|

|

|

Email this page / Email this page /  Bookmark this page / Bookmark this page /  Download print-friendly PDF Download print-friendly PDF |

| • |

Started full commercial operation of our US$1 billion Salalah Independent Water and Power Plant in Oman |

| • |

Commenced commercial operation of our newest and largest S$40 million industrial wastewater treatment facility

in the new growth area of Jurong Island in Singapore |

| • |

Officially opened our first woodchip-fuelled biomass steam production plant on Jurong Island in Singapore,

and announced further plans to grow our energy-from-waste capacity on Jurong Island |

| • |

Grew our renewable energy capabilities with the successful completion of our US$85.5 million acquisition of power

assets in China, which included four wind power assets |

| • |

Entered into a joint venture agreement to build, own and operate an industrial wastewater treatment plant in the

Qidong Lvsi Port Economic Development Zone in Jiangsu province, China |

| • |

Selected by the Fushun government to develop centralised utilities facilities in the Fushun Hi-tech Industrial Zone in Liaoning province, China |

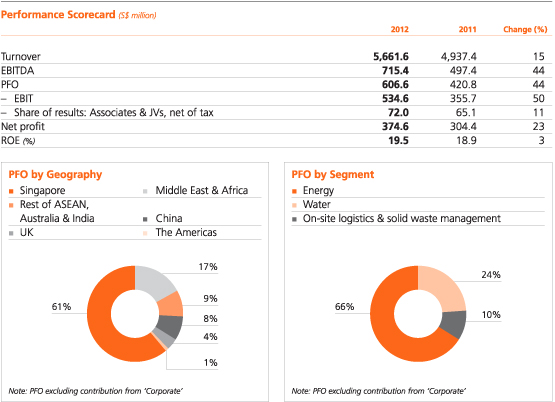

The Utilities business continued to deliver strong revenue and profit growth in 2012. Net profit increased 23% from S$304.4 million to S$374.6 million on the back of a 15% jump

in revenue from S$4.9 billion in 2011 to S$5.7 billion. Profit from operations (PFO) grew 44% from S$420.8 million to S$606.6 million, driven by strong growth from our Singapore and Middle East operations.

During the year in review, PFO from our Singapore operations increased 44%, contributing 61% of the business’ PFO. While our Singapore operations remained the largest contributor, our overseas operations in China, Vietnam, Australia and the Middle East also posted strong improvements in PFO. Our operations in the Middle East registered strong growth following the commencement of full commercial operation of our 60%-owned Salalah Independent Water and Power Plant (Salalah IWPP) in Oman in May 2012. Our operations in China also recorded growth, mainly due to our newly acquired power assets in the country. The acquisition has been accretive to earnings immediately following its completion in September 2012. In 2012, the Utilities business secured contracts from the industrial sector amounting to S$1.5 billion, primarily for gas supply, utilities and on-site logistics services.

We also made good headway in strengthening our capabilities in renewable energy. In Singapore, we officially opened our first energy-from-waste plant in April 2012 on Jurong Island, which will provide a sustainable and economical source of steam supply to our customers. We also announced plans to further grow our energy-from-waste capacity in the country. In China, we added wind energy to our global renewable energy portfolio with a US$85.5 million acquisition of power assets, including a 49% stake in four wind power assets in Inner Mongolia and Hebei. These wind power assets will provide a platform to accelerate our growth in the renewable energy sector and in China, the largest wind power market in the world. With these strategic investments, our renewable energy capacity in operation and under development now accounts for approximately 5% of our total power portfolio.

In January 2013, we successfully completed the squeeze-out proceedings for Sembcorp Utilities (Netherlands), formerly known as Cascal, under the Dutch Civil Code in the Netherlands. With this, Sembcorp now owns 100% of the shareholding in the company, completing our acquisition of Cascal whose operations have already been integrated into the Group since July 2010.

Despite our cogeneration plant’s planned major maintenance, PFO from our Singapore operations grew 44% to S$373.4 million, from S$258.6 million in 2011. The growth was driven primarily by additional gas sales following the delivery of a further 90 billion British thermal units per day

of natural gas imported from Indonesia’s West Natuna Sea, which started in November 2011. With this second gas sales agreement, we supply a total of 431 billion British thermal units per day of natural gas, an increase of 26%. During the year in review, our Singapore operations secured contracts totalling S$1.2 billion, laying the foundation for sustainable long-term growth.

On Jurong Island, we commenced commercial operation of our newest and largest industrial wastewater treatment plant. With a capacity of 9,600 cubic metres per day, the S$40 million plant doubled our industrial wastewater treatment capacity in Singapore. We also started providing industrial wastewater treatment services to German specialty chemicals company LANXESS’ butyl rubber facility in August 2012. The industrial wastewater treatment plant is part of our upcoming S$960 million cluster of facilities to serve companies setting up operations in the new growth areas of Jurong Island, namely Banyan, Angsana and Tembusu. The facilities also comprise a combined cycle gas turbine cogeneration plant that can produce 400 megawatts of power and 200 tonnes per hour of process steam, and a multi-utilities centre that will provide the integrated supply of steam, water, industrial water and wastewater treatment services, cooling water and other services. Both the cogeneration plant and multi-utilities centre are expected to be completed in December 2013. At the same time, we will extend our service corridor network to connect customers in the new growth areas and the rest of Jurong Island.

To achieve further improvements in efficiency, cost and environmental sustainability, we will develop a new technology and innovation centre, which will be located at the same site as our upcoming cogeneration plant. The centre will house our researchers and engineers who will develop and integrate innovative processes and run test-beds for emerging technologies relevant to the Utilities business.

Our latest woodchip-fuelled biomass steam production plant on Jurong Island marked a step forward in our strategy to grow our renewable energy capabilities. The new S$34 million plant produces 20 tonnes per hour of process steam, using waste wood collected and processed by our solid waste management business. Leveraging our capabilities in our solid waste management and energy businesses, the plant uses recovered waste wood to provide an alternative economical source of energy for our customers, while reducing greenhouse gas emissions. We are in the midst of expanding capacity by another 40 tonnes per hour of steam with the construction of a second boiler, scheduled for completion in June 2013. Together, both boilers will produce 60 tonnes per hour of steam and reduce carbon dioxide emissions by an estimated 70,000 tonnes a year.

Our plans to expand our energy-from-waste capacity on Jurong Island will help to enhance the island’s competitiveness to remain an attractive location to investors. In addition, by recovering waste meant for incineration at a fee and processing it into a resource, our energy-from-waste plants not only convert a cost into revenue, but also provide our customers with an alternative economical source of energy, thereby enhancing Sembcorp’s competitiveness at the same time.

The region registered a marked improvement, with PFO growing 50% to S$51.4 million from S$34.2 million in 2011. The increase in PFO was due to higher contribution from our solid waste management business in Australia, which recognised one-off costs relating to its acquisition of WSN Environmental Solutions in 2011 and higher electricity output from our power plant in Vietnam.

In Vietnam, we were granted an in-principle approval by the People’s Committee of Quang Ngai Province to explore the feasibility of developing a 1,200-megawatt coal-fired power plant in Dung Quat Economic Zone, located in central Vietnam’s Quang Ngai province. Dung Quat Economic Zone has been earmarked by the Vietnamese government to become a multi-sectorial economic zone and a base for oil refining and petrochemical industries. The development of this power project was explored in conjunction with our Urban Development business, which was then exploring the feasibility of developing its fifth integrated township and industrial park in Quang Ngai province. This project demonstrates the synergy between our businesses and our ability to offer integrated solutions as a Group – in addition to providing a world-class urban development, we are also able to supply essential power to the province.

The construction of our first power plant in India – a 1,320-megawatt coal-fired power plant in Krishnapatnam, Nellore District, Andhra Pradesh – is 65% completed and is on track to be completed in the second half of 2014. The plant will utilise supercritical technology that allows for enhanced efficiency, thereby reducing emissions of carbon dioxide and other pollutants by consuming less fuel per unit of electricity generated. We also made good progress in securing a portion of the plant’s fuel supply. We sealed an agreement with PT Bayan Resources to supply approximately one million tonnes per year of coal at a competitive rate for 10 years, and finalised a shipping agreement with NYK of Japan for the same tranche of coal. We remain focused on the execution of this project and will make every effort to ensure its successful completion and delivery.

Our operations in China recorded a PFO growth of 14% to S$46.8 million in 2012, due to the four months earnings contribution from our newly acquired assets. The acquisition was completed in September 2012. Performance from our existing industrial and municipal water operations in China, together with our Shanghai cogeneration plant, was comparable to last year’s.

We completed a strategic acquisition in China during the year, which gave us our first foothold in China’s renewable energy sector. The acquisition of power assets comprised a 49% stake in four wind power assets in Inner Mongolia and Hebei that have a total gross power capacity of 248 megawatts, as well as a 25% stake in a co-operative joint venture for a 2,100-megawatt coal-fired power plant in Shanxi. The co-operative joint venture will expire in 2016. The acquisition from The AES Corporation was a strategic move to strengthen Sembcorp’s global energy portfolio and accelerate our growth in the renewable energy sector. Our new wind power assets will also enable us to support the Chinese government’s goal to reduce reliance on fossil fuels. China’s twelfth Five-Year Plan aims to lift the contribution from non-fossil fuels including renewable energy to 15% of China’s energy mix by 2020, from 8% in 2010. In addition, our wind power assets will give us a foothold to tap opportunities in China, the largest wind power market in the world.

In Jiangsu province, we entered into a joint venture agreement with Jiangsu Province Lvsi Coastal Economic Zone Development & Construction Co to build, own and operate an industrial wastewater treatment plant in Qidong Lvsi Port Economic Development Zone (Qidong Lvsi EDZ) – Jiangsu’s new petrochemical industrial zone. With an investment of RMB80 million, the plant will be 95% owned by Sembcorp. It will have a design capacity of 10,000 cubic metres per day and capable of treating multiple streams of high concentration industrial wastewater. As part of the agreement, Sembcorp will be the exclusive provider of industrial wastewater treatment services within the Petrochemical & New Materials Industrial Park, a 12-square kilometre park within the Qidong Lvsi EDZ, upon completion of the plant by the second half of 2014. We have also secured a 15-year contract to provide industrial wastewater treatment services to anchor customer, state-owned China National Chemical Engineering Group.

In Liaoning province, our plans are underway to develop centralised utilities facilities in the Fushun Petrochemical and Fine Chemical Park. This project represents a significant milestone as we expand our centralised utilities business in China. Our RMB326.6 million investment will comprise a service corridor network, as well as facilities for industrial wastewater treatment and industrial water and firewater supply. We have been granted exclusivity as the provider of the service corridor network and water supply in the chemical park, which is slated to be the largest integrated refining and petrochemical base in northeastern China. As the first phase, we developed a three-kilometre service corridor network, which was completed in January 2013. At the same time, we acquired a portfolio of existing water assets from the local government and will develop a 3.6-kilometre water pipeline and a new industrial water treatment plant with an initial capacity of 22,500 cubic metres per day in 2013.

With these strategic developments, our Utilities business has an established presence with 22 operations across 11 provinces in China, further strengthening our reputation as an established energy and water player.

PFO from the Middle East and Africa increased 213% from S$32.9 million to S$103.0 million due to contribution from our Salalah IWPP. The facility commenced full commercial operation in May 2012, following the successful completion of acceptance tests.

Salalah IWPP, which consists of a gas-fired power plant and a seawater desalination plant, provides 445 megawatts of power and 15 million imperial gallons per day (MiGD) of water to the government-owned Oman Power and Water Procurement Company under a 15-year contract. Salalah IWPP is the largest and most energy-efficient power and water plant in Dhofar in southern Oman and is our second project in the Middle East.

Our first Middle East plant, Fujairah 1 Independent Water and Power Plant (Fujairah 1 IWPP) in the United Arab Emirates (UAE), is one of the world’s largest operating hybrid desalination plants. It continues to deliver good operating performance, underpinned by its long-term purchase agreement with Abu Dhabi Water & Electricity Company (ADWEC). In January 2013, we announced the expansion of Fujairah 1 IWPP’s seawater desalination capacity by 30 MiGD. The expansion will boost Sembcorp’s total seawater desalination capacity in the UAE from 100 MiGD to 130 MiGD. Targeted for completion in the first half of 2015, the US$200 million expansion will make the Fujairah 1 IWPP the largest reverse osmosis desalination facility in the Middle East. We have also signed a 20-year water purchase agreement with ADWEC for this additional 30 MiGD water output.

Together, our two plants in the Middle East will generate a total of 1,383 megawatts of power and 145 MiGD of water, playing a key role in helping to address the region’s pressing power and water needs.

As a testament to the high quality of water and service we provide to our customers, both our South African municipal water operations have been accredited with the prestigious Blue Drop award, with Sembcorp Silulumanzi achieving platinum status for winning the Blue Drop award for three consecutive years.

PFO from our UK operations declined 45% to S$24.8 million in 2012 due to lower contributions from our Teesside operations, which continues to face a challenging operating environment with low power spreads and carbon prices. Our earnings were also impacted by an extended maintenance shutdown of our 35-megawatt biomass power plant.

Our municipal water operations in Bournemouth continued to perform well during the year. New tariffs were implemented in April 2012, according to the five-year schedule set in the 2010 tariff review with the UK water services regulator, Ofwat.

PFO from our operations in the Americas, comprising Chile, Panama and the Caribbean, declined 12% to S$8.9 million due to a one-off adjustment in 2011 from the change in accounting treatment for a service concession arrangement in Chile. Excluding the one-off item, our operations delivered a steady performance, comparable to last year’s.

The global economy in 2013 is expected to remain fragile, according to the World Bank. The global economy is projected to grow at a relatively weak 2.4% in 2013, comparable to 2.3% in 2012. Developing economies, which have been the main driver of global growth, are estimated to grow by 5.5% in 2013 while high-income countries are forecasted to expand by 1.3%.

In Singapore, the Ministry of Trade and Industry is forecasting Singapore’s economy to grow between 1% and 3% in 2013, from 1.3% in 2012. Electricity demand is expected to grow in tandem with economic growth. On the supply side, over 2,400 megawatts of new generation capacity, including the 400 megawatts from our new cogeneration plant, will gradually come onstream over the next few years, starting from 2013. In addition, the completion of Singapore’s liquefied natural gas (LNG) terminal in the second quarter of 2013 will bring about a greater supply of natural gas via the arrival of LNG imports. The increase in generation capacity and gas supply is expected to intensify competition and may impact the performance of our Singapore operations.

Meanwhile, over in Europe, the EU Emissions Trading Scheme transitioned into phase three at the start of 2013. With a stricter carbon regime, our operations in Teesside, UK, will no longer be able to benefit from the sale of excess carbon credits. The new carbon regime as well as a proposed UK carbon tax will also reduce the competitiveness of our coal-fired assets.

Nevertheless, we have strong platforms in place for long-term growth. In Singapore, our upcoming projects in the new growth areas of Jurong Island, namely our multi-utilities centre and cogeneration plant, are on track for completion in end 2013. Our second woodchip boiler is also expected to be completed in June 2013, which will further enhance our competitiveness by lowering our cost of steam production. Beyond 2013, our Indian coal-fired power plant will commence operation in the second half of 2014, while the expansion of our seawater desalination capacity in Fujairah will be completed in 2015, adding 1,320 megawatts and 30 MiGD respectively to our power and water capacity in operation.

We continue to keep our focus on Singapore, where long-term prospects for Jurong Island remain positive with several petrochemical and chemical companies announcing plans to expand their investments. These include Shell, which announced the expansion of its 800,000 tonnes per annum upstream ethylene cracker by over 20%. We will continue to grow in tandem with

demand in Singapore. At the same time, our future initiatives will aim at lowering costs while increasing efficiency, thereby increasing our competitiveness and helping our customers stay competitive. Our energy-from-waste solution is one such example.

Looking ahead, we will continue to explore opportunities for growth particularly in our target emerging markets, where we have been extending our footprint. We believe that rapid urbanisation and industrialisation in these markets will drive demand for our solutions.

With our long-term contracts and strong operational performance, our Utilities business will remain focused on the execution of our pipeline of projects and the pursuit of new growth opportunities to deliver long-term growth.

|

|

|

|