|

|

|

|

|

| |

|

| |

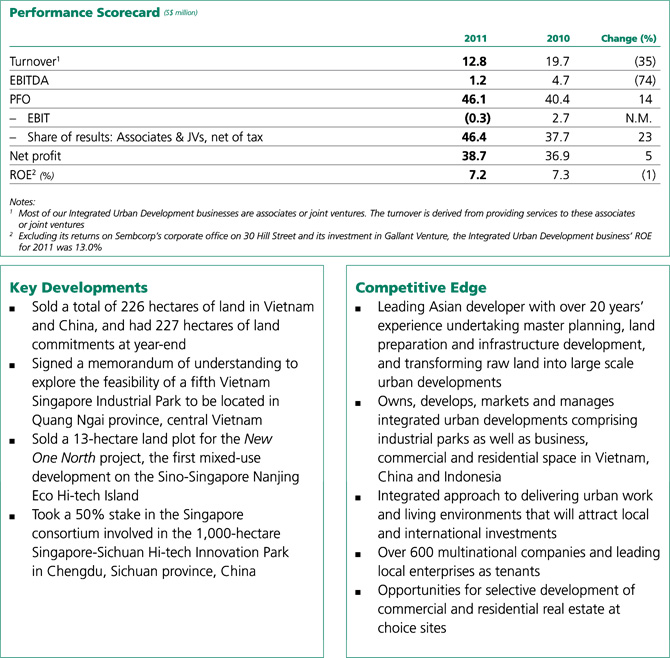

Sembcorp’s Integrated Urban Development

business (formerly known as Industrial Parks) turned

in a good performance in 2011. Net profit grew

5% to S$38.7 million, compared to S$36.9 million

in 2010, while profit from operations (PFO) increased

14% from S$40.4 million to S$46.1 million. The

business benefited from strong land sales in the

Vietnam Singapore Industrial Park (VSIP) projects,

which registered a 30% growth compared to 2010.

Meanwhile, the Wuxi-Singapore Industrial Park (WSIP)

continued to see a steady income stream from factory

rentals as well as contribution from residential sales.

In 2011, the business sold a total of 226 hectares

of land in Vietnam and China, a 24% increase from

the previous year’s 182 hectares. Industrial land comprised 77% of land sales while commercial and residential land accounted for 23%. The growth in land sales was achieved in spite of a weaker global economic sentiment in the second half of the year. First land sales for both VSIP Hai Phong in Vietnam and the Sino-Singapore Nanjing Eco Hi-tech Island (SNEI) in China were secured during the year.

In early 2012, the business was renamed Integrated Urban Development, in line with our focus

on providing integrated urban solutions. Taking an

integrated approach to delivering urban work and

living environments, we have more than 20 years of

track record transforming raw land into large scale

urban developments comprising industrial parks as

well as business, commercial and residential space.

We also have the ability to extract further value by

undertaking selective development of commercial

and residential real estate at choice sites.

2011 has been a challenging year for Vietnam.

The country’s economy expanded 5.9% for the full

year, down from an average of 7% in the past

decade as the government tightened fiscal and

monetary policies to rein in high inflation. Despite

the challenging business environment, our VSIP

projects performed well, securing high value land

sales from several big multinational corporations.

For the year, VSIP sold a total of 212 hectares, an

increase of 30% from 2010’s 163 hectares. Demand

for industrial land continued to be strong, accounting

for 82% of the sales and growing 73% from the

previous year.

In southern Vietnam, our VSIP projects delivered

a steady performance, surpassing the previous year’s

land sales performance and accounting for 58% of

VSIP’s total land sales. Our first 500-hectare VSIP

project in Thuan An district is almost sold out and

contributes steady recurrent income from factory

rentals and electricity distribution. The second

2,045-hectare VSIP in the New Binh Duong Township

is 38% taken up and continues to see interest from

potential investors. 68 hectares of land have been

committed by customers and another 873 hectares

of saleable land remained available as at end 2011.

In northern Vietnam, the 700-hectare VSIP Bac

Ninh continued to build on its momentum of

securing well-established, long-term customers.

Nokia is setting up its first manufacturing facility in

Southeast Asia in VSIP Bac Ninh, joining PepsiCo and

Foster Electric. The integrated urban development

also attracted Malaysia’s SP Setia who took up a large

plot of residential land for an eco housing project.

VSIP Bac Ninh sold 64 hectares of land in 2011 and

total land take-up stood at 64% as at end 2011.

Investor interest remained healthy with 103 hectares

of land committed by potential investors and 142

hectares of saleable land remaining available as at

end 2011. Meanwhile, land preparation and

infrastructure works continued to progress for our

fourth VSIP project in Hai Phong City. During the

year, it achieved its first land sales to Kyocera Mita

Corporation of Japan. The official inclusion of Hai

Phong City in the Dinh Vu-Cat Hai Economic Zone

is expected to further boost the attractiveness and

marketability of the development.

Following the successful progress of our first four

VSIP projects, a memorandum of understanding was

signed with the People’s Committee of Quang Ngai

province during the year to explore the feasibility

of a 1,020-hectare integrated urban development

in central Vietnam. The proposed development will

comprise a 500-hectare industrial park located within

the Dung Quat Economic Zone, where government-supported

special economic zone incentives will be

made available to manufacturers. Separately, 520

hectares of land are expected to be zoned for

commercial and residential purposes near downtown

Quang Ngai city. The signing was witnessed by the

President of Vietnam His Excellency Truong Tan Sang

and Singapore Prime Minister Lee Hsien Loong.

In 2011, WSIP performed well despite being

a mature industrial park that has been operating

for 18 years. Rentals from ready-built factories and

electricity distribution continue to provide a stable

income stream while initiatives to enhance the yield

on this project have progressed well. During the year,

we completed and handed over a 140,000-square

metre custom-built factory to New York Stock

Exchange-listed Suntech Power, which will rent

the premises under a long-term lease agreement.

Five new ready-built factories have also been rented

out, including those in the Solar City photovoltaic

park. In the commercial and residential space,

occupancy rates for the business and technology

park improved from 38% to 50%. Good take-up

was also registered for the International Garden City apartment project in Wuxi New District, which sold

137 units during the year, 50% more compared

to 2010. Construction of Hongshan Mansion, a

108-unit residential development, progressed well

during the year and is targeted to be launched in

the second quarter of 2012.

Over in Nanjing, the SNEI project has completed

its urban master plan, industry positioning study

and ecology planning system. Of the island’s

1,500-hectare gross land area, 809 hectares will be

preserved for eco-tourism, while 715 hectares will be developed which includes 324 hectares of office,

commercial and residential land available for sale.

Through our joint venture company, we have secured

a 13-hectare site to develop the first major mixed-use

development on the island named New One North.

Encompassing a research and development park,

an exhibition centre and a waterfront commercial-leisure-residential precinct overlooking Hexi New

City on Nanjing mainland, New One North will yield

about 152,000 square metres in gross floor area.

During the year, we also completed the feasibility

study for a new integrated development, the

Singapore-Sichuan Hi-tech Innovation Park.

Strategically located in Chengdu’s Tianfu New City

central business district, the project adds 500

hectares to our land bank available for sale. The

integrated development will focus on attracting

innovative and knowledge-intensive industries in

eight clusters comprising information technology,

digital media, pharmaceutical research, precision

engineering, environmental services, service

outsourcing, banking and insurance, and will be

developed by a joint venture between the Singapore

consortium, in which Sembcorp has a 50% stake,

and its Chinese partners.

Our 23.92%-owned associate company Gallant

Venture continued to deliver positive results although

its profit contribution in 2011 was lower compared

to 2010. Its property development business registered

lower resort land sales while the industrial parks

business continued to face competitive pressure.

The Integrated Urban Development business

is expected to deliver better performance in 2012

compared to 2011, in anticipation of contribution

from the SNEI project and underpinned by 227

hectares of land commitments. Our projects in

Vietnam and China remain attractive destinations

for foreign investors. However, the economic downturn in Europe and the USA may slow down

manufacturing exports and delay potential customer

investment decisions that could in turn impact the

pace of our land sales. The Vietnamese and Chinese

governments’ measures to stabilise the housing

market in their countries may also moderate the

demand for commercial and residential space.

In the longer term, industrialisation and

urbanisation remain a core priority for both Vietnam

and China. The Vietnamese government has set

a target to achieve full industrialisation by 2020.

Its urban population is expected to reach 59% in

2050 from 30% in 20091. Similarly, China’s economic

and social priorities are moving towards industry

upgrading, sustaining growth and promoting

domestic consumption. Its urban population is

expected to grow from 46% in 2009 to 73% by

20501, adding a projected 46 million middle class

households from 2010 to 20152.

With 2,711 hectares of land available for sale, our projects in Vietnam and China provide a robust development pipeline. Furthermore, with our ability to extract further value by undertaking selective development of commercial and residential real estate at choice sites, we believe that the business is poised for growth in the coming years. |

| |

1 United Nations World Urbanisation Prospects, The 2009 Revision

2 Boston Consulting Group: ‘Winning in Emerging-market Cities’, September 2010 |

| |

|

|

|

|