Sembcorp Industries

Annual Report 2022

# Group Financials shown include discontinued operation, unless otherwise stated

Message from the ChairmanDear Shareholders,

I will be retiring from the board at the upcoming annual general meeting on April 20, 2023. Post the demerger with Sembcorp Marine and almost two years into our brown to green transformation journey, this is an appropriate juncture for me to step down and hand over the helm to Mr Tow Heng Tan.

It has been a rewarding and fulfilling journey serving as Chairman of Sembcorp. I am grateful and privileged to have contributed to and witnessed the transformation of Sembcorp. Through the years, Sembcorp has exhibited resilience, embraced change and built up its capabilities to emerge as a growing regional renewable energy and integrated urban solutions leader, well-positioned to take on the opportunities and challenges of the future.

I am immensely thankful to have worked with so many committed and talented members of the Sembcorp's board and management over the years. To our shareholders, thank you for your support during my tenure as Chairman. Heng Tan brings with him extensive business management experience and a passion for sustainability. I am confident that under his leadership, Sembcorp will continue to deliver performance and growth and importantly, play a part in building a sustainable future.

Ang Kong Hua

Dear Shareholders,

2022 was a period of transiting and navigating to a new normal, with pandemic measures lifted across most economies. The rapid post-pandemic economic rebound outpaced energy supply, leading to higher energy prices. This escalated into a widespread global energy crisis following the Russia-Ukraine war.

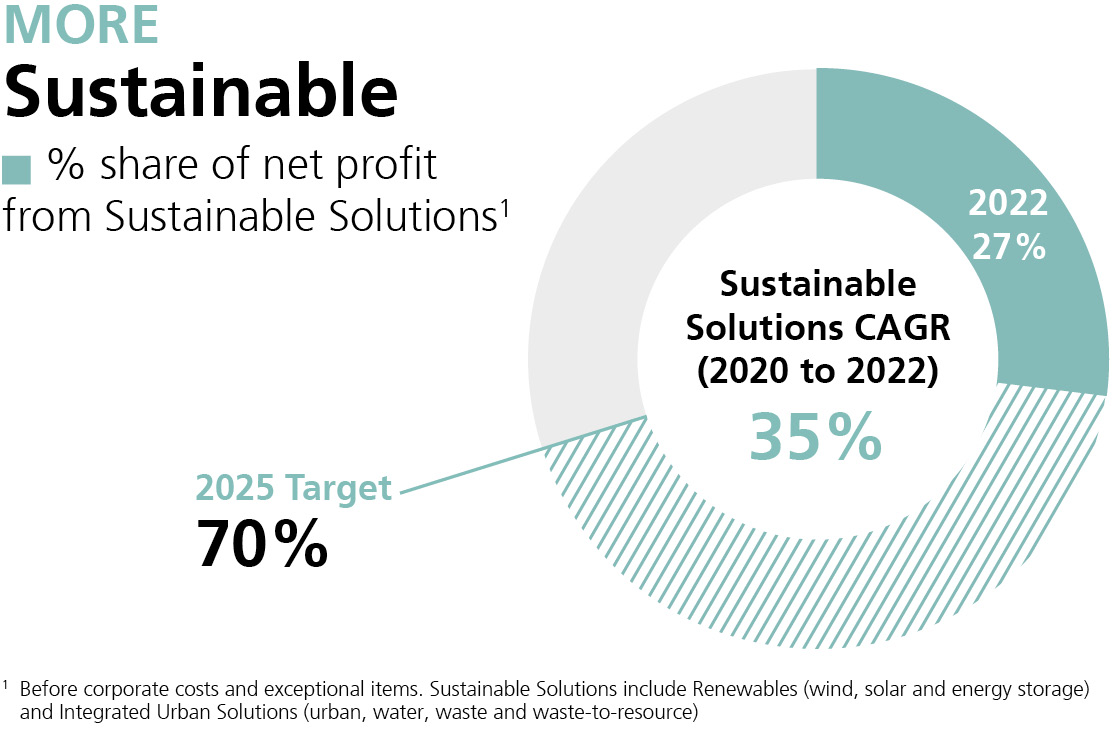

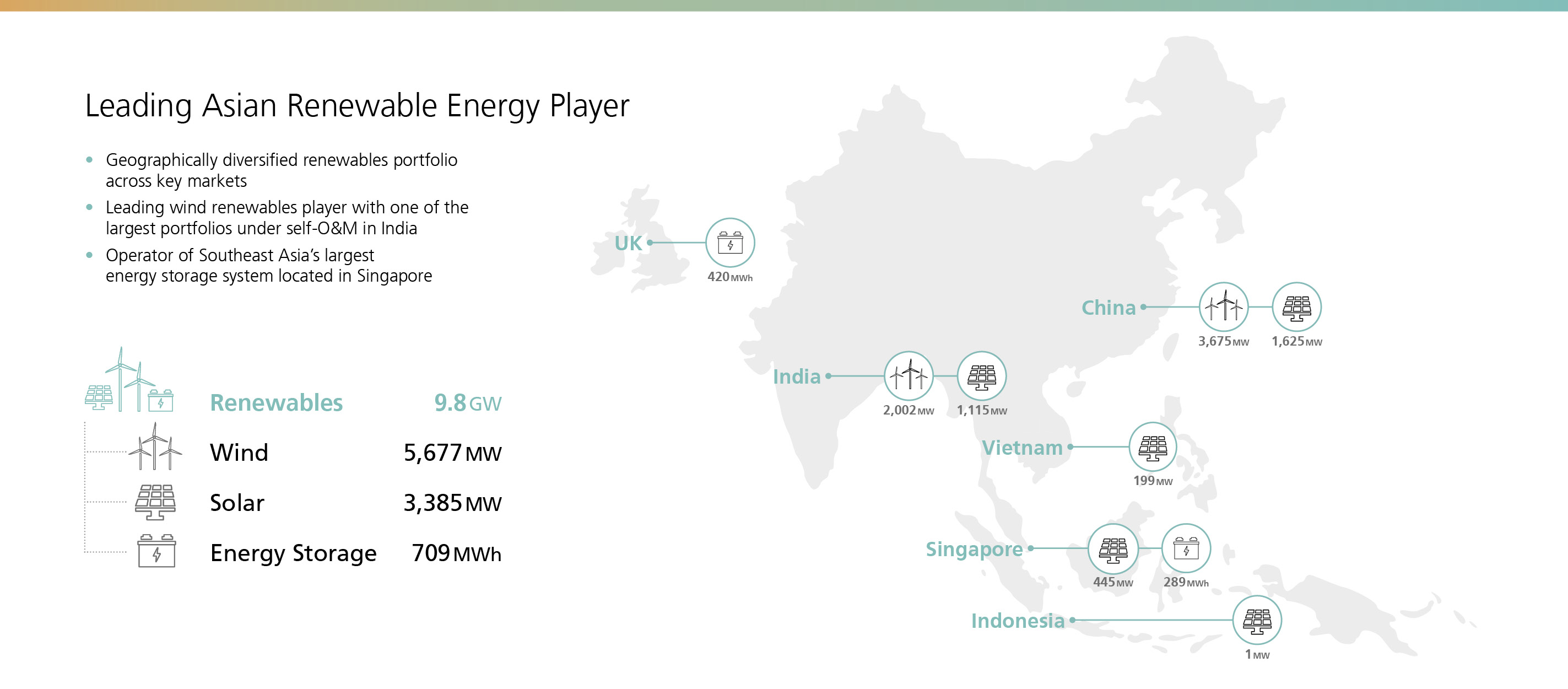

While governments have resorted to emergency measures to tackle immediate challenges, it is paramount to increase investments and support the deployment of renewable energy, to accelerate the transition to a low-carbon economy. As a leading Asian renewable energy player, Sembcorp plays a key role in the shift towards a sustainable and clean energy future.

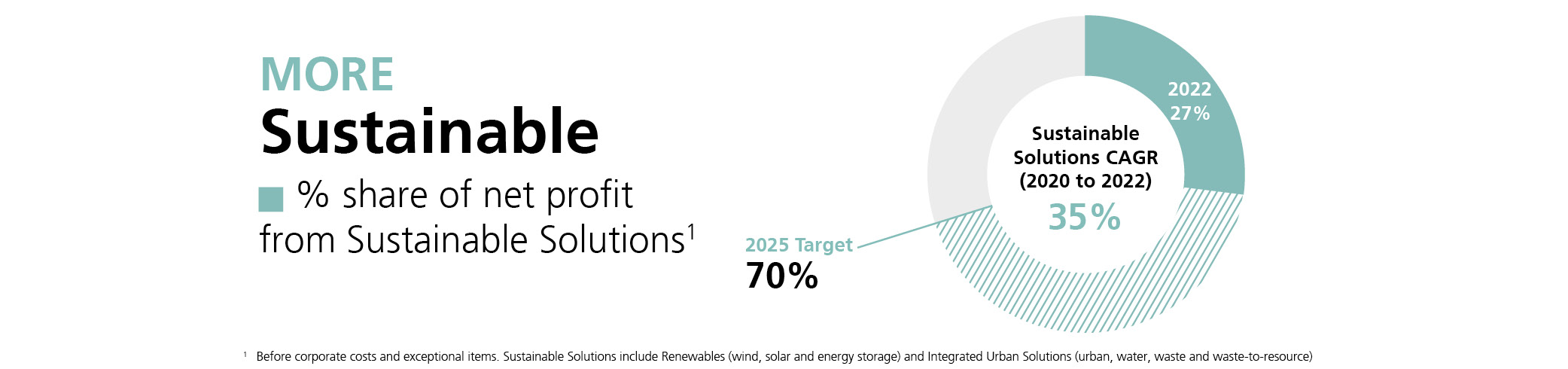

Sembcorp delivered a strong set of 2022 results, amidst a volatile market environment. Underlying Group net profit was S$883 million, compared to S$472 million in 2021. With the approval of the sale of Sembcorp Energy India Limited (SEIL) in November 2022, SEIL's contribution is now classified as a discontinued operation. Excluding discontinued operation, underlying Group net profit increased 129% to S$739 million, driven by the Conventional Energy and Renewables segments, which grew by 115% and 150% respectively. Net profit from the Integrated Urban Solutions segment remained stable. Exceptional items totalling negative S$35 million were recorded in the year, compared to exceptional items of negative S$193 million in 2021. Group net profit from continuing operations after exceptional items was S$704 million compared to S$130 million in 2021.

Given the Group’s strong operational results, the board has proposed a final dividend of 4 cents and a special dividend of 4 cents per ordinary share, subject to shareholders’ approval. Together with the interim dividend paid out in August 2022, this brings our total dividend for the year to 12 cents per ordinary share, an increase of 140% from 5 cents in 2021. With a 69% increase in our share price during the year, our total shareholder return (TSR) was 73%, significantly outperforming the benchmark Straits Times Index’s TSR of 8%.

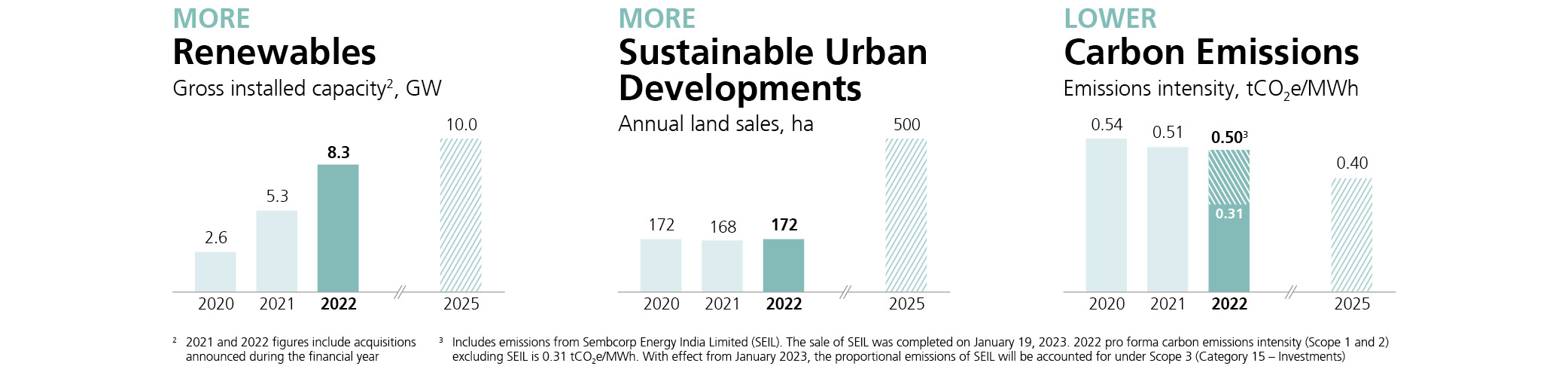

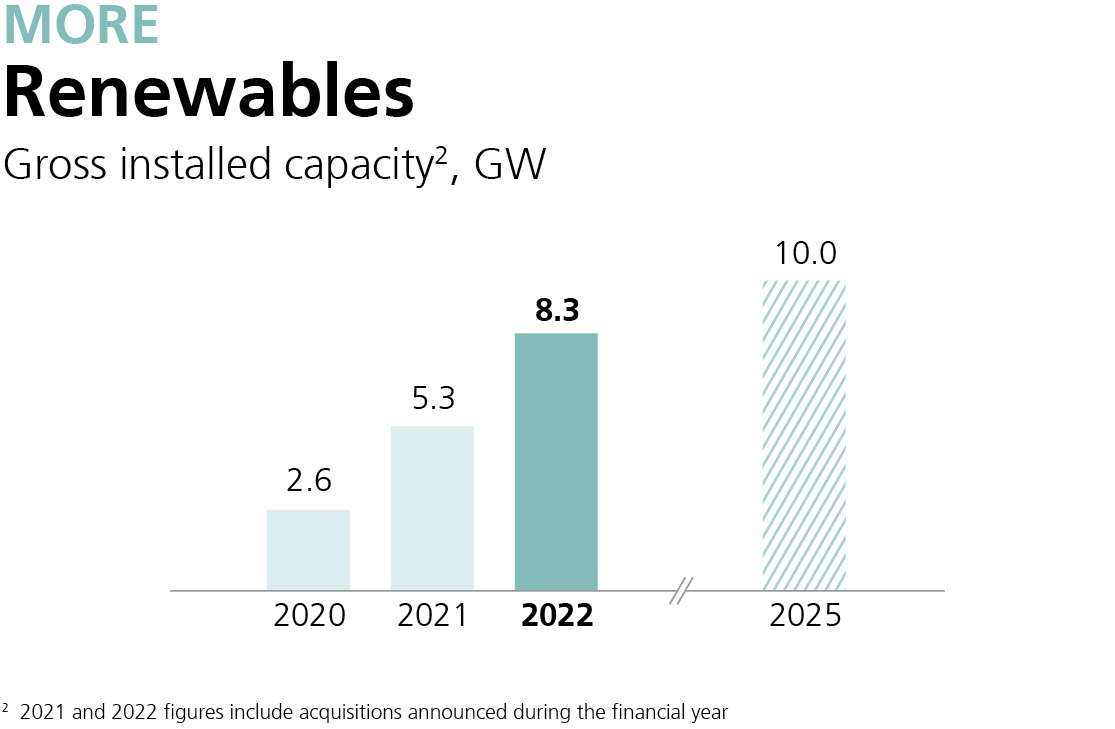

On track to achieve 2025 renewables target

We continued the build-out of our renewables portfolio, securing 3.6GW of renewables capacity through acquisitions and organic growth in 2022.

Capacity of our solar portfolio in Singapore reached 551MWp, contributing to more than a third of the nation’s 2025 target of 1.5GWp. During the year, we secured the 75MWp SolarNova 7 project, in addition to other commercial and industrial contracts.

We strengthened our presence in China, and successfully completed the acquisition of a 35% stake in SDIC New Energy and a 98% stake in Shenzhen Huiyang New Energy. In November 2022, we announced the acquisitions of 795MW of solar assets through 49%-owned joint venture Beijing Energy Sembcorp (Hainan) International Renewables and an 892MW portfolio held through a 45.3% stake in Hunan Xingling New Energy in China. Hunan Xingling New Energy has since completed the acquisition of 792MW of the 892MW portfolio from Wuling Power, with the remaining 100MW expected to be completed in the first half of 2023. These projects further diversify our renewables portfolio geographically and open opportunities for us to pursue other renewables projects with our partners.

In India, we acquired a 100% interest in Vector Green, which holds 583MW of renewables assets. The acquisition brings significant utility-scale solar capacity to our India business, complementing our existing wind portfolio. It broadens and deepens our renewable energy capabilities and presence across states in India, positioning us well for further green growth in the country.

Our battery portfolio continues to grow. Our UK operational capacity increased to 120MWh with the commencement of an additional 50MWh battery portfolio in August 2022. In Singapore, a 285MWh energy storage system (ESS), Southeast Asia’s largest ESS was successfully commissioned in six months. The facility on Jurong Island commenced operations in December 2022 and will enhance grid reliability and resilience. This is testament of our ability to replicate our capabilities from the UK to other markets. As the proportion of renewable power in the region increases, demand for ESS is expected to grow. With a further 304MWh under development, we are well-placed as one of Asia’s largest battery operators with a battery storage portfolio totalling 709MWh.

With these developments, our gross renewables capacity has more than tripled from 3.2GW in 2020 to 9.8GW, including acquisitions pending completion.

Complementing Sembcorp’s offering as a leading renewable energy player, we launched GoNetZeroTM, our carbon management solutions corporate venture at the 27th United Nations Climate Change Conference.

GoNetZeroTM offers one-stop access to renewable energy certificates and carbon credits, as well as renewable energy and environmental attribute portfolio management. Collaborations with leading industry players including Oversea-Chinese Banking Corporation Limited, Razer and UBS were also announced with the launch of GoNetZeroTM.

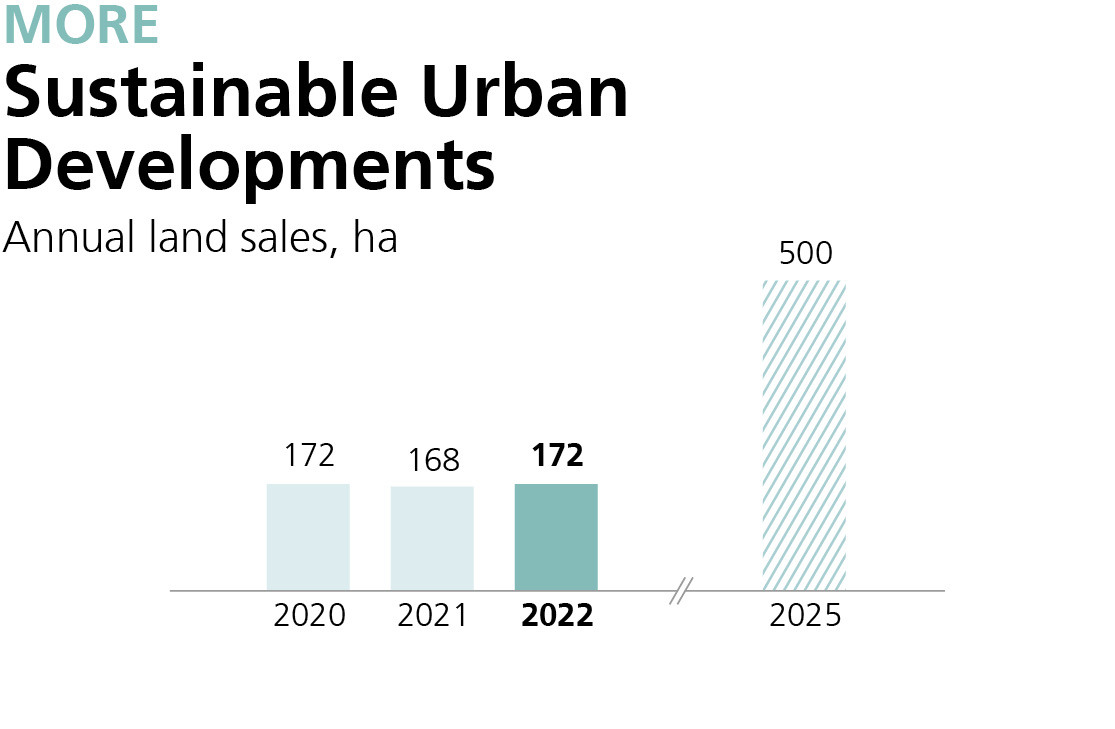

Focusing on sustainable developments

The Urban business remained steady, recording 172 hectares (ha) of land sales and a net orderbook of 312ha, despite a weak market in China. We extended our lead in Vietnam’s industrial park development sector, receiving licences for Quang Tri Industrial Park, Vietnam Singapore Industrial Park (VSIP) Binh Duong III, VSIP Can Tho as well as VSIP Nghe An (park II). The four projects awarded will collectively add 1,369ha of saleable land inventory to our portfolio.

In March 2022, we broke ground for VSIP Binh Duong III, marking a new smart and sustainable design concept that aligns with Sembcorp’s focus on growing our portfolio of sustainable urban developments. A distinguishing feature of VSIP Binh Duong III is its planned 50ha onsite solar farm, offering grid reliability and sustainability benefits to large industrial tenants. LEGO Group will commence the construction of its first carbon-neutral factory in VSIP Binh Duong III, which is planned to be powered by renewable energy drawn from the solar farm installed by VSIP as well as solar panels installed onsite.

We also expanded our industrial properties portfolio, with new ready-built factories and warehouses, totalling over 155,000 square metres, in China and Vietnam. The properties, when completed, will enhance our recurring income portfolio, which is one of the strategic growth objectives for our Urban business.

Conventional Energy: transiting and preserving value

The sale of SEIL marked a major milestone in our brown to green transition. 99.95% of shareholders who voted were in favour of the sale during the extraordinary general meeting. We thank you for your support.

Both supercritical coal-fired power plants totalling 2.6GW in India were sold to Tanweer Infrastructure for a consideration of S$2.0 billion and the purchase consideration will be settled via a deferred payment note. The transaction structure was developed in accordance with the strategic commitments we have communicated and will preserve value for shareholders as well as protect the interests of SEIL’s stakeholders. We will continue to support SEIL’s operational excellence and initiatives to reduce its greenhouse gas emissions, through a technical services agreement. To underscore our commitment to sustainability, we have provided a financial incentive that rewards reduction in emissions intensity to Tanweer Infrastructure.

Hydrogen plays a vital role in the energy transition, to decarbonise the world’s energy system. Green hydrogen, produced using renewable energy, holds significant promise to meet global energy demand, while contributing to climate action goals. It has the potential to be adopted across different sectors, and decarbonise hard-to-abate sectors.

During the year, we entered into strategic partnerships with Japan Bank for International Cooperation, Sojitz Corporation and IHI Corporation, to progress hydrogen and other decarbonisation initiatives. We are advancing our collaboration with Mitsubishi Corporation and Chiyoda Corporation with the commencement of pre-FEED studies for the development of hydrogen imports via methylcyclohexane, a type of liquid organic hydrogen carrier.

As the leading producer of renewable energy and the largest importer of natural gas in Singapore, we are well-positioned to support the government’s ambition to develop hydrogen as a major decarbonisation pathway. We see ourselves playing a key role in green hydrogen production, given our growing renewables presence in the region.

Since the launch of our Green Financing Framework and Sustainable Financing Framework in 2021, we have successfully raised S$3.3 billion of funding from sustainable financing, with competitive margins achieved in a rising interest rate environment. This includes a five-year S$1.2 billion syndicated sustainability-linked revolving credit facility, the first and largest Singapore Overnight Rate Average-based facility for an energy company in Southeast Asia. The funds will support the Group’s transformation strategy and our pursuit of growth plans in the Sustainable Solutions segment.

On behalf of the management and board, we would like to thank Mr Tham Kui Seng, who will be stepping down from our board at the forthcoming annual general meeting. Mr Tham has made a great contribution to the board, and his deep insights and wise counsel will be missed.

We would also like to express our thanks to shareholders, stakeholders and partners for their continued confidence and support for Sembcorp. Our appreciation also goes to the thousands of employees globally for the outstanding efforts they have put in throughout the year.

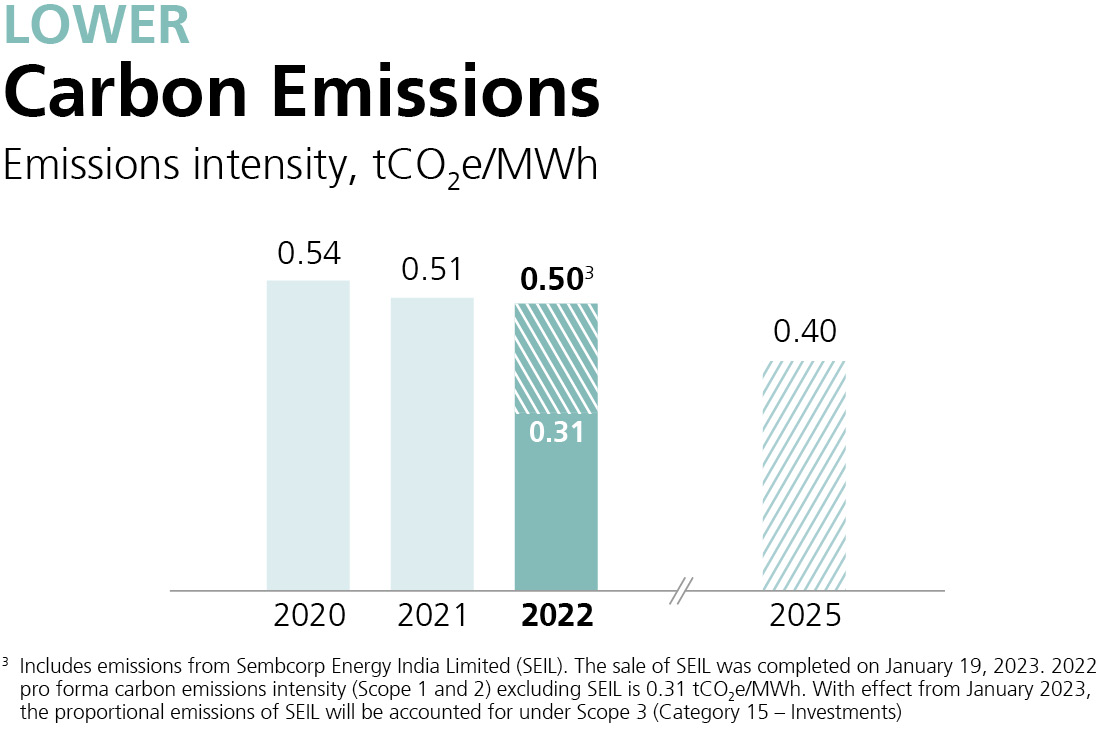

Our focus on execution has yielded results and we have made tremendous progress in our brown to green transition in less than two years. Including acquisitions pending completion, we have achieved 9.8GW of gross renewables capacity installed and under development. With the divestment of SEIL, we would have met our 2025 carbon emissions intensity target ahead of time. Given the strong growth momentum, we are looking beyond 2025 and will communicate our revised strategy and targets to shareholders and investors later this year.

While the global economic outlook remains uncertain, the opportunities ahead are significant. With our combination of energy and urban development capabilities, we are ideally positioned to seize opportunities in the energy transition. Our commitment to transform our portfolio from brown to green and to be a leading provider of sustainable solutions is steadfast and we will continue to accelerate growth in our focus markets, to deliver lasting value for all our stakeholders.

Ang Kong Hua Chairman

Ang Kong Hua Chairman

Wong Kim Yin Group President & CEO

Wong Kim Yin Group President & CEONote of Thanks to Outgoing Chairman

At the upcoming annual general meeting in April 2023, Mr Ang Kong Hua will be retiring from the board of Sembcorp. Mr Ang presided over the board during a period of transformation which saw the development and growth of Sembcorp into a leading provider of sustainable solutions, well-positioned for success in the global energy transition and sustainable development.

His chairmanship has been characterised by his visionary leadership, strong business acumen and focus on value creation driven by his deep sense of purpose and stewardship. From the internationalisation of Sembcorp’s operations to the demerger of Sembcorp’s stake in Sembcorp Marine, his leadership and guidance have played a pivotal role in Sembcorp’s delivery of value and growth.

The company has benefitted from his wise counsel and the board and management of Sembcorp would like to record their gratitude and appreciation to Mr Ang for his tremendous contribution as Chairman of Sembcorp.

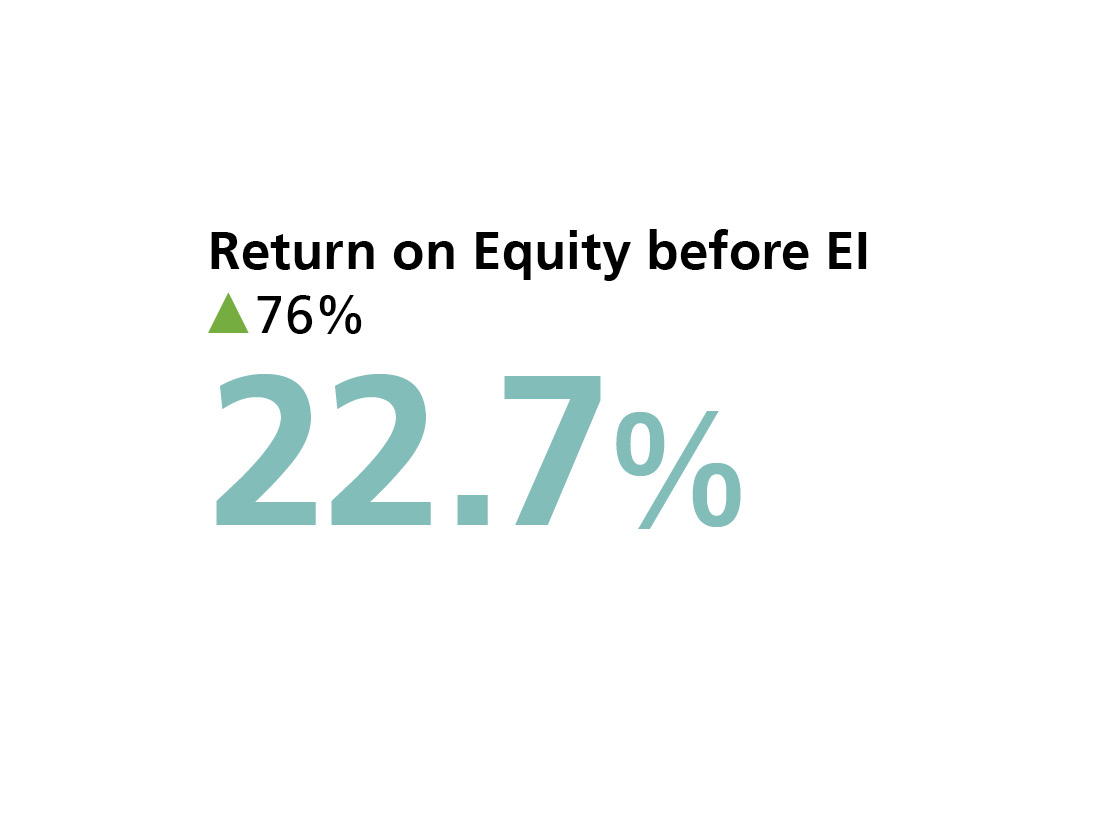

Sembcorp achieved a strong performance in 2022, driven by higher contributions from the Conventional Energy and Renewables segments. Net profit before exceptional items including discontinued operation was S$883 million in 2022, compared to S$472 million in 2021.

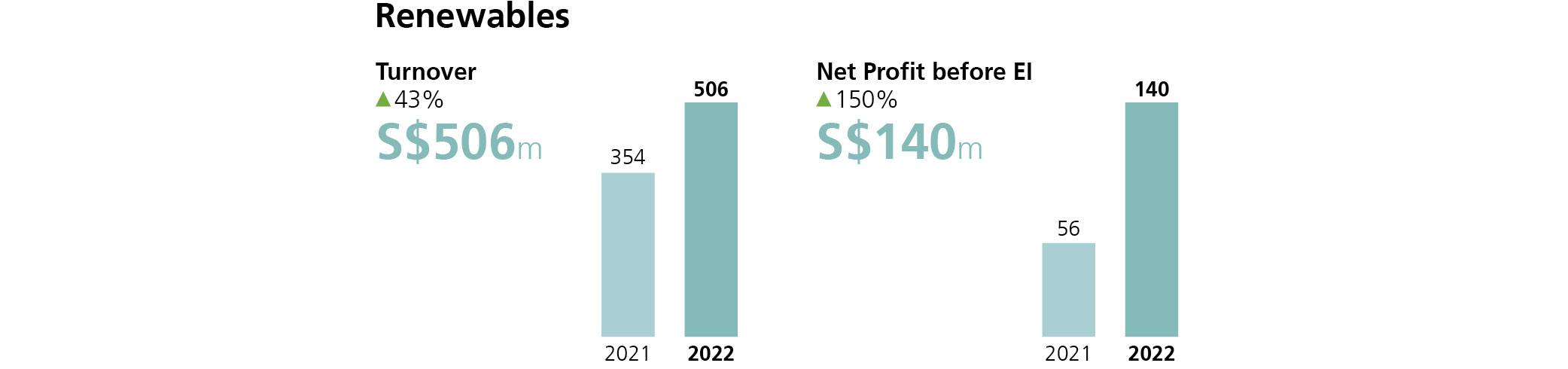

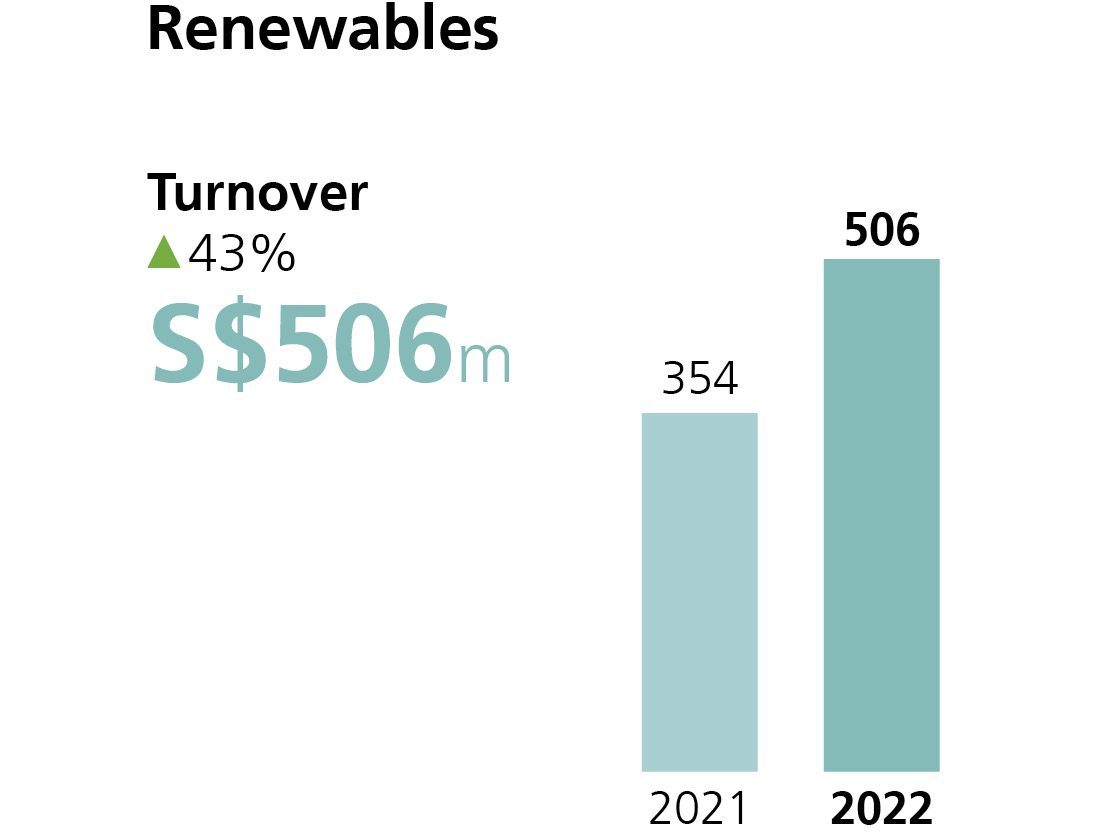

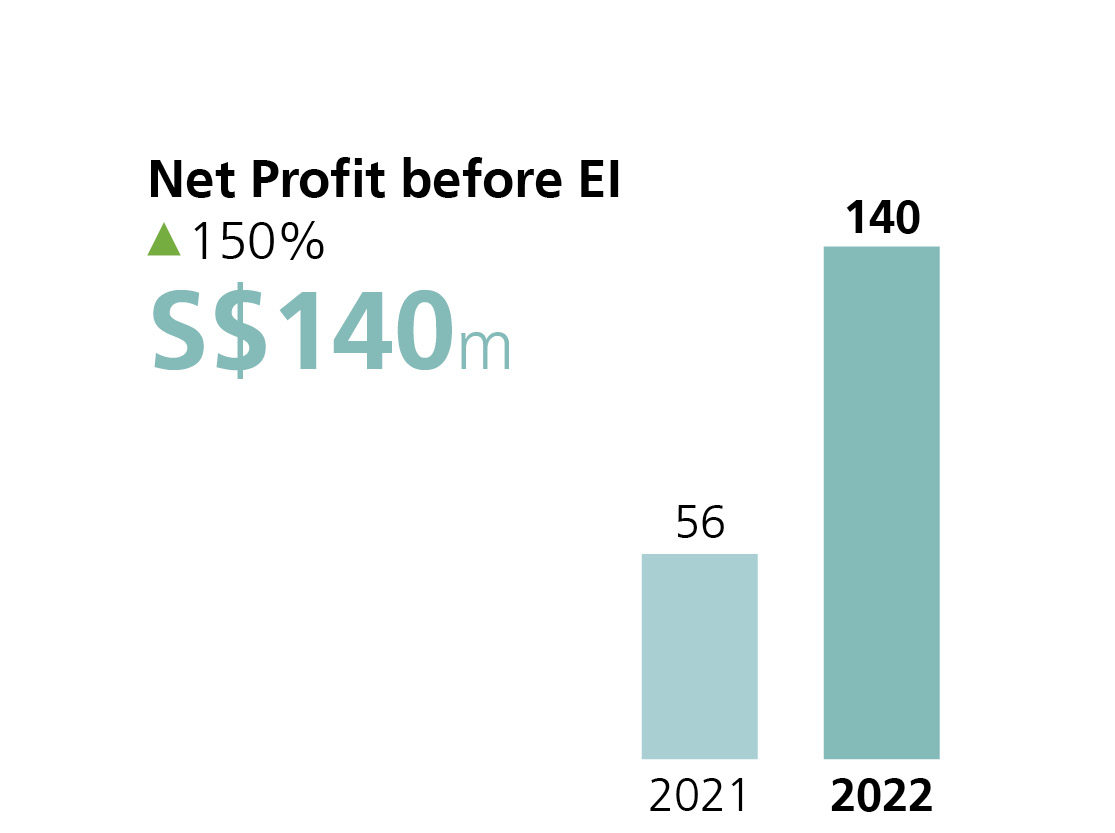

Group Financial ReviewGrowth momentum for the Renewables segment remained strong in 2022. During the year, our portfolio grew to 9.8GW, including acquisitions pending completion. Net profit before exceptional item increased by 150% year-on-year to S$140 million.

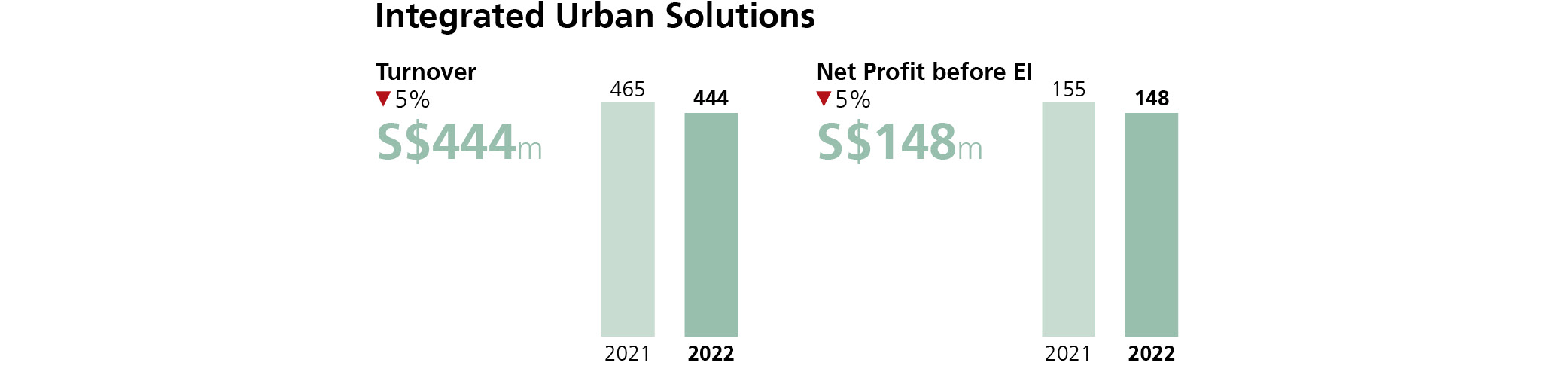

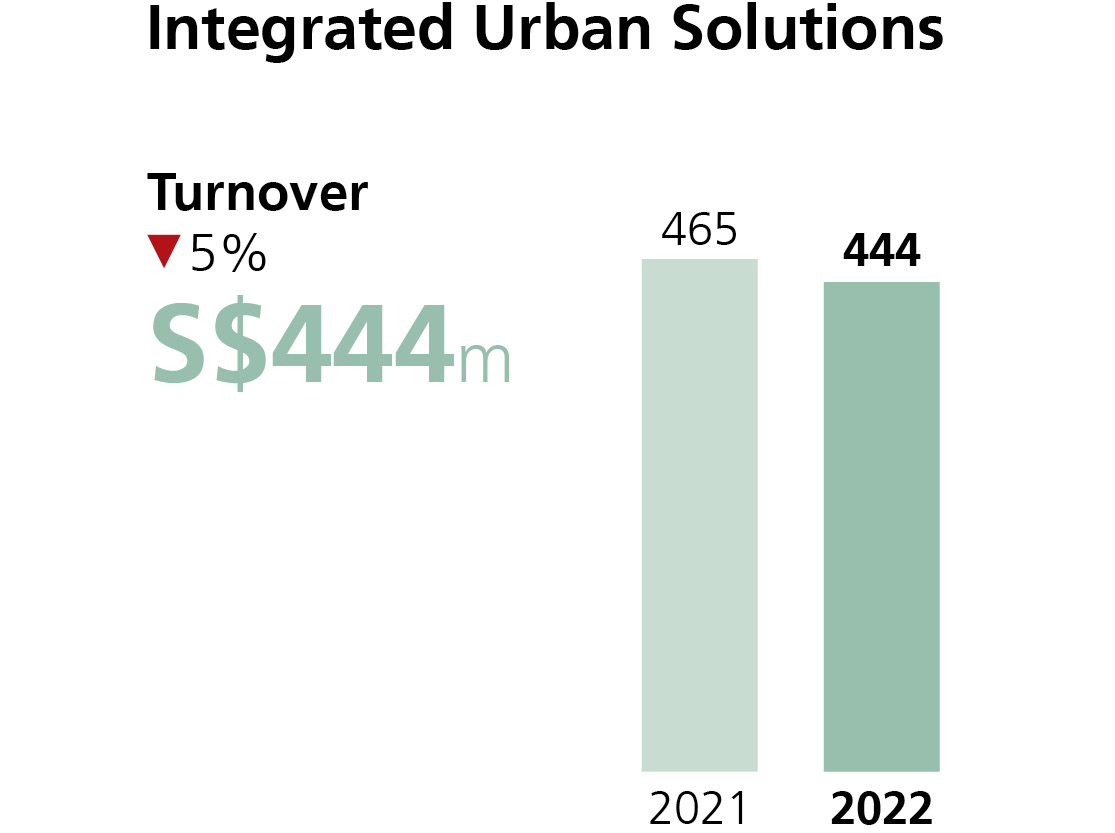

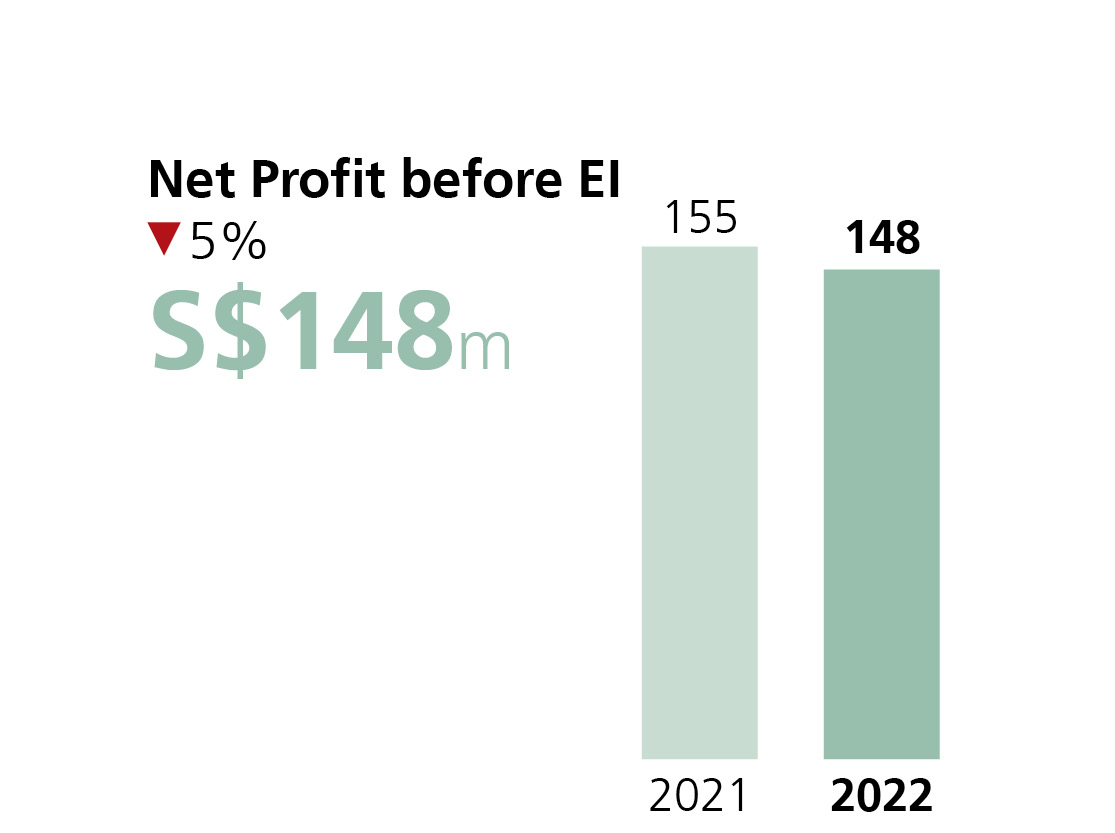

Renewables ReviewNet profit before exceptional items moderated to S$148 million in 2022 compared to S$155 million in 2021, mainly due to a slowdown in the China market for the Urban business, which was mitigated by higher contribution from the energy-from-waste operation in the UK. The Urban business continues to secure landbank to ensure a steady sales pipeline.

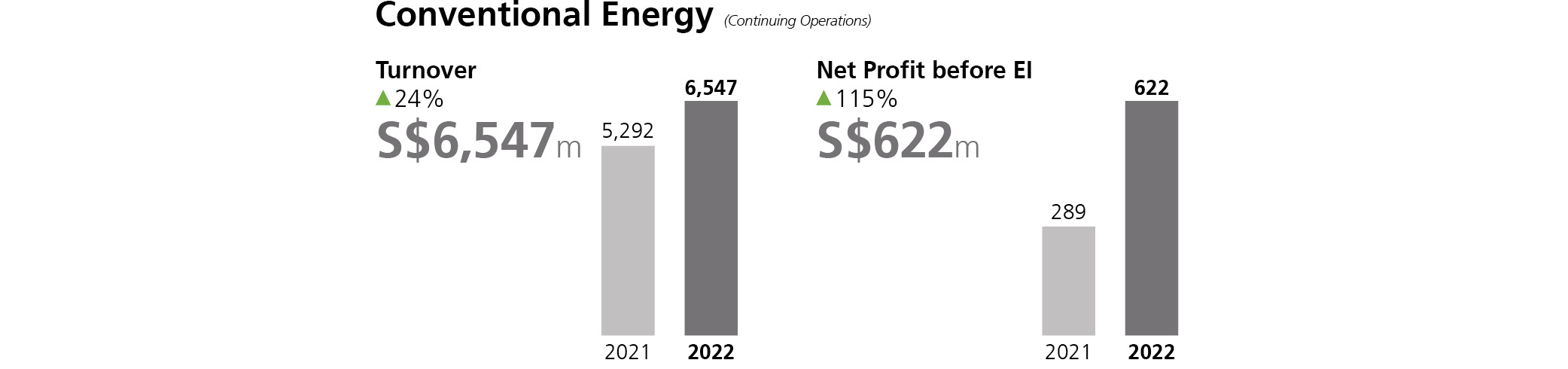

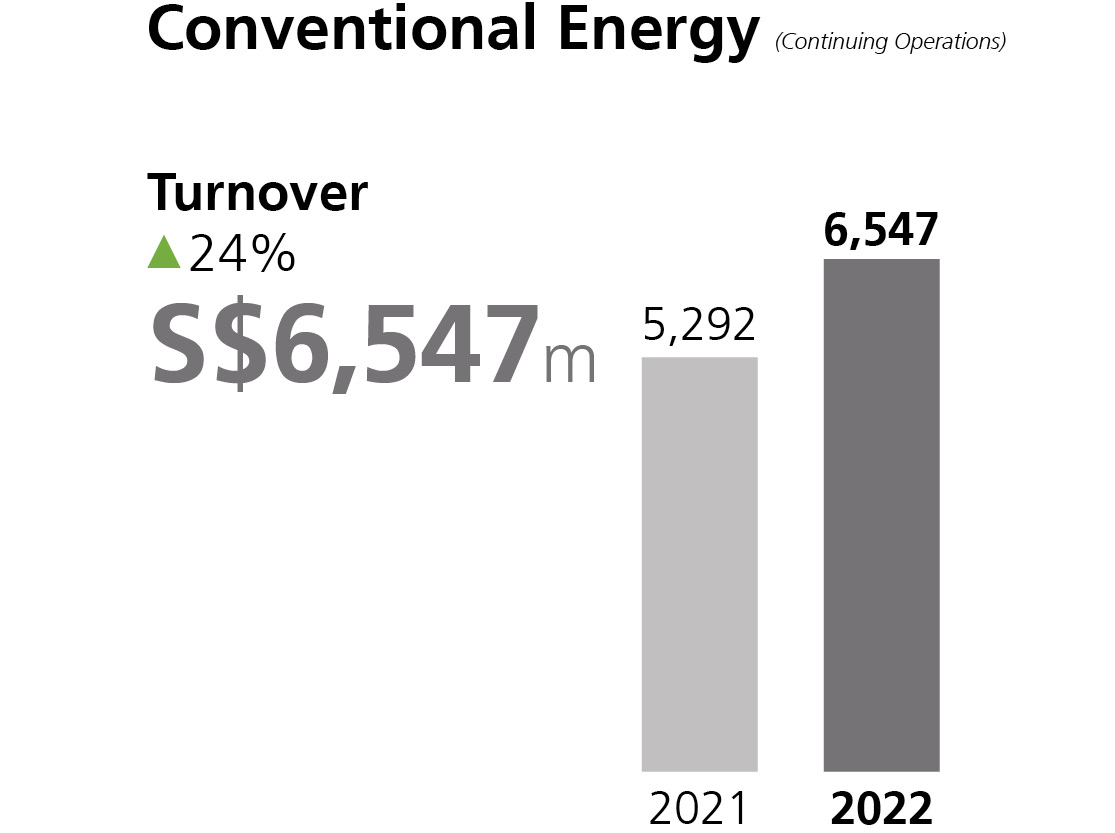

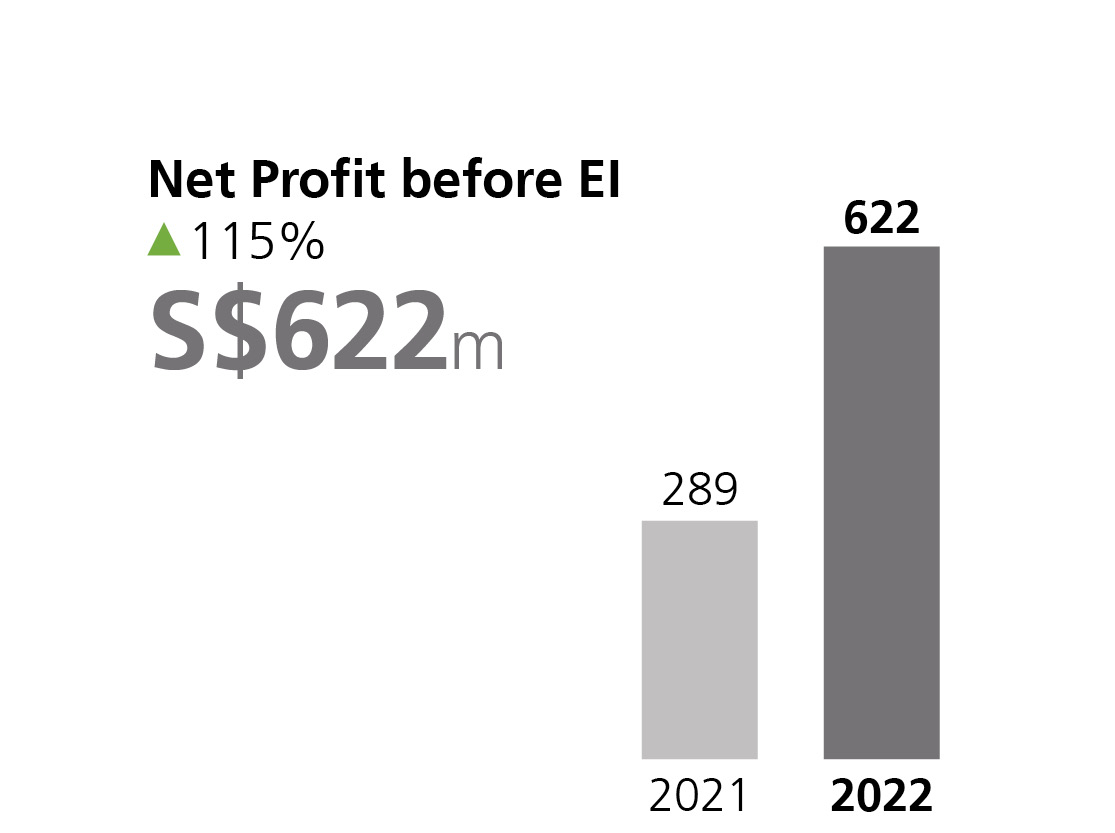

Integrated Urban Solutions ReviewWe accelerated the transformation of Sembcorp's portfolio from brown to green, with the sale of SEIL, which operates two supercritical coal-fired power plants. Net profit before exceptional items for continuing operations was S$622 million in 2022, due to better performance in Singapore and the UK.

Conventional Energy ReviewSembcorp has long held a strong commitment to sustainability. We are driven by our purpose to play our part in building a sustainable future. We see sustainability in our company as inextricably linked to our ability to deliver long-term value and growth to our stakeholders.

Sustainability ReportSembcorp’s corporate governance framework is built on the principle of integrity and reflects our commitment to enhance shareholder value.

Corporate Governance StatementSembcorp is committed to providing clear, reliable and meaningful information to the investment community in a timely manner to enable them to make informed investment decisions.

Investor Relations