El: exceptional items, m: million

1 Following the completion of the distribution in specie of ordinary shares in the capital of Sembcorp Marine Limited to Sembcorp Industries shareholders (the Distribution), the performance of the Marine business for the period from January 1, 2020 to September 11, 2020 is reported under discontinued operation

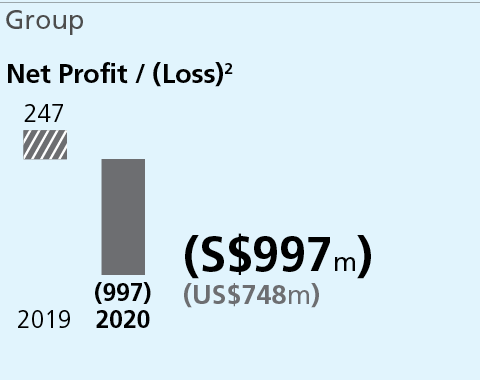

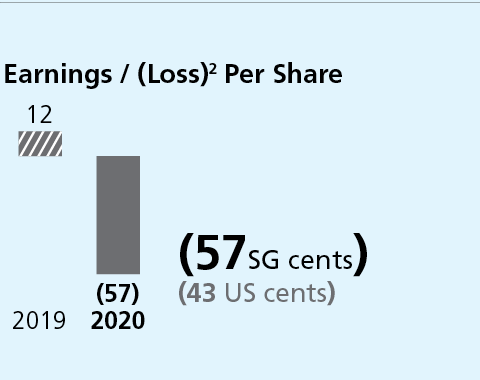

2 Includes a non-cash, non-recurring fair value loss of S$970 million recorded following the completion of the Distribution and net loss from the discontinued Marine business

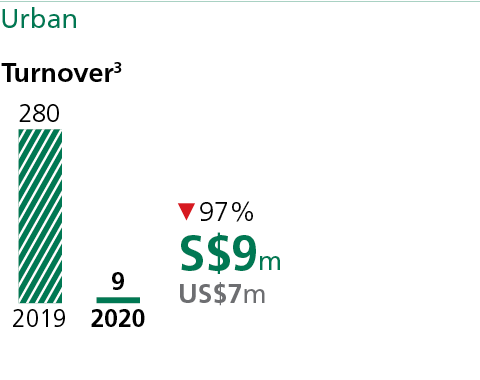

3 Most of our Urban businesses are associates or joint ventures. Turnover reflects payment for services provided to these associates or joint ventures. For 2019, turnover included recognition from the sale of Riverside Grandeur in Nanjing, China, a residential development wholly-owned by Sembcorp

Dear Shareholders,

2020 was a year of immense challenge and profound change. Nations, companies and individuals struggled to cope with the impact of the global coronavirus (COVID-19) pandemic. Meanwhile, disruption to the energy sector continued to gain pace.

In some ways, this unprecedented change mirrored Sembcorp’s own. We started a new chapter in our history, by ushering in new leadership and completing the landmark demerger between Sembcorp Industries and Sembcorp Marine.

Amid extraordinary times, the global Sembcorp team responded with exceptional commitment and character. They were ready on the frontlines to deliver reliable essential services, which continued with no disruption. They rallied together to support communities hard hit by the COVID-19 pandemic and also scored wins for the business in a difficult year. We salute them.

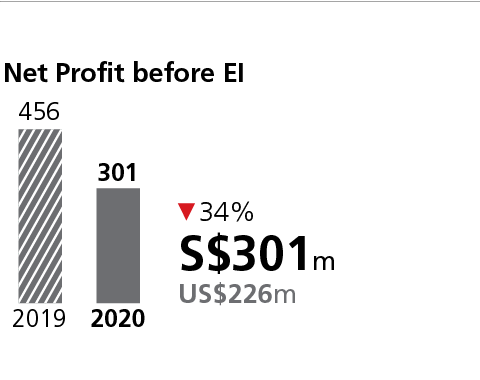

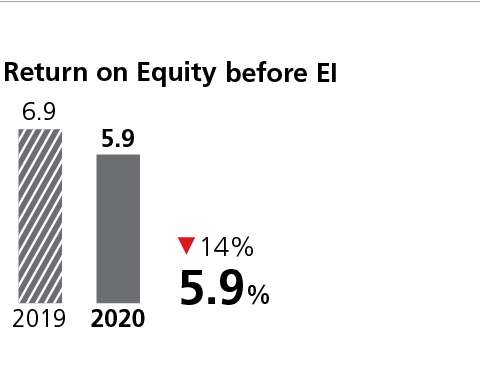

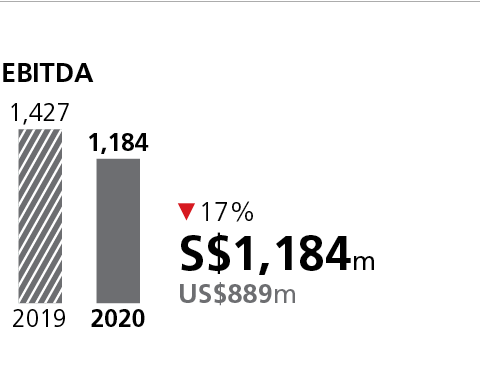

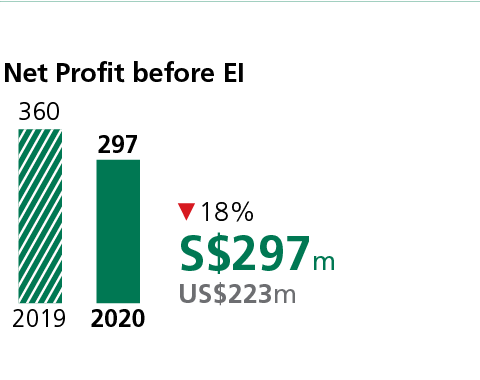

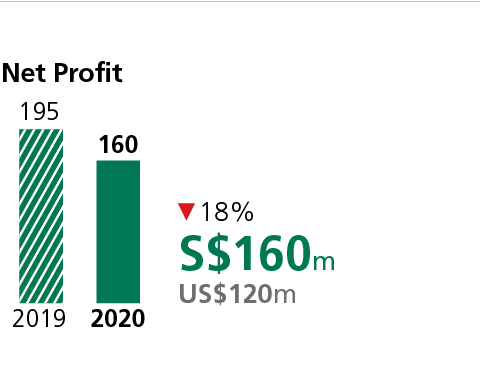

2020 was very challenging. While the underlying performance of our Energy and Urban businesses remained resilient and we continued to deliver positive operating cash flow, the Group incurred a net loss of S$997 million for the full year mainly due to a non-cash, non-recurring fair value loss of S$970 million recorded following the completion of the distribution in specie of the ordinary shares in the capital of Sembcorp Marine and a net loss of S$184 million for the Marine business prior to the demerger. In addition, the Group recorded exceptional items of negative S$144 million. Given the unprecedented impact of COVID-19 on the global economic outlook and the challenging market environment, this included impairments amounting to S$240 million that were made in the year. Without these exceptional items, and excluding the discontinued Marine business, Group net profit was S$301 million compared to S$456 million in 2019.

The demerger via a distribution in specie of Sembcorp Industries’ stake in Sembcorp Marine was completed in September, following a recapitalisation of Sembcorp Marine through a S$2.1 billion renounceable rights issue. Our shareholders received 491 Sembcorp Marine shares for every 100 Sembcorp Industries shares owned, with no cash outlay. The demerger has unlocked value, with our share price increasing 78% in 2020 following its completion.

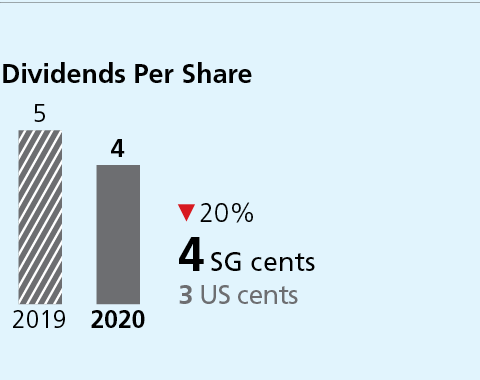

The board proposes a final and total dividend of 4.0 cents per ordinary share for 2020, subject to shareholders’ approval.

Notwithstanding the adverse business conditions, the Group continued to gain momentum in renewables growth and deepened our presence in key markets.

Amid extraordinary times, the global Sembcorp team responded with exceptional commitment and character.

Together with 400MW of new solar capacity secured in India, we grew our global renewables portfolio in operation and under development to over 3,200MW in 2020. This included a 60MWp inland floating solar photovoltaic (PV) system in Singapore, which will be one of the world’s largest when completed later this year. In India, we cemented our position as one of the nation’s leading independent power producers by being the first to successfully commission 800MW of wind capacity from the first three tenders by the Solar Energy Corporation of India (SECI).

In 2020, we completed divestments in Chile, China and Panama. Since 2018, we have unlocked cash proceeds of S$735 million through 17 divestment transactions, demonstrating our commitment to systematic capital recycling.

For more on the performance of the Group and our businesses, please click here.

Looking forward, the path to a post-COVID world remains unclear. Yet the megatrends of decarbonisation, urbanisation and electrification are clearly here to stay. As economies start to rebuild, the emphasis is expected to be on resilient and sustainable infrastructure and development.

With our strategy fully anchored in this purpose, sustainability is front and centre of all that we do. It is our business.

At Sembcorp, we are driven by a clear purpose to play our part in building a sustainable future. With our strategy fully anchored in this purpose, sustainability is front and centre of all that we do. It is our business.

Our vision is to be a leading provider of sustainable solutions. We aim to transform our portfolio towards a greener future, by focusing on growing our renewables and sustainable urban solutions businesses.

For more on sustainability at Sembcorp, please click here.

We are confident that our strategy is built on a strong foundation. With Singapore as our home base, we are well-placed to serve markets in Asia, where population growth is driving rising demand for sustainable solutions that enable rapid industrialisation, urbanisation and electrification.

Sembcorp is today one of Singapore’s largest home-grown renewable energy players, operating an international portfolio of wind, solar and energy storage assets. Backed by our strong market positions, project development and operations & maintenance expertise, we believe we can vie to be a regional front runner. We are a leading renewables player in Singapore with about 280MWp of solar capacity. We are able to offer a full suite of solutions including ground-mounted, rooftop and floating solar PV systems. In India, we achieved the highest wind capacity under self-operations of any independent power producer in the country, thanks to a solid execution track record. Across our markets, we leverage digital and advanced analytics – from predictive asset management and energy generation forecasting to remote and automated operations – as a key differentiator.

Meanwhile, our Urban business has 13 projects strategically located across Vietnam, China and Indonesia. Partnering governments, we undertake a full range of services including master planning, land and property development as well as asset management, to develop the economic engines for growth that have attracted about US$41 billion in direct investments to date.

It is our belief that this unique combination of energy and urban development capabilities creates a strong platform ideally positioned to seize growth opportunities presented by global megatrends. By leveraging synergies across our businesses, we can provide solutions focused on meeting the twin goals of clean energy and sustainable urbanisation in Asia.

On behalf of the management and board, we would like to extend a warm welcome to Nagi Hamiyeh and Lim Ming Yan who joined us in March 2020 and January 2021 respectively. Mr Hamiyeh is joint head of Temasek’s Investment Group and head of Portfolio Development. Mr Lim is chairman of the Singapore Business Federation and chairman of Workforce Singapore. He was previously president and group chief executive officer of CapitaLand, one of Asia’s largest diversified real estate groups.

We would also like to record our thanks to Tan Sri Mohd Hassan Marican, Dr Teh Kok Peng and Jonathan Asherson OBE who will be retiring from our board at the forthcoming annual general meeting. We extend our deepest appreciation for the contributions they have each made during their many years in service to the company.

Special mention and thanks must also go to Neil McGregor who retired as Group President & CEO in June 2020. Mr McGregor played a pivotal role in charting our strategic direction towards sustainability. Under his leadership, the reshaping of our portfolio towards renewables and sustainable solutions gained considerable momentum.

Before closing, we would like to again express our gratitude to our employees for their hard work and dedication, and to our shareholders and stakeholders who have stood by us.

Transforming and performing in the face of such difficult times will be challenging. However, as we start this new decade, we enter it with confidence and determination. With a strong foundation underpinning our strategy, we are confident that as we press on to deliver and create value for our stakeholders, together, we will build a thriving Sembcorp.

Driven by our purpose, we are determined to transform our portfolio towards a greener future – not just for ourselves but for the generations to come.

Ang Kong Hua

Chairman

Ang Kong Hua

Chairman Wong Kim Yin

Group President & CEO

Wong Kim Yin

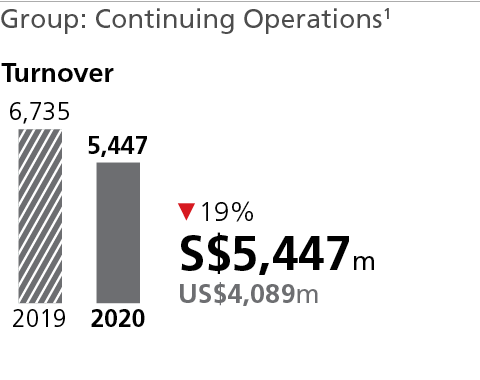

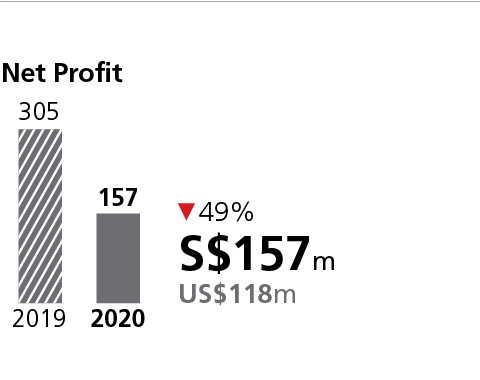

Group President & CEOSembcorp posted a net profit of S$157 million and turnover of S$5,447 million from continuing operations. In 2020, before exceptional items and the discontinued Marine business, net profit was S$301 million compared to S$456 million in 2019.

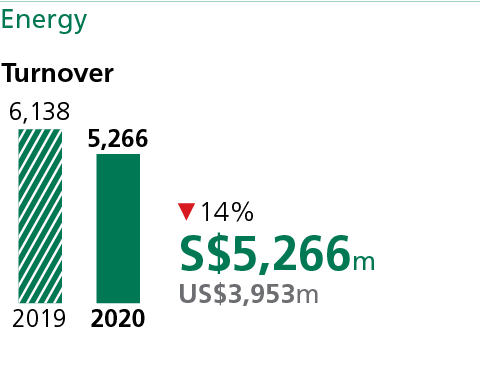

Group Financial ReviewThe activities and financial performance in 2020 were affected by the unprecedented impact of COVID-19 on global economic conditions and low energy prices. Amid the pandemic, our Energy business continued to deliver essential and environmental services globally without disruption.

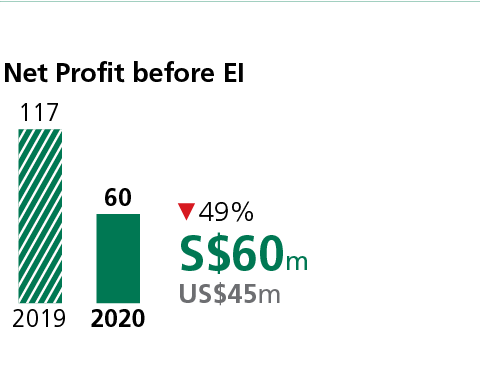

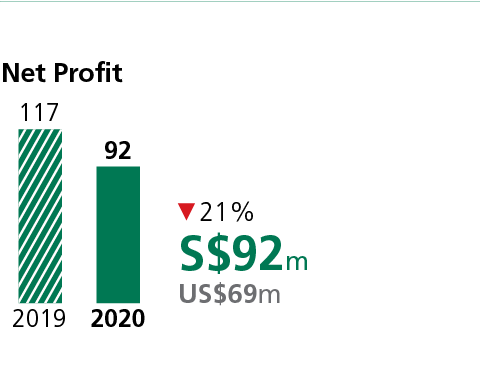

Energy ReviewThe Urban business turned a creditable performance in 2020, driven by higher contributions from our China and Indonesia projects, despite the impact of COVID-19. Net profit was S$92 million compared to S$117 million in 2019.

Urban Review

Sembcorp has long held a strong commitment to sustainability. We are driven by our purpose to play our part in building a sustainable future. We see sustainability in our company as inextricably linked to our ability to deliver long-term value and growth to our stakeholders.

Sustainability ReportSembcorp’s corporate governance principles are built on integrity and reflect our commitment to enhance shareholder value.

Corporate Governance StatementSembcorp is committed to ensuring that all capital market players have easy access to clear, reliable and meaningful information on our company in order to make informed investment decisions.

Investor Relations