Sembcorp Industries

Annual Report 2023

# The financial figures pertain to the Group’s continuing operations. In 2022, following shareholders’ approval of the sale of Sembcorp Energy India Limited (SEIL), SEIL was classified as a disposal group held for sale and as a discontinued operation. The sale was completed on January 19, 2023

Dear Shareholders,

We have done well despite a challenging 2023.

Concerns on inflation and high interest rates exacerbated by growing geopolitical tensions lingered in 2023. This led to a marked shift from globalisation and an increasing pace of energy transition, in response to growing demands for energy security and resilience. At the United Nations Climate Change Conference (COP 28), over 100 countries pledged to triple the world’s installed renewable energy capacity and double the global average annual rate of energy efficiency improvement yearly until 20301. Renewable energy remains the trending development and as a steward of responsible energy transition, we recognise Sembcorp’s pivotal role in shaping a sustainable, low-carbon future.

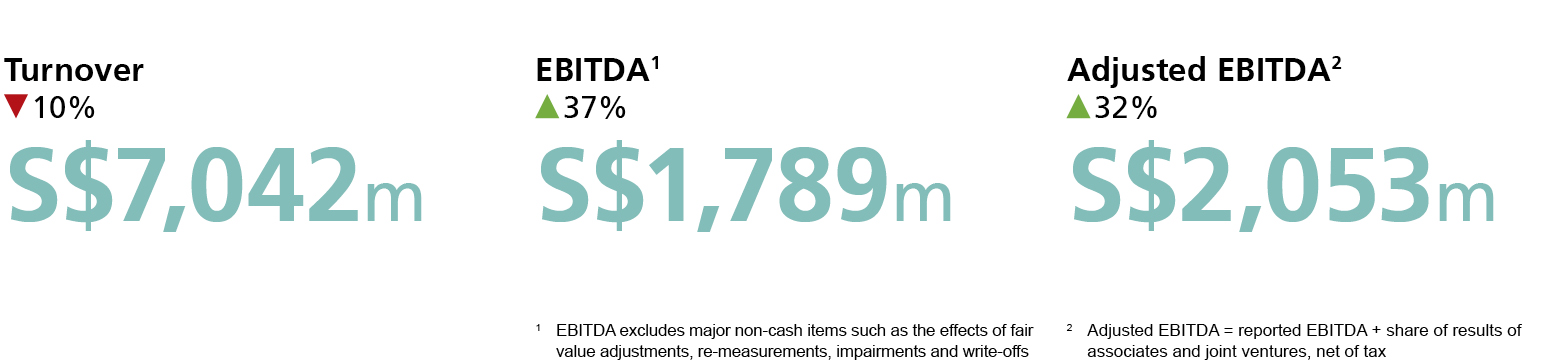

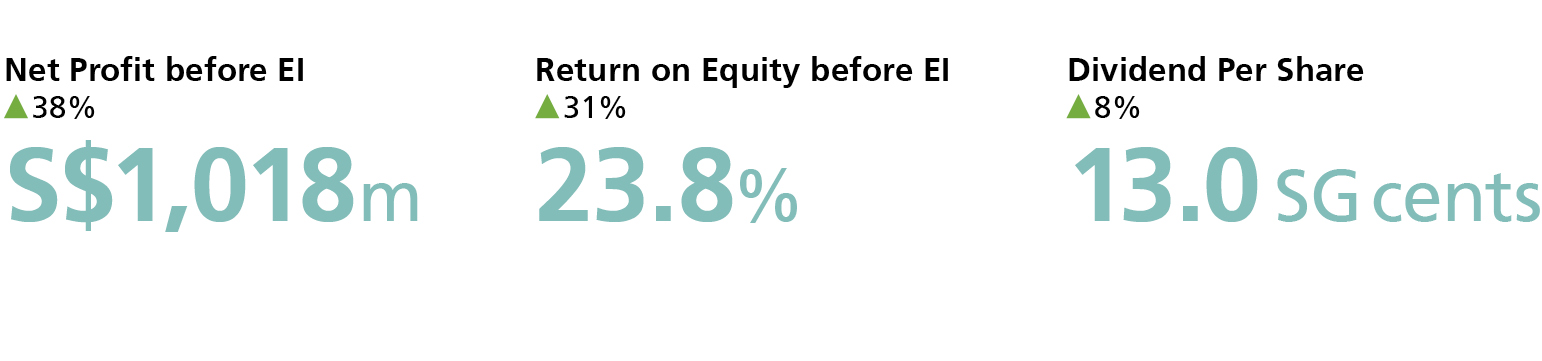

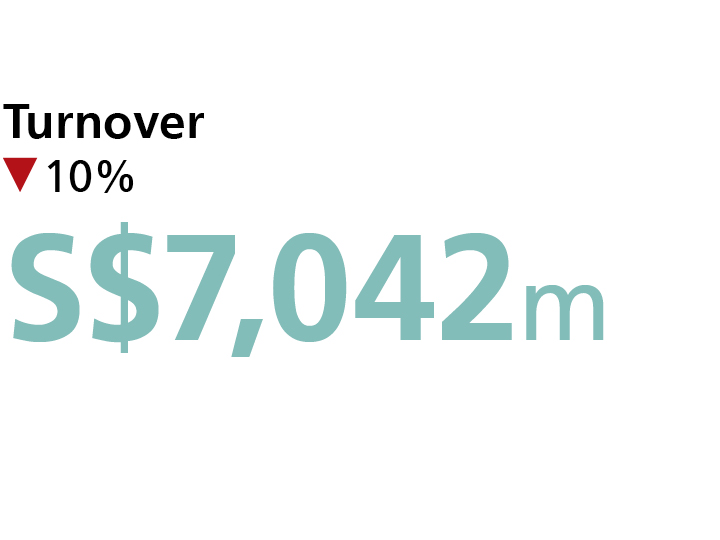

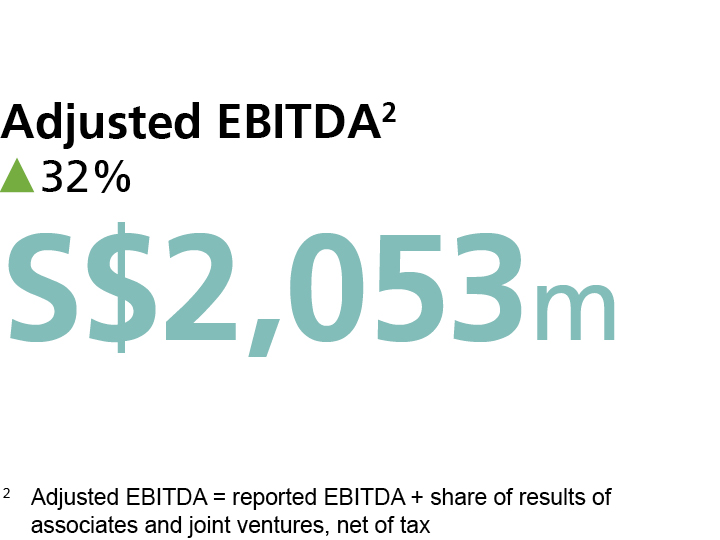

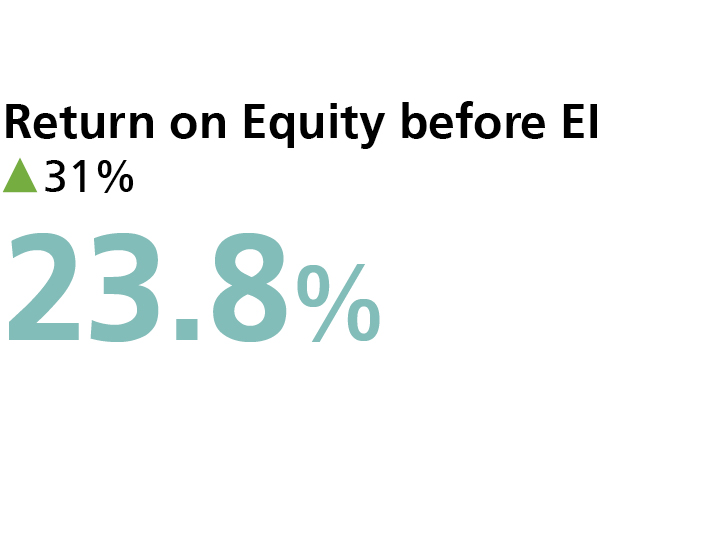

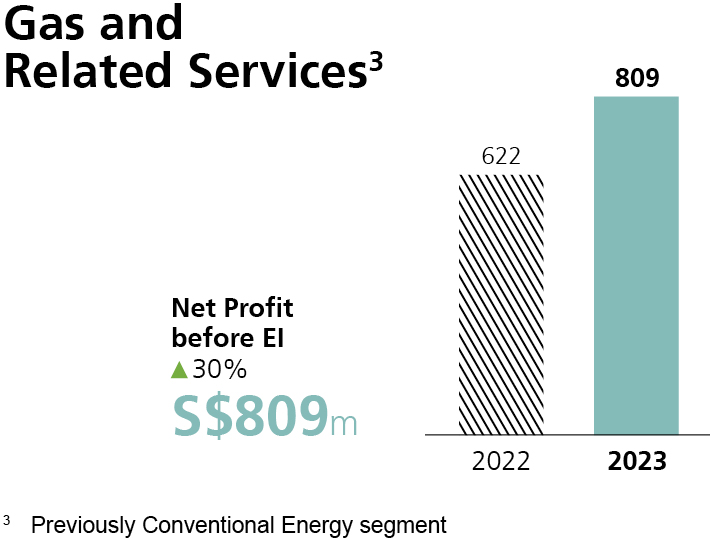

In 2023, the Group maintained focus on executing its strategic plan and delivered a robust performance. Net profit from continuing operations before exceptional items (EI) was S$1 billion, a 38% increase from S$739 million in 2022. This was driven by strong contributions from the Gas and Related Services as well as Renewables segments. Return on equity before EI was 23.8%, an improvement from 18.2% in 2022.

Net profit after EI and discontinued operation2 was S$942 million, an increase of 11% from S$848 million in 2022. EI comprised income of S$2 million and a net loss of S$78 million from discontinued operation. The net loss of S$78 million arose from the realisation of an accumulated currency translation loss recognised in the foreign currency translation reserve and a gain in capital reserve and other reserves from the disposal of Sembcorp Energy India Limited2.

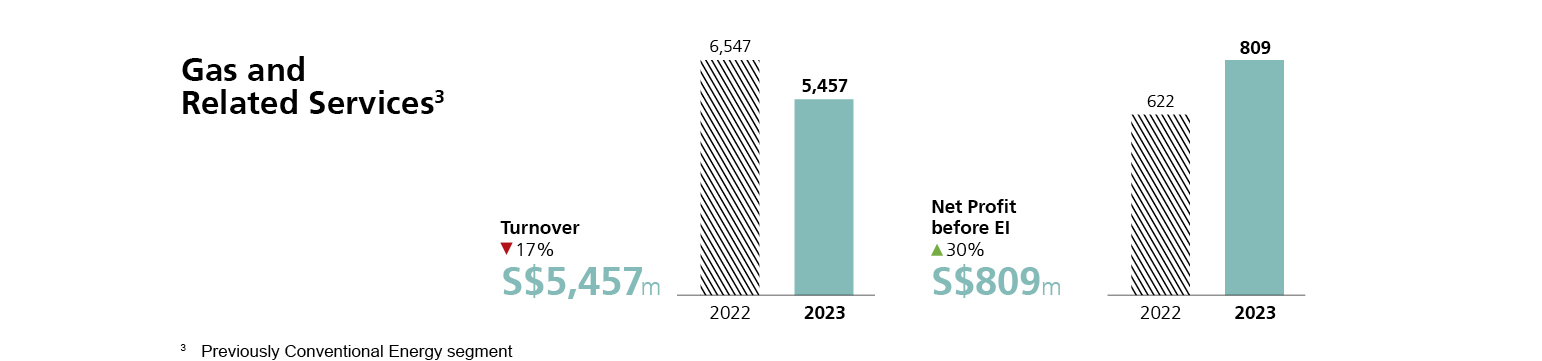

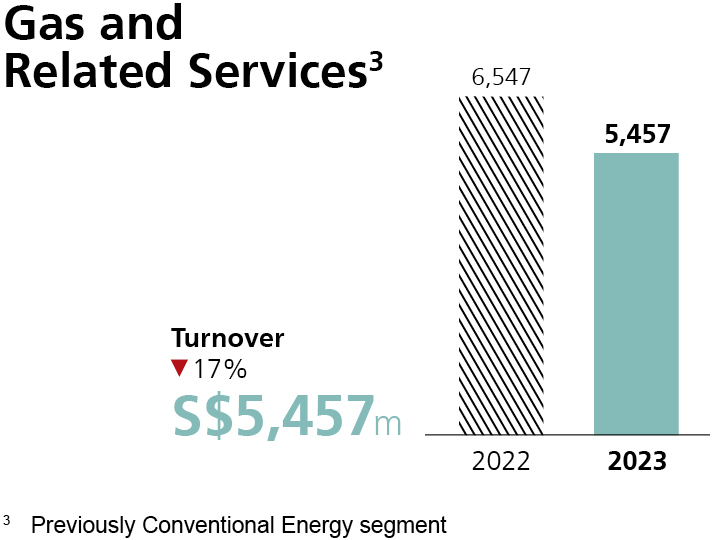

Earnings from our Gas and Related Services segment grew by 30% to S$809 million, driven by higher power prices and margins achieved in Singapore. With our unique position as one of the largest importers of natural gas into Singapore, we have been able to offer long-term power purchase agreements (PPAs) to customers, helping them navigate the volatile energy market through our reliable gas access and costs transparency. In 2023, we signed long-term PPAs with Micron Semiconductor Asia Operations, Singapore Telecommunications and ST Telemedia Global Data Centres, which provide a secure base load of demand for our Singapore cogeneration assets. Consequently, we now have a strong, secure and stable stream of operating cash flows which can be channelled into funding green and energy transition investments.

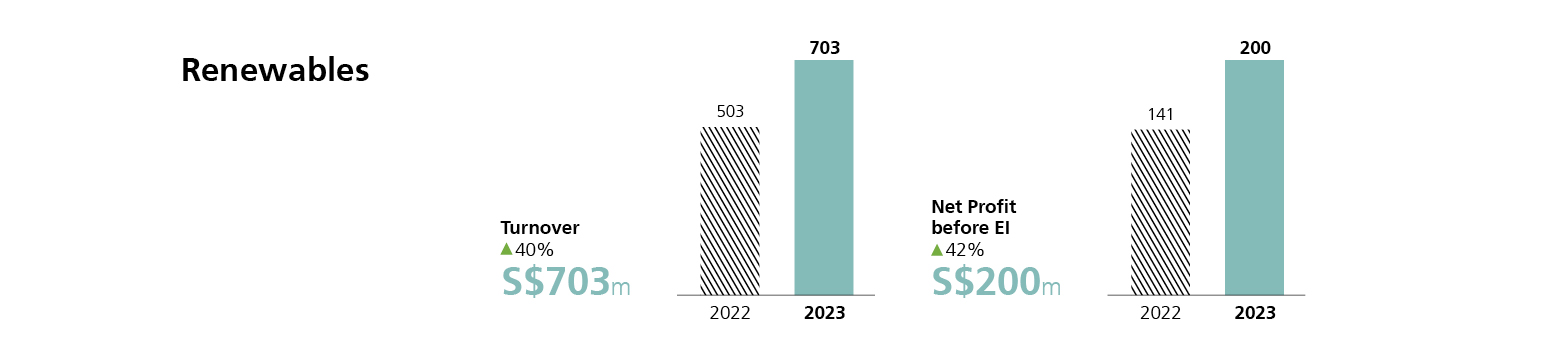

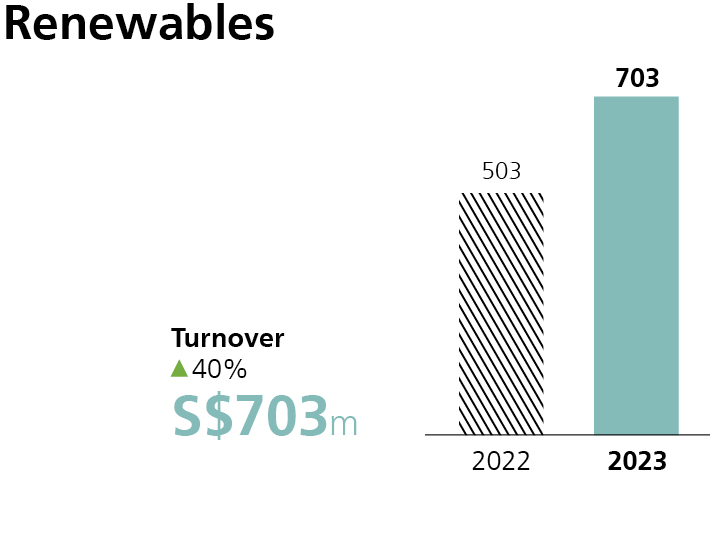

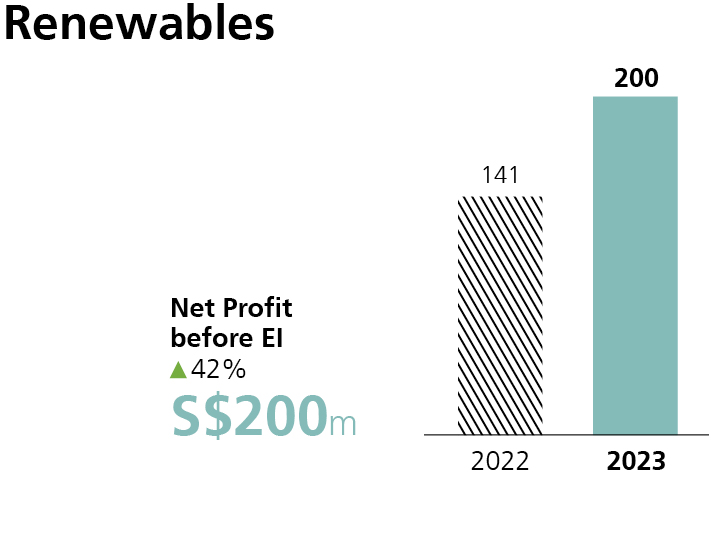

The Renewables segment continued to show strong underlying performance, with net profit of S$200 million during the year, a 42% growth compared to 2022. Leveraging organic growth and partnerships, our gross installed renewables capacity is at 9.8GW while gross renewables capacity has increased to 13.8GW as of February 2024. Renewables now represents 65% of Sembcorp’s energy portfolio and we will continue to build up our renewables portfolio.

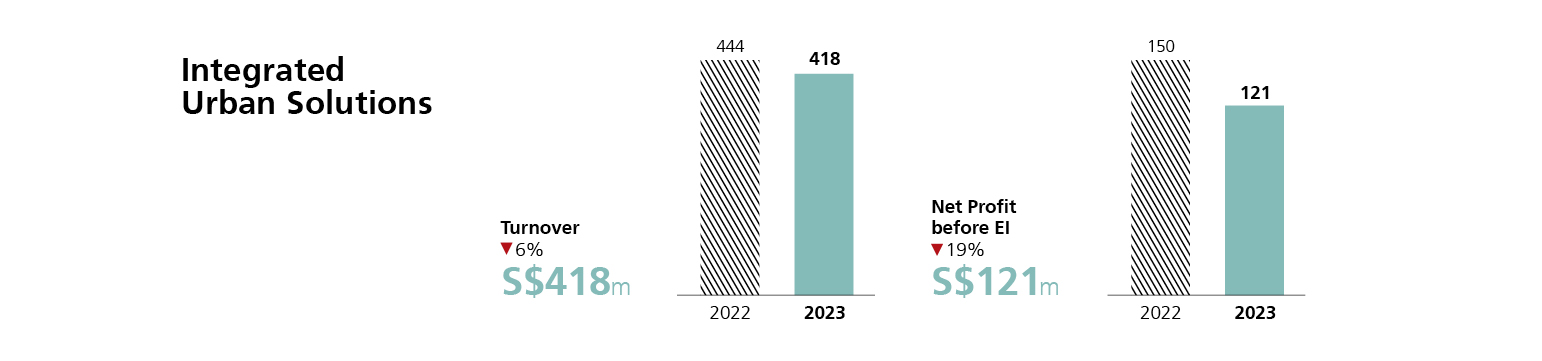

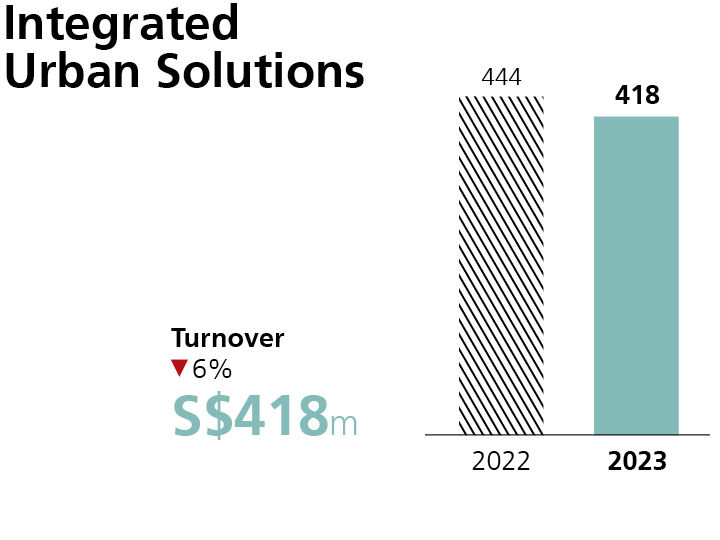

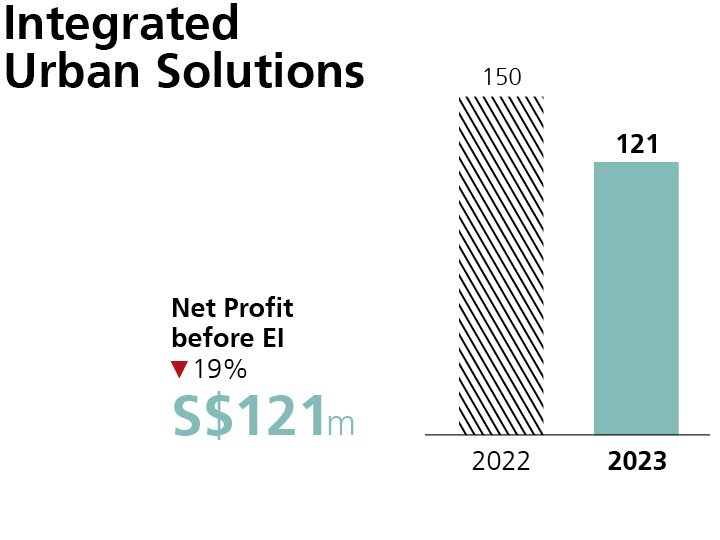

Net profit from the Integrated Urban Solutions segment decreased to S$121 million from S$150 million in 2022, mainly due to lower commercial and residential land sales in the Vietnam Urban business and the cessation of a public cleaning contract in the waste management business in Singapore. While earnings in the Urban business were below our expectations, we remain optimistic as strong market potential remains in Vietnam and Indonesia, and a strategic review of the Urban business is underway.

With the stronger operating performance, free cash flow increased to S$2.0 billion from S$1.7 billion the year before.

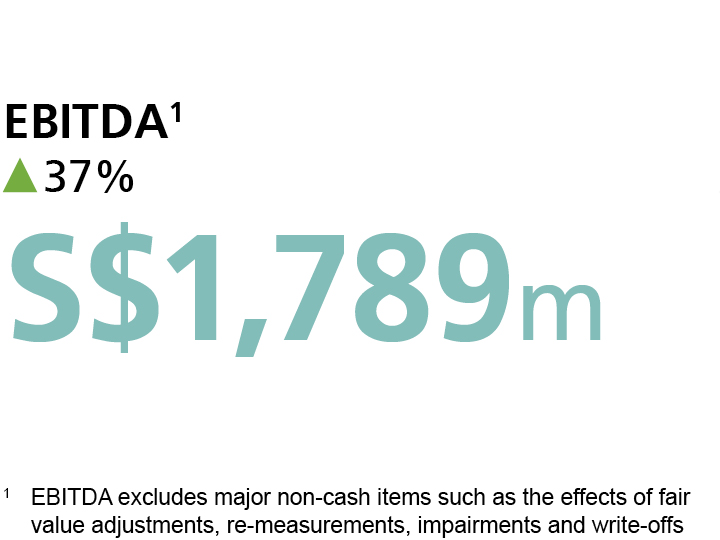

Leverage ratios similarly improved, with Net Debt-to-Adjusted EBITDA reducing to 3.2x from 3.7x. Adjusted EBITDA-to-Interest was steady, at 5.0x.

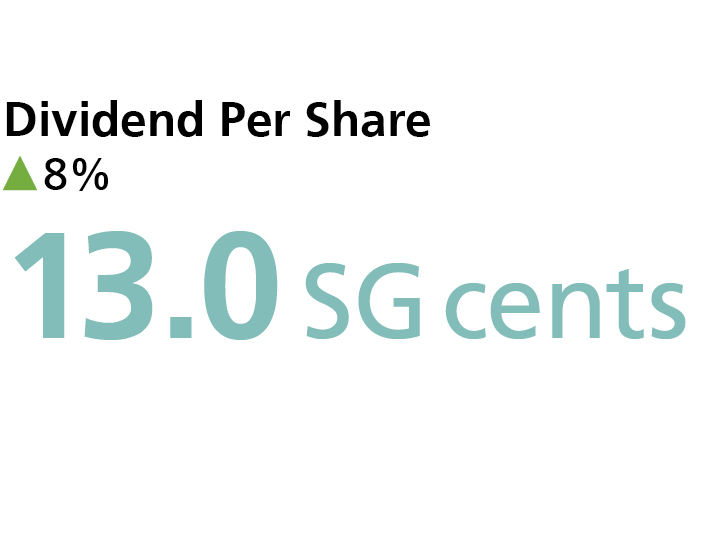

The Board of Directors has proposed a final dividend of 8 cents per share, in view of the strong performance. Together with the interim dividend of 5 cents paid in August 2023, the total dividend for 2023 will be 13 cents per share, higher than the dividend of 12 cents per share in 2022. Total shareholder return (TSR) for the year was 62%, a significant outperformance against the benchmark Straits Times Index’s TSR of 5%.

Our approach to community investments mirrors our strategy to increase the use of renewable energy and enable a low-carbon future.

We collaborate with charities and communities across our markets, supporting the installation of solar power systems to achieve the United Nation Sustainable Development Goal 7: Affordable and Clean Energy. In Singapore, we have set aside S$25 million in the Sembcorp Energy for Good Fund to drive decarbonisation programmes in the charity sector. We look forward to delivering positive impact, leveraging our strengths to enable communities to decarbonise and build capabilities, ultimately improving quality of lives.

People are the foundation of our success. We will continue to invest in training and employee development to nurture our global talent pool. We remain committed to promote strong ownership of workplace health and safety and prioritise safety and well-being in our operations.

Regrettably, there was one incident of work-related fatality which occurred at a project site in Indonesia during the year. We are deeply saddened by the loss. A thorough investigation was carried out, following which preventive measures were implemented to prevent recurrence. We have also instituted targeted initiatives to enhance the identification and mitigation of unsafe conditions or actions at our operations and project sites.

As we reflect on the past year, we extend our sincere appreciation to our former Chairman Ang Kong Hua and our former independent director Tham Kui Seng, for their dedication and strategic guidance. Their contributions, alongside those of other esteemed board members, have been instrumental in our successes.

We would also like to express our gratitude and appreciation to non-executive and independent director Ajaib Haridass, who will be stepping down from the board at the upcoming annual general meeting. We are grateful to Mr Haridass for his invaluable contributions and wise counsel over the years. We warmly welcome Kunnasagaran Chinniah, Marina Chin Li Yuen and Ong Chao Choon, who were appointed as non-executive and independent directors during the year. Collectively, they bring a wealth of senior leadership experience spanning various industries to Sembcorp.

With a refreshed board, we look to jointly usher in a new era with the management team. During the year, the board and management worked concertedly to craft our strategy that underscores our commitment to transform our portfolio from brown to green and drive energy transition. The collaborative effort culminated in our second Investor Day in November 2023, where we unveiled our 2024-2028 strategic plan with the following targets:

Accelerate renewables growth

Strengthen commitment to decarbonisation3

Continue to leverage gas as a transition fuel to fund renewables growth

Our existing gas assets support Asia’s energy needs. We will actively manage our gas portfolio to support Asia’s shift to a clean and responsible energy future and to meet its carbon commitment. Our contracted gas portfolio provides cash flow visibility and will continue to contribute meaningfully through 2028. This cash flow will be used to fund the growth of our Renewables segment.

We would like to thank the Sembcorp team for their hard work and dedication as we drive Sembcorp’s growth and transformation. Our profound gratitude also goes to you, our shareholders and stakeholders, for your steadfast support. The board and management will work together to ensure the success and execution of Sembcorp’s strategy. As we navigate the evolving landscape, we are confident that the synergies between the board, management and Sembcorp team will lead us to greater heights. Sembcorp is well-positioned to navigate the path of energy transition and sustainable development, as a leading Asian renewable energy player and a sustainable urban developer. We will accelerate growth in our strategic markets and the delivery of value in the years ahead for our stakeholders.

Tow Heng Tan Chairman

Tow Heng Tan Chairman

Wong Kim Yin Group President & CEO

Wong Kim Yin Group President & CEO

1 COP28: Global Renewables and Energy Efficiency Pledge. https://www.cop28.com/en/global-renewables-and-energy-efficiency-pledge

2 In January 2023, the Group completed the sale of Sembcorp Energy India Limited (SEIL) and the financials of SEIL are reported under discontinued operation

3 GHG emissions intensity target refers to the Group’s total Scope 1, Scope 2 and biogenic emissions, divided by total energy generated and purchased. 2030 and 2050 targets cover the Group’s absolute Scope 1 and Scope 2 emissions. Our GHG emissions (absolute and intensity) are calculated using an equity share approach in accordance with the GHG Protocol

In 2023, Sembcorp continued to accelerate its portfolio transformation through disciplined investments in greenfield and brownfield renewables assets as well as organic growth. The Group achieved a 45% increase in net profit to S$1 billion from continuing operations.

Group Financial ReviewSembcorp's businesses are categorised into the following main segments, Gas and Related Services, Renewables, Integrated Urban Solutions as well as Decarbonisation Solutions.

Our Businesses

Gas and Related Services

We remain committed to managing our gas assets efficiently to aid the transition towards a clean energy future for economies, while exploring ways to further decarbonise and manage our gas portfolio for value.

Renewables

The Renewables segment is expected to perform well as more greenfield projects are commissioned and brownfield acquisitions are completed progressively. We will leverage our key success factors to grow our renewables capacity and enhance returns within the portfolio.

Integrated Urban Solutions

We continue to build up our land bank and invest in sustainable infrastructure. Sembcorp’s capabilities in providing integrated urban solutions and sustainable development put us in good stead to capitalise on the growing trend and capture growth opportunities.

Decarbonisation Solutions

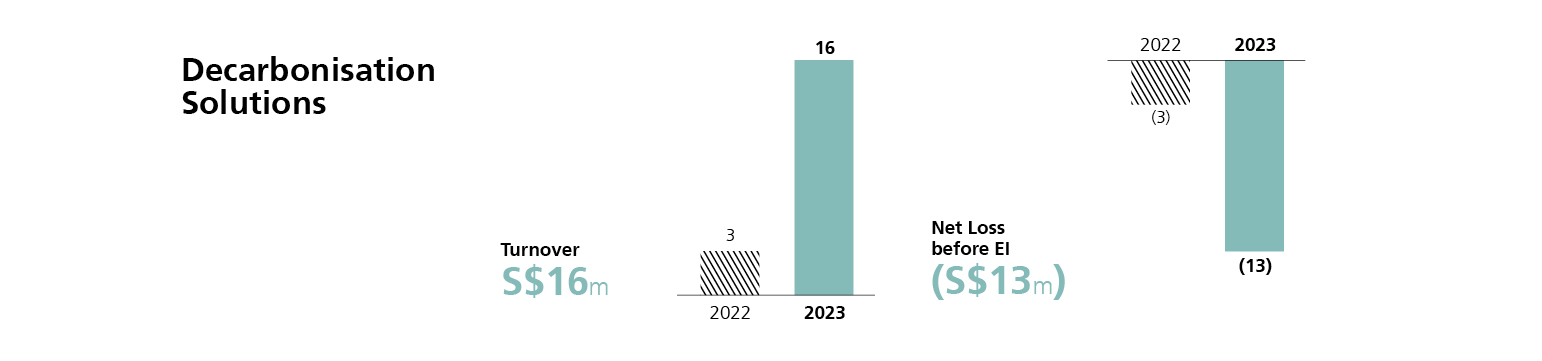

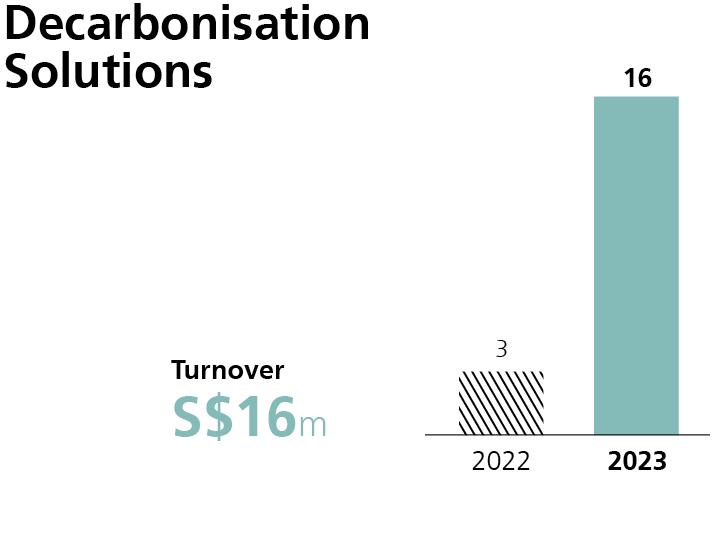

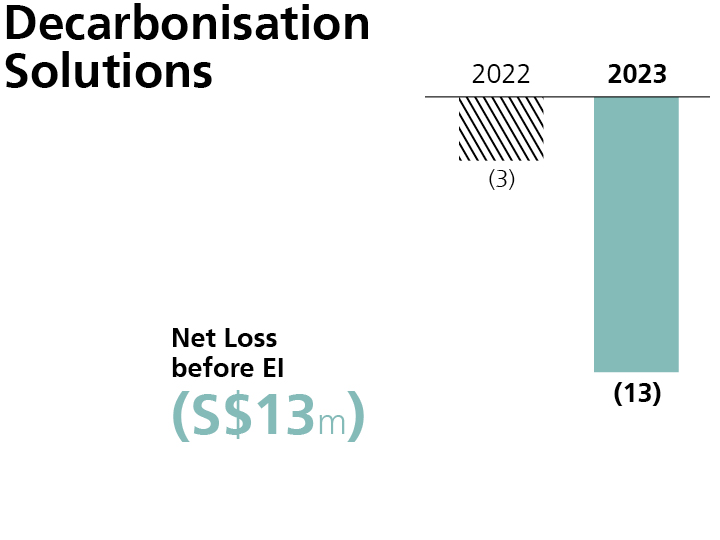

We will continue to focus on developing our capabilities and invest circumspectly in the Decarbonisation Solutions segment. We expect the segment to generate positive earnings by 2028 and position the company for growth beyond 2028.

Sembcorp has long held a strong commitment to sustainability, driven by our purpose to play our part in driving the energy transition towards a low-carbon future responsibly. Our Sustainability Report presents our most material sustainability factors and outlines our strategic approach to address them.

Sustainability ReportSembcorp’s Climate-related Financial Disclosures follow TCFD recommendations, and complement the information set forth in our Annual and Sustainability Reports. It outlines our climate-related governance, risks and opportunities, strategy and performance.

Climate-related Financial DisclosuresSembcorp’s corporate governance framework is built on principles of integrity, accountability, transparency and sustainability, and reflects our commitment to long-term sustainable business performance.

Corporate Governance StatementSembcorp is committed to providing accurate and timely updates to the investment community to enable informed investment decision-making.

Investor Relations