- BUILDING THE FUTURE

- OPERATING & FINANCIAL REVIEW

- GOVERNANCE & SUSTAINABILITY

- FINANCIAL STATEMENTS

- Directors’ Statement

- Independent Auditors’ Report

- Balance Sheets

- Consolidated Income Statement

- Consolidated Statement of

Comprehensive Income - Consolidated Statement of

Changes in Equity - Consolidated Statement of

Cash Flows - Notes to the Financial Statements

- Supplementary Information

- EVA Statement

- Shareholders' Information

- Governance Disclosure Guide

- Corporate Information

- Notice of Annual General Meeting

- Proxy Form

- Letter to Shareholders

MARINE REVIEW

Competitive Edge

| • | A global leader in integrated marine and offshore solutions with more than 50 years’ proven track record |

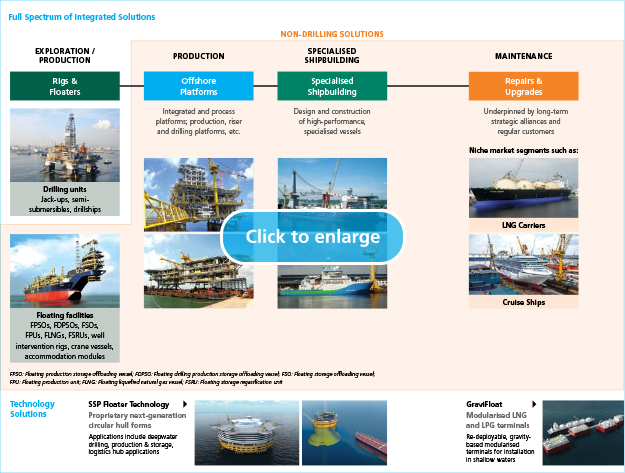

| • | Focused on four key capabilities: rigs & floaters; repairs & upgrades; offshore platforms and specialised shipbuilding |

| • | Global network of strategic locations in Singapore, India, Indonesia, the UK and Brazil |

OPERATING AND FINANCIAL REVIEW

A difficult market environment

In 2015, the Marine business faced a very difficult market environment. Amid further collapse in oil prices, oil and gas exploration projects were curtailed globally. This led to a reduction in new projects for yards worldwide, as well as requests for deferment or cancellation of existing rig deliveries. In addition, the Marine business was affected by uncertainties in the Brazil market and by the financial difficulties of its customer, Sete Brasil.

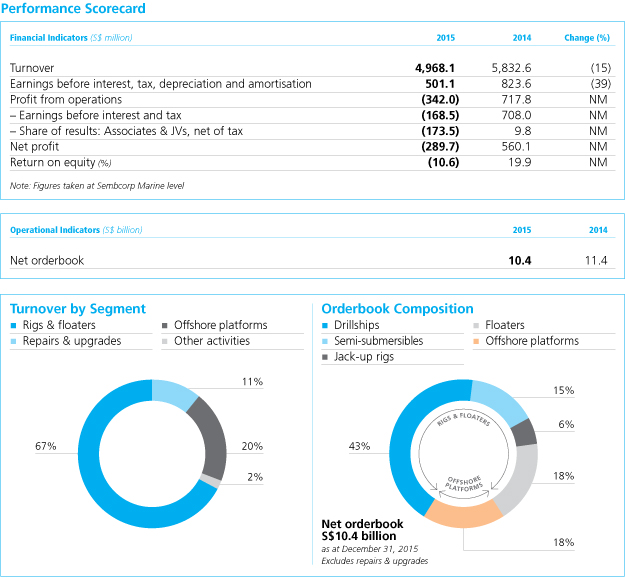

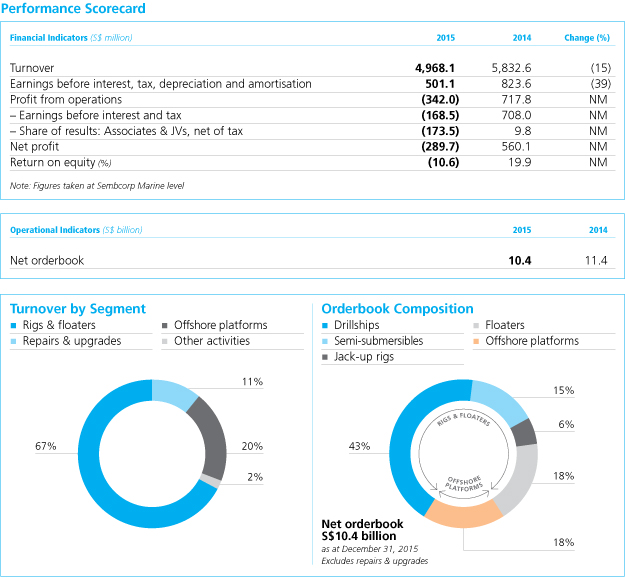

Against this background, in 2015, Sembcorp Marine recorded a turnover of S$5.0 billion compared to S$5.8 billion in 2014, and a net loss of $289.7 million compared to a net profit of S$560.1 million in 2014. Profit from operations was negative S$342.0 million for 2015, in comparison to S$717.8 million

in 2014.

2015 saw the business making prudent impairment and provisions totalling S$609 million for its rig contracts, of which S$329 million was for Sete Brasil projects. It also recorded S$192 million of

associate / joint venture losses.

In light of uncertainties in Brazil, a provision of S$329 million was made by the business for its Sete Brasil projects, taking into consideration what the business believes to be the full extent of its exposure to the contracts. In addition, the business also made provisions of approximately S$280 million in case of prolonged deferment or possible cancellation of rigs. Following the failure of one of its customers to take delivery of its rig, the business has terminated that contract and taken legal action to recover the amount due to it. All other completed rigs with deferment requests have been technically accepted by customers and the business has arrived at, or is finalising, mutually acceptable solutions with these customers. To date, the business has not had any cancellation of rig orders.

The business’ share of losses in associates and joint ventures of S$192 million comprised the net impact of the Marine business’ equity-accounted share in provisions made by its 30%-owned associate Cosco Shipyard Group, which was also affected by the severe industry down-cycle, as well as its share of loss in other associates and non-operating items.

Excluding the impairment, provisions and share of losses of associates and joint ventures, the business posted a net profit of S$384 million for 2015.

Orderbook of S$10.4 billion

S$3.2 billion of orders secured in 2015 despite depressed market conditions

S$3.2 billion of orders secured in 2015 despite depressed market conditions

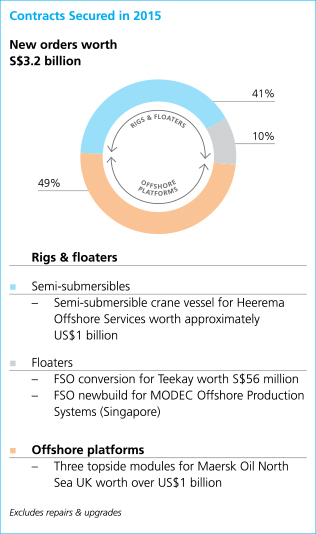

In 2015, the business’ best-in-class facilities, new capabilities and success in broadening its customer base enabled it to secure S$3.2 billion in new orders, despite the depressed market conditions. These new orders brought the business’ net orderbook to S$10.4 billion as of December 31, 2015.

The new orders included a contract from Heerema Offshore Services

to design and build the world’s largest semi-submersible crane

vessel for approximately US$1 billion. Scheduled for delivery in

the fourth quarter of 2018, this giant crane vessel will be built

at the state-of-the-art Sembcorp Marine Tuas Boulevard Yard. Also,

the business secured an engineering, procurement and construction

contract worth more than US$1 billion from Maersk Oil North Sea UK,

for the construction of a central processing facility,

two connecting bridges, a wellhead platform as well as utilities and

living quarters platform topsides, for deployment in the Culzean

field development.

In addition, during the year the business entered into a floating storage and offloading (FSO) conversion contract worth S$56 million with Teekay, as well as a contract to design and build a new FSO for MODEC Offshore Production Systems (Singapore).

Over the last five decades, Sembcorp Marine has developed strong relationships with many customers, including national and international oil companies and key players in the drilling and production markets. With its diversified and enhanced capabilities, the Marine business aims to further cement such relationships and build strategic partnerships with them.

In addition, during the year the business entered into a floating storage and offloading (FSO) conversion contract worth S$56 million with Teekay, as well as a contract to design and build a new FSO for MODEC Offshore Production Systems (Singapore).

Over the last five decades, Sembcorp Marine has developed strong relationships with many customers, including national and international oil companies and key players in the drilling and production markets. With its diversified and enhanced capabilities, the Marine business aims to further cement such relationships and build strategic partnerships with them.

Strategic response to competition

Building long-term capabilities, diversifying to serve new segments

Building long-term capabilities, diversifying to serve new segments

Sembcorp Marine recognises the need to deepen and broaden its yard capabilities to enable cost- effective execution and maintain its competitiveness globally. In 2015, the business completed a new state-of-the-art steel structure fabrication workshop at its flagship Sembcorp Marine Tuas Boulevard Yard in Singapore. The 120,000-square-metre workshop is the largest of its kind in Southeast Asia. It will boost the business’ steel fabrication capacity and productivity, and allow the business to undertake more complex projects in a more cost-effective manner and with shorter delivery times.

In addition, the Marine business sees further need to diversify to serve different segments within the exploration and production value chain, such as the development and production segments. To this end, it remains committed to enhancing its technology and engineering expertise, investing prudently in research and development to improve operational efficiency and develop new capabilities. The business has broadened its product offering to include well intervention semi-submersibles, accommodation rigs and proprietary design drillships.

The business is also developing other product segments within the offshore oil and gas value chain to enhance its full spectrum of integrated solutions. Through its investment in GraviFloat, it has the technology to design, deliver and operate re-deployable, gravity-based, modularised terminals for nearshore gas and power generation installations. It also has proprietary expertise in the design, engineering and delivery of innovative floating production and drilling solutions for the oil and gas industry, through its Houston-based subsidiary Sembmarine SSP. This enables it to offer next-generation innovative and cost-effective solutions for deep-water oil and gas drilling, production and storage, as well as logistics hub applications in harsh environments and extreme arctic conditions.

Becoming nimbler and more efficient

Transformation to build a global integrated company

Transformation to build a global integrated company

In 2015, the Marine business reached a key milestone in transforming its businesses for the future. From a multi-brand, multi-business-unit entity, the business became an integrated company, operating under one brand. The new integrated Sembcorp Marine is focused on four key capabilities: rigs & floaters, repairs & upgrades, offshore platforms as well as specialised shipbuilding.

As an integrated company, Sembcorp Marine will be able to harness the combined scale and expertise of its global operations to become more flexible, innovative and responsive. This puts the business in a good position to undertake larger and more complex projects, and take on challenges and opportunities in a fast-changing and increasingly complex business environment. Furthermore, integrating the combined shared expertise and accumulated experience of high-calibre teams across its global operations will allow our Marine business to serve its customers better.

OUTLOOK

Looking ahead, the current down-cycle for the business

is expected to be more protracted than previous cycles.

However, Sembcorp Marine believes that it is sufficiently

prepared, not just to ride out the storm, but also to

lay stronger foundations for its future when the market

recovers. The business will continue to actively manage

its balance sheet to maintain a healthy financial position.

The business remains optimistic on its longer-term prospects, as its facilities have been built to cater to the industry’s demand for the long term. As an integrated Sembcorp Marine, the business will optimise its capabilities and capacities, as well as increase its efficiency and productivity to better serve its partners and customers.

The business remains optimistic on its longer-term prospects, as its facilities have been built to cater to the industry’s demand for the long term. As an integrated Sembcorp Marine, the business will optimise its capabilities and capacities, as well as increase its efficiency and productivity to better serve its partners and customers.