In the context of constantly evolving requirements

of disclosure, transparency and corporate

governance, we aim to provide investors with

an accurate, coherent and balanced account of

the Group’s performance. To do this, multiple

communication platforms are utilised including

group briefings to analysts, investors and the

media; one-on-one meetings with shareholders

and potential investors; investor roadshows and the

investor relations section of our corporate website.

In addition, company visits and facility tours are

organised to help investors gain better insight

into the Group’s operations.

During the year, senior management and the

investor relations team continued to actively

maintain open communication channels with the

financial community. We held over 160 one-on-one

and group meetings with shareholders, analysts

and potential investors. These included non-deal

roadshows in major international financial centres.

In Asia, we covered Singapore and Hong Kong; in

Europe, Frankfurt, London, Geneva and Zurich; and

in North America, New York, Boston and Toronto.

We also participated in five investor conferences

in Singapore during the year: the Deutsche Bank

Access Asia Conference, HSBC Annual ASEAN

Conference and CIMB ASEAN Series in May,

the CLSA ASEAN Access Day in June, and the

Macquarie ASEAN Conference in August. We

also organised site visits to our Utilities operations

on Jurong Island to provide analysts and investors

a better understanding of our capabilities in

energy and water.

In June 2012, our Group President & CEO Tang

Kin Fei was ranked third for Best CEO and our Group

CFO Koh Chiap Khiong was ranked second for Best

CFO in Institutional Investor magazine’s 2012 All-Asia Executive Team. They were both nominated by

buy-side portfolio managers and analysts under the

conglomerates sector. The All-Asia Executive Team

is a survey that identifies the top CEOs, CFOs and

investor relations professionals and teams in Asia

(ex-Japan) in relation to the quality of a company’s

investor relations programme.

In terms of corporate governance and

sustainability, Sembcorp improved its ranking from

eleventh to fourth in Singapore’s Governance

and Transparency Index 2012. Jointly launched

by The Business Times and the NUS Business

School’s Centre for Governance, Institutions and

Organisations, the index assesses the transparency

of 674 listed companies’ financial disclosures as

well as governance, ethics and rigour in financial

reporting. In addition, Sembcorp was again

selected as an index component of the Dow Jones

Sustainability Index (DJSI) Asia Pacific, for the

second year running. The index represents the top

20% in terms of sustainability out of the largest

600 companies in the developed Asia Pacific region.

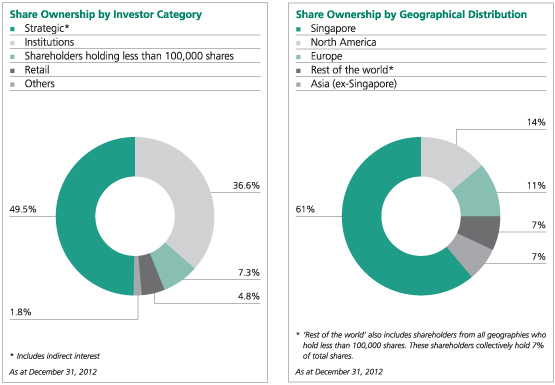

Sembcorp Industries’ share price closed the year at

S$5.25 with a market capitalisation of S$9.4 billion.

The company’s share price averaged S$5.16 during

the year, registering a low of S$4.11 on January 5,

2012 and a high of S$5.76 on October 2, 2012.

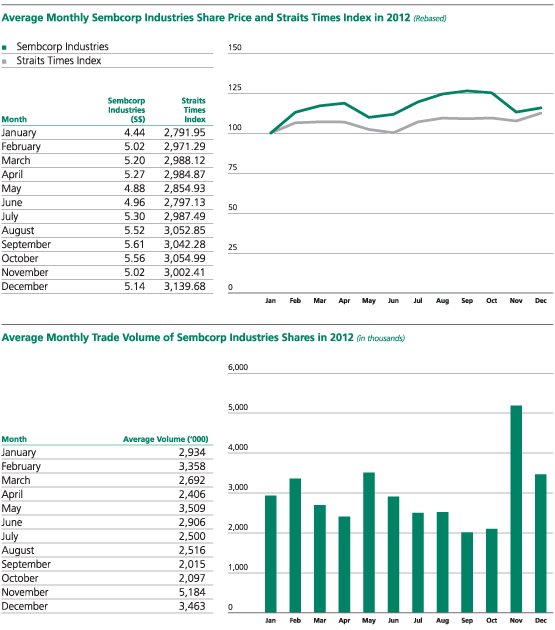

Daily turnover in 2012 averaged 3.0 million shares.

In May 2012, we paid out a final tax exempt

one-tier dividend of 17 cents per ordinary share, comprising a final ordinary dividend of 15 cents

per ordinary share and a final bonus dividend of

2 cents per ordinary share. For the year, Sembcorp

Industries shares delivered a total shareholder

return of 30%, outperforming the Straits Times

Index’s 21% and MSCI Asia Pacific ex-Japan

Industrial Index’s 9%.

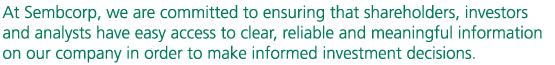

In 2012, other than our major shareholder Temasek

Holdings, which held 49.5% of our shares as at the

end of 2012, institutional shareholders as a group

continued to dominate Sembcorp’s shareholder base.

Institutional shareholders accounted for

36.6% of our issued share capital or 72.4% of free

float. Retail shareholders, shareholders holding

less than 100,000 shares, and others held the

remaining 13.9% of issued share capital or 27.6%

of free float. In terms of geographical breakdown,

excluding the stake held by Temasek Holdings,

Singapore shareholders accounted for 11% of

issued share capital. Our largest geographical

shareholding base was North America with 14%

of issued share capital. Shareholders from Europe

and Asia excluding Singapore accounted for 11%

and 7% of issued share capital respectively.

|