|

|

|

Email this page / Email this page /  Bookmark this page / Bookmark this page /  Download print-friendly PDF Download print-friendly PDF |

The board and management of Sembcorp

recognise that well-defined corporate governance

processes are essential in enhancing corporate

accountability and long-term sustainability and

remain committed to ensuring high standards of

corporate governance to preserve and maximise

shareholder value.

This report sets out the companyís corporate

governance processes and activities for the financial

year with reference to the principles set out in the

revised Singapore Code of Corporate Governance

2012 (2012 Code). Although the 2012 Code only

takes effect in respect of annual reports relating

to financial years commencing from November 1,

2012, the company is committed to high standards

of corporate governance and believes in the early

adoption of best practices. The board is pleased

to report that the company has complied in all

material aspects with the principles and guidelines

set out in the 2012 Code. Deviations from the 2012

Code, if any, are explained under the respective

sections. The company continually reviews and

refines its processes in light of the best practice,

consistent with the needs and circumstances

of the Group.

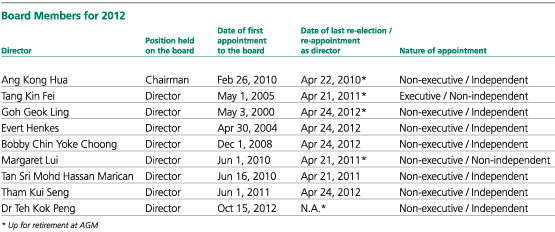

Boardís Conduct of Affairs (Principle 1)

Effective board to lead and effect controls

Sembcorp is led by an effective board comprising

mainly independent non-executive directors.

The board is headed by Ang Kong Hua. He is

joined on the board by Tang Kin Fei, Goh Geok

Ling, Evert Henkes, Bobby Chin Yoke Choong,

Margaret Lui, Tan Sri Mohd Hassan Marican,

Tham Kui Seng and Dr Teh Kok Peng, who joined

the board on October 15, 2012.

Role of the board

The board is collectively responsible for the

long-term success of the company. Each director

exercises his independent judgement to act in good

faith and in the best interest of the company for

the creation of long-term value for shareholders.

The board oversees the business affairs of

the Group. It provides leadership and guidance

to management on the Groupís overall strategy,

taking into consideration sustainability issues

and ensuring that the necessary financial and

human resources are in place, and also reviews

management performance. As part of its role, the

board also ensures the adequacy of the Groupís

control and risk framework and standards including

ethical standards, and that obligations to its

shareholders and other identified key stakeholders

are understood and met.

The board is responsible for the Groupís

overall performance objectives, key operational

initiatives, financial plans and annual budget, major

investments, divestment and funding proposals,

quarterly and full year financial performance

reviews, risk management and corporate

governance practices. It also provides guidance

on sustainability issues such as environmental and

social factors, as part of its overall business strategy.

To assist the board in the efficient discharge of its

responsibilities and provide independent oversight of

management, several board committees, including

the Executive Committee, Audit Committee,

Executive Resource & Compensation Committee,

Nominating Committee and Risk Committee, have

been established with written Terms of Reference

(TOR). The committeesí respective composition,

roles and responsibilities are further explained in this

report. Minutes of board committee meetings are

circulated to the board to keep directors updated

on the activities of each committee. Special purpose

committees are also established as dictated by

business imperatives. For instance, the Technology

Advisory Panel formed in early 2013 is chaired by Mr

Ang to lead the Group in setting up a framework to

better manage existing and new technologies and

research and development activities relating to the

businesses of the Group. More details are explained

in the Technology Advisory Panel section of this

annual report.

The composition of the board committees is

structured to ensure an equitable distribution of

responsibilities among board members, maximise

the effectiveness of the board and foster active

participation and contribution. Diversity of

experience and appropriate skills are considered

along with the need to maintain appropriate checks

and balances between the different committees.

Hence, membership of the Executive Committee,

with its greater involvement in key businesses

and executive decisions, and membership of the

Audit and Risk Committees, with their respective

oversight roles, are mutually exclusive.

The Group has adopted a set of internal controls

and guidelines that set out financial authorisation

and approval limits for borrowings, including

off-balance sheet commitments, investments,

acquisitions, disposals, capital and operating

expenditures, requisitions and expenses. The board

approves transactions exceeding certain threshold

limits, while delegating authority for transactions

below those limits to the Executive Committee and

management to facilitate operational efficiency.

Executive Committee

The Executive Committee (ExCo) is chaired

by Mr Ang and its members include Mr Goh,

Mr Tang and Mrs Lui.

Within the limits of authority delegated by the

board, the ExCo reviews and approves business

opportunities, strategic investments, divestments,

and major capital and operating expenditures.

The ExCo also evaluates and recommends larger

investments, capital and operating expenditures,

as well as divestments to the board for approval.

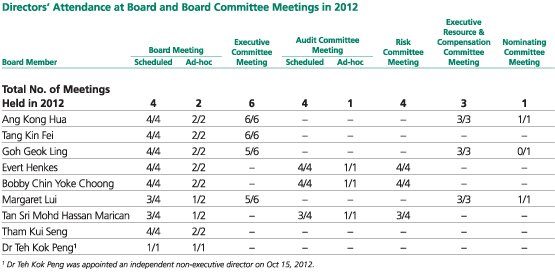

Meetings and attendance

The schedule of all board and board committee

meetings as well as the Annual General Meeting

(AGM) for the next calendar year is planned

in advance, and telephonic attendance and

conference via audio-visual communication

are allowed under the companyís Articles of

Association. Board meetings are scheduled on a

quarterly basis to review and approve the release

of the quarterly results and discuss reports prepared

by management on the Groupís performance,

business development plans and prospects. A

board meeting is also held at the end of each

financial year to review the Groupís strategy going

forward and to consider and approve the Groupís

budget for the following year. Further board

meetings may also be held to specifically consider

other issues arising. The board also sets aside

time during its scheduled meetings without the

presence of management to discuss, among other

matters, managementís performance. Decisions

of the board and board committees may also be

obtained via circular resolutions. A full day board

and management strategy meeting was organised

in November 2012 to review in depth the strategic

direction of the Group. The directorsí attendance

at board and committee meetings held during the

financial year is set out below.

Board orientation and training

A formal letter of appointment is sent to newly-appointed

directors upon their appointment

explaining the Groupís governance policies and

practices, as well as their duties and obligations

as directors. The newly-appointed director also

receives an information pack which contains

the Groupís organisation structure, senior

managementís contact details, the companyís

Memorandum & Articles of Association, respective

committeesí TORs, Group Policy relating to

disclosure of interests in securities and prohibition

on dealings in Sembcorp securities, and guidelines

on directorsí fees.

The company conducts orientation programmes

for newly-appointed directors where comprehensive

presentations on Sembcorpís strategic plans and

direction, financial performance as well as business

activities in the various geographical markets are

given by senior management. In addition, the

Group President & CEO briefs the board at each

meeting on the business and project developments.

As part of the training and professional

development programmes for the board, the

company ensures that directors are briefed on

changes to regulations, guidelines and accounting

standards from time to time. These are done either

during board meetings or at specially convened

sessions, including sponsored training sessions

and seminars conducted by external professionals.

Articles and reports relevant to the Groupís

businesses are also circulated to the directors

for information. Facility visits to our subsidiariesí

operation sites are also arranged to provide

directors with an understanding of the Groupís

business operations. In 2012, briefing sessions by

external lawyers were organised for the board to

have an in-depth understanding of the 2012 Code

and directorsí obligations and responsibilities.

Board Composition and Guidance (Principle 2)

Strong and independent board exercising

objective judgement

Board composition

The current board comprises nine directors, of

whom seven are independent directors. Excluding

the Group President & CEO, all the directors are

non-executive. The board members comprise

business leaders and professionals with strong

relevant experience in the Groupís businesses. Best

efforts have been made to ensure that, in addition

to contributing their valuable expertise and insight

to board deliberations, each director brings to the

board an independent and objective perspective to

enable balanced and well-considered decisions to

be made. The board is of the view that, given that

the majority of the board comprises non-executive

directors who are independent of management and

independent in terms of character and judgement,

objectivity on issues deliberated is assured. Profiles

of the directors may be found here.

Review of directorsí independence

The independence of each non-executive director is

assessed annually. This year, each director is required

to complete a Directorís Independence Checklist

drawn up based on the guidelines provided in the

2012 Code. The checklist further requires each

director to assess whether he considers himself

independent despite not being involved in any

of the relationships identified in the 2012 Code.

Thereafter, the Nominating Committee reviews the

completed checklists, assesses the independence of

the directors and recommends its assessment to the

board. Particular scrutiny is applied when assessing

the continued independence of directors who have

served more than nine years.

The board, after taking into account the views

of the Nominating Committee, determined that

with the exception of Mr Tang, Group President &

CEO and an executive director, and Mrs Lui, Chief

Operating Officer of Pavilion Capital International,

a related company of Temasek Holdings who holds

more than 10% interest in the Group, all the other

non-executive directors are independent.

Mr Goh and Tan Sri Mohd Hassan Marican sit

on the board of Sembcorp Marine, a listed

subsidiary of the company from which the company

has received payment in excess of S$200,000 in

aggregate for consultancy services and provision

of utilities services to Sembcorp Marine.

The board has assessed and is of the view that

the payment received from Sembcorp Marine is

insignificant in the context of the Groupís earnings.

The board believes that Mr Goh and Tan Sri Mohd

Hassan Maricanís directorships on Sembcorp Marine

will not interfere, or be reasonably perceived to

interfere, with their ability to exercise independent

judgement and act in the best interests of

Sembcorp Industries.

Mr Goh has served on the board of the company

since his appointment in 2000. The board established

that despite serving as a director for more than

nine years, Mr Goh continues to demonstrate the

essential characteristics of independence expected

by the board. His length of service and in-depth

knowledge of Groupís businesses are viewed by the

board as especially valuable, particularly given the

changes to the board in the recent years.

The board also determined that Tan Sri Mohd

Hassan Marican, who is appointed a Senior

International Advisor of Temasek International

Advisors, a subsidiary of Temasek Holdings, is

independent. The board believes that Tan Sri

Mohd Hassan Marican is able to exercise strong

independent judgement in his deliberations and

act in the best interest of the company as his

appointment is non-executive in nature and does

not entail involvement in the day-to-day conduct

of Temasek Holdingsí businesses.

Chairman and Chief Executive Officer

(Principle 3)

Clear division of responsibilities between

the board and management

The Chairman and the Group President & CEO

are not related to each other. The roles of Chairman

and the Group President & CEO are kept separate

to ensure an appropriate balance of power,

increased accountability and greater capacity of

the board for independent decision making.

The Chairman, who is non-executive, leads

and ensures effective and comprehensive board

discussion on matters brought to the board

including strategic issues as well as business

planning. The Chairman monitors that the

boardís decisions are translated into executive

action. The Group President & CEO manages the

operations of the Group in accordance with the

Groupís strategies and policies and provides close

oversight, guidance, advice and leadership to

senior management.

Board Membership (Principle 4)

Formal and transparent process for the

appointment and re-appointment of directors

Nominating Committee

The Nominating Committee (NC) comprises

non-executive directors, namely Mr Ang, Mr Goh

and Mrs Lui. Two out of three directors in the NC

(including the Chairman) are independent.

The NC is charged with the responsibility of

ensuring that Sembcorpís board is reviewed to

ensure strong, independent and sound leadership

for the continuous success of the company and its

businesses. It ensures that the board has a balance

of skills, attributes, background, knowledge

and experience in business, finance and related

industries, as well as management skills critical to the companyís businesses.

The NC reviews and makes recommendations

to the board on independence of the directors,

new appointments, re-appointments and

re-elections to the board and board committees

to ensure the board maintains at an appropriate

size. The NC is also responsible for reviewing

the succession plans for the board, developing a

process for performance evaluation of the board

and board committees, and reviewing training

and professional development programmes for

the board.

Appointment & re-appointment of directors

All appointments to the board are made on

merit and against objective criteria. Candidates

must be able to discharge their responsibilities as

directors while upholding the highest standards of

governance practised by the Group. The board also

recognises the contribution of directors who, over

time, have developed deep insights into the Groupís

businesses and exercises its discretion to retain the

services of such directors where appropriate.

When the need for a new director is

identified, the NC will prepare a shortlist of

candidates with the appropriate profile and

qualities for nomination. The board reviews the

recommendation of the NC and appoints the new

director. In accordance with the companyís Articles

of Association, the new director will hold office

until the next AGM, and if eligible, the director can

stand for re-appointment.

The company subscribes to the principle that

all directors including the Group President & CEO

should retire and submit themselves for re-election

at regular intervals, subject to their continued

satisfactory performance. The companyís Articles

of Association require a third of its directors to

retire and subject themselves to re-election by

shareholders at every AGM (one-third rotation rule).

In addition, a newly-appointed director submits

himself for retirement and re-election at the

AGM immediately following his appointment.

Thereafter, he is subject to the one-third rotation

rule. Directors who are above the age of 70 are

also statutorily required to seek re-appointment

at each AGM.

Pursuant to the one-third rotation rule, Mr

Ang, Mr Tang and Mrs Lui will retire and submit

themselves for re-election at the forthcoming AGM.

Dr Teh, who was newly appointed to the board

on October 15, 2012, will also submit himself for

retirement and re-election by shareholders at the

forthcoming AGM.

Mr Goh, who is above the age of 70, will

also submit his retirement and offer himself for

re-appointment pursuant to the Companies Act.

Review of directorsí time commitments

While reviewing the re-appointment and

re-election of directors, the NC also considers the

directorsí other board directorship representations

and principal commitments to ensure they have

sufficient time to discharge their responsibilities

adequately. Taking into consideration the total time

commitment required at the board and committee

level of Sembcorp and the other directorships and

committee duties of all its board members, the

board has determined that the maximum number

of listed company board representations which any

director may hold should not exceed six.

Board Performance (Principle 5)

Active participation and valuable contributions

are key to overall effectiveness of the board

Board evaluation process and performance criteria

The board believes that board performance is

ultimately reflected in the long-term performance

of the Group. In consultation with the NC, the

board assesses its performance annually to identify

key areas for improvement and requisite follow-up

actions. To provide feedback to aid in this

assessment, each director is required to complete

a questionnaire on the effectiveness of the board,

board committees and directorsí contribution and

performance. The evaluation considers factors such

as the size and composition of the board and board

committees, directorsí access to information, board

processes, communication with senior management

and accountability. The evaluation and feedback

are then consolidated and presented to the board

for discussion on areas of strengths and

weaknesses to improve the effectiveness of the

board and its committees.

Access to Information (Principle 6)

Directors have complete, adequate and

timely information and resources

Complete, adequate and timely information

The company recognises that directors should

be provided with complete, adequate and timely

information on an on-going basis and prior to

board meetings. This is to enable the board to

make informed decisions to discharge its duties

and to keep abreast of the Groupís operational and

financial performance, key issues, challenges and

opportunities. Sembcorpís management furnishes

adequate management and operation reports as well

as financial statements to the board on a regular

basis. Financial highlights of the Groupís performance

and key developments are presented on a quarterly

basis at board meetings. The Group President & CEO,

Group Chief Financial Officer and members of senior

management are present at these board meetings to

address any queries which the board may have.

As a general rule, board and board committee

papers are submitted to directors at least three

working days before each meeting so that they may

better understand the matters prior to the meeting

and discussions may be focused on questions that

the directors have on these matters. Members of

senior management who may provide insight into

the matters to be discussed are also called on to

be present during the relevant discussions.

The board has ready and independent

access to the Group President & CEO, senior

management, the Company Secretary and internal

and external auditors at all times to request for

additional information.

Company Secretary

The Company Secretary facilitates good

information flow between the board and its

committees and senior management, in addition

to attending to corporate secretarial matters such

as arranging orientation for newly-appointed

directors. In consultation with the Chairman

and the Group President & CEO, the Company

Secretary assists the board with the preparation

of meeting agendas, and administers, attends

and prepares minutes of board proceedings. She

also assists the board on the compliance of the

Group with the Memorandum and Articles of

Association and regulations, including requirements

of the Companies Act, Securities & Futures Act

and the SGX-ST. She liaises with the SGX-ST, the

Accounting and Corporate Regulatory Authority

and, when necessary, shareholders.

Independent professional advice

In the furtherance of its duties, the board exercises

its discretion to seek independent professional advice

at the companyís expense, if deemed necessary.

Procedures for Developing Remuneration

Policies (Principle 7)

Remuneration of directors adequate and

not excessive

With the assistance of the Executive Resource

& Compensation Committee (ERCC), the board

ensures that a formal and transparent procedure

for developing a policy on remuneration of

executives and directors is in place.

Executive Resource & Compensation Committee

The ERCC is chaired by Mr Ang, an independent

non-executive director, and is joined on the committee by Mr Goh and Mrs Lui.

The ERCC is responsible for developing,

reviewing and recommending to the board the

framework of remuneration for the board and

key management personnel. It assists the board

to ensure that competitive remuneration policies

and practices are in place. The ERCC also reviews

and recommends to the board the specific

remuneration packages for each director as well

as for key management personnel. The ERCCís

recommendations are submitted to the entire board

for endorsement. In its deliberations, the ERCC

takes into consideration industry practices and

norms of compensation. The Group President &

CEO does not attend discussions relating to his own

compensation, terms and conditions of service,

or the review of his performance. In addition,

no ERCC member or any director is involved in

deliberations in respect of any remuneration,

compensation, share-based incentives or any form

of benefits to be granted to himself.

The ERCC also establishes guidelines on share-based

incentives and other long-term incentive

plans and approves the grant of such incentives

to key management personnel. These incentives

serve to motivate executives to maximise operating

and financial performance and shareholder value,

and are aimed at aligning the interests of the key

management personnel with those of shareholders.

The ERCC has access to expert professional

advice on human resource matters whenever

there is a need for such external consultations.

In 2012, external consultants Carrots Consulting

and Mercer were engaged to provide such advice.

In engaging external consultants, the company

ensures that the relationship, if any, between

the company and its external consultants will not

affect the independence and objectivity of the

external consultants.

The ERCC reviews succession planning for key

management personnel in the Group and the

leadership pipeline for the organisation. It reviews

the development of senior staff and assesses their strengths and development needs based on the

Groupís leadership competencies framework, with

the aim of building talent and maintaining strong

and sound leadership for the Group. The ERCC

conducts a succession planning review of the

Group President & CEO, officers reporting directly

to him, as well as selected key positions in the

company on an annual basis. Potential internal and

external candidates for succession are reviewed for

different time horizons according to immediate,

medium-term and long-term needs. In addition, the

ERCC also reviews the companyís obligation arising

in the event of termination of the Group President

& CEO and key management personnelís contracts

of service to ensure that such contracts contain fair

and reasonable termination clauses.

Level and Mix of Remuneration (Principle 8)

Competitive reward system to ensure highest

performance and retention of directors and

key management personnel

Sembcorp believes that its remuneration and

reward system is aligned with the long-term

interest and risk policies of the company and that a

competitive remuneration and reward system based

on individual performance is important to attract,

retain and incentivise the best talents.

The Group President & CEO, as an executive

director, does not receive directorís fees from

Sembcorp. As a lead member of management, his

compensation consists of his salary, allowances,

bonuses and share-based incentives conditional

upon meeting certain performance targets. Details

on the share-based incentives and the performance

targets are available in the Directorsí Report and

Note 36 in the Notes to the Financial Statements.

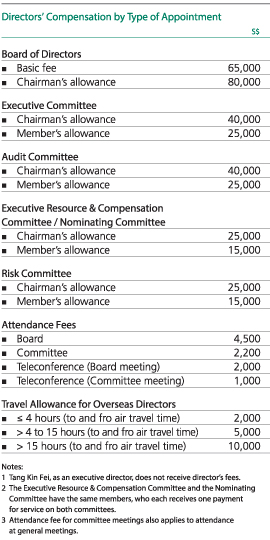

Non-executive directorsí fees

The directorsí fees payable to non-executive

directors are paid in cash and in the form of share

awards under the Sembcorp Industries Restricted

Share Plan 2010. The ERCC has determined that up

to 30% of the aggregate directorsí fees approved by shareholders for a particular financial year may

be paid out in the form of restricted share awards.

The directorsí cash fees and share awards will

only be paid and granted upon approval by

shareholders at the AGM of the company.

The following Directorsí Compensation

Framework is based on a scale of fees divided into

basic retainer fees, attendance fees, fees for service

on board committees and travel allowance:

For the year 2012, the share awards granted

under the Sembcorp Industries Restricted

Share Plan 2010 to all directors as part of their

directorsí fees (except for Mr Tang, who is the

Group President & CEO and does not receive

any directorsí fees) will consist of the grant of

fully paid shares outright with no performance

and vesting conditions attached, but with a selling

moratorium. Non-executive directors are required

to hold shares (including shares obtained by

other means) worth at least one-time the annual

base retainer (currently S$65,000); any excess

may be sold as desired. A non-executive director

can dispose of all of his shares one year after

leaving the board.

The actual number of shares to be awarded to

each non-executive director will be determined by

reference to the volume-weighted average price

of a share on the SGX-ST over the 14 trading days

immediately following the date of the AGM. The

number of shares to be awarded will be rounded

down to the nearest hundred and any residual

balance will be settled in cash.

The company does not have a retirement

remuneration plan for non-executive directors.

Key management personnelís remuneration

Key management personnel are rewarded based

on actual performance relative to pre-agreed

performance targets, which include financial and

non-financial performance indicators such as

economic value added (EVA), total shareholder

return and promoting and maintaining health,

safety and environmental standards. The Group

believes that the current reward systems are in line

with market norms and formulated to motivate

executives to give their best to the Group. Rewards

include long-term share-based incentives, which

would further ensure the retention of the most

talented and high-performing executives in the

Group. For further details on the share-based

incentives and performance targets, please refer

to the Directorsí Report and Note 36 in the Notes to the Financial Statements.

The Group has an incentive compensation

plan for key management personnel that is tied

to the creation of EVA, as well as to the

achievement of individual and Group performance

goals. A ďbonus bankĒ is used to hold incentive

compensation credited in any year. Typically, one-third

of the available balance in the bonus bank

is paid out in cash each year and the balance

two-thirds carried forward to the following year.

Such carried-forward balances of the bonus bank

may either be reduced or increased in future,

based on the yearly EVA performance of the

Group and its subsidiaries. There are provisions

in the EVA incentive plan to allow for forfeiture

of the outstanding bonus bank in exceptional

circumstances of misstatement of financial

results or misconduct resulting in financial loss

to the company.

In 2012, a pay-for-performance alignment

study was commissioned to review if the Groupís

executive pay programme is aligned with actual

business results and shareholder returns on

a relative basis against a pre-selected set of

comparator companies. The study shows that

there is strong alignment between the Groupís

executive pay programme and business results

and shareholder returns.

Disclosure on Remuneration (Principle 9)

The computation of non-executive directorsí

fees totalled S$1,198,842 in 2012, (2011:

S$1,280,613) comprising S$839,189 in cash

derived using the compensation structure above

and S$359,653 to be paid in the form of restricted

share awards under the Sembcorp Industries

Restricted Share Plan 2010. More information

on directors and key management personnelís

remuneration may be found under the related

item in the Supplementary Information section

of the Financial Statements.

Accountability (Principle 10)

The board is accountable to the shareholders

Sembcorp is committed to open and honest

communication with shareholders at all times.

The company presents a balanced and clear

assessment of the Groupís performance, position

and prospects to shareholders through the timely

release of its quarterly and annual financial

reports. The company believes that prompt

compliance with statutory reporting requirements

is imperative to maintaining shareholdersí

confidence and trust in the company. In line

with stock exchange requirements, negative

assurance statements were issued by the board

to accompany the companyís quarterly financial

results announcements, confirming that to the

best of its knowledge, nothing had come to its

attention which would render the companyís

quarterly results false or misleading.

Risk Management and Internal Controls

(Principle 11)

The board has overall responsibility for the

governance of risk of the Group. The board and

management of the company are fully committed

to maintaining sound risk management and

internal control systems to safeguard shareholdersí

interests and the Groupís assets.

The board also determines the companyís levels

of risk tolerance and risk policies, and oversees

management in the design, implementation and

monitoring of the risk management and internal

control systems.

Risk Committee

The Risk Committee (RC) assists the board in

overseeing risk management for the Group.

The RC is chaired by Mr Henkes and its other

members include Mr Chin and Tan Sri Mohd

Hassan Marican. The RCís main role is to appraise the adequacy and effectiveness of the Groupís

risk management plans, systems, processes and

procedures, group-wide risk policies, guidelines and

limits, as well as its risk portfolio, risk levels

and risk mitigation strategies.

Adequate and effective system of

internal controls

Sembcorp strives to maintain and improve its risk

management and internal control systems to ensure

that they remain sound and relevant. During the

year under review, the board was assured by the

Group President & CEO and Group Chief Financial

Officer that financial records have been properly

maintained and the financial statements give a

true and fair view of the companyís operations

and finances, and that the risk management and

internal control systems of the Group are adequate

and effective.

Based on the internal controls established

and maintained by the Group, work performed

by external and internal auditors, and reviews

performed by senior management, the board,

with the concurrence of the Audit Committee,

is of the opinion that the companyís internal

controls are adequate and effective in addressing

the financial, operational and compliance risks of

the company. Internal controls, because of their

inherent limitations, can provide reasonable but

not absolute assurance regarding the achievement

of their intended control objectives. In this regard,

the board will ensure that if any significant internal

control failings or weaknesses were to arise,

necessary remedial actions would be swiftly taken.

A dedicated Enterprise Risk Management

(ERM) function has been set up to facilitate the

implementation of the ERM framework. Through

this framework, risk capabilities and competencies

are continuously enhanced. The Group has

engaged KPMG Risk Consulting Services to

further assist in enhancing the ERM framework over the identification, prioritisation, assessment,

management and monitoring of key risks. The

risk management process in place covers, inter

alia, financial, operational and compliance risks

faced by the Group. The key risks identified are

deliberated by management, with the support of

the ERM function, and reported to the RC. The RC

reviews the adequacy and effectiveness of the ERM

programme and process against leading practices

in risk management and vis-ŗ-vis the external and

internal environment which the Group operates in.

Complementing the ERM programme is a group-wide

system of internal controls, which includes

the Code of Conduct, documented policies and

procedures, proper segregation of duties, approval

procedures and authorities, as well as checks-and-balances

built into the business processes. The

Group has also considered the various financial

risks, details of which can be found here.

For more information on the companyís

enterprise risk management system, please refer

to the Risk Management & Mitigation Strategies section of this annual report.

Audit Committee (Principle 12)

The Audit Committee (AC) comprises directors who

are both independent and non-executive. During

the year under review, the AC was chaired by Mr

Chin. The other members are Tan Sri Mohd Hassan

Marican and Mr Henkes.

Authority and duties of the AC

The AC assists the board in fulfilling its fiduciary

responsibilities relating to the internal controls,

audit, accounting and reporting practices of the

Group. Its main responsibilities are to review

the companyís policies and control procedures

with the external auditors, internal auditors

and management and act in the interest of the

shareholders in respect of interested person transactions as well as any matters or issues that

affect the financial performance of the Group.

The AC reviews the quarterly, half-yearly and full

year results announcements, accompanying press

releases and presentation slides as well as the

financial statements of the Group and company for

adequacy and accuracy of information disclosed

prior to submission to the board for approval.

The AC has explicit authority to investigate any

matter within its TOR and enjoys full access to and

co-operation from management to enable it to

discharge its function properly.

Where relevant, the AC is guided by the

recommended best practices for audit committees

as set out in the Guidebook for Audit Committees

issued by Singaporeís Audit Committee Guidance

Committee in October 2008.

External auditors

Each year, the AC reviews the independence

of the companyís external auditors and makes

recommendations to the board on the re-appointment

of the companyís external auditors.

The AC reviews and approves the external

audit plan to ensure the adequacy of audit scope.

It also reviews the external auditorsí management

letter and monitors the timely implementation

of the required corrective or improvement

measures. The AC meets the external and internal

auditors at least once a year without the presence

of management. The AC has reviewed the nature

and extent of non-audit services provided by

the external auditors to the Group for the year,

excluding services provided to Sembcorp Marine,

a listed subsidiary that has its own audit committee.

The AC is satisfied that the independence of

the external auditors has not been impaired by

their provision of non-audit services. Details of

non-audit fees payable to the external auditors

are found in Note 33(a) in the Notes to the

Financial Statements.

Whistle-blowing policy

The AC also oversees the Groupís whistle-blowing

policy implemented by the company to

strengthen corporate governance and ethical

business practices across the Group. Employees

are provided with accessible channels to the

Group Internal Audit department to report

suspected fraud, corruption, dishonest practices

or other misdemeanours. The aim of this policy is

to encourage the reporting of such matters in

good faith, with the confidence that employees

making such reports will, to the extent possible,

be protected from reprisal.

For more information on the whistle-blowing

policy, please click here.

Internal Audit (Principle 13)

Independent internal audit function

The Group Internal Audit department (GIA) is

an independent function of the Group. The AC

approves the hiring, termination, evaluation and

compensation of the Head of GIA, who reports

directly to the AC on audit matters and to the

Group President & CEO on administrative matters.

Adequacy of the internal audit function

The AC reviews the effectiveness of the internal

audit function on an annual basis, including the

adequacy of audit resources. GIA adopts a risk-based

methodology in defining its annual internal

audit plan, which is reviewed and approved by the

AC. GIA also assists the board and management

in the discharge of their corporate governance

responsibilities as well as in improving and

promoting effective and efficient business processes

within the Group. The internal audits performed

are aimed at ensuring that the Group maintains

a sound system of internal controls and that

the operations comply with the internal control

framework. Internal audit reports issued are

reviewed by the AC.

Professional standards and competency

GIA employs qualified staff and identifies and

provides training and development opportunities

for them so that their technical knowledge remains

current and relevant. GIA is guided by and has

met the standards for the professional practice

of internal audit promulgated by the Institute

of Internal Auditors (IIA). In 2012, an external

assessment of GIA was conducted and the results

affirmed that the internal audit activity generally

conformed to the standards set by IIA.

Shareholder Rights (Principle 14)

Sembcorp ensures that all shareholders are treated

fairly and equitably. The company recognises,

protects and facilitates the exercise of shareholdersí

rights and continually reviews and updates such

governance arrangements.

The company is committed to ensuring that all

shareholders have easy access to clear, reliable and

meaningful information in order to make informed

investment decisions. The company regularly

communicates major developments in its business

operations via SGXNET, press releases, circulars

to shareholders and other appropriate channels.

The company also encourages shareholder

participation and voting at general meetings

of shareholders.

Communication with Shareholders

(Principle 15)

Regular, effective and fair communication

with shareholders

Sembcorp is committed to upholding high

standards of corporate transparency and disclosure.

This commitment is embodied in the companyís

Investor Relations policy which adheres to fair

disclosure principles and emphasises active

dialogue and engagement with shareholders,

investors and analysts.

Disclosure of information on timely basis

Sembcorp makes every effort to ensure that

shareholders and all capital market players have

easy access to clear, meaningful and timely

information on the company in order to make

informed investment decisions. To do this, various

channels including announcements, press releases,

shareholder circulars and annual reports are

utilised. All price-sensitive and material information

are disseminated via SGXNET on a non-selective

basis and in a timely and consistent manner. The

companyís press releases are also uploaded on

the corporate website, www.sembcorp.com, after

dissemination on SGXNET.

The date of the release of quarterly results

is disclosed at least two weeks prior to the date

of announcement via SGXNET. On the day of

announcement, the financial statements as

well as the accompanying press release and

presentation slides are released via SGXNET

and on the company website. Thereafter, a

briefing or teleconference by management

is jointly held for the media and analysts. For

first half and full year results announcements,

results briefings are concurrently broadcast

live via webcast. Investor relations officers are

also available by email or telephone to answer

questions from shareholders, analysts and the

media as long as the information requested

does not conflict with the SGX-STís rules of

fair disclosure.

The company also maintains a dedicated

Investor Relations section on its corporate website

which caters to the specific information needs of

shareholders, investors, analysts and the financial

community. Designed to provide a convenient

location for investorsí information needs, the

site includes filings on the companyís results

announcements since the companyís listing in

1998, an archive of the companyís results briefings

webcasts, downloadable five-year financial data, a calendar of upcoming events as well as pertinent

stock information such as dividend history,

share price charts and analyst coverage. Investor

relations contact information is also displayed on

the website for direct shareholder enquiries.

Establishing and maintaining regular

dialogue with shareholders

Sembcorp employs multiple communication

platforms to engage with its shareholders. In

addition to its results briefings, the company also

maintains regular dialogue with its shareholders

through investor-targeted events such as AGMs,

roadshows, conferences, site visits, group briefings

as well as one-to-one meetings. These platforms

offer opportunities for senior management

and directors to interact first-hand with the

shareholders, understand their views, gather

feedback as well as address concerns.

To keep senior management and the board

abreast of market perception and concerns,

the Investor Relations team provides regular

updates on analyst consensus estimates and

views. On an annual basis, a more comprehensive

update is presented, which includes updates

and analysis of the shareholder register, highlights

of key shareholder engagements for the year

as well as market feedback.

For further details on Sembcorpís communications

with its shareholders, please see the Investor

Relations chapter of this annual report.

Dividend policy

Sembcorp is committed to achieving sustainable

income and growth to enhance total shareholder

return. The Groupís policy aims to balance

cash return to shareholders and investment for

sustaining growth, while aiming for an efficient

capital structure. The company strives to provide

consistent and sustainable ordinary dividend

payments to its shareholders on an annual basis.

Conduct of Shareholder Meetings (Principle 16)

Greater shareholder participation at

general meetings

All shareholders are invited to participate in the

companyís general meetings.

The company disseminates information on

general meetings through notices in the annual

reports or circulars. These notices are also released

via SGXNET, published in local newspapers as well

as posted on the company website ahead of the

meetings to give ample time for shareholders to

review the documents.

The companyís Articles of Association allow all

shareholders the right to appoint up to two proxies

to attend general meetings and vote on their behalf.

The company also allows Central Provident Fund

investors to attend general meetings as observers.

Voting in absentia by mail, facsimile or email

is currently not permitted as such voting methods

would need to be cautiously evaluated for

feasibility to ensure that there is no compromise

to the integrity of the information and the

authenticity of the shareholdersí identity.

At each AGM, the Group President & CEO

delivers a short presentation to shareholders to

update them on the performance of Sembcorpís

businesses. At general meetings, every matter

requiring approval is proposed as a separate

resolution. Shareholders present are given an

opportunity to clarify or direct questions on

issues pertaining to the proposed resolutions

before the resolutions are voted on. The board

and management are present to address these

questions and obtain feedback from shareholders.

The external auditors and legal advisors (if

necessary) are also present to assist the board.

To ensure greater transparency of the voting

process, the company conducts electronic poll

voting at the shareholder meetings for all the

resolutions to be put to vote to allow shareholders

present or represented at the meetings to vote

on a one share, one vote basis. The total number

of votes cast for or against each resolution is

announced after the meetings via SGXNET.

Minutes of shareholder meetings are available

upon request by shareholders.

The company has adopted a Code of Compliance

on Dealing in Securities, which prohibits dealings

in the companyís securities by its directors and

senior management within two weeks prior to

the announcement of the companyís financial

statements for each of the first three quarters

of its financial year and within one month prior

to the announcement of the companyís full year

financial statements. Directors and employees

are also expected to observe insider trading laws

at all times, even when dealing in the companyís

securities outside the prohibited trading period.

Shareholders have adopted an Interested Person

Transaction (IPT) Mandate in respect of interested

person transactions of the company. The IPT

Mandate defines the levels and procedures to

obtain approval for such transactions. Information

regarding the IPT Mandate is available on the

company website, www.sembcorp.com. All

business units are required to be familiar with

the IPT Mandate and report any interested person

transactions to the company. The Group maintains

a register of the companyís interested person

transactions in accordance with the reporting

requirements stipulated by Chapter 9 of the

SGX-ST Listing Manual. Information on interested

person transactions for 2012 may be found

in the related item under the Supplementary

Information section of the Financial Statements

in this annual report. |

|

|