- BUILDING THE FUTURE

- OPERATING & FINANCIAL REVIEW

- GOVERNANCE & SUSTAINABILITY

- FINANCIAL STATEMENTS

- Directors’ Statement

- Independent Auditors’ Report

- Balance Sheets

- Consolidated Income Statement

- Consolidated Statement of

Comprehensive Income - Consolidated Statement of

Changes in Equity - Consolidated Statement of

Cash Flows - Notes to the Financial Statements

- Supplementary Information

- EVA Statement

- Shareholders' Information

- Governance Disclosure Guide

- Corporate Information

- Notice of Annual General Meeting

- Proxy Form

- Letter to Shareholders

URBAN DEVELOPMENT REVIEW

Competitive Edge

| • | Over 20 years’ track record in undertaking master planning, land preparation and infrastructure development to transform raw land into urban developments |

| • | Significant land bank of integrated urban developments comprising industrial parks as well as business, commercial and residential space in Vietnam, China and Indonesia |

| • | A valued partner to governments, with the ability to deliver the economic engine to support industrialisation and urbanisation by attracting local and international investments |

OPERATING AND FINANCIAL REVIEW

Strong land sales but higher costs

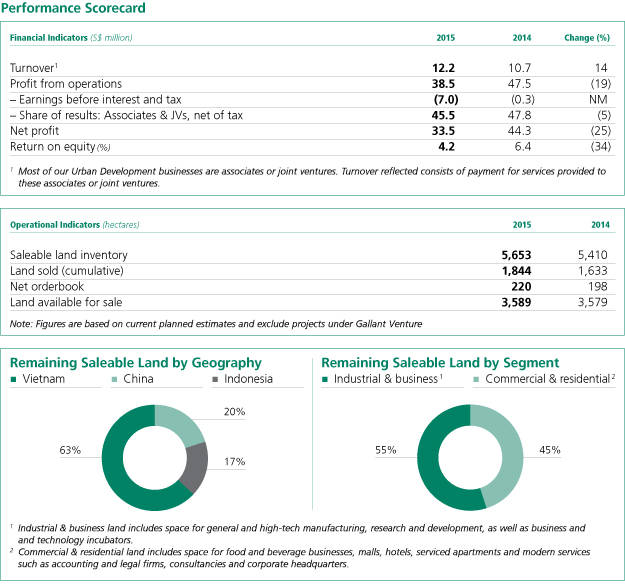

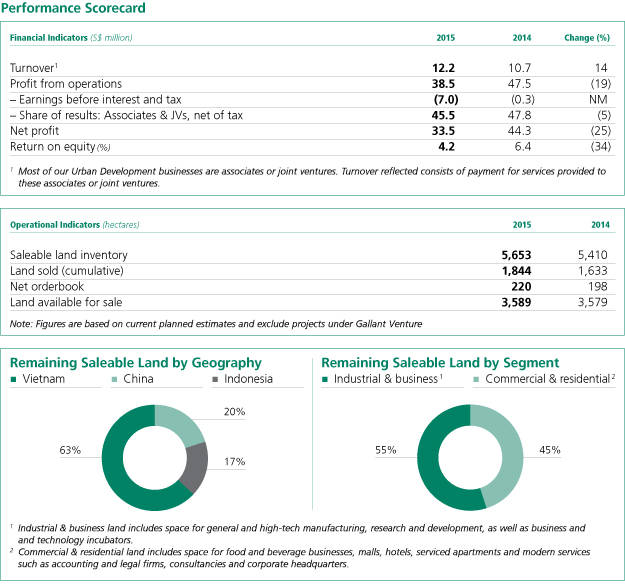

The Urban Development business recorded a net profit of S$33.5 million compared to S$44.3 million the previous year. Profit from operations (PFO) stood at S$38.5 million compared to S$47.5 million

in 2014.

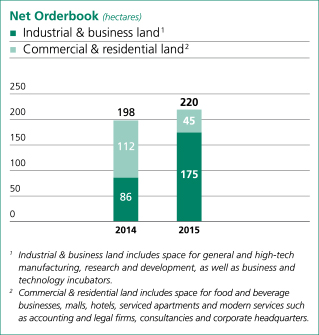

The business achieved strong land sales in 2015, with more land sold in Vietnam, China as well as Indonesia compared to 2014. During the year, the business sold 211 hectares of land and received commitments from customers for a further 233 hectares, bringing its net orderbook to 220 hectares as at the end of the year. Land for industrial and business purposes accounted for 91% of land sold during the year, while land for commercial and residential purposes accounted for 9%.

However, the business’ net profit was lower due to a greater proportion of industrial and business land sold, which has lower margins, as well as higher corporate costs and pre-operating costs from

new projects.

Vietnam

Our Vietnam business performed well in 2015. Investor interest was strong, with manufacturers keen to benefit from free trade pacts concluded in 2015, such as the Trans-Pacific Partnership. Industrial and business land continued to form the bulk of land sold across Vietnam Singapore Industrial Park (VSIP) projects, accounting for 96% of land sold. The remaining 4% of land sold was for commercial and residential purposes.

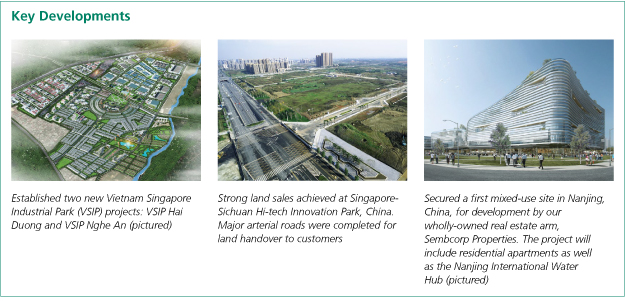

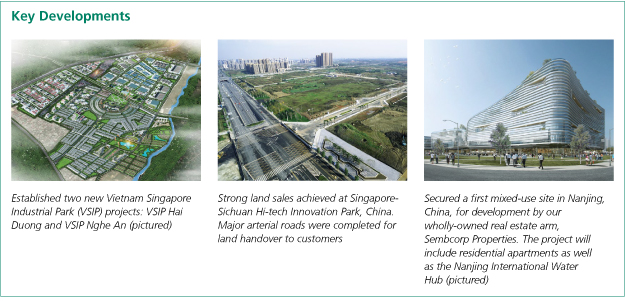

During the year, we extended the reach of the VSIP with the establishment of two new developments. The first, VSIP Hai Duong, is located in northern Vietnam between two existing VSIP projects, VSIP Bac Ninh and VSIP Hai Phong, and connected by highway to Hanoi and Hai Phong port. VSIP Hai Duong is positioned to attract supporting industries for manufacturing companies located in Bac Ninh and Hai Phong. In April, we received the investment licence for the project, which had 110 hectares of industrial land for immediate sale. Since then, the project has already secured three customers.

In June, we then announced our second new VSIP project for the year, the 750-hectare VSIP Nghe An, on the north central coast of Vietnam. Following the receipt of the investment licence, we broke ground for the first phase of this integrated township and industrial park, comprising 198 hectares of industrial land and 81 hectares of commercial and residential land, in September. VSIP Nghe An is located along the East-West Economic Corridor linking Laos, Myanmar and Thailand with the East Sea, close to the port of Cua Lo. It is also within the boundaries of the newly established Dong Nam Economic Zone, which offers generous investment incentives to manufacturers for up to 15 years.

During the year, we welcomed Japan’s MC Development Asia (MCDA) as a partner in our Vietnam real estate business. MCDA is a subsidiary of Japan’s Mitsubishi Corporation, which has delivered real estate projects in Japan, North America, Europe and China. It has taken up a 19.1% effective stake in

The Habitat Binh Duong, our residential project currently under construction at our first VSIP. Sembcorp’s effective stake in The Habitat Binh Duong, formerly known as Gateway, is 50.4%. The project will offer condominiums catered to the needs of tenants of VSIP, as well as professionals working in the province. The sales permit for the project’s first phase of 267 units was received in November.

In total, VSIP now has seven VSIP projects across the southern, central and northern economic corridors of Vietnam, spanning 6,660 hectares in gross project size. The market leader in Vietnam, VSIP has attracted US$8.2 billion in total investment capital from over 590 companies, and created more than 157,000 jobs.

China

In China, direct investment in high-technology manufacturing rose 9.5% in 2015, reflecting the central government’s increasing emphasis on high value-added manufacturing and services as economic drivers. This boosted the take-up of land at our developments in Sichuan and Nanjing, which target the high-technology segment.

Our 1,000-hectare Singapore-Sichuan Hi-tech Innovation Park (SSCIP), located in the central business district of Chengdu’s Tianfu New City, delivered a strong performance for the year. We successfully attracted 10 high-technology companies to set up operations in the development, bringing with them RMB11.4 billion in investment capital. These companies are largely in the biomedical science sector, one of our key target industries for the development. An additional eight companies have committed to invest in the SSCIP and handover of land to them is expected to take place progressively in 2016. In 2015, we also made good progress in land preparation. Major road networks connecting SSCIP to Sichuan’s main cities were completed, and a state-of-the-art common utilities trench was installed underground for the site.

Land sales at our Sino-Singapore Nanjing Eco Hi-tech Island (SNEI) project increased over the previous year. Sales of industrial and business land increased. However, several residential land sales were deferred, impacting profits. During the year, our real estate arm, Sembcorp Properties, acquired a

5.7-hectare mixed-use site on the SNEI through a public auction. Spanning close to 76,000 square metres’ gross floor area, the site will house residential apartments, as well as the Nanjing International Water Hub (NIWH). Owned and marketed by Sembcorp Properties, the NIWH will offer office space targeted at water companies, including technology, research and development, engineering, as well as commercial players. Targeted for completion in 2018, it will offer conference facilities, as well as a water technology innovation centre for tenants’ use, equipped to support both analytical and field tests.

Meanwhile, our Wuxi-Singapore Industrial Park (WSIP) project recorded more than 90% occupancy in its ready-built and built-to-specifications factories. It also continued to receive healthy revenue from electricity and rental income. However the project’s performance was impacted by an impairment and doubtful debt provisions for two built-to-specifications factories, as well as an impairment loss for the Hongshan Mansion development.

Indonesia

In Indonesia, our new Kendal Industrial Park (KIP) project in Central Java continued to draw interest from both local and foreign manufacturers, primarily in the furniture and garment-related industries as well as the food processing sector. Lower operating costs in Kendal regency, where the KIP is located, formed a key factor in the KIP’s attractiveness to companies. Four customers have purchased industrial land at the KIP to date, with additional customers in the pipeline for 2016.

During the year, we continued to focus on land preparation at the 860-hectare KIP. Good progress was made on this front and we have begun land and infrastructure development for the project.

OUTLOOK

Vietnam’s economy and industrial production continued to show positive

momentum in 2015. The country’s gross domestic product (GDP) grew

by around 6.5%. In addition, the State Bank of Vietnam’s move to devalue

the dong against the US dollar in January, May and August 2015 and widen

the currency’s trading band should serve to increase export competitiveness

and safeguard GDP growth going forward. Coupled with low inflation,

these exchange rate measures should reduce operating costs for companies

and enhance Vietnam’s attractiveness as an investment destination. The recent

conclusion of the Trans-Pacific Partnership has also encouraged investment

by manufacturers eager to benefit from market access the trade pact would

offer upon its ratification.

China’s economy grew by 6.9% in 2015. Investment in high-technology manufacturing and services increased significantly. This trend affirms the positioning of our newer developments, the SNEI and SSCIP, as high-technology and innovation-driven integrated developments. Where the residential real estate market may be affected by the slower release of land by the local government, we will focus on mixed-use developments and the sale of industrial and business land to drive performance instead.

Indonesia’s economy has slowed, with GDP growth falling below 5% and the manufacturing purchasing managers’ index (PMI) contracting below 50 in 2015. Nonetheless, our KIP project continues to draw enquiries from manufacturers in West and East Java, who are attracted by lower operating costs in Kendal regency and Central Java. Current upgrading of road networks and the expansion of the domestic airport also serve to improve the attractiveness of the project to investors.

The Urban Development business has a healthy orderbook of 220 hectares of land, which will be converted into sales in the next two years. This comprises 175 hectares of land for industrial and business use, and 45 hectares for commercial and residential use. In addition, we continue to receive enquiries for land within our projects in Vietnam, China and Indonesia.

Sembcorp’s Urban Development business remains well-positioned, with a good track record and

13 large-scale projects in emerging markets. We continue to pursue land sales, while maximising value from our land bank through selective property development. In recent years, the business has expanded in terms of geographical reach and number of projects. It has also grown its range of products, which now includes high-technology parks, integrated townships and traditional industrial parks. Over the last two years, good progress has also been made in land resettlement and infrastructure development, laying important groundwork to capture value from land sales in the coming years.

For 2016, the Urban Development business is expected to deliver a steady operating performance.

China’s economy grew by 6.9% in 2015. Investment in high-technology manufacturing and services increased significantly. This trend affirms the positioning of our newer developments, the SNEI and SSCIP, as high-technology and innovation-driven integrated developments. Where the residential real estate market may be affected by the slower release of land by the local government, we will focus on mixed-use developments and the sale of industrial and business land to drive performance instead.

Indonesia’s economy has slowed, with GDP growth falling below 5% and the manufacturing purchasing managers’ index (PMI) contracting below 50 in 2015. Nonetheless, our KIP project continues to draw enquiries from manufacturers in West and East Java, who are attracted by lower operating costs in Kendal regency and Central Java. Current upgrading of road networks and the expansion of the domestic airport also serve to improve the attractiveness of the project to investors.

The Urban Development business has a healthy orderbook of 220 hectares of land, which will be converted into sales in the next two years. This comprises 175 hectares of land for industrial and business use, and 45 hectares for commercial and residential use. In addition, we continue to receive enquiries for land within our projects in Vietnam, China and Indonesia.

Sembcorp’s Urban Development business remains well-positioned, with a good track record and

13 large-scale projects in emerging markets. We continue to pursue land sales, while maximising value from our land bank through selective property development. In recent years, the business has expanded in terms of geographical reach and number of projects. It has also grown its range of products, which now includes high-technology parks, integrated townships and traditional industrial parks. Over the last two years, good progress has also been made in land resettlement and infrastructure development, laying important groundwork to capture value from land sales in the coming years.

For 2016, the Urban Development business is expected to deliver a steady operating performance.