In 2021, we delivered strong performance while making strides in growing our Sustainable Solutions businesses. We also unveiled our strategic plan to transform our portfolio from brown to green.

Dear Shareholders,

2021 started on an optimistic note. We saw progress in the development and rollout of COVID-19 vaccines, and the global economy was recovering. However, uneven economic recovery, high commodity and energy prices, and the outbreak of COVID-19 variants led to considerable risks and uncertainty as we entered another year of living with the pandemic.

Meanwhile, the urgency of moving towards a net-zero future was pressed home with the signing of the Glasgow Climate Pact at COP26, together with the conviction that everyone in our global community has a role to play in building an inclusive and sustainable future. All these developments have served to affirm Sembcorp’s brown to green transformation strategy and focus on sustainability as our business.

Driven by Sembcorp’s clear purpose to play our part in building a sustainable future, we unveiled in May 2021, our strategic plan to transform our portfolio from brown to green. With our proven track record across Asia and expertise across the renewables and urban solutions sectors, we believe we have the opportunities and capabilities to take advantage of and succeed in the global energy transition and sustainable development.

Our transformation plan is underpinned by clear targets.

More sustainable

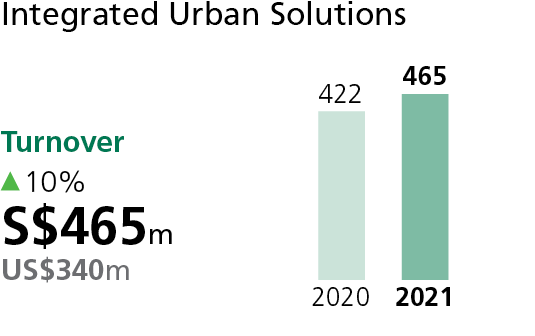

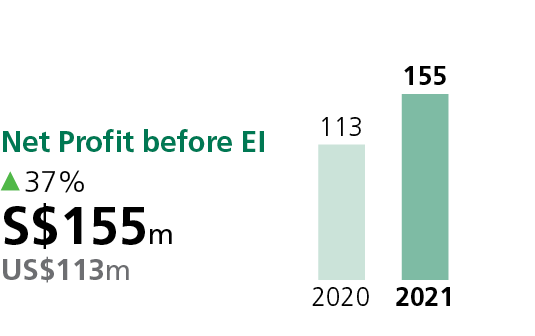

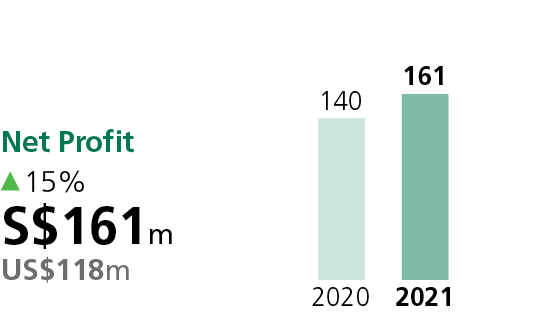

By 2025, we aim for our Sustainable Solutions portfolio to comprise 70% of the Group’s net profit before exceptional items and corporate costs. In 2020, our Sustainable Solutions portfolio contributed to around 40% of the same for the Group. By 2025, net profit of our Renewables and Integrated Urban Solutions segments are expected to achieve compound annual growth rate of 30% and 10% respectively, from 2020.

More renewables

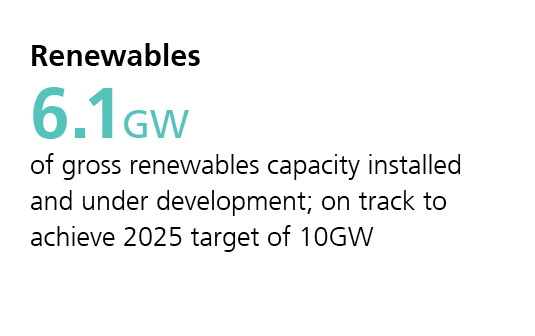

By 2025, we aim to quadruple our gross installed renewables capacity to 10GW. In 2020, our gross installed renewables capacity (comprising wind, solar and energy storage) was 2.6GW.

More sustainable urban developments

By 2025, we aim to triple our Urban business’ land sales to 500 hectares. In 2020, land sales amounted to 172 hectares.

Lower carbon emissions

Central to our strategy is also our commitment to bold climate action. By 2025, we aim to reduce our greenhouse gas (GHG) emissions intensity to 0.40 tonnes of carbon dioxide equivalent per MW hour (tCO2e /MWh) from 0.54 tCO2e/MWh in 2020.

In addition, we aim to reduce absolute GHG emissions to 2.7 million tCO2e by 2030. This is a significant 90% reduction from our 2020 levels and a 50% reduction from 2010 baseline. We aim to deliver net-zero emissions by 2050 and have committed to not invest in new coal-fired energy assets.

In 2021, we delivered strong performance, while making strides in growing our Sustainable Solutions businesses.

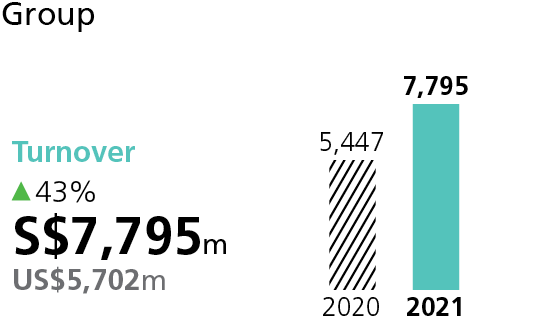

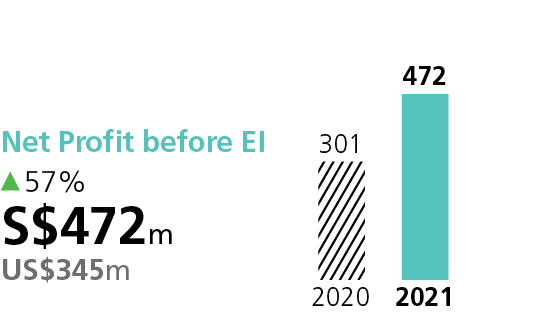

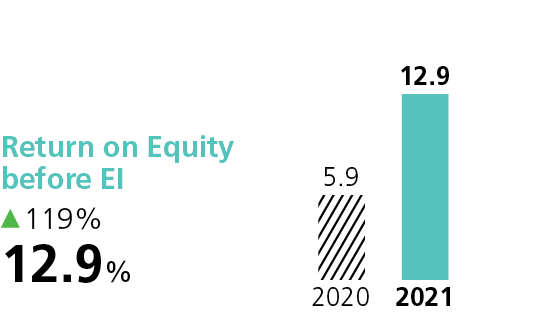

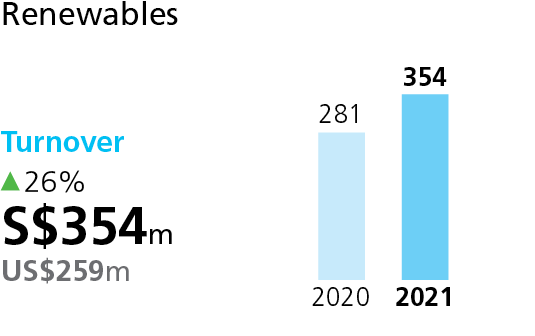

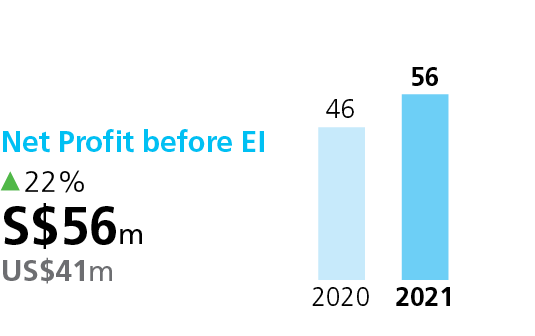

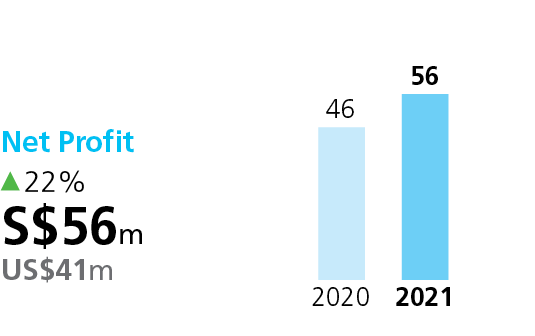

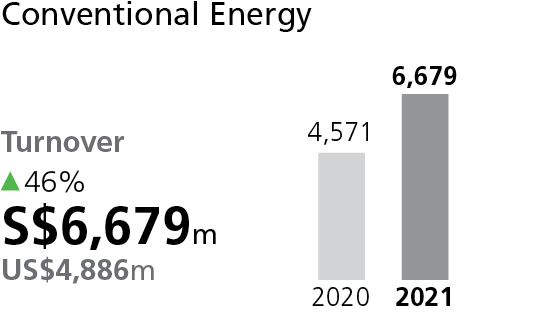

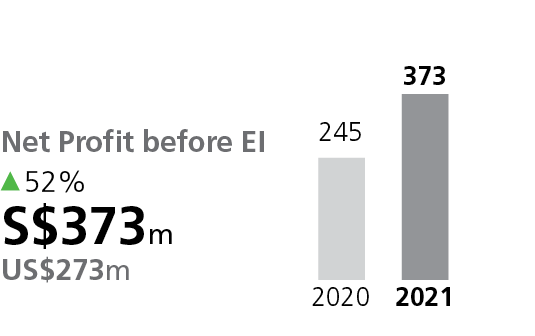

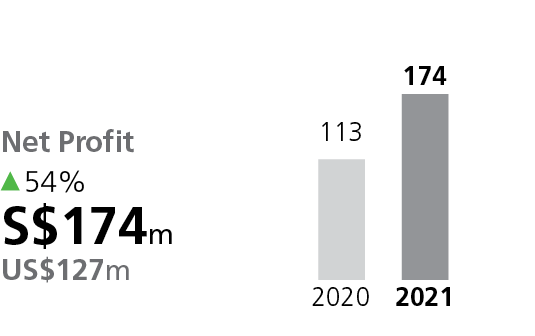

We turned in a strong set of earnings in 2021. Turnover was S$7.8 billion, 43% higher than turnover of S$5.4 billion in 2020. Group net profit was S$279 million, 78% higher than 2020. Exceptional items totalling S$193 million were recorded in the year mainly due to a S$212 million impairment for the 49%-owned Chongqing Songzao coal-fired power plant in China. Group net profit before exceptional items grew 57% to S$472 million, due to better performance from all segments, with the biggest contribution from the Conventional Energy segment. Net profit for the Sustainable Solutions businesses comprising the Renewables and Integrated Urban Solutions segments grew by 33% and accounted for 35% of the Group’s net profit before exceptional items and corporate costs in 2021.

In view of the Group’s strong performance, the Board has proposed a final dividend of 3.0 cents per ordinary share, subject to shareholders’ approval. Together with the interim dividend of 2.0 cents per ordinary share paid in August 2021, this brings our total dividend for the year to 5.0 cents per ordinary share.

With a focus on growing our Renewables and Integrated Urban Solutions businesses in Southeast Asia, China and India, we set out plans to strengthen our capabilities, build on partnerships, and leverage our urban businesses as platforms for growth. 2021 saw strategic momentum on all these fronts.

Less than a year into executing Sembcorp’s strategic transformation plan, we are making good progress. During the year, an additional 2.9GW of renewable energy projects were secured. We also officially opened the 60MWp Sembcorp Tengeh Floating Solar Farm in Singapore in July 2021. One of the largest inland floating solar farms in the world, the project is a showcase of our solar capabilities as a leading regional renewable energy player.

In November 2021, we announced the acquisition of a 98% stake in a 658MW portfolio of operational wind and solar photovoltaic (PV) assets in China, which will provide a scalable platform to drive our growth in the country. This was followed by the acquisition of a 35% interest in SDIC New Energy in December 2021, which has since been completed. The SDIC New Energy portfolio consists of 1.9GW of operational wind and solar PV assets located across seven provincial regions in China. Upon completion of the 658MW portfolio acquisition, expected in the first half of 2022, our gross renewables capacity will have grown to 6.1GW, almost double from the 3.2GW as at end 2020. We are pushing confidently towards our target of 10GW of gross installed renewables capacity by 2025.

At the same time, we recognise that the path to a net-zero emissions future will require innovation and technological transformation. To this end, we continue to work with like-minded partners. In 2021, we signed a strategic memorandum of understanding with Chiyoda Corporation and Mitsubishi Corporation to explore the feasibility and implementation of a commercial-scale supply chain to deliver decarbonised hydrogen into Singapore, utilising Chiyoda’s proven hydrogen storage and transportation technology “SPERA Hydrogen™”. In the UK, we also started our collaboration with Zero Degrees Whitetail Development to explore the development of the UK’s first net-zero emissions NET Power station at Wilton International on Teesside.

For the Integrated Urban Solutions segment, we continue to focus on building our land bank of urban developments. In March 2021, we received the investment licence to develop a 481-hectare new industrial park in Quang Tri province, Vietnam. The province has been earmarked as a future economic hub along the East-West Economic Corridor linking Vietnam, Laos, Thailand and Myanmar. With the establishment of the joint venture company completed in February 2022, we now have 15 urban projects strategically located across Vietnam, China and Indonesia, which provide platforms to leverage our businesses’ synergies and drive future growth in sustainable solutions. In 2021, the Urban business performed well, recording 168 hectares of land sales and a net orderbook of 279 hectares, despite COVID-19 related restrictions in Vietnam and Indonesia.

To grow our Sustainable Solutions portfolio, we expect to invest approximately S$5.5 billion from 2021 to 2025. In line with this focus, we launched the Sembcorp Green Financing Framework as well as the Sembcorp Sustainable Financing Framework, and successfully raised S$1.1 billion of green and sustainable financing within the year. In June 2021, we issued the first certified green bond by a Singapore-based energy company under the Climate Bonds Standard, raising S$400 million with a 10-year tenor and a fixed interest rate of 2.45%. This was followed by the successful issuance of a 10.5-year S$675 million sustainability-linked bond (SLB) in October 2021 at a fixed interest rate of 2.66%, the first issuance by an energy company in Southeast Asia and the region’s largest issuance at the time of launch. The SLB was anchored by an investment of S$150 million from International Finance Corporation (IFC), and marked IFC’s first SLB investment globally. The integration of our sustainability targets into our financing strategy underscores our commitment to transform our portfolio, and we have been heartened by the strong support received from investors.

On behalf of the management and board, we would like to extend a warm welcome to Lim Ming Yan and Tow Heng Tan, who joined us in January 2021 and June 2021 respectively. Mr Lim is chairman of the Singapore Business Federation and chairman of Workforce Singapore. He was previously president and group chief executive officer of CapitaLand. Mr Tow is chief executive officer at private equity firm Pavilion Capital International. He previously served as the chief investment officer of Temasek International, senior director of DBS Vickers and managing director of Lum Chang Securities. We would also like to thank our non-executive and independent director Nicky Tan Ng Kuang, who will be retiring from our board at the upcoming annual general meeting. We are grateful to Mr Tan for his dedicated service and wise counsel, which has benefitted the board and company.

We would like to express our gratitude to our shareholders and stakeholders for your continued support. Special mention and thanks must go to our employees. Amidst an incredibly challenging and volatile market, we embarked on our transformation journey. Putting the institution first, the global Sembcorp team has risen to the challenge admirably, with courage, agility and dedication. They continued to provide uninterrupted essential services to our customers and communities throughout the pandemic, drove change and delivered on performance.

Sustainability is Sembcorp’s business. Our commitment to transform our portfolio from brown to green is unwavering. Our strategy and targets are clear. Our focus on execution is delivering results. We look forward to you journeying with us as we continue to accelerate our transformation and deliver lasting value and growth for all our stakeholders.

Ang Kong Hua Chairman

Ang Kong Hua Chairman

Wong Kim Yin Group President & CEO

Wong Kim Yin Group President & CEOSembcorp achieved a turnover of S$7.8 billion compared to S$5.4 billion in 2020. Group net profit before exceptional items grew 57% to S$472 million due to better performance from all segments.

Group Financial ReviewThe Renewables segment recorded a net profit of S$56 million, an increase of 22% from 2020, driven mainly by higher contribution from the wind business.

Renewables ReviewStronger performance from the Urban business and Waste and Waste-to-resource businesses led to a 15% growth in net profit to S$161 million in 2021.

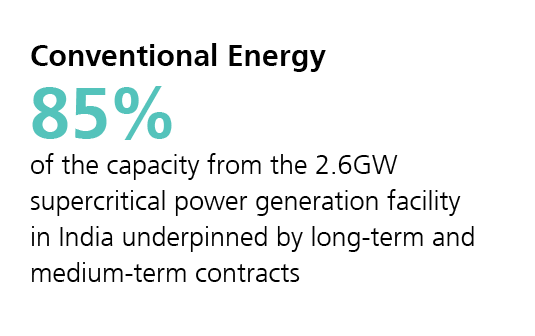

Integrated Urban Solutions ReviewTurnover for the Conventional Energy segment was S$6.7 billion, 46% higher compared to 2020. This was mainly due to better performance in India, Singapore and the UK.

Conventional Energy ReviewSembcorp has long held a strong commitment to sustainability. We are driven by our purpose to play our part in building a sustainable future. We see sustainability in our company as inextricably linked to our ability to deliver long-term value and growth to our stakeholders.

Sustainability ReportSembcorp’s corporate governance principles are built on integrity and reflect our commitment to enhance shareholder value.

Corporate Governance StatementSembcorp is committed to ensuring that all capital market players have easy access to clear, reliable and meaningful information on our company in order to make informed investment decisions.

Investor Relations