|

|

|

|

|

| |

|

| |

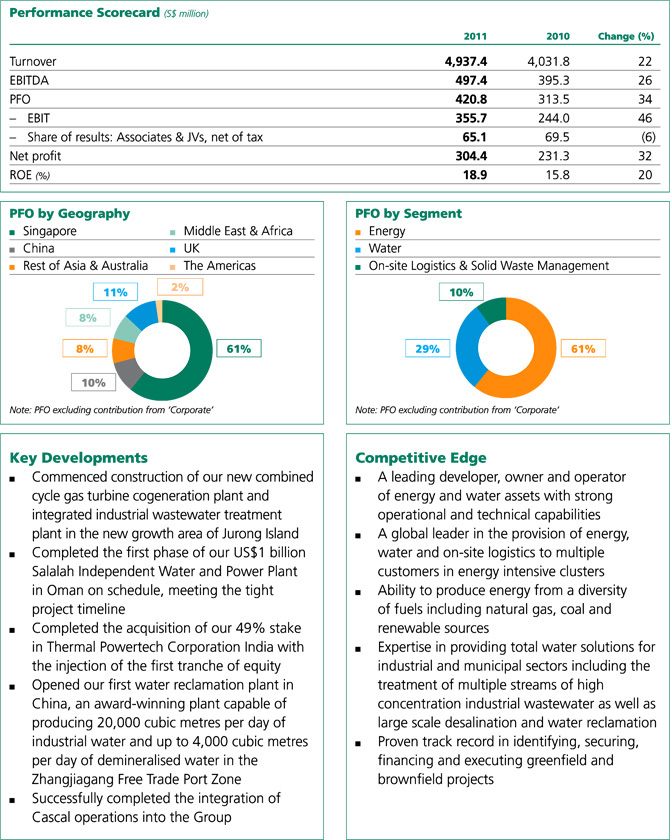

The Utilities business delivered strong profit growth in 2011. We recorded a 22% increase in turnover from S$4.0 billion a year ago to S$4.9 billion and grew our net profit attributable to

shareholders (net profit) by 32% from S$231.3

million to a record S$304.4 million. Profit from

operations (PFO) increased 34% from S$313.5

million to S$420.8 million. Singapore operations

performed exceptionally well, with PFO growing

31% and contributing 61% of the business' PFO

during the year under review. Operations outside

Singapore contributed 39% of the PFO, with China

and the Middle East & Africa registering the strongest

growth at 53% and 51% respectively. Total contracts

secured from the industrial sector during the year

amounted to S$1.7 billion, comprising primarily

new gas contracts secured in Singapore.

In April 2011, we were named the Water

Company of the Year at Global Water Intelligence’s

2011 Global Water Awards. This top honour at the

prestigious Global Water Awards recognises the

water company that has made “the most significant

contribution to the development of the international

water sector in 2010”. Besides clinching the top

honour, our Salalah Independent Water and Power

Plant (IWPP) in Oman won the Desalination Deal

of the Year award, in recognition of its “financial

innovation or in meeting the demands of challenging

circumstances”. Despite the deal coming at the tail

end of the financial crisis, the project’s financing

team nevertheless secured funding support at

a competitive cost. Both these awards attest to

our growing standing as a trusted global water

services provider.

During the year, we also successfully integrated

the operations of Cascal into Sembcorp, following

our acquisition of the municipal water and

wastewater service provider in 2010. Fully integrated

into the Group, its operations performed well in

2011 with its maiden full year contribution boosting

our Utilities performance. The success of this

acquisition demonstrates Sembcorp’s capabilities

in executing and extracting value from acquisitions.

We were not only able to successfully identify a

suitable acquisition target that complemented

Sembcorp’s existing business, but we were also able

to smoothly integrate 18 municipal water operations

across eight countries into the Group. The integration

also involved the rationalisation and streamlining

of operations, alignment of systems, processes and

policies as well as the establishment of a unified

organisation-wide branding.

Sembcorp’s Singapore operations delivered

strong PFO growth in 2011. Our Singapore

operations’ 31% increase in PFO to S$258.6 million

was driven primarily by strong performance from

our cogeneration plant due to high energy prices

during the period.

During the year, our multi-utilities operations

on Jurong Island performed well and continued to

provide its petrochemical customers on the island

with reliable utilities, maintaining an average of

97% availability and 100% reliability. To further

enhance our competitiveness on Jurong Island,

we completed a woodchip-fuelled biomass steam

production plant, with a steam capacity of 20 tonnes

per hour, in November 2011. Leveraging synergy

across our businesses, the biomass plant uses waste

wood collected and processed by our solid waste

management business to generate efficient green

steam for our customers on the island. In November

2011, we also started receiving the second tranche

of natural gas from West Natuna, Indonesia. This

second gas sales agreement is for a total of 90 billion

British thermal units per day and increases our

existing supply by 26%. In 2011, a total of

S$1.6 billion worth of new and renewed utilities

and gas contracts were secured. In addition, our solid

waste management business also secured a new

S$121 million contract in July 2011 to serve the

Bedok sector in Singapore. The seven-year contract,

which began in November 2011, entails the provision

of refuse collection and recycling services. With this

contract, Sembcorp now serves five out of nine

geographical sectors in Singapore.

In 2011, our expansion projects in the new

growth area of Jurong Island continued to make

good progress. We commenced construction of our

new combined cycle gas turbine cogeneration plant,

our second on Jurong Island, in the second half of

2011. With a capacity of 400 megawatts of power

and 200 tonnes per hour of process steam in the

initial phase, the plant is expected to be completed

by the fourth quarter of 2013. Construction of our

new 9,600 cubic metres per day integrated industrial

wastewater treatment plant also commenced in

2011. Expected to begin operations in the second

half of 2012, the plant will be capable of treating

high concentration industrial wastewater with

chemical oxygen demand of up to 800 milligrammes

per litre, which is two times the concentration of

municipal sewage. Once operational, Sembcorp’s

industrial wastewater treatment capacity will more

than double. At the same time, we are also

developing a new multi-utilities facility in the area,

expected to be completed by the fourth quarter

of 2013. As a provider of third-party open access

service corridor networks across the island, we also

continued to extend our service corridor network

to the new growth area, connecting customers

located there to the rest of Jurong Island. These new

facilities in the Banyan and Angsana districts of

Jurong Island will serve the energy and water needs

of our customers as well as other companies in

the new area, reinforcing our market position as a

global leader in the provision of energy, water and

on-site logistics to multiple customers in energy

intensive clusters.

Our operations in China continued to deliver

a strong performance in 2011, contributing

S$41.2 million of PFO, an increase of 53% over

2010. This growth was largely underpinned by

better performance from our cogeneration plant in

Shanghai due to higher electricity tariffs, full year

contribution from our municipal water business as

well as higher customer demand. In 2011, volume

demand from our existing customers grew, with

volume demand for industrial wastewater treatment,

industrial water and municipal water growing

approximately 20%, 30% and 12% respectively

over the previous year. Our China operations also

secured a total of S$63 million of new and renewed

contracts in 2011.

During the year, we continued to expand our

facilities and grow our water and wastewater

capabilities in various targeted industrial sites. In

Zhangjiagang, we opened our first water reclamation

plant in China, capable of producing 20,000 cubic

metres per day of industrial water and up to 4,000

cubic metres per day of demineralised water for

supply to customers in the Zhangjiagang Free Trade

Port Zone. This award-winning facility is able to

produce industrial water using treated effluent from

Sembcorp’s existing centralised industrial wastewater

treatment plant in the zone, thereby promoting

water reuse and environmental conservation. In

Nanjing, we expanded our industrial water capacity

output by 20% to 120,000 cubic metres per day,

while in Qinzhou we completed our 15,000 cubic

metres per day industrial wastewater treatment plant

in the Qinzhou Port Economic & Technological

Development Zone.

Focusing on industrial sites and the water-stressed

regions of China, and leveraging our

extended presence through our newly-acquired

municipal operations from Cascal, we also signed

several letters of intent and memoranda of

understanding during the year to explore

opportunities to expand our water and multi-utilities

business in the provinces of Liaoning, Jiangsu,

Shandong, Inner Mongolia, Hebei, Tianjin

and Heilongjiang.

PFO from Rest of Asia and Australia declined

24% in 2011 to S$34.2 million due to one-off

integration costs and purchase price allocation

adjustments relating to the acquisition of WSN

Environmental Solutions (WSN) in Australia as well

as lower contribution from our Phu My 3 power

plant in Vietnam, which was impacted by lower

tariffs and the depreciation of the US dollar.

Looking to expand our reach in Vietnam, we

signed a memorandum of understanding with the

People’s Committee of Quang Ngai Province in

January 2012 to explore the feasibility of developing a

1,200-megawatt coal-fired power plant in Dung Quat

Economic Zone, located in central Vietnam’s Quang

Ngai province. Meanwhile, in India, we made progress

on our first investment in the fast-growing Indian

energy market. In February 2011, we injected the first

tranche of equity for our 49% stake in Thermal

Powertech Corporation India. The total consideration

that will be injected by Sembcorp for the entire 49%

stake is Rs1,042 crores (S$293 million). In the same

month, we commenced construction of the

1,320-megawatt coal-fired power plant in

Krishnapatnam, Nellore District, Andhra Pradesh.

Construction has been progressing well and full

commercial operation is expected to begin in 2014.

In Australia, our solid waste management

associate, SembSITA Australia, strengthened its

leading position with the completion of the

A$235 million acquisition of WSN, a solid waste

management service provider previously owned by

the New South Wales government, in January 2011.

Adding over 90 facilities and service centres

nationwide, SembSITA is now the second largest

waste management operator in Australia and the

largest in the state of New South Wales.

PFO from the Middle East and Africa grew 51%

from S$21.7 million to S$32.9 million. In the UAE,

our Fujairah 1 Independent Water and Power Plant

continued to deliver good operating performance,

underpinned by its long-term purchase agreement

with Abu Dhabi Water & Electricity Company.

In Oman, a significant milestone was achieved

when we successfully completed the first phase

of our US$1 billion Salalah IWPP in July 2011. The

facility met the tight timeline of 19 months from the

signing of the power and water purchase agreement

and began dispatching 61 megawatts of net power,

on schedule, to the Dhofar power grid in southern

Oman. Targeted to commence full commercial

operations in the second quarter of 2012, the plant

will have a total gross power capacity of 490

megawatts and will produce 15 million imperial

gallons (69,000 cubic metres) per day of water. Set to

be the most energy-efficient power and water plant

in Dhofar, this project will enhance our Middle East

portfolio and play a major role in meeting the

region’s pressing power and water needs.

In South Africa, in recognition of our continuing

efforts to provide water and sanitation services of the

highest quality to our customers, both our municipal

operations, Sembcorp Silulumanzi and Sembcorp Siza

Water, received the prestigious Blue Drop and Green

Drop status for some of its water and wastewater

systems in 2011.

PFO from the UK improved 46% from

S$30.8 million to S$45.0 million largely due to

the full year contribution of our municipal water

business and a reduction in the UK tax rate from

27% to 25%. Our municipal water operations in

Bournemouth delivered a healthy performance

during the year, while contribution from our Teesside

operations declined marginally compared to the

previous year as the business continued to face a

challenging operating environment with low power

spreads and carbon prices.

In Bournemouth, new tariffs were effected for

our municipal operations according to the five-year

tariff schedule set during its 2010 tariff review with

the UK water services regulator, Ofwat. In Teesside,

our 52-megawatt steam condensing turbine project

was completed in the fourth quarter of 2011 and

commenced dispatching power to the grid in

February 2012. Modification works to our biomass

plant were also completed to increase heat recovery

and enhance our green income from renewable

obligation certificates.

Meanwhile, PFO from the Americas, comprising

Chile, Panama and the Caribbean, grew from

S$2.3 million to S$10.1 million due to full year

contribution from the region as well as a one-off

adjustment from the change in accounting treatment

for a service concession arrangement in Chile.

In January 2012, the World Bank reduced its

forecast for global economic growth in 2012 to

2.5% from 3.6% in its earlier forecasts in June 2011,

and cautioned that the financial turmoil generated

by the intensification of the fiscal crisis in Europe

has spread to both developing and high-income

countries and is generating significant headwinds1.

Growth in the high-income economies is expected

to be subdued at 1.4%, with the Eurozone countries

expected to contract by 0.3%. Developing countries

are still expected to grow, albeit at a slower pace of

5.4% compared to 6.2% previously.

In Singapore, the government expects 2012

Gross Domestic Product growth to be in the range

of 1% to 3%, compared to 2011’s growth of 4.8%.

Singapore’s Economic Development Board reported

that total fixed asset investment commitments

increased from S$12.9 billion in 2010 to S$13.7 billion

in 2011 despite economic uncertainties during the

second half of the year. After the electronics sector,

the chemical sector received the next largest

investment commitment at S$2.5 billion. The

Economic Development Board is cautiously optimistic

about the investment climate in 2012, but expects

investment commitments in 2012 to be sustained

at 2011’s level, citing that investment interest in

Asia remains healthy in spite of the uncertainties

in the global economy, especially in the Eurozone.

Meanwhile, petrochemical companies with confirmed

investments continued to push ahead with the

construction of their new plants on Jurong Island.

These include Denka and Sumitomo Chemical whose

plants are expected to start up in 2012; Chang Chun

Group, LANXESS, Asahi Kasei and Zeon in 2013; and

Jurong Aromatics Corporation and Evonik in 2014.

In 2012, our Utilities business is expected to

deliver a steady performance despite our

cogeneration plant in Singapore undertaking a

planned major maintenance during the year.

However, the weaker macro-economic environment

may impact power and carbon prices and affect the

performance of our energy businesses in Singapore

and the UK.

With a healthy pipeline of projects both in

Singapore and overseas, we are committed to

delivering long-term growth through the focused

execution of these projects as well as the active

pursuit of new growth opportunities.

1 The World Bank, ‘Global Economic Prospects January 2012: Uncertainties and vulnerabilities’

|

| |

|

|

|

|