|

|

|

|

|

| |

|

| |

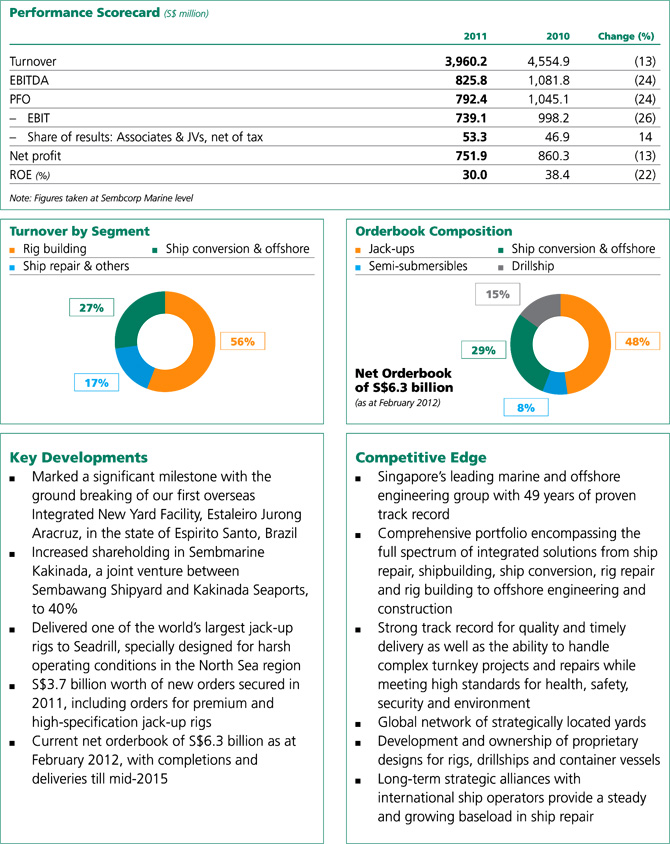

Sembcorp’s Marine business recorded a turnover

of S$4.0 billion in 2011 compared to S$4.6 billion

in 2010 due to the timing, number and value of the

projects in varying progressive revenue recognition

stages in the three different sectors of rig building,

ship conversion and offshore and ship repair.

The business’ profit from operations (PFO) was

S$792.4 million compared to S$1.0 billion in 2010

mainly due to fewer jack-up and semi-submersible

rig projects. The business’ operating margin was

18.6% as compared with 20.7% in 2010, largely

attributable to fewer rig building projects, mainly

jack-up rigs, as compared to more turnkey semi-submersible

rigs in 2010.

The business’ net profit attributable to

shareholders of the company (net profit) was

S$751.9 million compared to S$860.3 million in

the previous year due to lower operating profit and

the receipt of the full and final amicable settlement

of the disputed foreign exchange transactions with

Société Générale in 2010. This was offset by the

higher interest income received in 2011 for deferred

payment granted to customers and write-back of

prior years’ tax over-provisions. Return on equity

for the year stood at 30%.

During the year, ship repair turnover stood at

S$643.9 million, comparable to 2010’s S$646.1 million

and accounting for 16% of total turnover. A total of

264 vessels docked at our yards in 2011, lower than

2010’s 282 vessels. However the average value per

vessel increased to S$2.4 million from S$2.3 million

in 2010. Long-term strategic alliance customers

continued to provide a steady and growing baseload.

Together with our regular repeat customers, they

contributed 82% of total ship repair revenue in

2011. High value repairs to oil tankers, container

vessels, liquefied natural gas (LNG) and liquefied

petroleum gas (LPG) tankers, passenger ships

and upgrading of drillship and floating production

storage and offloading (FPSO) units dominated

the segment.

During the year, we secured a long-term

contract from Teekay Marine Services to provide

repairs, refurbishment and upgrading of their fleet

of 137 vessels.

Turnover from ship conversion and offshore

activities in 2011 registered a growth of 31% to

S$1.1 billion from S$820.4 million in 2010. The

sector contributed 27% of the total turnover of the

Marine business. Projects delivered during the year

included the conversion of FPSO PSVM for MODEC,

the upgrading of FPSO Glas Dowr for Bluewater

Energy Services and the pre-FPSO conversion of P-62 for Petrobras Netherlands. In addition, we successfully

completed the engineering and construction of

Flintstone, a new generation of environmentally-friendly

designed fallpipe rock dumping vessel for

Tideway and the Gajah Baru platforms for Premier

Oil Natuna Sea.

In terms of new contract wins, we secured a

S$20 million contract from Golar LNG Energy to

convert the LNG Khannur, a LNG tanker, to a floating

storage and regasification unit, the FPSO conversion

of the very large crude carrier (VLCC) tanker

MV TAR II valued at S$130 million from MODEC and

a US$300 million floating storage offloading tanker

conversion contract from Mobil Cepu, a subsidiary

of Exxon Mobil.

The business secured two contracts for offshore

vessels comprising a S$123 million contract for the

engineering, procurement, construction and

commissioning of the RV Investigator, a dynamic

positioning (DP) bluewater research vessel for Teekay

Shipping (Australia) as well as a US$140 million contract

from Equinox Offshore Accommodation to convert

a ROPAX vessel into a DP Class 2 Accommodation

and Repair Vessel.

Two offshore platform contracts were also

secured during the year which included a S$600 million

contract from PTTEP International for an Integrated

Processing and Living Quarters platform and a

contract from Bechtel Overseas for the assembly

of process and cryogenic pipe-rack modules for

Australia Pacific LNG’s liquefied natural gas facility.

Valued at US$100 million, the value of this contract

may potentially increase in excess of US$150 million.

The rig building segment contributed S$2.2 billion

or 56% of our Marine business’ total turnover,

compared to S$3.0 billion in 2010. During the year,

we completed and delivered three jack-up rigs on

or ahead of schedule: the El Qaher II, a proprietary

Pacific Class 375 design jack-up rig to Egyptian

Offshore Drilling Company; the West Elara, a Gusto

MSC CJ70 150A harsh-environment jack-up rig, the

largest of its kind to be constructed by our Marine

business, to Seadrill; and the Transocean Honor, the

first proprietary Pacific Class 400 design jack-up rig to

Transocean. In addition, we completed and delivered

four semi-submersible rigs: the West Pegasus, a Moss

Maritime CS50 MKII design semi-submersible rig, and

three newbuild Friede & Goldman ExD ultra-deepwater

semi-submersible rigs: the West Capricorn for Seadrill, the Atwood Osprey for Atwood Oceanics

Pacific, and the Songa Eclipse for Songa Offshore.

Seven new rig orders were clinched during

the year including the building of a turnkey Pacific

Class 400 jack-up rig valued at US$182 million

from Atwood Oceanics Pacific; a turnkey Gusto MSC

CJ70 150A harsh-environment high-specification

jack-up rig worth US$450 million from Seadrill;

two sets of two turnkey Friede & Goldman

JU3000N jack-up rigs valued at US$427.6 million

and US$444 million from Noble, the latter with

options for another two similar jack-up rigs; and a

US$291.6 million GVA 3000E design accommodation

semi-submersible rig from Prosafe, with options for

another two units.

In December 2011, our Marine business achieved

an important milestone in its growth and expansion

strategy with the ground breaking of the first

overseas Integrated New Yard Facility, Estaleiro

Jurong Aracruz, in the municipality of Aracruz in the

state of Espirito Santo – Brazil’s second largest oil

producer. Situated on an 82.5-hectare site with

1.6 kilometres of coastline, Estaleiro Jurong Aracruz

is strategically located in close proximity to the rich

oil and gas basin of Espirito Santo, one of Brazil’s

giant pre-salt reservoirs, and is poised to further

strengthen our business’ foothold in the country.

The Integrated New Yard Facility in Brazil will

be developed in stages over a period of three years

with full completion targeted for end 2014. Estaleiro

Jurong Aracruz is well-positioned to serve Brazil’s

vibrant offshore and marine sector with wide-ranging

capabilities in the construction of drilling rigs, FPSO

integration, topside modules fabrication, and the

repair and upgrading of ships and rigs.

In February 2012, Estaleiro Jurong Aracruz

secured a contract worth approximately

US$792.5 million from Guarapari Drilling,

Netherlands, a subsidiary of Sete Brasil Participacões,

for the design and construction of a drillship based

on Jurong Shipyard’s proprietary Jurong Espadon

drillship design. Scheduled for delivery no later

than the second quarter of 2015, the Jurong

Espadon drillship represents the next generation

of high-specification drillships with advanced capabilities for operational efficiency and ultra-deepwater

operations worldwide. The order win

is expected to be among the first of many orders

in Sete Brasil’s drillship expansion programme to

develop Brazil’s giant pre-salt oil fields.

The business also continues with the growth

and expansion strategy in Singapore with

construction of the Integrated New Yard Facility

at Tuas View Extension progressing on schedule. As

Singapore’s first purpose-built, custom-designed

integrated yard facility, the 206-hectare development

will further reinforce our Marine business’

competitive edge through enhanced work-efficient

processes as well as state-of-the-art facilities

and equipment.

Designed as a centralised and integrated

“one-stop solutions” hub for ship repair and

conversion, shipbuilding, rig building and offshore

engineering and construction, the New Yard

Facility will be well-equipped to serve a wide range

of vessels including VLCCs, new generations

of mega containerships, LNG carriers and passenger

ships, while meeting new regulatory and

environmental standards.

The facility will be built in three phases over

a period of six years. Under the first phase,

73.3 hectares will be developed for ship repair

and ship conversion operations. It will feature four

VLCC drydocks with a total capacity of 1.6 million

deadweight tonnes and quays of more than

three kilometres.

In 2011, the Marine business exercised the

option to increase its shareholding in Sembmarine

Kakinada (SKL), a joint venture between Sembawang

Shipyard and Kakinada Seaports, from 19.9% to

40%, becoming the largest single shareholder of

the joint venture facility. The Technical Management

and Services Agreement to operate and manage

the joint venture was also extended from the current

five years to 10 years. This increase in shareholding

of SKL, a joint venture established since November

2009, is in line with the business’ strategy to

establish and grow a hub in India to cater to the

growing needs of our customers operating in India

and South Asia. SKL will be developed in three

phases with the construction of the first phase well

underway. When fully completed by end 2012,

SKL will offer ship owners and offshore operators

a one-stop integrated offshore service facility for

the repairs and servicing of offshore vessels and

ships, new builds, oil and gas riser and equipment

repairs as well as platforms and modules fabrication.

The Marine business has a net orderbook

of S$6.3 billion as at February 2012, with

completions and deliveries until mid-2015. This

includes S$3.7 billion in contracts secured in 2011

and S$1.3 billion worth of orders secured since the

start of 2012, excluding ship repair contracts.

Despite the global macro-economic uncertainty,

fundamentals for the offshore oil and gas

industry remain intact, underpinned by high oil

prices and projected increases in exploration and

production spending.

The offshore market continues to display signs

of cyclical improvement, especially in the deep and

ultra-deepwater segments fuelled by the growing

needs of operators in multiple regions, in particular

the “Golden Triangle” of Brazil, the Gulf of Mexico

and West Africa.

In the Gulf of Mexico, deepwater drilling activities

remain robust as operators continue to move ahead

with drilling programmes. Day rates for both jack-up

and semi-submersible rigs have been strengthening.

With offshore drilling moving towards deeper waters,

coupled with the business’ proven track record in rig

building, our Marine business will be well-positioned to capture new orders for high-specification

deepwater rigs which meet the industry’s most

stringent operating requirements.

Ship repair continues to see strong demand with

the newly forged long-term partnerships with several

renowned international ship owners and operators,

in particular in the niche segments for the repair,

upgrading and life extension of LNG carriers,

passenger and cruise vessels. These alliances and

long-term customers will continue to provide a stable

and steady baseload for the repair business.

In Brazil, the wholly-owned shipyard Estaleiro

Jurong Aracruz is strategically positioned to support

developments in one of the world’s fastest growing

offshore oil and gas exploration markets. In

Singapore, the Integrated New Yard Facility in Tuas

View Extension will become operational in 2013 and

will nearly double the Marine business’ ship repair

and ship conversion and offshore capacity from the

current 1.9 million deadweight tonnes.

Overall, competition is intense though enquiries

for the various segments of the market remain robust.

|

| |

|

|

|

|