|

|

|

|

|

| |

|

| |

|

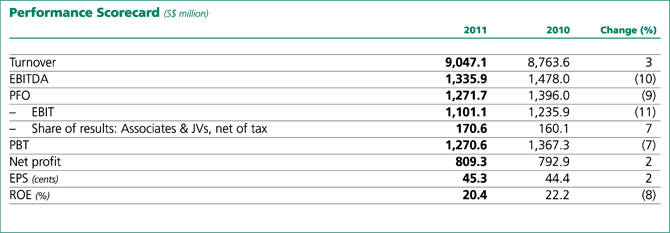

Sembcorp delivered a strong performance

in 2011. Our robust operating performance

demonstrated the strength of our businesses. The

Group’s net profit attributable to shareholders of

the company (net profit) in 2011 grew by 2% to

S$809.3 million, while turnover was up 3% from

S$8.8 billion in the previous year to S$9.0 billion.

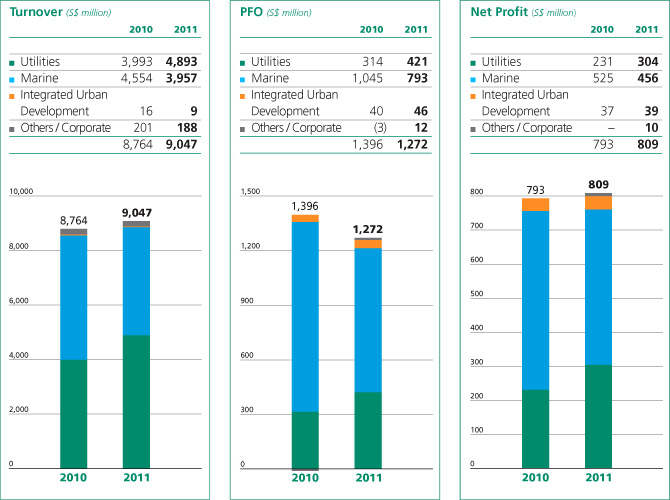

The Group achieved a turnover of S$9.0 billion,

with the Utilities and Marine businesses contributing

98% of total turnover.

The Utilities business’ turnover increased by

23%, mainly attributable to our Singapore operations

where part of the revenue was indexed to higher

High Sulphur Fuel Oil (HSFO) prices recorded during

the year. Furthermore, we started receiving our

second tranche of natural gas from West Natuna,

Indonesia, in November 2011, further boosting

revenue during the year.

The Marine business’ 2011 turnover decreased

by 13% to S$4.0 billion mainly due to lower revenue

recognition from rig building projects, as well as the

resumption of revenue recognition on delivery of

PetroRig III semi-submersible rig and the sale of a CJ-70 harsh environment jack-up rig in 2010. This was partially offset by higher revenue recognition from ship conversion and offshore projects.

Group net profit in 2011 grew 2% from

S$792.9 million to S$809.3 million, while profit

from operations was S$1,271.7 million compared

to S$1,396.0 million in the previous year.

Our Utilities business delivered robust profit

growth in 2011, with net profit growing 32%

to S$304.4 million. Record profits for the business

were driven by good operating performance in

Singapore, China and the Middle East & Africa.

Marine’s 2011 net profit contribution to the Group

was S$456.2 million compared to S$524.9 million

in 2010. The Marine business’ net profit was lower

mainly due to fewer jack-up and semi-submersible

rig projects. The Integrated Urban Development

business’ higher net profit in 2011 was primarily

due to higher land sales recognised. |

| |

|

| |

|

As at December 31, 2011, the Group’s cash

and cash equivalents stood at S$3.0 billion.

Cash flows from operating activities before

changes in working capital decreased from

S$1,440.2 million in 2010 to S$1,380.8 million

in 2011. Net cash inflow from operating

activities for 2011 was S$975.0 million compared

to S$1,702.4 million in 2010, mainly due to

Marine’s increase in working capital for the

ongoing projects.

Net cash outflow for investing activities for

2011 was S$1,142.9 million. S$1,090.2 million

was spent on purchase of property, plant and

equipment and payment for intangible assets and

S$197.6 million was used for equity interests into

associates and joint ventures. The above cash

outflows were partially offset by dividends and

interest received of S$140.4 million.

Net cash outflow from financing activities

for 2011 was S$323.5 million, mainly related

to dividends and interest paid and purchase of

treasury shares, partially offset by net proceeds

from borrowings.

Group shareholders’ funds increased from

S$3.8 billion as at December 31, 2010 to S$4.1 billion

as at December 31, 2011.

Non-current assets increased primarily due

to higher capital work-in-progress mainly for

Utilities and Marine projects. Trade and other

receivables and trade and other payables increased

in line with turnover. Tax recoverable decreased

mainly due to receipt of tax refunds from the

Inland Revenue Authority of Singapore. Cash and

cash equivalents decreased mainly as a result of

payment of dividends and funding for capital

expenditure. Interest-bearing borrowings increased

due to increased bank borrowings from the

drawdown of project finance debts.

Return on equity (ROE) for the Group was a

healthy 20.4% in 2011 and earnings per share (EPS)

increased to 45.3 cents.

Subject to approval by shareholders at the next

annual general meeting, a final tax exempt one-tier

dividend of 17.0 cents per ordinary share, comprising

an ordinary dividend of 15.0 cents and a bonus

dividend of 2.0 cents, has been proposed for the

financial year ended December 31, 2011.

The Group generated positive economic value

added (EVA) of S$728.2 million in 2011.

Our net operating profit after tax for 2011

amounted to S$1.2 billion while capital charges

increased to S$479.1 million, mainly due to a

higher capital base.

In 2011, the Group’s total value added was

S$2.4 billion. This was absorbed by employees

in wages, salaries and benefits of S$739.2 million,

by governments in income and other taxes of

S$188.3 million and by providers of capital in

interest and dividends of S$369.7 million, leaving

a balance of S$1.1 billion reinvested in business.

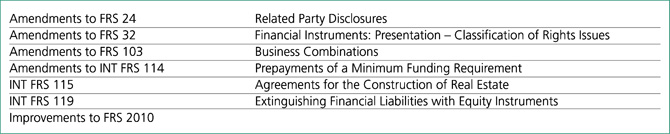

Sembcorp’s financial statements are prepared

in accordance with Singapore Financial Reporting

Standards (FRS).

With effect from January 1, 2011, the Group adopted

the following new / amended FRSs and Interpretations

of Financial Reporting Standards (INT FRS): |

| |

|

| |

The adoption of the FRSs (including consequential

amendments) does not have any significant impact

on the Group’s financial statements.

The Group’s activities expose it to a variety

of financial risks, including changes in interest rates,

foreign exchange rates and commodity prices as

well as credit risk.

Please refer to the Risk Management & Mitigation

Strategies chapter of this report for details on the

management of these risks.

Sembcorp’s financing and treasury activities

continue to be mainly centralised within our wholly-owned

subsidiary, Sembcorp Financial Services (SFS),

the Group’s Treasury vehicle. SFS facilitates funding

and on-lends funds borrowed by it to the businesses

within the Group, where appropriate.

SFS also actively manages the cash within the

Group by taking in surplus funds from businesses

with excess cash and lending to those with funding

requirements. We actively manage the Group’s excess

cash, deploying it to a number of financial

institutions, and actively track developments in the

global banking sector. Such proactive cash

management continues to be an efficient and

cost-effective way of managing the Group’s cash

and financing its funding requirements.

Including SFS’ S$1.5 billion and Sembcorp

Marine’s S$2.0 billion medium-term note programme,

the Group’s total funded facilities as at end 2011 amounted to S$8.2 billion (2010: S$7.6 billion),

with unfunded facilities standing at S$2.0 billion

(2010: S$1.9 billion).

In 2011, SFS signed a S$520.0 million bank

loan comprising a S$230.0 million loan maturing

in September 2017 and a S$290.0 million loan

maturing in September 2020. The Group aims to

term out the loans such that their maturity profile

mirrors the life of our core assets, while we continue

our focus on maintaining adequate liquidity for the

Group’s businesses.

We continue to build on our banking

relationships to ensure that we are able to secure

funding on competitive terms as and when

commercially viable and strategically attractive

opportunities arise.

The Group remains committed to balancing

the availability of funding and the cost of funding,

together with the need to maintain prudent financial

ratios. We also aim to maintain an efficient and

optimal mix of committed and uncommitted facilities

and fixed and floating rate borrowings. Of the

overall debt portfolio, 83% (2010: 79%) constituted

fixed rate debts which were not exposed to interest

rate fluctuations.

As at December 31, 2011, gross borrowings

amounted to S$2.2 billion (2010: S$1.7 billion)

which was higher than last year. The incremental

borrowings were mainly due to drawdown of project

finance loans, which were funded at relatively higher

interest rates, to fund the construction of our power

and water plant in Oman. As a result, Group

borrowings and interest expense were slightly higher

in 2011 as compared to 2010. The weighted average

cost of funding in 2011 was 5.09% (2010: 5.06%)

while the interest cover ratio remained in a healthy

range of 20.3 times in 2011 (2010: 24.2 times). The

lower interest cover ratio in 2011 was due to the

combination of lower EBITDA and slightly higher

interest expense as compared to 2010.

As the Group strives to grow, the Group’s interest

expense is expected to increase along with higher

borrowings to fund its growth strategy.

|

| |

|

|

|

|