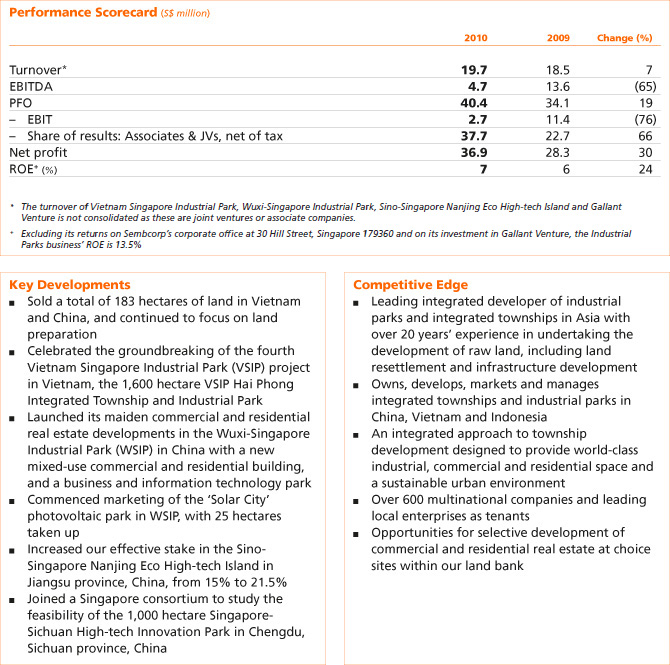

The Industrial Parks business performed well in

2010. Its turnover for 2010 grew 7% to S$19.7 million,

compared to S$18.5 million in 2009. Turnover from

integrated townships and industrial parks owned and

under management amounted to approximately

S$450 million, 18% higher than their 2009 turnover

of S$380 million. The business’ net profit in 2010

grew 30% to S$36.9 million, compared to S$28.3

million in 2009, while profit from operations (PFO)

increased 19% from S$34.1 million to S$40.4 million.

The business’ improved performance was driven by

healthy take-up for commercial and residential land

in its Vietnam Singapore Industrial Park (VSIP) project

in Binh Duong, strong industrial land sales in VSIP

Bac Ninh, as well as improved contribution from the

business’ associate, Gallant Venture.

In 2010, our Industrial Parks business maintained

its focus on building its land bank and developing its

industrial parks and integrated townships in Vietnam

and China, where its projects cover a total gross land

area of 6,687 hectares. With more than 20 years of

experience in undertaking the development of raw

land, including land resettlement and infrastructure

development, the business takes an integrated

approach to township development, designing self-sufficient

sites that provide world-class industrial,

commercial and residential space with an emphasis on

sustainable urban development. In 2010, the business

sold a total of 183 hectares of land, with a remaining

2,700 hectares of land available for sale in Vietnam and

China to support future growth.

Based on current master plans, the business’ six

developments in Vietnam and China offer more than

12 million square metres of commercial and residential

gross floor area to third party property developers for

the development of building clusters for direct sale or

lease. Going forward, in order to maximise the yield

from our land bank, we also intend to undertake the

selective development of commercial and residential

real estate at choice sites within our land bank.

Significant progress was made during the year in terms

of land resettlement and infrastructure development.

Within VSIP Binh Duong, our second VSIP project

in southern Vietnam, we resettled 30 hectares of

land during the year, leaving only 20 hectares of the project’s total gross land area of 2,045 hectares to be

resettled in 2011. We also completed the preparation

and infrastructure development of 44 hectares of

industrial land and 96 hectares of residential land.

Profits from the sale of 36 hectares of industrial land

and 62 hectares of commercial and residential land

were realised. These sales have brought VSIP Binh

Duong’s take-up rate to 24% of saleable land, with

1,060 hectares of saleable land remaining available.

While almost all 500 hectares of the nearby VSIP I

are fully committed, the development continues to

provide steady recurrent income from factory rentals

and electricity distribution. The two VSIP projects in

southern Vietnam now have a total of 404 committed

customers, compared to 382 customers in 2009.

In northern Vietnam, while no additional

resettlement was done in VSIP Bac Ninh during the

year, effort was instead focused on land preparation.

We completed land preparation for 120 hectares,

enabling several customers to begin construction

of their factories, including Foster Electric Company

and Mapletree Logistics. Profits from the sale of

54 hectares of industrial land were realised, bringing

the take-up rate to 20% of saleable land, with a total

of 350 hectares saleable land remaining. VSIP Bac Ninh

now has 30 committed customers compared to 21 in

2009, including PepsiCo, which took up 12 hectares of

industrial land during the year to construct its second

largest beverage production facility in Southeast

Asia. We will progressively resettle the remaining

228 hectares out of the 700 hectare project gross

land area over the next two years in tandem with

customer demand.

The Industrial Parks business also stepped up its

successful presence in the country with the

groundbreaking for its fourth VSIP development in Hai

Phong, northern Vietnam, which was witnessed by the

Prime Ministers of Vietnam and Singapore. Located

in Hai Phong City’s new waterfront district in the

vicinity of the North Cam River area, the 1,600 hectare

integrated township has a planned 1,100 hectares

allocated for commercial and residential development

and 500 hectares allocated for a business and industrial

park. A highlight of the site, which has 920 hectares

of land available for sale, is a four kilometre stretch of

waterfront land along the river, with additional water

frontage along river tributaries within the site.

To date, VSIP Hai Phong has received the investment licence for 611 hectares of industrial land and the

business expects to receive an additional investment

licence for a further 137 hectares of commercial and

residential land in 2011. During the year, land resettlement

was completed for 250 out of the 611 hectares. In

addition, land preparation commenced for the arterial

boulevards within the resettled land. Piling works were

also completed for five detached ready-built factories

of 2,000 square metres each to be completed in 2011.

In 2010, several new developments were launched

in the Wuxi-Singapore Industrial Park (WSIP), including

a mixed-use commercial and residential building, a

business and information technology park and the

’Solar City’ photovoltaic park. The launches were

well-received with a healthy take-up for land and

units released for sale.

The development of the mixed-use commercial

and residential building as well as the business and

information technology park marked a first for

the business, as it leveraged on opportunities

available to participate in the selective development

of commercial and residential real estate to enhance

returns on land in choice sites. The business and

information technology park, a joint venture with

Hong Kong-listed First Shanghai Group, offers a total

99,000 square metres of gross floor area. Since the soft

launch of the development’s first phase in June 2010,

38% of its gross floor area has been taken up.

Meanwhile, the business also saw the soft launch

in October of its mixed development, ’International

Garden City’, comprising a 120-room serviced

apartment block owned by WSIP and operated

by Modena Residence, which is under the Frasers

Hospitality Group. The soft launch of two apartment

blocks of 177 units totalling 17,000 square metres gross

floor area saw an encouraging response, with 92 units

covering a total of 52% of gross floor area sold.

Another development which saw encouraging

take-up was the ’Solar City’ photovoltaic park, a

collaboration between Suntech Power and the Wuxi

New District with a planned area of 400 hectares.

40 hectares of land belonging to WSIP will be used

for the project’s first phase. Of these 40 hectares,

25 hectares have been taken up.

To date, WSIP is almost fully taken up, with a mere

15 hectares’ remaining saleable land. During the year, WSIP secured a 12 hectare plot of land in the

Wuxi New District’s Hongshan area for the planned

development of Hongshan Mansion, a 120,000 square

metre gross floor residential development with a total

of 700 units. To be developed over five phases, the

initial phase to be completed by the third quarter of

2011 will comprise 30,200 square metres or 156 units

of apartments and villas.

Meanwhile in September, the Industrial Parks

business increased our shareholding in the Singapore

consortium involved in the Sino-Singapore Nanjing

Eco High-tech Island (SNEI) from 30% to 43%. This

increased our effective stake in the Singapore-China

joint venture SNEI project from 15% to 21.5%.

During the year, the conceptual master plan for the

entire 1,500 hectare development was finalised and

approved, and plans are currently underway to appoint

an urban planner for the development of 630 hectares

with the remaining 870 hectares set aside under the

master plan for eco-tourism. Situated a mere

6.5 kilometres from Nanjing’s city centre on

Jiangxinzhou, the SNEI is Nanjing City’s largest foreign

collaborative development to date. The project is

expected to yield up to 3.2 million square metres of

office and commercial space and about 2.2 million

square metres of residential gross floor area. To date,

it has 360 hectares of land available for sale.

In September, Temasek Holdings, through its

wholly-owned company Singapore-Sichuan Investment

Holdings, signed a memorandum of understanding

with the Chengdu High-tech Zone Administration

Commission to explore the joint development of the

1,000 hectare Singapore-Sichuan High-tech Innovation

Park in Chengdu, Sichuan province. Sembcorp leads

the Singapore consortium currently undertaking a

feasibility study for the project, which is expected to

be completed by mid-2011. Should the outcome of the

study be favourable, a 50:50 Singapore-Chinese joint

venture will be formed to undertake the project.

In 2010, our 23.9%-owned associate company

Gallant Venture (GV) turned around from a net loss

position. The improved performance was mainly due

to the commencement of transfer of land titles in

2010 by GV’s property development business, which

recognised S$33.3 million of resort land sales.

In its World Urbanisation Prospects report released

in 2009, the United Nations states that it expects

urbanisation in Asia to continue at an unprecedented

pace, with the projected creation of an estimated

90 new cities over the next 15 years. Asia’s emerging

middle class is expected to grow significantly, in terms

of both size as well as spending power.

Against this background, we see significant

opportunities for our Industrial Parks business,

which delivers the economic engine to drive inward

investments, job creation, growth in exports and fiscal

revenues core to the economic growth of these fast-developing

Asian economies through our industrial

parks and integrated townships. The continued pace

of industrialisation and urban population growth is

also expected to increase demand for commercial

and residential real estate, which is set to benefit

the business, with its plans to undertake selective

development of commercial and residential real estate

at choice sites in its land bank.

In Vietnam, we expect VSIP Hai Phong to

start contributing to our net profit in 2011. While

its competitiveness may be somewhat affected by

higher national wage levels as a result of economic

growth, Vietnam’s market is nonetheless expected

to remain attractive to foreign investors given the

country’s increasing level of domestic consumption.

In China, the government’s implementation

of tightened credit controls and market cooling

measures is expected to result in a slowdown in

property demand, particularly in first-tier cities.

Nonetheless, second-tier cities such as Nanjing and

Wuxi, where our business operates, are expected to

remain relatively attractive given their lesser degree

of market saturation and lower business costs. With

the population of second-tier cities expected to rise

and per capita income for their growing middle class

expected to increase, the housing market in second-tier

cities is likely to still see growth. Furthermore,

the anticipated relaxation of China’s hukou, or

household registration system, is also expected to

result in an influx of first-time home buyers who may

be attracted to second-tier cities with their continued

growth and lower level of congestion. Against this

background, we expect to see continued contributions

from our residential and commercial developments in

WSIP and from land sales in SNEI.

Meanwhile, Indonesia continues to be an increasingly

attractive destination for foreign investments. We

expect our associate GV’s resort land sales to continue

in 2011. |

| |

|

|

|

|