Dear Fellow Shareholders,

2019 marked the end of a significant decade for the global energy transition with the effects of climate change being felt more acutely than ever worldwide. In line with calls for urgent climate action, we have entered an energy transition of unprecedented scale and velocity.

Now more than ever, the transformation journey we began two years ago to reposition ourselves as an integrated energy and urban player has proven critical.

The transition to a sustainable future has inevitably brought significant risks and business model disruptions. Yet this critical period of change also presents opportunity.

As a diversified company, Sembcorp is uniquely positioned to deliver solutions to support this shift. With Singapore as our home base, we are also well-placed to serve markets in Asia where population growth is driving rising demand for sustainable solutions that enable rapid industrialisation, urbanisation and electrification. From renewable energy, water management and waste-to-resource, to greener engineering solutions and eco-friendly integrated townships, our businesses have a real capacity to make a change for a more sustainable world.

Now more than ever, the transformation journey we began two years ago to reposition ourselves as an integrated energy and urban player has proven critical. Though competition remains intense, market conditions difficult, and our businesses faced another challenging year, we believe that our strategy is sound.

The task at hand requires us to act simultaneously on many fronts. We must manage our portfolio for performance, deepen our digital capabilities, step up sustainability efforts and green our portfolio while forging a dynamic organisation with the right capabilities and culture. The challenges of building forward-looking and competitive businesses are real, but we are making progress and working hard to continue to lift performance. While the journey will take time, we are confident that we are on the right path.

For more on our value creation process, please click here.

From renewable energy, water management and waste-to-resource, to greener engineering solutions and eco-friendly integrated townships, our businesses have a real capacity to make a change for a more sustainable world.

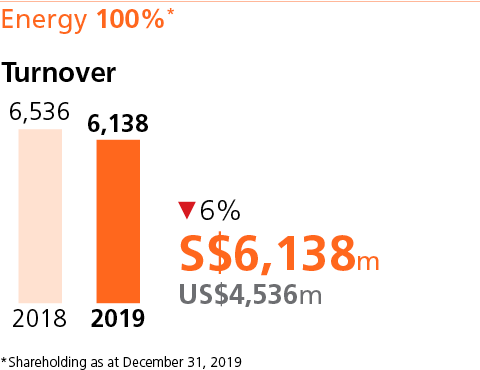

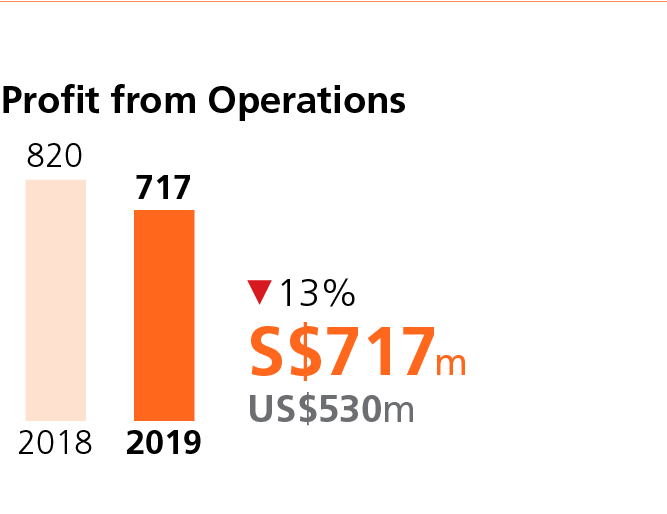

2019 was a challenging year for the Group. While the Urban business delivered record profits, with the continuing downturn in the offshore and marine sector, our Marine business made a net loss for the year. In addition, despite improved underlying profits, our Energy business recorded material impairments in the fourth quarter of 2019.

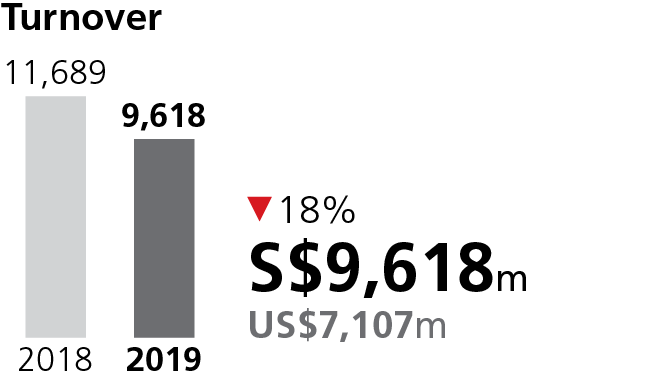

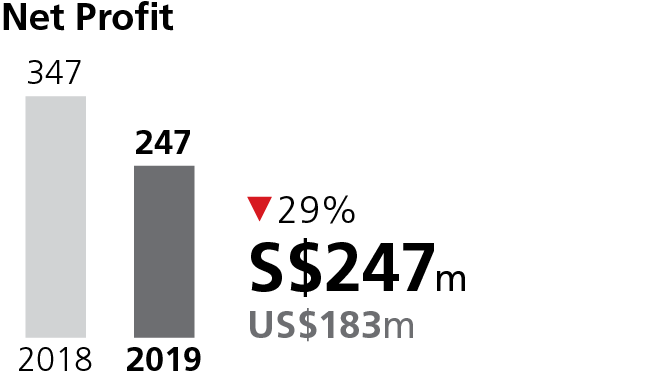

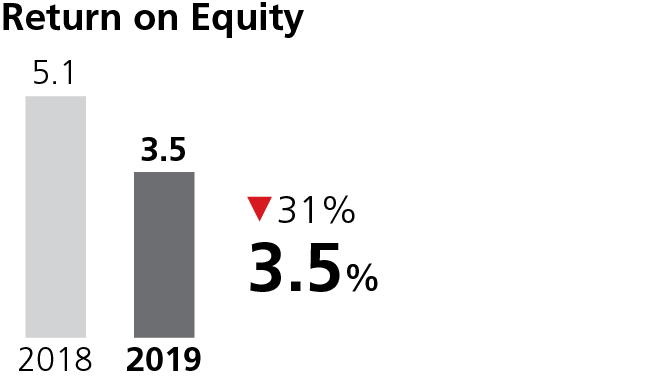

Group turnover in 2019 was S$9.6 billion, compared to S$11.7 billion the year before. Group net profit was S$247 million compared to S$347 million in 2018. Excluding exceptional items, underlying Group net profit grew 17% to S$395 million.

Underlying profits for the Energy business increased 12% from S$321 million in 2018 to S$360 million in 2019, owing to better performance from our overseas markets including profit growth in India where the thermal energy business turned around to profitability. Our global energy portfolio is more than 12,600MW. Over 900MW of new capacity was completed in 2019, including the completion of our gas-fired power project in Bangladesh and the first 60MW of our 120MW battery energy storage system in the UK.

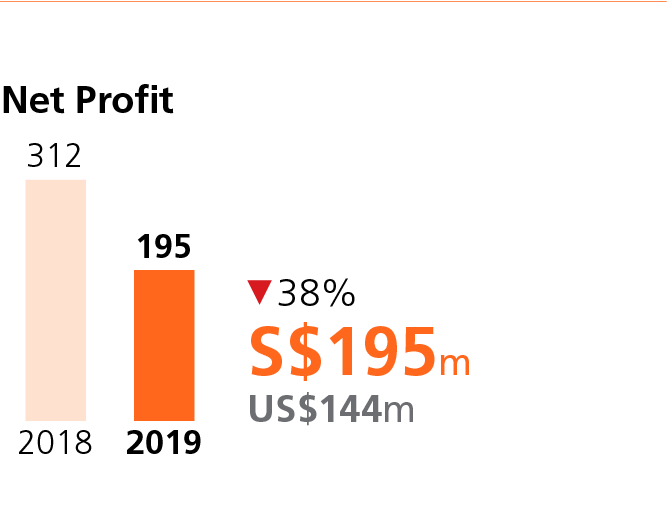

While the business made progress in growing its underlying net profit, including exceptional items, Energy net profit was S$195 million in 2019 compared to S$312 million the year before as net divestment gains of S$86 million was offset mainly by impairments amounting to S$245 million. An impairment charge of S$158 million was made for UK Power Reserve assets based on its expected value-in-use. Performance of the flexible generation business in the UK has been impacted by a combination of economic and industry factors including an increase in energy capacity, reduction in underlying demand and moderated grid volatility. The business also saw a S$64 million impairment arising from the sale of its non-core Chilean water business, and a S$23 million impairment in China for its wastewater treatment assets.

Our Urban business posted another year of record net profits which grew 36% to S$117 million, driven mainly by profit recognition from its Riverside Grandeur development in China. In 2019, the business secured a healthy net orderbook of 423 hectares and an additional 900 hectares of saleable land in Vietnam for future growth.

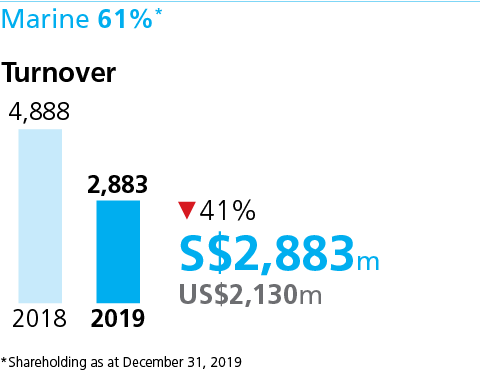

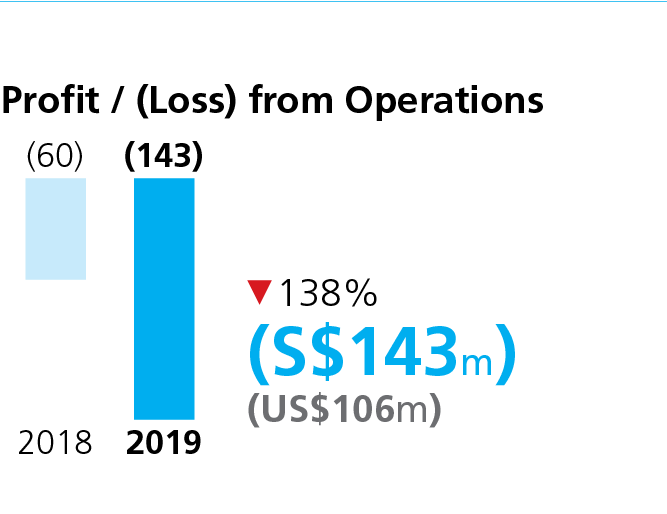

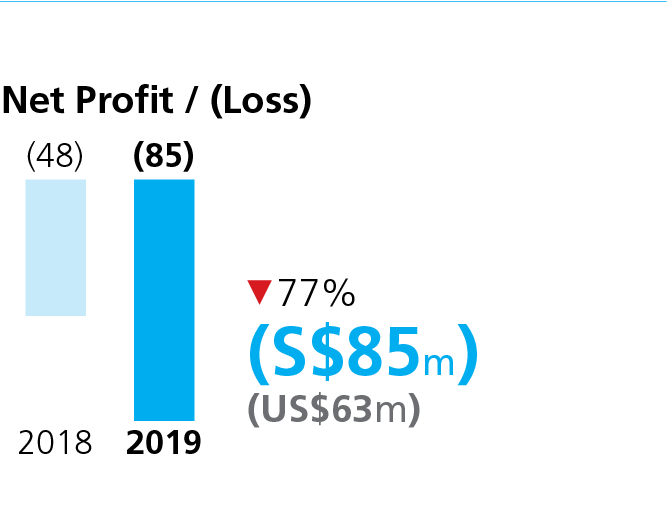

The Marine business posted a net loss of S$85 million to the Group in 2019 compared to a loss of S$48 million in 2018, due to slow orders and intense competition in a protracted industry downturn. Nevertheless, Sembcorp Marine secured a total of S$1.5 billion worth of new contracts in 2019, compared to S$1.2 billion the year before. Approximately S$530 million of the new orders in 2019 were related to greener solutions including gas and renewable energy projects.

In June 2019, the Group announced a S$2 billion subordinated loan to our subsidiary, Sembcorp Marine, whose current financial performance and position have been affected by the prolonged downturn in the offshore and marine sector. While the sector is showing signs of recovery, this is expected to be gradual. Although the loan has weighed on the speed of progress of the Group’s growth strategy, we believe that this financing strengthens a key subsidiary and better positions the Group for the long-term.

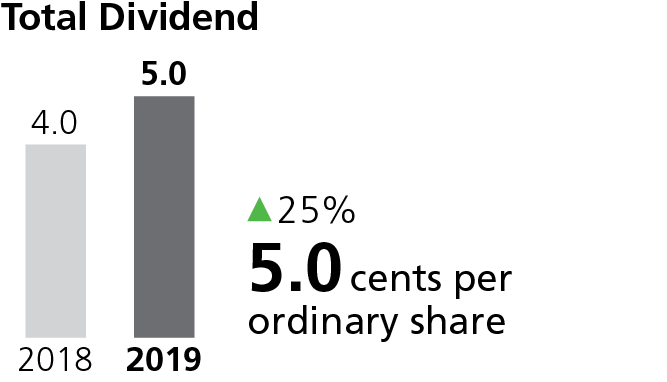

In view of the Group’s improved underlying profits, the board proposes a final dividend of 3 cents per ordinary share for 2019, subject to shareholders’ approval. Together with the interim dividend paid out in September 2019, this brings our total dividend to 5 cents per ordinary share.

For more on the performance of the Group and our businesses, please click here.

In 2019, we continued deepening our bench strength and investing in our workforce to build an agile, values-based and performance-led organisation.

We made progress on several fronts over the past year as our strategy continued to take shape.

We remain committed to maintaining a disciplined approach to capital management, optimising our portfolio and undertaking systematic capital recycling to strengthen our balance sheet. Since the start of 2018, we have unlocked cash proceeds of S$600 million, exceeding our S$500 million target.

Building a dynamic organisation with the right people and capabilities is foundational to our strategy and growth. In 2019, we continued deepening our bench strength and investing in our workforce to build an agile, values-based and performance-led organisation. This included a concerted push to strengthen our capabilities in digital solutions and applications as well as in merchant businesses.

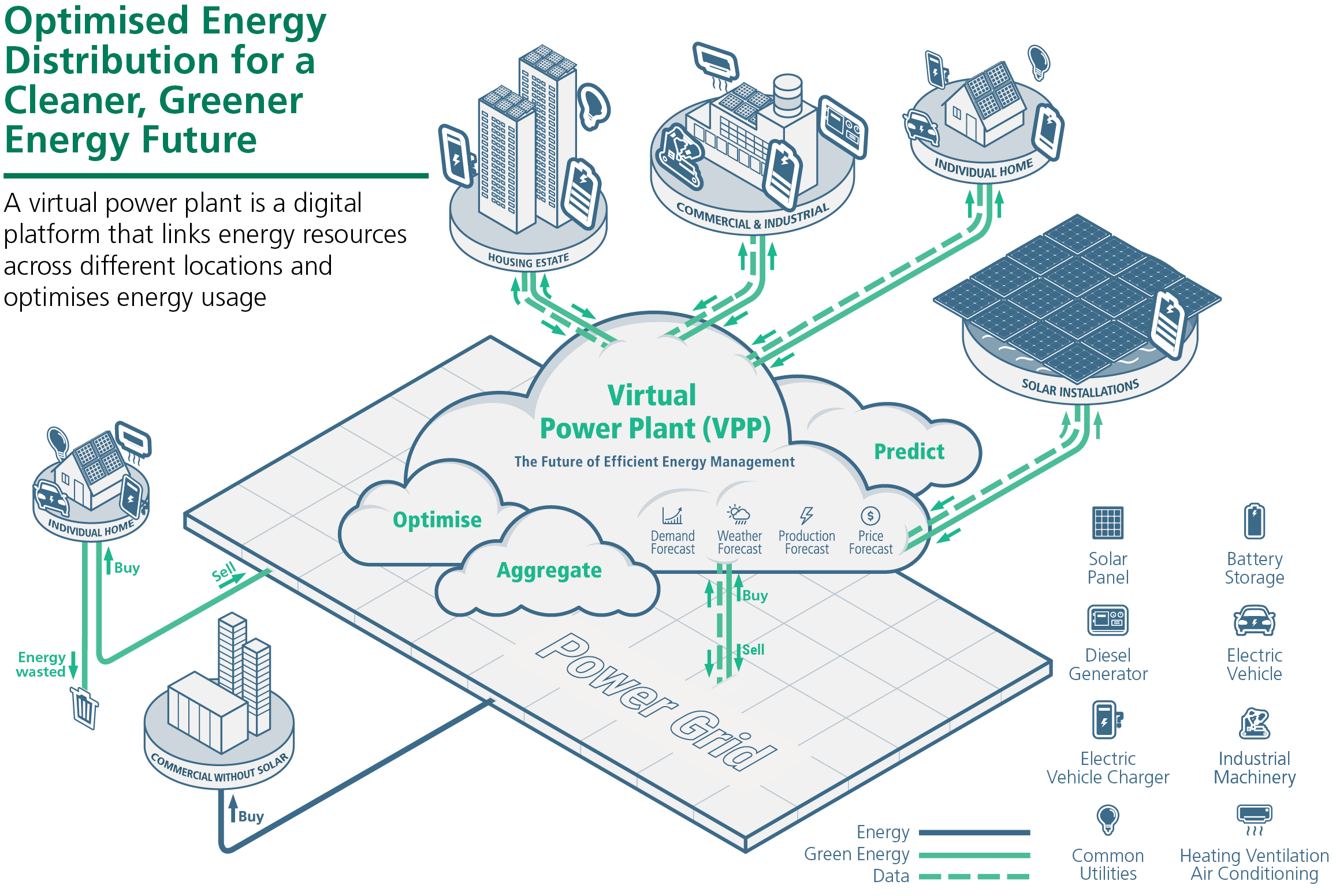

Exemplifying this thrust, we are in partnership with the Energy Market Authority and Nanyang Technological University to develop Singapore’s first virtual power plant. Using real-time information from various distributed energy resources, the system will help optimise power output and allow seamless integration of cleaner energy sources like solar into the national grid.

While we furthered efforts to maintain effective risk management and governance, we recognise that we can and need to do better. Last year, we suffered two fatalities concerning our contractors in India. We are deeply saddened by the loss, and are working closely with our stakeholders across the Group to further improve safety and prevent injuries. In addition, we deeply regret that the criminal and illegal activities of some former employees of a joint venture company in Nanjing, China, had caused the illegal discharge of off-specification wastewater for a period prior to early 2017. Sembcorp remains committed to responsible operations and compliance with legal and regulatory requirements, and under no circumstances do we condone such actions and behaviours. We have strengthened our processes and in 2019, continued with the roll out of an Integrated Assurance Framework, which sets out three lines of defence for a multi-layered approach to governance, oversight and risk management. Group-wide programmes were also adopted to enhance health, safety, security and environmental measures, as well as embed a values-based culture founded on integrity.

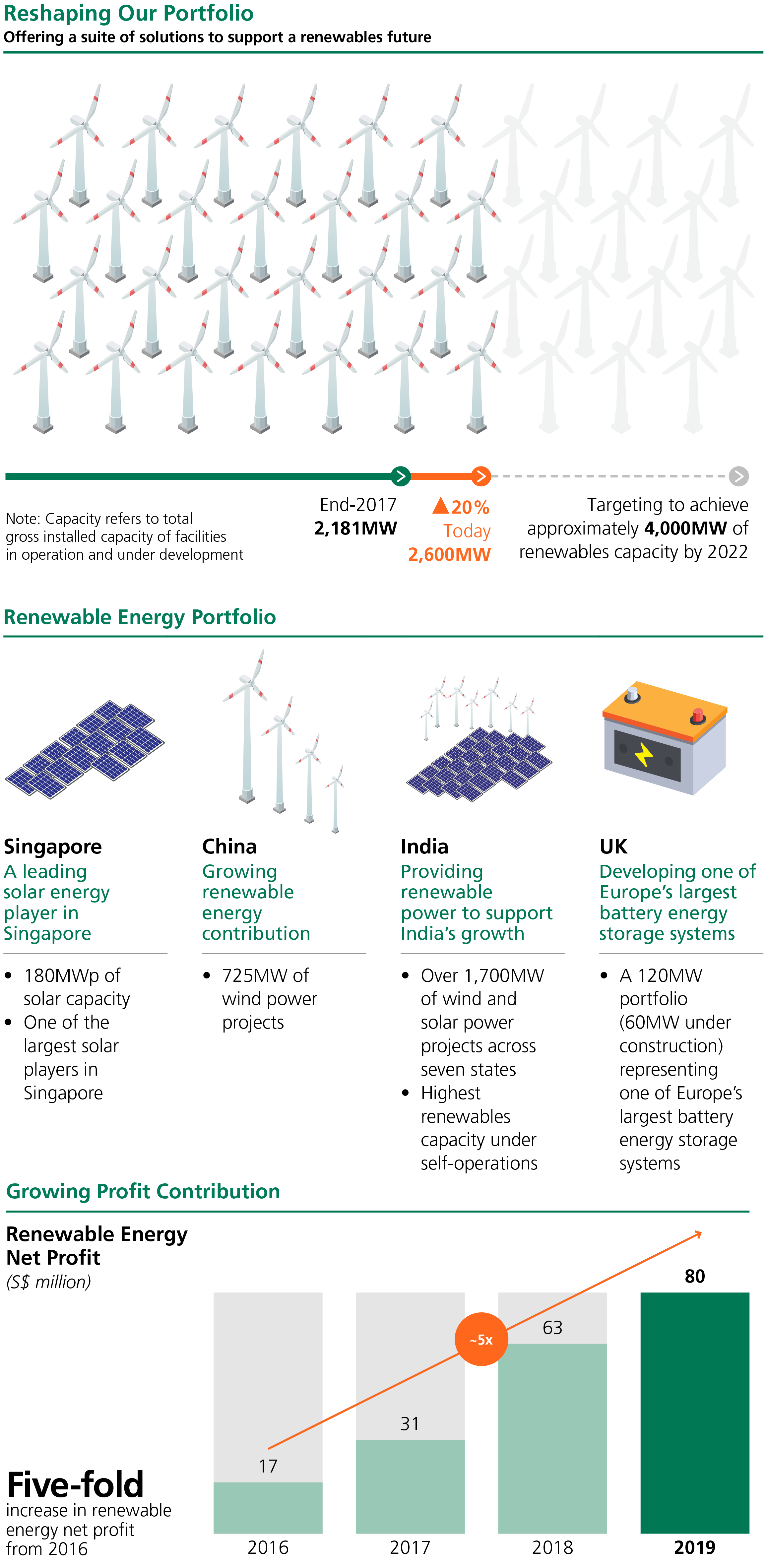

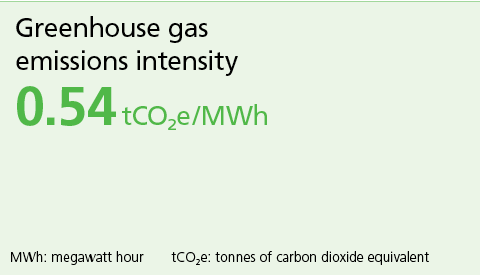

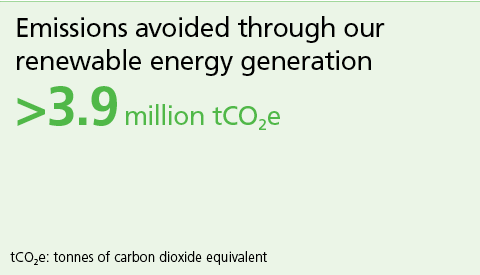

A key ambition in our transformation journey has been to play our part in supporting a low-carbon future through renewables. In 2018, we set out to double our renewables capacity from our 2017 baseline to approximately 4,000MW by 2022, with the aim of becoming one of the region’s leading renewable energy players. Today, we have grown our renewables capacity to 2,600MW and are one of Singapore’s largest home-grown renewable energy players, operating an international portfolio of wind and solar assets. In addition to greening our portfolio, we are actively seeking to drive the adoption of renewables by partnering industry leaders to lead the charge together.

In key growth markets such as India, which is one of the world’s largest producers of renewable energy, we have an established track record and now have the highest renewables capacity under self-operations for an independent power producer in the country. We also operate the UK’s largest distributed energy portfolio which includes small-scale, fast-ramping power generation assets. In addition, we are developing a 120MW battery energy storage system, one of the largest in Europe, to address the intermittency of renewables.

Since 2016, net profit from our renewables business has increased nearly five-fold to S$80 million.

In the push for sustainable solutions, renewable power is just one part of the answer. Managing energy, water and waste together is vital to addressing complex environmental challenges. This concept of holistic resource management started with our pioneering work on Jurong Island, Singapore’s energy and chemical industrial hub, and has been the mainstay of our business over the last 25 years.

As a centralised utilities provider, our integrated offerings have shown the benefits of a circular economy, and how holistic resource management of energy, water and waste can help companies do more with less. Today, we are leveraging synergies across our businesses to provide integrated solutions to customers from different sectors.

In 2019, we made some headway in capturing opportunities on this front. For example, in Vietnam, we set up a joint venture with Becamex IDC Corporation and Vietnam Singapore Industrial Park JV Co (VSIP) to provide smart energy and sustainable solutions. The tripartite partnership aims to deliver a range of energy and utilities solutions such as renewable energy, waste-to-energy, wastewater treatment and water recycling to VSIP and Becamex facilities. This partnership in Vietnam signals the untapped growth potential for sustainable solutions in the region.

Today, we have grown our renewables capacity to 2,600MW and are one of Singapore’s largest home-grown renewable energy players, operating an international portfolio of wind and solar assets.

At Sembcorp, we are driven by a clear purpose. At the heart of all that we do is our passion to play our part in creating a sustainable future. Our businesses are centred on providing energy and innovative solutions that support development and create value for our stakeholders and communities. Our ambitions are focused on enabling a low-carbon and circular economy, empowering our people and communities, and embedding responsible business practices.

Doing right, doing good and doing well. This is what success will look like for Sembcorp, and this is the future we are confident of achieving in partnership with our customers, governments, communities, and shareholders.

At Sembcorp, we are driven by a clear purpose. At the heart of all that we do is our passion to play our part in creating a sustainable future.

For more on sustainability at Sembcorp, please click here.

Our sincere thanks to you, our shareholders, for your trust and support as we continue our transformation journey. Our thanks also to all our employees for their dedication and hard work.

On behalf of the management and board, we would also like to thank Margaret Lui, who will be retiring from the board at our forthcoming annual general meeting. A director of the Group since 2010, Mrs Lui has made a great contribution to the board. Her wise counsel and valuable insights will be missed. We would also like to extend a warm welcome to Nagi Hamiyeh, who joined our board as non-executive and non-independent director on March 3, 2020. Mr Hamiyeh is Joint Head of Temasek’s Investment Group as well as the Head of Portfolio Development at Temasek.

In a world of rapid change and disruption, the road ahead is not without its challenges. Driven by our purpose and passion to play our part in creating a sustainable future, we are confident that the actions we are taking will make for a strong Sembcorp that will deliver value and growth to our stakeholders and communities for generations to come.

Ang Kong Hua

Chairman

Ang Kong Hua

Chairman Neil McGregor

Group President & CEO

Neil McGregor

Group President & CEO

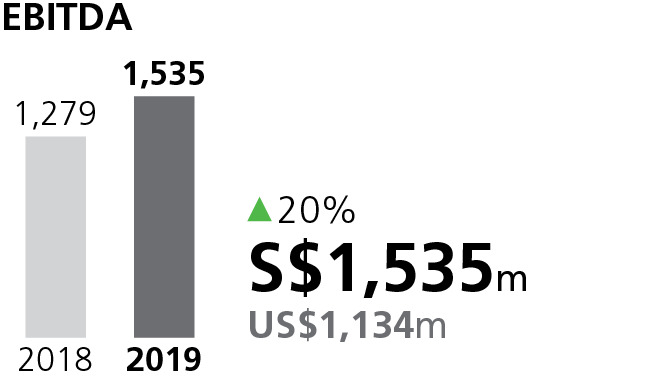

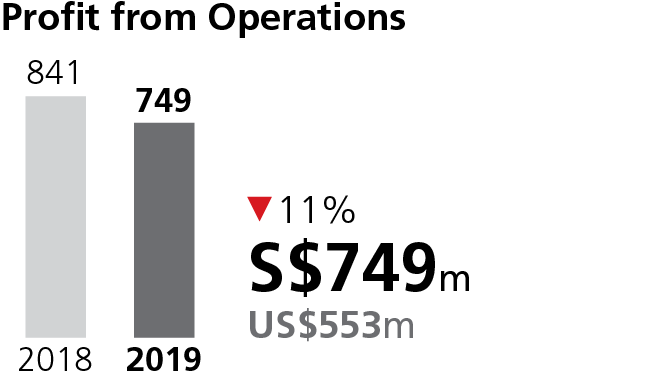

Sembcorp posted a net profit of S$247 million and turnover of S$9,618 million in 2019, compared to S$347 million and S$11,689 million in 2018, respectively. Net profit before exceptional items in 2019 was S$395 million, an improvement of 17% from S$339 million in 2018.

Group Financial ReviewIn 2019, the Energy business made strides in reshaping its energy portfolio towards renewables and sustainable solutions. Today, it is one of Singapore’s largest home-grown renewable energy players, operating an international portfolio of wind and solar assets.

Energy Review2019 was a challenging year for the Marine business with intense competition and continued low work volume. Despite difficult market conditions, the business secured S$1.5 billion in new orders.

Marine Review2019 was a stellar year for the Urban business, underpinned by residential sales. The business delivered record financial performance, exceeding S$100 million in net profit.

Urban ReviewSembcorp has long held a strong commitment to sustainability. We believe that responsible corporates can play a role as agents of transformation for a sustainable future. We see sustainability at our company as inextricably linked to our ability to deliver long-term value and growth to all our stakeholders.

Sustainability ReportSembcorp’s corporate governance principles are built on integrity and reflect our commitment to enhance shareholder value.

Corporate Governance StatementSembcorp is committed to ensuring that all capital market players have easy access to clear, reliable and meaningful information on our company in order to make informed investment decisions.

Investor Relations