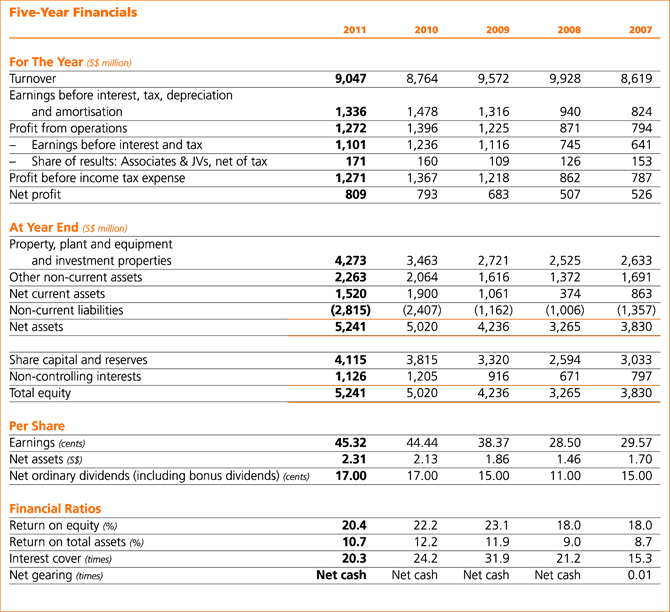

The Group delivered a strong

performance in 2011. Net profit

attributable to shareholders

of the company (net profit)

for the full year grew 2% from

S$792.9 million in 2010 to

S$809.3 million, while turnover

was up 3% from S$8.8 billion in

the previous year to S$9.0 billion.

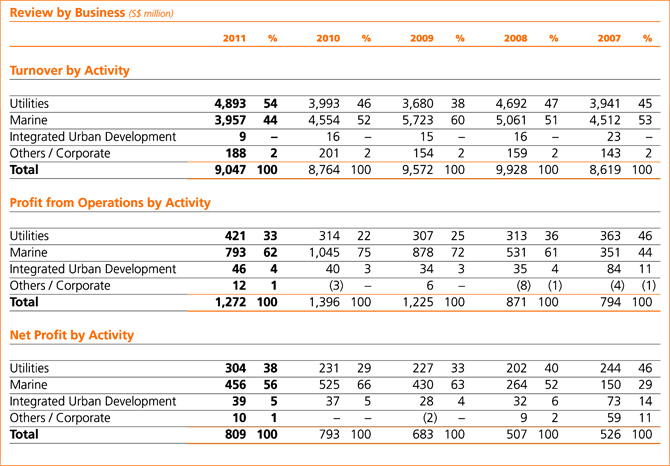

Our main profit contributors

continued to be our Utilities and

Marine businesses, which

accounted for 92% of Group net

profit. Our Utilities business

delivered robust profit growth in

2011, with net profit growing

32% to S$304.4 million. Record

profits for the business were

driven by good operating

performance in Singapore,

China and the Middle East &

Africa. The Marine business’

contribution to net profit was

13% lower at S$456.2 million

mainly due to fewer jack-up and

semi-submersible rig projects. This

was offset by the higher interest

income received in 2011 for

deferred payment granted to

customers and write-back of prior

years’ tax over-provisions.

Sembcorp’s net profit for the

year grew 16% from S$682.7

million to S$792.9 million,

while turnover was S$8.8 billion

compared to S$9.6 billion in 2009.

The Utilities business’ net

profit improved by 2% to

S$231.3 million with all regions

registering growth except for

operations in Teesside, UK, while

the Marine business’ contribution

to net profit grew 22% to

S$524.9 million.

During the year, the Group

recorded an exceptional gain

of S$32.1 million comprising

the Group’s share of the Marine

business’ full and final amicable

settlement of disputed foreign

exchange transactions.

Sembcorp’s net profit for the year

grew 35% from S$507.1 million

to S$682.7 million, while turnover

stood at S$9.6 billion.

The Marine business’ contribution

to net profit grew 63% from

S$263.7 million to S$430.2 million,

attributable to a combination of

operational efficiency and execution

of projects ahead of schedule

resulting in better margins and the

resumption of margin recognition

for some of the business’ projects. The Utilities business’ net profit grew by 12% from S$202.4 million to S$226.7 million, with operations in Singapore, China, Vietnam and the UAE showing growth.

Sembcorp’s turnover increased by

15% from S$8.6 billion to S$9.9 billion.

Net profit for the year stood at

S$507.1 million. Excluding the one-off

write-back of S$48.0 million of tax

provisions recorded in 2007, Sembcorp

achieved a net profit growth of 6%.

The Marine business’ contribution

to net profit rose 75% to S$263.7

million, mainly due to higher

revenue and operating margins

from its rig building and ship repair

businesses. The Utilities business’

net profit stood at S$202.4 million mainly due to contributions from our Singapore and UK operations.

During the year, the Group recorded an exceptional loss of S$26.9 million comprising the Group’s share of the Marine business’ foreign exchange losses from unauthorised transactions.

Sembcorp achieved a 6% growth

in turnover to S$8.6 billion. Net profit

in 2007 stood at S$526.2 million.

Strong business fundamentals

continued to drive Sembcorp’s

growth, backed by positive

operating performance from the

Utilities business’ Singapore and UK

operations and the Marine unit’s rig

building and ship repair businesses.

The Group recorded a net

exceptional loss of S$31.0 million

during the year, which comprised

the Group’s share of losses

recognised by the Marine business’

unauthorised foreign exchange

transactions, partially offset by gains

on the sale of certain investments. |

| |

|

| |

|

| |

|

| |