- BUILDING THE FUTURE

- OPERATING & FINANCIAL REVIEW

- GOVERNANCE & SUSTAINABILITY

- FINANCIAL STATEMENTS

- Directors’ Statement

- Independent Auditors’ Report

- Balance Sheets

- Consolidated Income Statement

- Consolidated Statement of

Comprehensive Income - Consolidated Statement of

Changes in Equity - Consolidated Statement of

Cash Flows - Notes to the Financial Statements

- Supplementary Information

- EVA Statement

- Shareholders' Information

- Governance Disclosure Guide

- Corporate Information

- Notice of Annual General Meeting

- Proxy Form

- Letter to Shareholders

INVESTOR RELATIONS

At Sembcorp, we are committed to ensuring that all capital market players have easy access to clear, reliable and meaningful information on our company in order to make informed investment decisions.

In the context of constantly evolving requirements of disclosure, transparency and corporate governance, we aim to provide investors with an accurate, coherent and balanced account of the Group’s performance and prospects. Sembcorp has a dedicated investor relations team and communicates with the investing public through multiple platforms and channels. These include group briefings to analysts, investors and the media; one-on-one meetings with shareholders and potential investors; investor roadshows as well as the investor relations section of our corporate website. In addition, we also organise company visits and facility tours to help investors gain insights into the Group’s operations.

PROACTIVE COMMUNICATION WITH THE FINANCIAL COMMUNITY

During the year, senior management and the investor relations team continued to actively engage with the financial community. We held approximately 130 one-on-one and group meetings with shareholders, analysts and potential investors. These included non-deal roadshows in Singapore, London, Edinburgh, Frankfurt and Amsterdam.

We also participated in five investor conferences: the Credit Suisse 18th Annual Asian Investment Conference in Hong Kong, and in Singapore, the Maybank Invest ASEAN Conference, the 6th Annual dbAccess Asia Conference, the UBS ASEAN Conference and the Morgan Stanley 14th Annual Asia Pacific Summit. We also continued to organise site visits to our facilities on Jurong Island, Singapore to provide analysts and investors a first-hand look at our operations and allow them to gain a better understanding of Sembcorp’s capabilities and operational track record.

Sembcorp constantly strives to strengthen its investor relations and we are pleased that our efforts in this regard have been recognised. During the year, we won the silver award for Best Investor Relations at the 2015 Singapore Corporate Awards, for companies with S$1 billion and above in market capitalisation. In addition, at the IR Magazine Awards South East Asia 2015, we were nominated for having the best investor relations amongst companies in the utilities sector.

Sembcorp constantly strives to strengthen its investor relations and we are pleased that our efforts in this regard have been recognised. During the year, we won the silver award for Best Investor Relations at the 2015 Singapore Corporate Awards, for companies with S$1 billion and above in market capitalisation. In addition, at the IR Magazine Awards South East Asia 2015, we were nominated for having the best investor relations amongst companies in the utilities sector.

COMMITMENT TO GOOD CORPORATE GOVERNANCE

Sembcorp continues to rank among the top companies in Singapore for good corporate governance and transparency. We were the sixth-highest ranked company in Singapore in the 2015 edition of the Governance & Transparency Index (GTI). A well-respected ranking exercise by The Business Times and National University of Singapore Business School’s Centre for Governance, Institutions and Organisations, the GTI assesses the transparency of 639 Singapore-listed companies based on their annual financial announcements.

In addition, we were recognised as the Most Transparent Company under the Oil & Gas category at the SIAS Investors Choice Awards 2015. This award honours and recognises public listed companies that have demonstrated exemplary corporate governance and transparency practices throughout the year.

In addition, we were recognised as the Most Transparent Company under the Oil & Gas category at the SIAS Investors Choice Awards 2015. This award honours and recognises public listed companies that have demonstrated exemplary corporate governance and transparency practices throughout the year.

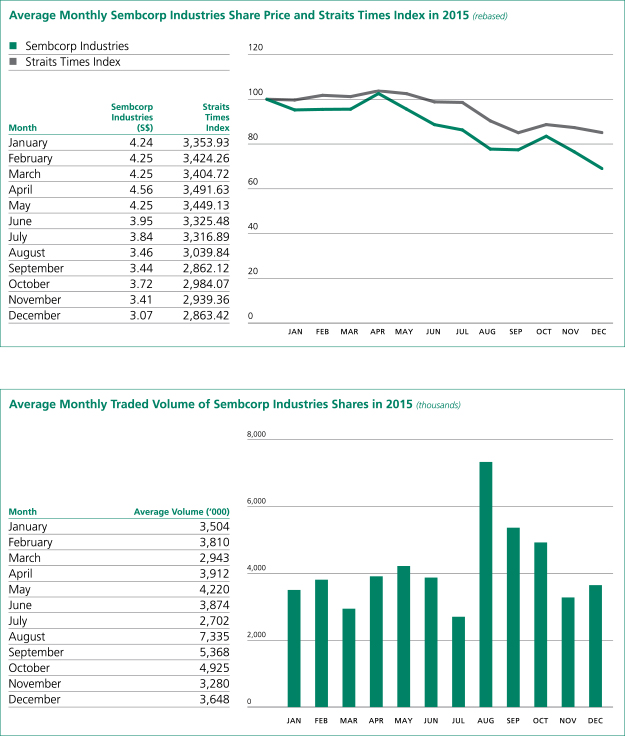

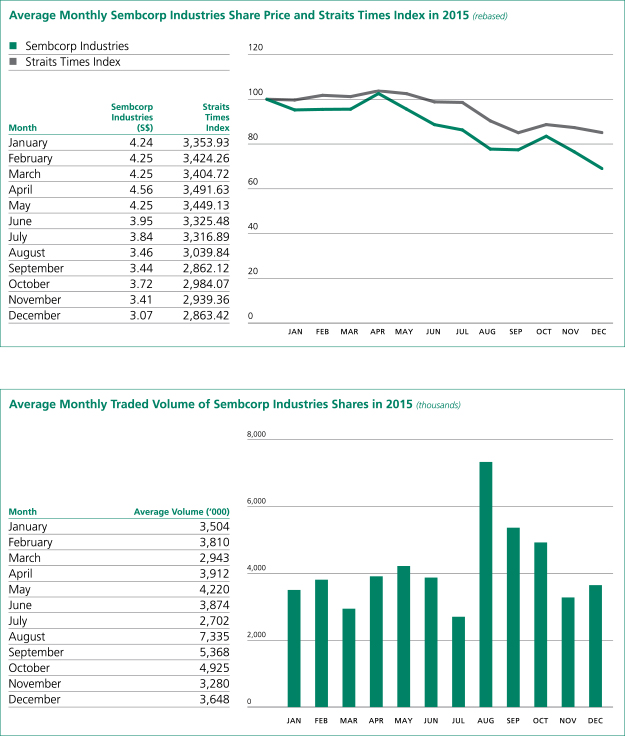

TOTAL SHAREHOLDER RETURN

Sembcorp Industries’ last traded share price in 2015 was S$3.05, and the company ended the year with a market capitalisation of S$5.5 billion. The company’s share price averaged S$3.87 during the year, registering a high of S$4.86 in April and a low of S$2.98 in December. Daily turnover averaged

4.1 million shares.

The weak and uncertain global economic outlook continued to weigh on the equities markets in Singapore and the region in 2015. Low oil prices have also put pressure on the share prices of companies tied to the oil and gas industry, including our Marine subsidiary. Sembcorp Industries’ total shareholder return for the year stood at negative 29%. In 2015, the FTSE ST Oil & Gas Sector Index recorded a negative 31% return. Aside from the performance of oil and gas stocks, markets as a whole across Singapore and the region turned in a weak performance, reflecting the challenging conditions across the board. The Straits Times Index and the MSCI Asia Pacific ex-Japan Industrials Index ended the year with a negative 11% return and a negative 15% return respectively.

Sembcorp remains committed to delivering shareholder value amidst these difficult operating conditions. For the financial year 2015, an interim dividend of 5 cents per ordinary share was declared and paid to shareholders in September 2015. In addition, a final dividend of 6 cents per ordinary share has been proposed, subject to approval by shareholders at the next annual general meeting. Together with the interim dividend, this brings our total dividend for FY2015 to 11 cents per ordinary share.

4.1 million shares.

The weak and uncertain global economic outlook continued to weigh on the equities markets in Singapore and the region in 2015. Low oil prices have also put pressure on the share prices of companies tied to the oil and gas industry, including our Marine subsidiary. Sembcorp Industries’ total shareholder return for the year stood at negative 29%. In 2015, the FTSE ST Oil & Gas Sector Index recorded a negative 31% return. Aside from the performance of oil and gas stocks, markets as a whole across Singapore and the region turned in a weak performance, reflecting the challenging conditions across the board. The Straits Times Index and the MSCI Asia Pacific ex-Japan Industrials Index ended the year with a negative 11% return and a negative 15% return respectively.

Sembcorp remains committed to delivering shareholder value amidst these difficult operating conditions. For the financial year 2015, an interim dividend of 5 cents per ordinary share was declared and paid to shareholders in September 2015. In addition, a final dividend of 6 cents per ordinary share has been proposed, subject to approval by shareholders at the next annual general meeting. Together with the interim dividend, this brings our total dividend for FY2015 to 11 cents per ordinary share.

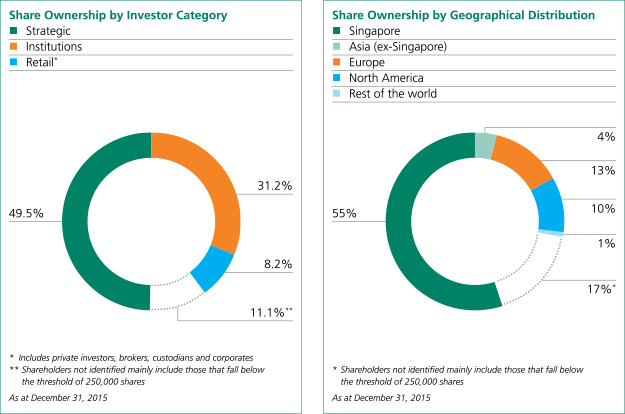

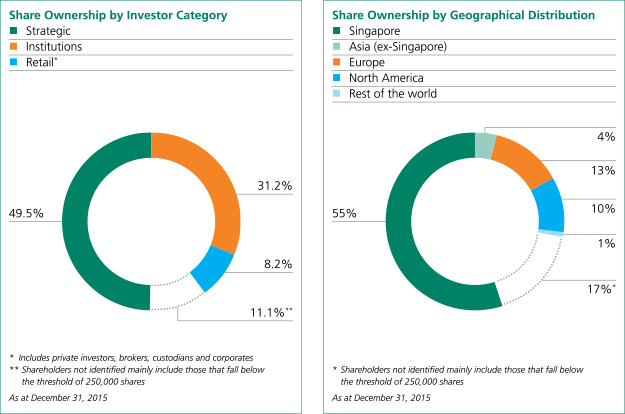

SHAREHOLDER INFORMATION

In 2015, institutional shareholders as a group continued to dominate Sembcorp’s shareholder base. Other than our major shareholder Temasek Holdings, which held 49.5% of our shares at the end of 2015, institutional shareholders accounted for 31.2% of our issued share capital or 62% of free float, while retail shareholders1 and unidentified shareholders2 held 19.3% of issued share capital or 38% of free float. In terms of geographical spread, excluding the stake held by Temasek Holdings, our largest geographical shareholding base was Europe with 13% of issued share capital, followed by shareholders from North America and Asia, which accounted for 10% and 9% of our company’s issued share

capital respectively.

capital respectively.

| 1 | Retail shareholders include private investors, brokers, custodians and corporates |

| 2 | Unidentified shareholders mainly include shareholders that fall below the threshold of 250,000 shares |