|

|

|

Email this page / Email this page /  Bookmark this page / Bookmark this page /  Download print-friendly PDF Download print-friendly PDF |

| • |

Record net orderbook of S$13.6 billion as at February 2013, with completions and deliveries till 2019 |

| • |

Record S$11.0 billion of new orders secured in 2012, surpassing the previous high of S$5.7 billion in 2008 |

| • |

Strategically expanded into the drillship market with seven drillship order wins worth over US$5.6 billion |

| • |

Acquired a 34.5-hectare site for the second phase of the 206-hectare Integrated New Yard Facility located at Singapore’s Tuas View Extension |

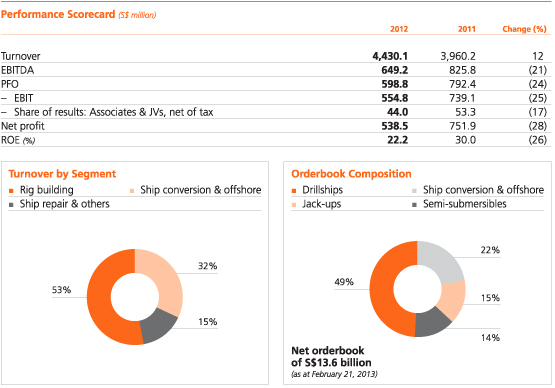

Sembcorp Marine’s turnover increased 12% from S$4.0 billion in 2011 to S$4.4 billion in 2012 due to higher revenue recognition for rig building and offshore platform projects.

Profit from operations (PFO) was S$598.8 million compared to S$792.4 million in 2011, while operating margin was 12.5% compared to 18.6% in 2011. The decline in operating profit

was due to lower margin from new design rigs and resumption of margin on completion and delivery of the Songa Eclipse semi-submersible rig in 2011.

The business’ net profit in 2012 stood at S$538.5 million, compared to S$751.9 million in 2011. Return on equity was 22%, compared to 30% last year.

During the year in review, the business secured contract orders worth S$11.0 billion, growing the net orderbook from S$5.1 billion as at end 2011 to a record high of S$13.6 billion as at February 21, 2013, with completion and deliveries extending till 2019. This included over US$5.6 billion worth of orders for seven drillships from Sete Brasil. This is part of our new product offering that will enable us to deliver complete solutions in the ultra-deepwater segment and strengthen our position in this fast-growing market.

We also made good progress in the construction of our new integrated shipyards in Brazil and Singapore during the year. Our new yards will enhance our competitiveness as we expand our capacity to offer a one-stop solution to our customers in some of the world’s fastest growing oil and gas markets.

In 2012, we also acquired a 20% equity interest in Singapore-based research and development company Ecospec Global Technology to strengthen our regulatory-compliant environmental solutions to ship owners. In addition, we established our first footprint in the UK through the acquisition of a 70% stake in UK-based SLP Engineering (now Sembmarine SLP), which will allow us to provide synergistic support to our North Sea clientele.

In December 2012, a jack-up rig under construction at our Marine business’ Jurong Shipyard in Singapore tilted. At the time of the incident, the company acted quickly, successfully evacuating all workers off the rig in around 20 minutes and ensuring all were accounted for within an hour. In mid-January 2013, the tilted rig was successfully restored to its original upright position, and this was followed by the resumption of work on the rig at the end of the month. There were no fatalities or serious injuries. Safety is of the utmost importance to us, and we are fully committed to strengthening our businesses’ safety provisions and ability to respond to emergencies.

Turnover for the ship repair segment was S$641.7 million or 14% of our Marine business’ revenue in 2012, comparable to S$643.9 million in 2011. A total of 337 vessels docked at our yards in 2012 compared to 264 vessels in 2011, while the average value per vessel was S$1.9 million, compared to S$2.4 million in 2011. Long-term strategic alliance customers continued to provide a steady and growing base-load. Together with our regular repeat customers, they contributed 82% of our total ship repair revenue in 2012. High value repairs to liquefied natural gas (LNG) and liquefied petroleum gas (LPG) tankers, oil tankers, passenger ships and upgrading of drillships and floating production storage and offloading (FPSO) vessels continue to dominate the segment.

During the year, we secured three ship repair contracts totalling S$130 million for floating storage and offloading (FSO) vessel repair and upgrading, as well as LNG carriers’ life extensions. This reinforced our reputation as a world-leading shipyard for ship repair and specialised offshore and LNG carriers upgrading. At the same time, we were also awarded a new favoured customer contract to provide ship repair, revitalisation, upgrading and related marine services for Royal Caribbean’s fleet of cruise ships.

Turnover from ship conversion and offshore grew 30% to S$1.4 billion from S$1.1 billion in 2011. The segment contributed 32% of the Marine business’ total revenue. As a leading provider for the conversion of FPSO systems and the turnkey engineering and construction of offshore platforms, we completed and delivered four projects during the year, including Seven Borealis, the world’s largest heavy lift crane carrier, and Nusantara Regas Satu, Asia’s first floating storage and regasification unit (FSRU).

During the year, we secured a US$63 million contract for the engineering and construction of two wellhead platforms for Premier Oil Natuna Sea BV and a US$674 million contract from a Petrobras majority-owned consortium for the construction of eight modules and module integration works for two units of FPSO. Work for this project will be undertaken in our wholly-owned Brazil shipyard, Estaleiro Jurong Aracruz.

Turnover from the rig building segment, which contributed 53% of our Marine business’ total turnover, stood at S$2.4 billion, representing a growth of 7% compared to 2011’s turnover of S$2.2 billion.

During the year, we delivered two jack-up rigs and two semi-submersible rigs.

A total of 15 new contracts worth US$7.9 billion were secured in 2012, including seven drillship orders worth over US$5.6 billion from Sete Brasil, five units of Pacific Class 400 jack-up rigs for various customers, a US$385.5 million semi-submersible well intervention rig from Helix Energy Solutions, a US$568 million harsh-environment semi-submersible rig from North Atlantic Drilling and a second unit of the harsh-environment accommodation semi-submersible rig worth US$295.2 million from Prosafe.

In 2012, we secured a total of seven orders worth US$5.6 billion from Sete Brasil for the design and construction of seven drillships based on our proprietary Jurong Espadon drillship design.

The strategic expansion of our product offering to cover the drillship market will enable us to deliver a complete solution in the ultra-deepwater segment, strengthening our leadership in the growing market for ultra-deepwater solutions. Our proprietary Jurong Espadon drillship design represents the next generation of high specification drillships with advanced capabilities for operational efficiency and ultra-deepwater operations worldwide. The drillships will be capable of operating at water depths of 10,000 feet and drilling to depths of 40,000 feet, with accommodation facilities for a crew of 180 personnel.

The seven drillship orders not only position us as a reputable builder of drillships, but also provide the momentum for us to accelerate our shipbuilding programme at our new Brazil shipyard, Estaleiro Jurong Aracruz.

Scheduled for deliveries between the second quarter of 2015 and fourth quarter of 2019, the vessels are among the first in a series of drillships to be built in Brazil to cater to the oil and gas discoveries in the offshore giant pre-salt fields of Espirito Santo. On delivery, all seven drillships will be chartered to Petrobras for 15 years.

We continue to make good progress in positioning the business for sustainable growth in the long term. Apart from expanding our product offering to include drillships and harsh-environment accommodation rigs, which will enable us to strengthen our position in the fast-growing ultra-deepwater segment, we are also augmenting our global network of shipyards which will give us a strategic presence in some of the world’s fastest growing oil and gas markets.

In Singapore, the 73.3-hectare first phase of our Integrated New Yard Facility at Tuas View Extension is on track to commence operation in the second half of 2013. It will feature four very large crude carrier (VLCC) drydocks with a total capacity of 1.55 million deadweight tonnes and quays of more than three kilometres. With these state-of-the-art facilities and equipment, it is well-equipped to serve a wide range of vessels including new generations of mega containerships, VLCCs, LNG carriers and passenger ships.

With the first phase nearing completion, we kick-started the development of the second phase with the acquisition of a 34.5-hectare site. Located adjacent to the first phase development, the second phase of the new yard will be developed in stages over a period of four to five years.

When fully completed, the entire shipyard, which will be built in phases over an estimated period of 16 years, will span 206 hectares. Designed as a centralised and integrated “one-stop solutions” hub for ship repair and conversion, shipbuilding, rig building and offshore engineering and construction, it is Singapore’s first purpose-built, custom-designed integrated yard facility, which will further reinforce our competitive edge.

Meanwhile in Brazil, construction of our wholly-owned Estaleiro Jurong Aracruz, our first overseas Integrated New Yard Facility, is progressing well. Situated on an 82.5-hectare site with 1.6 kilometres of coastline, Estaleiro Jurong Aracruz is strategically located in close proximity to the rich oil and gas basin of Espirito Santo, one of Brazil’s giant pre-salt reservoirs. The Integrated New Yard Facility is well-positioned to serve Brazil’s vibrant offshore and marine sector with wide-ranging capabilities in the construction of drilling rigs, FPSO integration, topside modules fabrication, and the repair and upgrading of ships and rigs. It will also be equipped with a one-kilometre berthing quay, a drydock and ancillary piping facilities and steel fabrication workshops. Targeted for full completion by end 2014, the shipyard is poised to further strengthen our foothold in the country. Contracts secured in 2012 that will be undertaken by the yard include the drillships for Sete Brasil and the fabrication and integration works for the Petrobras FPSO vessels P-68 and P-71.

In India, construction of our 40%-owned integrated yard, Sembmarine Kakinada, was completed and the yard commenced commercial operation in January 2013. Strategically located in the east coast of India, the yard offers ship owners and offshore operators a one-stop integrated marine and offshore service facility for the repairs and servicing of offshore vessels and ships, newbuilds, oil and gas riser and equipment repairs as well as platforms and modules fabrication. The joint venture, which is operated and managed by our Marine business under a 10-year technical management and services agreement, is in line with our strategy to establish and grow a hub in India

to cater to the growing needs of our customers operating in India and South Asia.

Our Marine business has a net orderbook of S$13.6 billion with completion and deliveries stretching into 2019. This includes S$11.0 billion in contract orders secured in 2012 and a

S$900 million contract secured since the start of 2013, excluding ship repair contracts. Moving ahead, the business remains focused on operational efficiency, productivity improvements, safety management and the timely deliveries of these record orders to our customers.

Amidst the fragile global economic environment, the long-term industry fundamentals for the offshore oil and gas sector remain sound, underpinned by high oil prices and projected increases in offshore exploration and production spending. Demand for rigs is expected to

remain strong given the aging rig fleet and the increasing focus by oil companies for new, safer and efficient rigs and rigs capable of operating in harsh environment.

There is continued demand for repair, upgrading and life extension work, in particular in the niche segments of LNG carriers, passenger / cruise vessels and offshore vessels. Demand for the business’ big docks remains strong as the alliance and long-term customers continue to provide a stable and steady base-load.

Our Marine business continues to receive healthy enquiries for the various segments although competition remains keen with effects on margin.

|

|

|