- BUILDING THE FUTURE

- OPERATING & FINANCIAL REVIEW

- GOVERNANCE & SUSTAINABILITY

- FINANCIAL STATEMENTS

- Directors’ Statement

- Independent Auditors’ Report

- Balance Sheets

- Consolidated Income Statement

- Consolidated Statement of

Comprehensive Income - Consolidated Statement of

Changes in Equity - Consolidated Statement of

Cash Flows - Notes to the Financial Statements

- Supplementary Information

- EVA Statement

- Shareholders' Information

- Governance Disclosure Guide

- Corporate Information

- Notice of Annual General Meeting

- Proxy Form

- Letter to Shareholders

UTILITIES REVIEW

Competitive Edge

| • | A leading developer, owner and operator of energy and water assets with strong operational, management and technical capabilities |

| • | Operations in 15 countries with an established presence in Asia and a strong growing presence in emerging markets |

| • |

Global leader in the provision of energy,

water and on-site logistics to multiple

industrial site customers |

| • | A balanced global portfolio of high-efficiency thermal and renewable assets, with capabilities in gas, coal, wind, solar, biomass and energy-from-waste |

| • | Solid track record in providing total water and wastewater treatment solutions for industries and water-stressed regions |

OPERATING AND FINANCIAL REVIEW

Good performance underpinned by overseas growth and divestment gains

Despite continued intense competition in the Singapore power market, the Utilities business continued to perform well in 2015, underpinned by overseas growth and divestment gains.

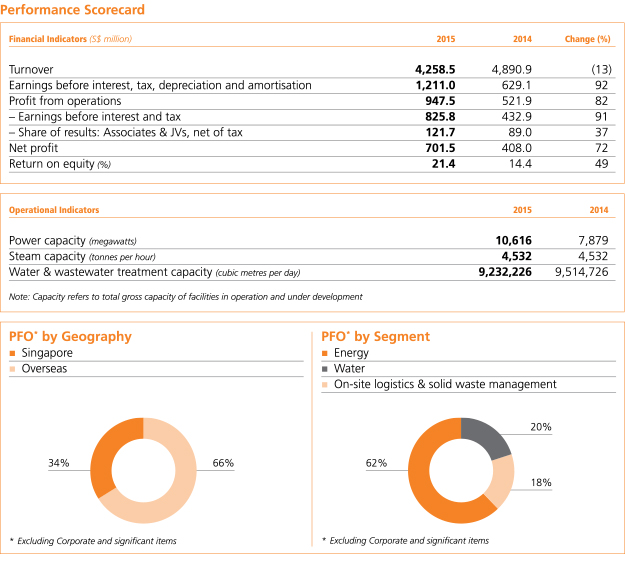

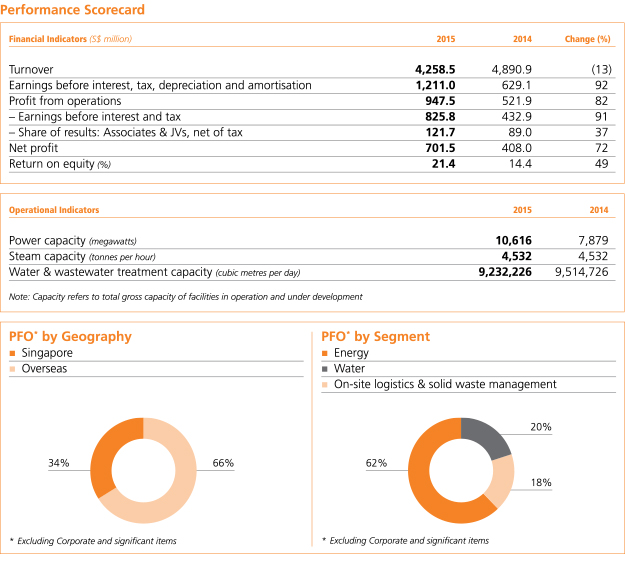

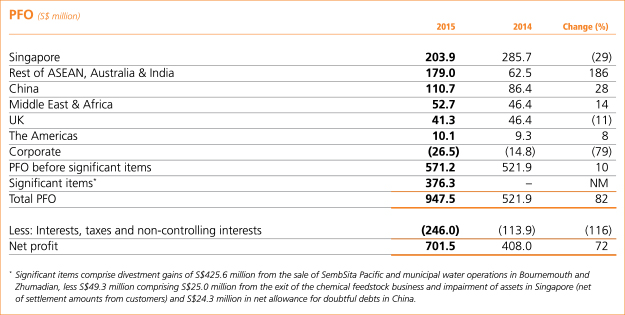

The business’ turnover was S$4.3 billion in 2015 compared to S$4.9 billion in 2014. Profit from operations (PFO) was S$947.5 million, an 82% increase from last year’s S$521.9 million, while net profit was S$701.5 million compared to S$408.0 million, representing a 72% increase year-on-year.

The increase in PFO and net profit was backed by divestment gains from the sale of our 40% stake in Australian solid waste management joint venture SembSita Pacific, as well as municipal water operations in Bournemouth, UK and Zhumadian, China. These divestments created value for the business by unlocking a net gain of S$425.6 million and will allow us to recycle capital for investment in businesses and markets with high growth potential, in line with our focus on the energy and

water sectors.

During the year, we exited the chemical feedstock business in Singapore and relooked the operating model on Jurong Island to optimise our operations following a reduction in demand. As a result, impairments were made for our steam assets, as well as some other assets relating to specific customers. This resulted in an impact of S$25.0 million on PFO and S$31.4 million on net profit. A S$24.3 million net allowance for doubtful debts was also made in China during the year.

Divestment gains, less the impact of the exit from the chemical feedstock business and impairment of assets in Singapore, net of settlement amounts from customers and the net allowance for doubtful debts in China, comprised the significant items recorded for the year.

Excluding these significant items, Utilities’ PFO and net profit was S$571.2 million and

S$331.6 million respectively.

The business’ overseas growth strategy remained on track. Utilities operations outside of Singapore contributed 66% of the business’ PFO and 60% of the business’ net profit, excluding corporate costs and significant items.

In 2015, PFO from Singapore operations decreased 29% to S$203.9 million, mainly due to continued intense competition in the local power market. The Uniform Singapore Energy Price averaged S$96 per megawatt for the year compared to S$137 per megawatt in 2014. Vesting contract level for the industry stood at 30% for the first half of 2015, stepping down to 25% during the second half of the year.

The business’ PFO from the Rest of ASEAN, Australia & India grew 186% to S$179.0 million from S$62.5 million in 2014. The increase in PFO was mainly due to contributions from India from our thermal power business and our newly acquired renewable energy business, Sembcorp Green Infra. The first unit of the Thermal Powertech Corporation India (TPCIL) power plant started operations in March, while the second unit was completed in September. However, unprecedented heavy rainfall during a cyclone contributed to a lower than expected plant load factor, coal losses and lower demand in the fourth quarter and at the net profit level, our Indian operations posted a loss. PFO contribution from the Rest of ASEAN and Australia was lower for the year with the divestment of our stake in Australian joint venture SembSita Pacific in November. In addition, in 2014, a S$10.3 million one-off net gain was recognised due to the increase in our effective stake in the Phu My 3 power plant in Vietnam.

In China, our PFO increased to S$110.7 million in 2015 compared to S$86.4 million in 2014, due to better performance from energy operations.

PFO from our Middle East and Africa operations also increased to S$52.7 million in 2015 from

S$46.4 million in 2014. This increase was driven by better operating performance and efficiency gains at our operations in the UAE and Oman.

PFO in the UK decreased to S$41.3 million from S$46.4 million due to the divestment of municipal water assets in Bournemouth, mitigated by a better performance from Teesside operations.

Meanwhile, our businesses in the Americas spanning Chile, Panama and the Caribbean registered a combined PFO of S$10.1 million, compared to S$9.3 million in 2014.

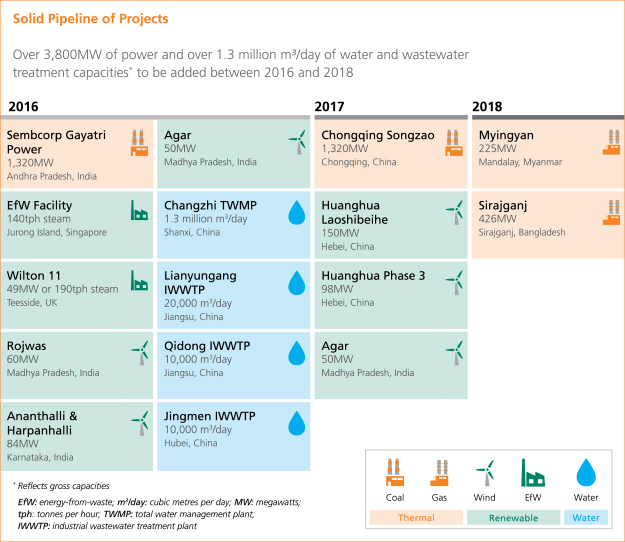

Positioned for long-term growth with a strong project pipeline

Adding more than 3,800 megawatts of power and over 1.3 million cubic metres per day of water and wastewater treatment capacities to our operating portfolio from 2016 to 2018

Adding more than 3,800 megawatts of power and over 1.3 million cubic metres per day of water and wastewater treatment capacities to our operating portfolio from 2016 to 2018

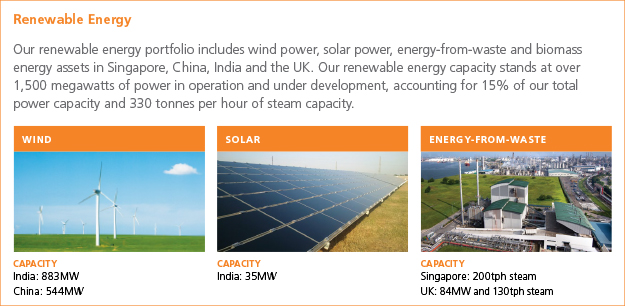

In 2015, we continued to invest for long-term growth, and secured over 3,000 megawatts of new energy projects. We made good headway in building up our overseas project pipeline with maiden investments in the fast-growing emerging markets of Bangladesh and Myanmar. In addition, to position ourselves for growth with a balanced portfolio of energy assets, we deepened our capabilities in the renewable energy sector, which presents a new engine for our growth. By acquiring wind and solar power capabilities in India and expanding our wind power capabilities in China, we grew our renewable energy capacity four-fold to 1,546 megawatts. Renewables now represent 15% of our total power capacity, and present a new platform for the business to grow.

Moving forward, we will continue to leverage our strength in project development and focus on securing and executing energy and water projects, especially in rapidly developing economies. Over the next three years, we will add more than 3,800 megawatts of power and over 1.3 million cubic metres per day of water and wastewater treatment capacity to our operating portfolio. This brings our gross power and water capacity to over 10,600 megawatts and over nine million cubic metres per day, achieving our ‘10/10 vision’ set in 2011 of growing our gross power and water capacities to approximately 10,000 megawatts and 10 million cubic metres per day.

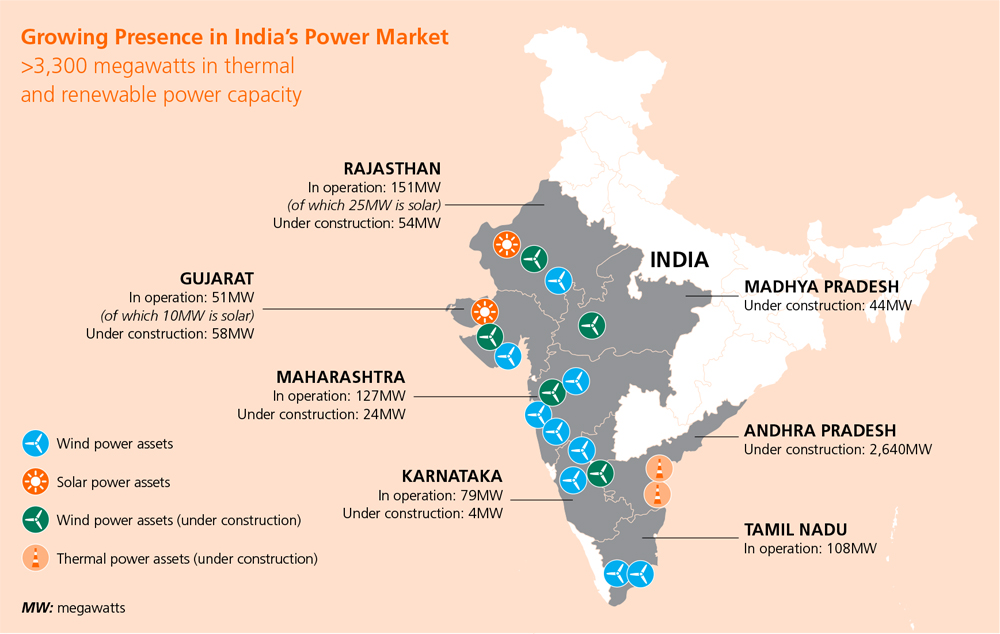

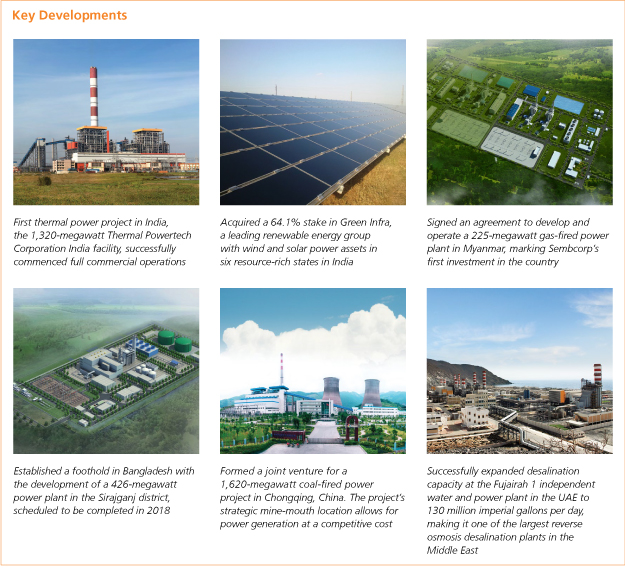

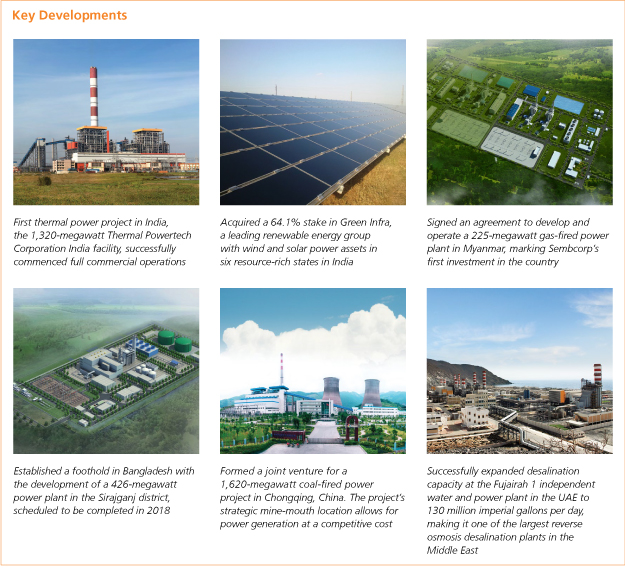

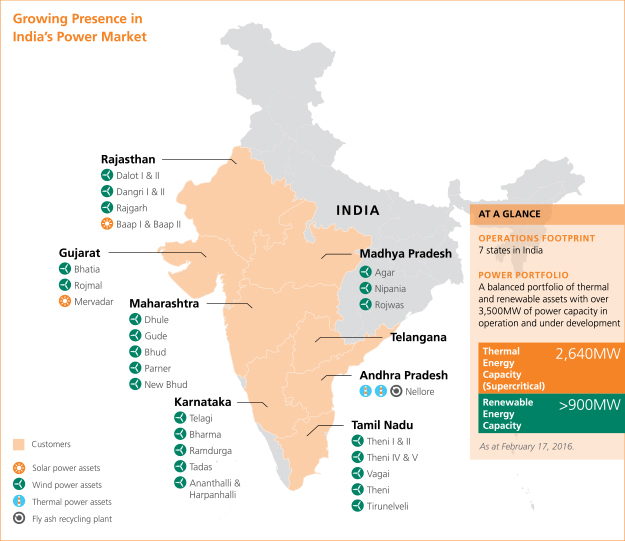

Strengthening our presence in India

In 2015, we continued to strengthen our presence in the fast-growing India power market. A significant milestone was achieved with the successful completion and commencement of operations for our first thermal power plant in the country. The supercritical coal-fired power plant, operational since March with the completion of the first 660-megawatt unit, commenced full commercial operations of its entire 1,320-megawatt capacity in September. To date, it has secured a 25-year long-term power purchase agreement for the supply of 500 megawatts of power to Andhra Pradesh and Telangana Power Distribution Companies. In addition, it secured an eight-year long-term power purchase agreement for the supply of 570 megawatts to the Southern and Northern Power Distribution Companies of Telangana in February 2016. With 86% of its net capacity contracted under long-term power purchase agreements, TPCIL is now eligible for mega power status. In addition to securing long-term power supply opportunities as and when they arise, the plant also sells the balance of its output on the Indian Energy Exchange under short-term contracts. Meanwhile, construction of our second coal-fired supercritical power plant on an adjacent site in Andhra Pradesh is progressing well, with the plant on track to be completed in 2016. Upon completion, the 1,320-megawatt plant will double our thermal power capacity in India and help meet power demand in the country, particularly in the

southern states.

In 2015, we also grew our renewable energy business and strengthened our capabilities by acquiring a majority stake in Green Infra, a leading renewable energy company in India. We now own a 64.1% stake in the unit, which we have renamed Sembcorp Green Infra. Following this acquisition in February, we continued to grow our renewable footprint in the country, expanding our renewable power capacity in operation and under development to 918 megawatts.

Since our entry into India in 2011, we have built up over 3,500 megawatts of power capacity in operation and under development in the country. With investments in both thermal and renewable energy, we are now well-positioned to continue to grow in the energy sector with a balanced portfolio of assets.

Growing our energy and water business in China

In 2015, we continued to focus on expanding our energy and water business in China, particularly in the areas of niche power and advanced water solutions for industries. At the end of 2015, we formed a joint venture for a 1,620-megawatt mine-mouth coal-fired power project in Chongqing. Through the joint venture, we hold a 49% stake in an existing 300-megawatt coal-fired power plant and will develop an adjacent 1,320-megawatt supercritical coal-fired power plant. These are the city’s only mine-mouth coal-fired power plants. The new greenfield plant is set to be one of the most efficient power plants in Chongqing and is scheduled for completion in 2017.

Maintaining our growth momentum in the world’s largest wind power market, 2015 saw two expansion projects to our wind power capacity in Huanghua, Hebei province, through our 49%-owned joint venture with Guohua Energy Investment. The first of these expansions, a 48-megawatt wind farm in Jiedijianhe, commenced operations in 2015 and supplies power to the Hebei South grid. We also started construction of a 150-megawatt wind farm in Laoshibeihe, which is expected to be completed in 2017. Our total wind power capacity in operation and under development in China is now

544 megawatts.

On the water front, we successfully completed the expansion of our Nanjing industrial water facilities, doubling our industrial water capacity in the Nanjing Chemical Industrial Park to 240,000 cubic metres per day. This increased capacity will allow us to better serve the fast-growing water needs of our existing and potential customers in the industrial park. In recognition of our capabilities in providing specialised total water and wastewater solutions for industries, we also received a special award for being the Leader in Water Treatment for Industrial Parks at the China Water Industry Annual Awards.

Expanding our footprint in fast-growing emerging markets

In line with our commitment to building platforms for long-term growth, our Utilities business expanded its footprint into two new fast-growing emerging markets in 2015: Myanmar and Bangladesh.

In Myanmar, we were awarded a project to develop and operate a 225-megawatt gas-fired power plant in Mandalay’s Myingyan district. We were awarded the project following an international tender, called by state-owned entity Myanmar Electric Power Enterprise and advised on by the International Finance Corporation, a member of the World Bank Group. The project is expected to be completed in 2018 and will supply power to the Myanmar Electric Power Enterprise under a 22-year power purchase agreement. The US$300 million plant is set to be the largest gas-fired independent power plant in the country, and will help ease the country’s severe power deficit and support its economic growth.

In Bangladesh, we will be developing a 426-megawatt combined cycle gas-fired power plant in the Sirajganj district under the country’s first public-private partnership for the power sector involving a foreign investor. To be built, owned and operated through a partnership with North-West Power Generation Company, an enterprise of the Bangladesh Power Development Board, the US$390 million plant will supply power to the grid under a 22.5-year power contract with the Bangladesh Power Development Board upon its completion in 2018.

2015 also saw the successful completion of an expansion to reverse osmosis facilities at the Fujairah 1 Independent Water and Power Plant in the UAE that increased the plant’s seawater desalination capacity from 100 million imperial gallons per day to 130 million imperial gallons per day. This makes the plant the largest reverse osmosis desalination facility in the Middle East. The additional water output from the expansion will be sold to the Abu Dhabi Water & Electricity Company under a 20-year water purchase agreement.

OUTLOOK

The World Bank expects growth in the global economy

to pick up modestly to 2.9% in 2016, from 2.4% in 2015.

In Singapore, the Ministry of Trade and Industry has forecast the economy to expand by between 1% to 3% in 2016. Meanwhile, due to global economic uncertainty, the Economic Development Board forecasts that fixed asset investments will be between S$8 billion and S$10 billion in 2016, compared to S$11.5 billion in 2015. The operating environment for our Utilities business in Singapore is expected to be challenging in 2016, with continued intense competition in the power market. The business will continue to focus on enhancing operational excellence and efficiency as well as managing costs.

In China, the World Bank expects growth to slow slightly to 6.7% in 2016, from 6.9% in 2015. However, the country’s upcoming 13th five-year plan is expected to contain increased focus on the environment. In addition, China has announced plans to peak its carbon dioxide emissions by 2030 or before, and lower the carbon intensity of its gross domestic product between 60% to 65% below the 2005 level by 2030. This is expected to provide further opportunities for growth in sectors aligned with this objective. Our Utilities business continues to be well-placed to benefit from this emphasis on environmental protection with our sustainable water solutions and renewable energy capabilities.

The South Asia region, led by India, is projected to be a bright spot in 2016, with growth in the region forecast to increase to 7.3% from 7% in 2015. India, the dominant economy in the region, is forecast to grow by 7.8% in 2016, up from 7.3% in 2015. 2016 will see the first full year of profit contributions from our 1,320-megawatt TPCIL power plant, as well as the phased completion of our second 1,320-megawatt power plant adjacent to it.

Following a landmark deal negotiated at the 2015 United Nations Climate Change Conference in Paris, countries around the world are expected to place increased focus on managing climate change moving forward. This is expected to lead to more opportunities in the renewable energy sector,

amongst others.

Backed by strong operational, management and technical capabilities, the business remains focused on the execution of its pipeline of projects and the pursuit of new growth opportunities to deliver long-term growth.

In Singapore, the Ministry of Trade and Industry has forecast the economy to expand by between 1% to 3% in 2016. Meanwhile, due to global economic uncertainty, the Economic Development Board forecasts that fixed asset investments will be between S$8 billion and S$10 billion in 2016, compared to S$11.5 billion in 2015. The operating environment for our Utilities business in Singapore is expected to be challenging in 2016, with continued intense competition in the power market. The business will continue to focus on enhancing operational excellence and efficiency as well as managing costs.

In China, the World Bank expects growth to slow slightly to 6.7% in 2016, from 6.9% in 2015. However, the country’s upcoming 13th five-year plan is expected to contain increased focus on the environment. In addition, China has announced plans to peak its carbon dioxide emissions by 2030 or before, and lower the carbon intensity of its gross domestic product between 60% to 65% below the 2005 level by 2030. This is expected to provide further opportunities for growth in sectors aligned with this objective. Our Utilities business continues to be well-placed to benefit from this emphasis on environmental protection with our sustainable water solutions and renewable energy capabilities.

The South Asia region, led by India, is projected to be a bright spot in 2016, with growth in the region forecast to increase to 7.3% from 7% in 2015. India, the dominant economy in the region, is forecast to grow by 7.8% in 2016, up from 7.3% in 2015. 2016 will see the first full year of profit contributions from our 1,320-megawatt TPCIL power plant, as well as the phased completion of our second 1,320-megawatt power plant adjacent to it.

Following a landmark deal negotiated at the 2015 United Nations Climate Change Conference in Paris, countries around the world are expected to place increased focus on managing climate change moving forward. This is expected to lead to more opportunities in the renewable energy sector,

amongst others.

Backed by strong operational, management and technical capabilities, the business remains focused on the execution of its pipeline of projects and the pursuit of new growth opportunities to deliver long-term growth.