|

|

|

Email this page / Email this page /  Bookmark this page / Bookmark this page /  Download print-friendly PDF Download print-friendly PDF |

| • |

Entered into a joint venture with Chengdu Hi-tech Investment Group Co to develop the Singapore-Sichuan Hi-tech Innovation Park in Chengdu’s Tianfu New City central business district. The groundbreaking ceremony took place in May 2012 |

| • |

Received the investment certificate issued by the People’s Committee of Quang Ngai Province to proceed with our fifth Vietnam Singapore Industrial Park (VSIP) project in Vietnam, VSIP Quang Ngai |

| • |

Signed a joint venture agreement with a wholly-owned subsidiary of P.T. Kawasan Industri Jababeka to develop an 860-hectare urban development in Kendal Regency, Central Java, Indonesia |

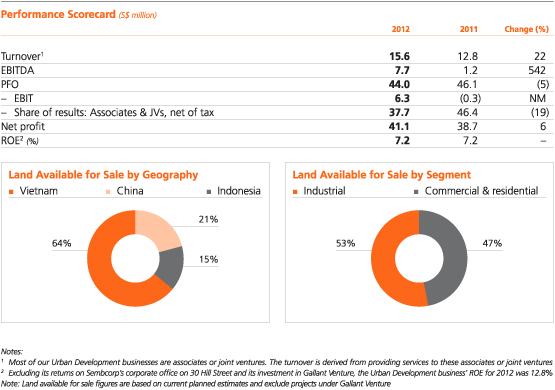

Our Urban Development business performed well in 2012. Net profit grew 6% from S$38.7 million to S$41.1 million while profit from operations (PFO) was S$44.0 million, compared to S$46.1 million in 2011. Land sales and rental income from built-to-suit factories boosted contribution from the Wuxi-Singapore Industrial Park (WSIP) and mitigated the lower land sales from the Vietnam Singapore Industrial Park (VSIP) projects.

The business sold a total of 158 hectares of land in Vietnam and China during the year compared to 226 hectares in 2011. Industrial land accounted for 98% of the land sold, while commercial and residential land accounted for the remaining 2%. Commercial and residential land sales slowed in 2012 due to bank lending restrictions for real estate development in Vietnam. In 2012, we received commitments for a further 167 hectares of land from customers, bringing our total land commitment to 236 hectares. These included commitments for 30 hectares of industrial, commercial and residential land in the new Nanjing and Chengdu projects in China, which we believe is a sign of renewed confidence in the Chinese economy.

During the year, we achieved major milestones in positioning the business for growth and expanding our development pipeline. We secured regulatory approvals for three projects in new beachheads, VSIP Quang Ngai in central Vietnam, Singapore-Sichuan Hi-tech Innovation Park in western

China and Kendal Industrial Park in Central Java, Indonesia. With these projects in key emerging markets, we increased our total gross project size in Vietnam, China and Indonesia by more than 40% to 10,257 hectares during the course of the year.

In 2012, Vietnam’s economy grew 5.1%, lower than the 5.9% growth achieved in the previous year and the government’s 2012 target of 6%. Economic growth continued to be weighed down by weaker external demand from major export markets as well as weakened domestic economy.

Against this backdrop, industrial land sales continued to do relatively well across Binh Duong, Bac Ninh and Hai Phong, achieving total land sales of 138 hectares. Commercial and residential land sales however, were impacted by domestic monetary policy as the Vietnamese government raised bank interest rates and restricted lending for real estate development in a bid to tackle double-digit inflation.

In southern Vietnam, our projects performed relatively well, with the first VSIP project in Thuan An district, which is almost fully sold, contributing steady recurring income from factory rentals and electricity distribution. Despite the weak business environment, 87 hectares of land were sold and 76 hectares have been committed by customers in our second 2,045-hectare VSIP in the New Binh Duong Township. Project take-up rate stood at 42% and 808 hectares of saleable land remained available as at end 2012. Meanwhile in northern Vietnam, land sales slowed considerably in the 700-hectare VSIP Bac Ninh despite land commitments as companies put investment decisions on hold due to banking restrictions. During the year, 17 hectares of land were sold and 42 hectares were committed by customers, bringing the land take-up rate to 65%. Another 157 hectares of land remained available for sale as at end 2012. Our VSIP project in Hai Phong city performed well. The project sold 36 hectares of land during the year, and had land commitments for another 18 hectares. Our projects in Vietnam continued to help drive investments into the country. Collectively, the VSIP projects have attracted more than US$5.5 billion in foreign direct investments.

In April 2012, we received the investment certificate issued by the People’s Committee of Quang Ngai Province to proceed with VSIP Quang Ngai – our fifth VSIP project in Vietnam. The US$337.8 million joint venture project comprises a 600-hectare industrial park located within the Dung Quat Economic Zone. Separately, a 520-hectare site has been earmarked for commercial and residential development near downtown Quang Ngai city. Detailed master plans for the industrial, commercial and residential zones are ongoing, and we expect to commence industrial land sales in 2013. With VSIP Quang Ngai, the total gross project size of our VSIP projects has increased 23% to 5,965 hectares.

During the year, we also entered into a 40:60 joint venture with VSIP Joint Venture Co to develop Gateway, our first residential project in Vietnam. Located within VSIP Binh Duong in Thuan An district, it is a mid-market residential project of about 163,807 square metres gross floor area, comprising 1,380 apartment units and amenities and will be developed in phases from 2013 onwards. Gateway is part of our efforts to develop projects that deliver an integrated urban work and living environment, enhancing the attractiveness of VSIP. Phase one will comprise two blocks of 250 apartment units.

China continued to be impacted by sluggish global demand and domestic challenges, which in turn affected potential customer investment decisions. Despite these, we made substantial progress in our China projects.

Our WSIP turned in a good performance with sales of 16 hectares of industrial land, as well as rental income from built-to-suit factories. The WSIP business model focuses on providing a recurring income base through factory space sales and rental. Currently it has a total factory built-up gross floor area of 570,000 square metres. We plan to secure more built-to-suit factories with long-term lease agreements to boost our recurring income base. During the year, we completed and handed over a 28,252-square metre factory to Epcos which has signed a 10-year long-term lease agreement for the premises. In terms of new lease agreements, we secured new customer Osram which will lease the 73,000-square metre initial phase factory for 20 years, as well as Muehlbauer which has signed an eight-year long-term lease agreement for its 11,000-square metre factory. The factories will be completed in 2013 and 2014 respectively. In the commercial and residential space, the business and technology park registered higher occupancy rates for phase one at 61% while the International Garden City apartment project sold 24 units and is now 94% taken up. In light of the weak property market, we have delayed the launch of Hongshan Mansion residential development to 2013.

Over at the Sino-Singapore Nanjing Eco Hi-tech Island, we secured two customers who committed to taking up a total of 15 hectares of land for residential development and three customers who took up 7.5 hectares for business use. Meanwhile, construction for the mixed-use development New One North is progressing well with the completion of the exhibition and office centre expected by mid-2014. Construction for the business park, commercial and residential areas will commence in 2013.

During the year, we signed the joint venture agreement with our Chinese partners for the Singapore-Sichuan Hi-tech Innovation Park project and also celebrated the project’s groundbreaking ceremony. Located within Chengdu’s Tianfu New City central business district, the 1,000-hectare park will be developed in phases with a start-up area of 300 hectares. The detailed design master plan has been completed and land preparation works on the site have commenced. Land sales are expected to commence in 2014.

To tap the growing investments in Central Java, we entered into a joint venture with a wholly-owned subsidiary of P.T. Kawasan Industri Jababeka, a publicly-listed company on the Jakarta Stock Exchange and one of the leading industrial estate developers in Indonesia. Sembcorp owns a 49% stake in the joint venture to co-develop the 860-hectare Kendal Industrial Park, which is located along the Jakarta-Semarang-Surabaya Economic Corridor in Kendal Regency, Central Java. We have received the investment licence to proceed with the project and are in the process of designing the conceptual master plan. We expect land sales for the project to commence in 2014.

The Urban Development business is expected to deliver better performance in 2013.

Gross Domestic Product (GDP) growth in Vietnam is expected to hit 5.7% in 2013 from 5.1% in 2012, while China’s economy is expected to rebound with a GDP growth forecast of 8.1% in 2013, from 7.8% in 2012. While government measures to stabilise the property markets in these countries may affect the pace of land sales in the short term, we continue to hold a long-term positive outlook for our business.

In Vietnam, we now have a total of five projects. Strategically located in the southern, central and northern economic zones, we are well-positioned to grow in tandem with industrialisation and urbanisation in the country. Our projects in China are also well-positioned for growth. Located in the key growth areas of Wuxi, Nanjing and Chengdu, we expect demand for industrial, commercial

and residential space to continue to be driven by urbanisation and the shift towards central-western China development. We also expect Central Java to experience heightened levels of economic activity as the province benefits from spillovers from investments in Jakarta.

The Urban Development business has built up a strong portfolio of projects totalling 10,257 hectares in gross project size in Vietnam, China and Indonesia. With continued urbanisation and industrialisation in these emerging markets, the demand for industrial, commercial and residential space is set to grow. We have an established track record in transforming raw land into large-scale urban developments, and the ability to extract further value from our landbank through selective commercial and residential development. With projects that provide the economic engine to drive investments into some of the world’s fastest developing markets, we believe that our Urban Development business is well-positioned for long-term growth.

|

|

|

|